Year End Market Review

for January 2nd 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

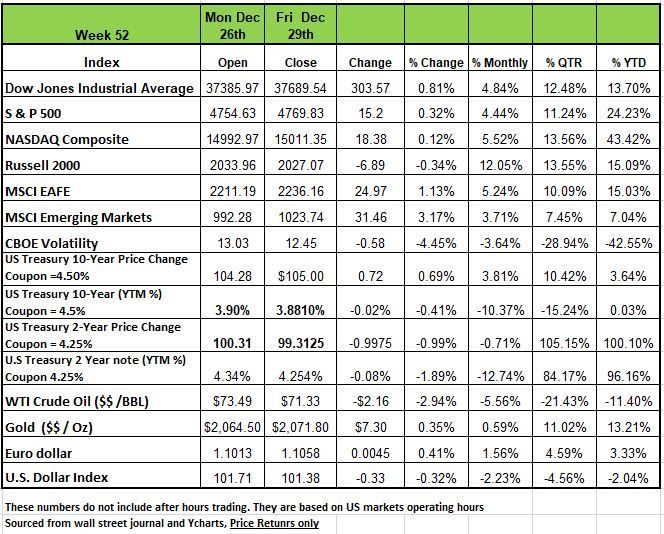

All four of the major indices posted extraordinary returns to closed out 2023. The NASDAQ ended the year with a whopping +43.4% price return followed by the S&P 500 with a +24.2% return The Russell 2000 came in with a +15.1% return and the DOW pulled up the rear with a +13.7% return. All of the indices posted double digit returns in Q4

The index's advances over the last two months marked a significant rebound from a three-month losing streak it suffered from August through October. The turnaround came as economic data increasingly pointed to easing inflation rates, helping curb investors' fears of another rate increase by the Federal Reserve's policy-setting committee.

Treasury yields dropped slightly over the course of last week as investors bought Treasurys at a strong pace to lock in higher rates in anticipation of sharp cuts in the Federal Funds rate in 2024. On Tuesday, indirect bidders, which includes foreign central banks, bought a record 77.6% of the 1-year Treasury auction and the 3rd largest share ever of the 6- month Treasury auction, indicating high demand for today’s relatively higher yields. This demand continued on Wednesday as the 5-year Treasury auction saw high demand and Treasury yields dropped significantly across all maturity levels. Treasury yields rebounded moderately on Thursday on concerns that the optimism for rate cuts from the Federal Reserve may be overblown. This concern continued Friday as former Treasury Secretary Lawrence Summers said that the market is probably underestimating the risk of inflation next year and that the Fed may not ease as much as investors are hoping for. The market implied probability of a interest rate cut by the Federal Reserve dropped slightly but still stayed near 100% for each of the March, May and June meetings.

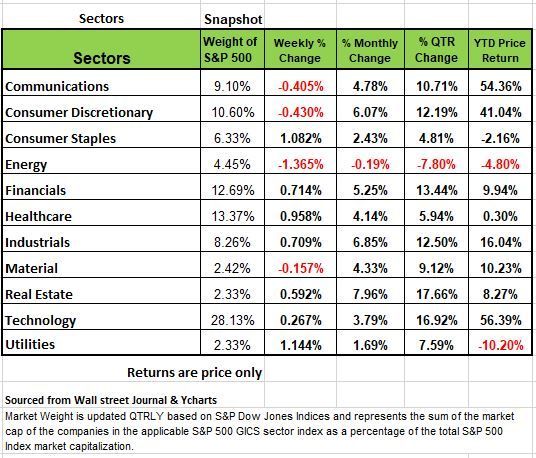

In looking at the 11 sectors that make up the S&P 500 3 of the 11 posted negative returns with Utilities having the largest decline with a -10.2% loss followed by Energy -4.8% and consumer Staples -2.16% Healthcare was basically flat with a +.30% change on the year.

The technology and communication services sectors had the largest percentage increases this year, soaring 56% and 54%, respectively. Consumer Discretionary Posted a +41.04% return on the year Industrials +16.04% Materials +10.23% and Financials came in at +9.94%. The big surprise came with Real Estate with a +8.27% increase on the year this with concerns that commercial Real Estate would have to refinance many properties at higher rates with lower occupancy

For the last week of the year the gainers came in utilities with shares of Edison International (EIX), which climbed +2.9% on the week as Evercore ISI raised its price target on the stock to $74 each from $71 while keeping its investment rating on the shares at outperform.

In consumer staples, shares of Dollar Tree (DLTR) added 4% last week as Truist Securities boosted its price target on the shares to $149 each from $135 while maintaining a buy investment rating on the stock.

On the downside, the energy sector's decline came as futures in natural gas and crude oil fell on the week. Decliners included Marathon Petroleum (MPC), down 1.7%, and Pioneer Natural Resources (PXD), down 1.6%.

Reflecting on the past year many will either feel regret for being too conservative or joyful for staying invested in the index and ETF vehicles. Those that opted to be more conservative should have still faired well with Money Market mutual funds still producing a +5% return for sitting on the sidelines. The year’s performance came mostly in 3 months last year with the Technology sector rebounding from 2022 in January and then again in November and December. Nvidia the most outperforming stock soaring in 2023 with a return of +239% with all of the hype on AI (Artificial Intelligence) and the demand for its product and the leader in the space. There were 9 other companies that had returns over 100% Meta’s stock price went from $120 to $354 a 194% increase RCL had a 162% increase followed by BLDR +157% UBER +149% CCL +127.6% PANW 111% and TSLA +101%

The top 16 companies in the S&P account for 38% of the weight in the movement of the index with an avg return of 65% in 2023 these are really significant numbers and the question on everyone’s mind is will the momentum continue in 2024

Most of the rest of 2023 was filled with a lot of volatility starting with the failures of SVB and First Republic Banks. In addition, the year was full of concerns of a collapse in the commercial Real Estate market with occupancy levels being at historic lows

In 2023, S&P 500 bounced back from the difficult environment in 2022 that saw a decline of more than -19%. The month of January started with +5.75 bounce off of a level 3854 February receded a bit falling 2.46% then bouncing back +3.67% in March. April kept the momentum going with a +1.64% move up and May was relatively flat at+ .03% But June is where the promise of AI kicked in with a 6.45% increase followed by 3.14% in July and -1.57% in August. Sept Dropped off -5.36% and Oct took another -2.12% decline but November and December both posted significant numbers with +8.72% and 4.61% respectively.

2024 kicks off the New Year with the major equity indexes looking to build on a nine-week winning streak that ended 2023 up 23.7%. The recent bull run has been fueled by the retreat in Treasury market yields during the final two months of last year and emerging sentiment that the Federal Reserve will at some point pivot on the monetary policy front in 2024. Much of these came off of the last two press conference held by Fed Chair Powell feeling that inflation would continue is downward move and that a return to neutral would be achieved in 2024. A close eye will be kept on the CPI data for Dec and January to see if there are any reversals, which would cause the Fed to change it tone.

We still think the direction of trading in the first week of the new year will likely depend upon a slew of data from the labor market, including Friday’s upcoming report on December employment and unemployment. Before we get to that potential market-moving release, we will receive reports on manufacturing activity and the Job Opening and Labor Turnover Survey (JOLTS) and initial weekly unemployment claims and private-sector job creation from ADP on Thursday.

A tight labor market and solid job creation figures over the final months of 2023, along with data showing a retreat in inflation have powered the equity markets higher. The late-year surge pushed the Dow Jones Industrial Average, the broader S&P 500 Index, and the technology heavy NASDAQ Composite 13.7%, 24.0%, and 43.4% higher for the 12-month period. A good portion of those gains came from strong of the top 16 stocks mentioned above.

The drop in Treasury market yields and the expectation of lower interest rates in 2024 helped the interest-rate sensitive small cap stocks, which for a good part of last year lagged their larger-cap colleagues.

As mentioned earlier the late-year buying beginning in November pushed equity valuations notably higher. The CBOE Volatility Index (or VIX), ended 2023 at 12.45, a level that clearly suggests that the market is overbought. This elevated valuation leaves stocks vulnerable to selling on any unfavorable news, much as we are seeing this morning with the reports of mounting tensions in the Red Sea. It will also put a lot of focus on the upcoming fourth-quarter earnings season. We think a good showing from Corporate America will be needed to justify the current elevated stock valuations. The expectation is that earnings growth slowed to the low-single-digit range in the fourth quarter. The season kicks off on January 12th when banking giant JPMorgan Chase (JPM) leads a slew of big banks to report. The commentary from those big banks may also give some clues about the health of the U.S. economy at the start of 2024.

With valuations for stocks looking quite frothy right now, we think the best way to play this market rally, which is being powered by falling Treasury market yields and the expectation that the Federal Reserve will begin cutting interest rates at some point in 2024, is by looking at the stocks of high-quality companies.

What to Look Out for in 2024

Pay attention to the consumer and what they are doing. Keep in mind that the last 3 years have been unique since the U.S. government infused a few trillion dollars into the economy. It seems that many economists got the impact of the stimulus wrong with the amount of time it was going to take to be depleted from savings accounts. The recession predictions for 2023 were way off and perhaps most pundits are now staying quiet to save face. Consumers now have all-time record high credit card balances and the work week is still lower that one expects since employers have been hording workers to account for labor shortage. The key to watch here is whether or not unemployment starts rising enough to impact the economy.

Economic indicators will be pivotal, especially as the professional try to project the Consumer Price Index (CPI) in the U.S. to decrease to 2.0% and the Federal Reserve's target rate to be at 4.50% by year's end. It seems like we are still in an interesting economic environment and if the Fed does not cut rates especially in March as the markets predict we expect be reaction to be quite negative. We will share more perspectives on 2023 in the days to follow .

The Week Ahead

Major economic reports (related consensus forecasts, prior data) for the upcoming holiday shortened week include: Tuesday: December Final S&P Global Manufacturing PMI (48.4, 48.2); Wednesday: December 29 MBA Mortgage Applications (n/a, n/a); Thursday: December ADP Employment Change (113k, 103k), December 30 Initial Jobless Claims (n/a, 218k); Friday: December Change in Nonfarm Payrolls (170k, 199k), December Unemployment Rate (3.8%, 3.7%), November Factory Orders (2.0%, -3.6%), November Final Durable Goods Orders (n/a, 5.4%).

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/