Weekly Market Review

for December 11, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

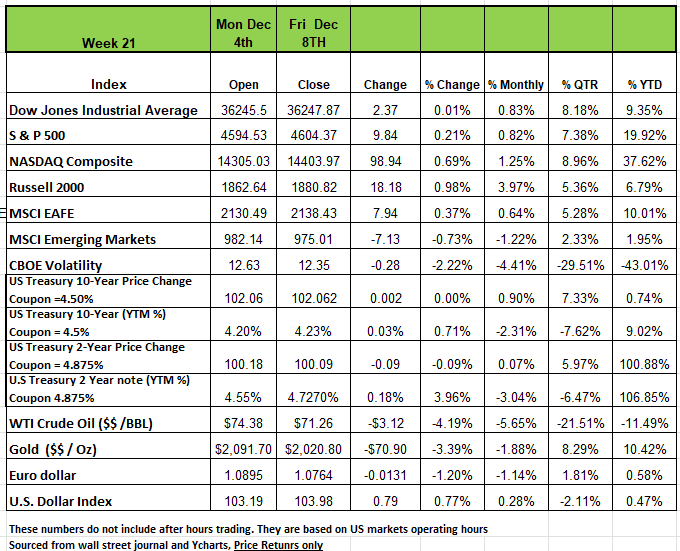

All four of the major indices ended the week of December 8th by barely posting positive returns. The Russell 2000 posted the highest return with a +0.98% followed by the NASDAQ +0.69% the S&P 500 +0.21 and the DOW +0.01%. The S& P 500 rose for the sixth straight week, the longest rally since November 2019, as markets parsed hotter-than-projected November jobs data and awaited this week's important Federal Reserve meeting and inflation reports.

Treasury yields increased across the board last week with the exception of the 30-year, as several sets of data showed the labor market has remained strong, encouraging the Fed to keep rates higher for longer.

Total nonfarm payrolls rose by 199,000 last month, the Bureau of Labor Statistics reported Friday. The consensus was for a 185,000 a gain in a survey compiled by Bloomberg. The ADP employment change showed 103k jobs were added in November, below the consensus of 130k. This follows data from the JOLT’s job-opening report that showed job openings fell to the lowest since 2021. While the labor market remains healthy, these reports signal a gradual cooling demand for workers. The trade balance report grew by $63 billion in October. Exports declined by $2.6 billion, led by autos, civilian aircraft, and gem diamonds. Imports rose by $0.5 billion, led by pharmaceuticals, computers, and drilling and oilfield equipment

Markets are widely expecting the Federal Open Market Committee to hold its benchmark lending rate steady next week, according to the CME FedWatch Tool. Last week, Fed Chair Jerome Powell said that it would be "premature" to "speculate" when interest-rate cuts may begin as the FOMC is ready to tighten policy further, if needed. The committee has increased interest rates by 525 basis points since March 2022 in a bid to combat inflation, with its last hike coming in July this year. The official readings on consumer inflation and producer prices for November are scheduled to be released this week. On the economic front, this week's calendar we also have reports on retail sales and industrial production for November, as well as the New York Fed's Empire State manufacturing index for this month.

Among sectors, communication services and consumer discretionary rose more than +1% each, with technology, industrials and health care also notching gains ever so slightly. Energy posted the steepest decline at 3.3%, while materials, consumer staples, real estate, utilities and financials also closed lower.

In communication services, Alphabet (GOOG, GOOGL) rose 2.5%, as its Google unit rolled out artificial intelligence model Gemini in some of its products, including its AI chatbot Bard.

In health care, the White House outlined new measures aimed at lowering prescription drug costs and preventing anti-competitive mergers in the industry. For the week, the sector got a boost from a 4.1% rise in AbbVie (ABBV), which agreed to acquire Cerevel Therapeutics (CERE) for $8.7 billion.

In consumer staples, an 11% gain in Walgreens Boots Alliance (WBA) helped counter an 8.1% slump in Brown-Forman (BF.A, BF.B). Walgreens announced expanded COVID-19 and flu testing and treatment options in the US. Brown-Forman cut its annual sales outlook following its fiscal Q2 miss.

In financials, Citigroup's (C) Jane Fraser joined the growing list of bank chief executives to warn about a potential economic recession. Wells Fargo Investment Institute separately said that the world's largest economy is likely to see a "moderate" slowdown in H1, leading to a cooling in inflation and potential monetary-policy easing, followed by an economic recovery in the latter part of the year.

Are the Markets and the Fed dancing the Tango

It feels like the markets and the Fed have dance4d the tango all year with markets moving forward in anticipation of early interest rate cuts and then stepping back to realign with "Fedspeak" on inflation and the labor market. As the year draws to a close, the dance continues.

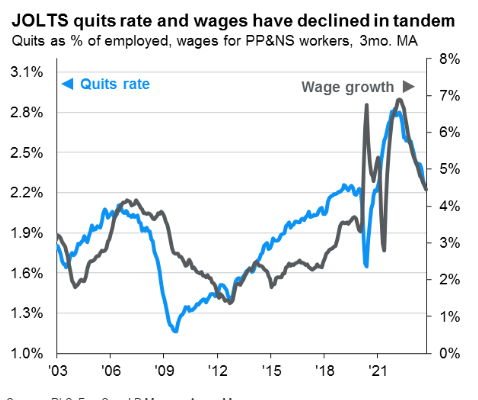

Last week’s labor data painted a nuanced picture. While job openings fell by more than expected, to 8.7 million, non-farm payrolls rose by 199k, bringing the unemployment rate down to 3.7%. However, this increase in payrolls was anticipated, given the return of auto union workers and film industry workers to the workforce. Moreover, as shown in the chart of the week, wage growth declined to 4% alongside the quits rate, which has softened gradually from its April 2022 peak.

While current wage growth is above the Fed’s target level, cumulative real wage growth since the end of the pandemic recession is still negative. As a result, wage pressure seems more in response to past inflation than an indicator of future inflation. However, it is still crucial to acknowledge that despite some recent moderation, the labor market is still very strong, and since the quits rate has stabilized over the last four months, any further moderation in wage growth will likely be gradual.

Currently, the futures market anticipates between four and five rate cuts in 2024, starting as early as 1Q. This seems to be a stretch, what most people need to realize is that the current rates are normal the 10 years of interest free ultra-low interest was an anomaly just like the late 1970’s and early 80’s with double digits rates

Unless the labor market weakens significantly and inflation falls back promptly to the Fed's 2% target, the Fed may opt for a more measured pace of easing than the market expects. This week’s FOMC meeting will be critical, with its revised dot plot (even though it has been wrong most of the time since its inception) set to clarify if market sentiment remains more dovish than actual Fed communications.

The Household Survey (HS), shocked the financial markets, as it rose +747k, more than doubly offsetting its -348k fall in October. So, it isn’t a surprise that the Unemployment Rate (U3) fell from 3.9% to 3.7%, (again unions went back to work) as that rate is calculated from the HS. The fall in the U3 will probably play to the hawk’s sentiment at the Fed meeting this week.

Once again, the Market odds of when the first-rate cut would occur, which had steadily moved forward from June to May and lately some significant odds of it occurring in March, have now moved back to May and June as a result. We are not expecting a cut unless the economy tanks and heads into a deep recession

It’s also important to look at other data before making conclusions about where things may be heading. When compared with other recent data, the inconsistencies in this jobs report are concerning:

In the NFP (non farm payrolls) report, government (+49k), education & health (+99k) and the return of striking auto workers (+30k) accounted for +178k of the +199k reported. The first two categories (gov’t and ed/health) are non-cyclical and therefore say little about the state of the economy. This leaves +21k from the cyclically sensitive sectors.

There were -35k of downward revisions to prior NFP reports. Such negative revisions have become standard fare, now totaling -372k year to date.

On a seasonally adjusted basis, retail employment fell -38k in November after losing nearly -5k in October. This, along with the Challenger report, showing the lowest level of retail hiring for the holiday season in a decade, illustrates the view told to us by retail management at their Q3 earnings presentations: “the holiday shopping period will be slow.”

The leisure/hospitality sector, which showed up as a depressed -7k in Wednesday’s (December 6th) ADP payroll report, came in at an unbelievable +40k in the NFP report. One of these has to be off base; we suspect it is the NFP number as there is a lot of corroborating evidence for the ADP data point.

If we use ADP’s leisure/hospitality number (-7k) and take into account the downward revisions (-35k), then the cyclically sensitive sectors of the economy actually contracted slightly in November.

Other Employment Indicators

The JOLTS (Job Openings and Labor Turnover Survey) for October (the latest) showed a fall of -617k job openings to +8.73 million. While this number looks large (there is a lot of double counting in the survey), it is the lowest it has been since March 2021.

Looking at some detail, job openings in the retail sector fell by -102k and are at the lowest level since April 2020. This is yet another detail that makes us skeptical of the +40k of retail hiring in the NFP report.

The University of Michigan’s Consumer Sentiment Survey for November indicated that the “Jobs: Hard to Get” category was at the highest reading since March 2021.

The S&P Global PMI Manufacturing and Services surveys for November served up the weakest employment component since the 2020 lockdowns.

Job listings by major recruiting firms continue to fall.

All in, data from the economy, outside the NFP and HS, lead us to conclude that the labor market is weakening and is far from the “strong” market the headline numbers would lead one to believe. As observed earlier, data revisions have been to the negative side all year, and we suspect the same will be the case for November’s jobs numbers.

The NFP and HS reports will likely be useful only for the Fed’s policy hawks. And while the recent inflation data has been very good, the Fed doesn’t like the financial markets, especially the bond market, anticipating policy moves. The recent fall in the 10-Year T-Note yield from 5% in mid-October to as low as 4.1% on Wednesday and Thursday (December 6th and 7th) is problematic for the Fed. Those lower market rates loosen financial conditions (in anticipation of a change in Fed policy). In this case, given the hawkish tone of FOMC members, “looser financial conditions” appear to be inappropriate at this time for this group. We expect Chairman Powell to push back hard on the market’s anticipatory moves during the post-meeting press conference this Wednesday (December 13th), using the jobs report as ammo.

This does not mean that the markets will have a correction. Since the pandemic the markets have been a bit more irrational than usual. Valuations were at all-time highs with low interest rates and continue on their upward move even with the rate hikes. Our concern is that we will ride the wave of euphoria until we come back down to reality and then many will be shocked not seeing what was ahead of us all along Source Economist Bob Barone and JP Morgan

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Market Swings and Overbought Conditions

The S&P 500 Equal Weight Index has traded sideways since the middle of last year. Through this sideways trading range, it has some sharp fluctuations. The chart below shows the index’s fluctuations.

From a technical perspective, overbought and oversold indicators have provided a good indication of market direction over the last two years. When an index or security becomes overbought, it suggests that it is likely to pullback. When an index or security becomes oversold, there is a higher likelihood of a rally. As you can see in the chart below, which shows the Equal Weight S&P 500 with its RSI indicator (highlights overbought/oversold conditions), each extreme fluctuation has come at a time when the RSI reads overbought or oversold.

The month of December is historically a stronger period for markets. Perhaps the holidays create consumer optimism. That being said, markets have behaved erratically. Investors felt much differently at the end of October than they did at the end of November. We highlighted consumer sentiment in last week’s update. Emotional, volatile swings in markets are not healthy.

As this update showed, markets are broadly “overbought.” Overbought conditions typically precede a pullback, and in the recent market environment, pullbacks have been large. We continue to monitor market conditions and evaluate portfolio holdings for potential rotations.

The Week Ahead

The economic calendar is jam-packed this week, headlined by interest rate decisions from the Federal Reserve, the European Central Bank, and the Bank of England. U.S. CPI will be released Tuesday, (which will occur prior to the release of this newsletter) a day before the Fed is widely expected to hold rates steady, and the reading could influence how hawkish or dovish the meeting is anticipated to be. Economic projections and the dot plot are included this week, and interestingly, traders have been shifting rate cut expectations forward from May 2024 to March in recent days. That may seem unlikely given a resilient U.S. economy and falling gasoline prices, but investors will be sensitive to the Fed’s forecasts after November’s strong equity rally set the tone for a potential policy pivot.

The domestic calendar also includes 10- and 30-year Treasury auctions, which occurred yesterday as well as retail sales and industrial production figures for November. Global flash PMIs for the manufacturing and services sectors will be released from late

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/