Weekly Market Review

for January 8th 2024

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

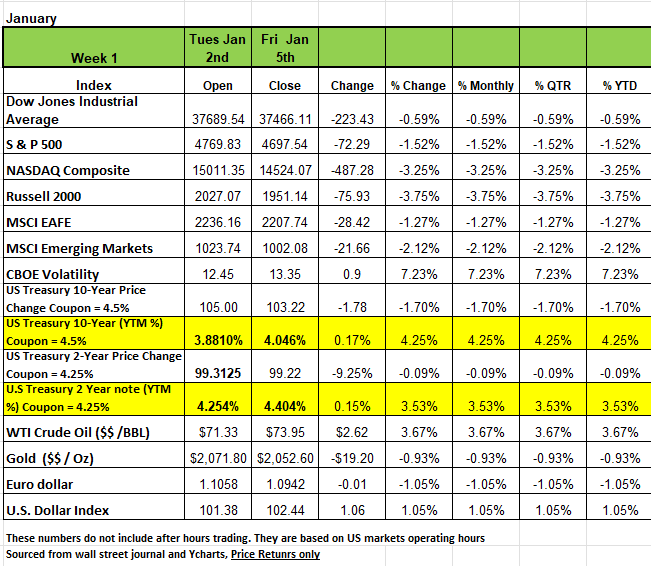

Last weeks marked the start of a new year, coming off a strong 2023 all four of the major indices pulled back last week with Russell 2000 posting the largest decline with a -3.75% and the NASDAQ with a -3.25% drop the S&P dropped -1.52% and -0.59% for the DOW. The S&P snapped a nine-week winning streak. The moves came in just 4 sessions as the markets were closed on Monday for New Year's Day.

The decline last week came as investors adjusted their portfolios following 2023 significant returns. The S&P was flirting with record highs last week amid easing inflation data that helped curb fears of another rate increase by the Fed. Some jitters and caution, however were evident last week as the new year began with looming questions over the Fed committee's next moves.

Treasury yields increased last week to start the year. Jobs data released last week showed the labor market was resilient in 2023 amid rate hikes by the Fed. The US economy added 216,000 jobs in December, more than expected. The report included downward revisions to the prior two months, however. The unemployment rate stayed at 3.7%, which also beat expectations. Average hourly earnings increased a healthy 0.4% from the prior month and 4.1% from a year ago. The US services sector missed expectations in December to close out a strong year measured by the ISM Services Index but remained in expansion territory, albeit at a slower pace. In contrast to services, the US manufacturing sector spent all of 2023 in contraction and has now contracted for 14 consecutive months. That’s the longest manufacturing slowdown since 2001. Despite better-than-expected headline jobs growth in December and solid wage gains, the market stood firm in its expectation that the Fed will cut rates six times this year, including one potentially as early as March, partly due to the slowdown in services. For context, the Fed said last month it projects three rate cuts in 2024. The December reading of the Consumer Price Index is scheduled to be released on Thursday.

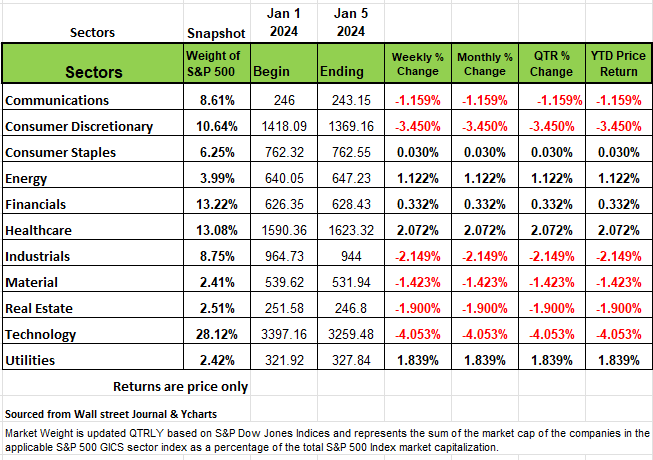

On the sector side 6 of the 11 sectors in the S&P were in the red. The technology sector had the largest percentage drop this week, falling -4.05%, followed by a -3.45% slide in consumer discretionary and a -2.1% decline in industrials. Other sectors in the red on the week included real estate, materials and communication services.

Five sectors still rose last week, limiting the index’s decline. Health care led the gainers with a +2.1% increase, followed by a +1.8% rise in utilities and a +1.1% advance in energy. Financials edged up +0.3% while consumer staples eked out a gain of less than +0.1%.

Decliners in the technology sector included shares of Enphase Energy (ENPH), which fell -13% on the week as KeyBanc downgraded its investment rating on the energy technology company's shares to sector weight from overweight. KeyBanc cited a "unfavorable setup" amid uncertain timing of a recovery in demand.

In consumer discretionary, shares of Norwegian Cruise Line (NCLH) shed -11% as Wells Fargo downgraded its investment rating on the cruise operator's stock to equal weight from overweight.

On the upside, the health care sector's gainers included shares of Moderna (MRNA), which rose +12% as Oppenheimer upgraded its investment rating on the vaccine maker's shares to outperform from perform. In making the upgrade, Oppenheimer said Moderna has multiple catalysts emerging in the next two years that could make it a five-product commercial company by 2026 and accelerate top-line growth starting in 2025.

Economic data will be on the lighter side early next week, though investors will be paying close attention to the December CPI numbers scheduled for Thursday and the December producer price index to be released on Friday, both of which are key inflation readings.

The stock market pulled back during the first week of 2024. However, many traders were probably not too surprised by this development, given the sizable gains achieved over the past couple of months. Looking ahead, it is not inconceivable that the broader index could soften further from here. Followers of technical systems might expect the market to retest and hopefully find support at its 50-day moving average (located near the 4,540 level). From a sector perspective, over the past week capital rotation has been taking place on Wall Street. Specifically, investors have been taking a renewed interest in dividend-yielding stocks, like healthcare equities and utilities. In contrast, the technology sector, which displayed leadership last year, has fallen out of favor, at least temporarily. To some extent, this development may prove constructive, as it can allow traders to reallocate their capital, while still providing some support for the market.

A number of economic reports will be released this week. However, the main event will take place on Thursday morning, when the latest month’s Consumer Price Index (CPI) will be published. (The Producer Price Index will follow on Friday.) Most analysts think the numbers will show that consumer prices rose roughly 3.3% in December (year over year), slightly higher than the figure logged in November. However, the core reading (excludes volatile food and energy items) is expected to show progress, confirming the thesis that inflation is gradually moving lower. The CPI report should be widely followed on Wall Street, as many investors now expect the Federal Reserve to lower interest rates in the months ahead.

In the corporate arena, a number of notable earnings reports are due out at the end of this week. On Friday, we will hear from JPMorgan Chase (JPM), Citigroup (C), Bank of America (BAC), and Wells Fargo (WFC). These releases will be closely followed on Wall Street, as they could set the tone for the fourth-quarter earnings season.

When we entered 2023, households were still flush with the cash from government handouts, the economy was healthy, the federal government was still running a significant deficit, and interest rates, while rising, had not yet been restrictive long enough to slow the economy. Real (inflation adjusted) GDP grew at an annualized rate of 3.0% for the first three quarters of 2023, and the Atlanta Fed’s GDP Now forecast is for a 2.3% growth rate in Q4. Hence, the year’s growth as a whole is going to be somewhere around 2.8%.

Equity values went on a tear last year, with the S&P 500 up more than +24% for the year. Keep in mind that the S&P 500 is a capitalization weighted index, meaning the larger companies have more impact on the index. Thus the Magnificent 7 had a large role in that +24%. The equal weighted index (each company in the index has the same weight) rose 14%. To keep a perspective of things of the 505 companies that make up the S&P index, 173 (34.2%) increased in value by more than 20% and they account for 43.36% of the index. NVIDIA for instance had the largest gain of 238% and accounts for 3% of the weight. 76 companies or (15% of the index) posted returns between 10-20%. There were 73 companies or 14% of the index that posted a return between .01 and 10% and the remaining 182 companies (36% of the index) posted a negative return anywhere between -.01% and -66% on the year. So, if you’re an index/ETF investor you did well if you stayed the course and did not run after 2022.

Among the many comments on inflation in the minutes of the last FOMC meeting was the following, rather gloomy, prediction:

"Several participants assessed that healing in supply chains and labor supply was largely complete, and therefore that continued progress on reducing

inflation may need to come from further softening in product and labor demand with restrictive monetary policy continuing to play a central role".

Translating from Fedspeak: Several Fed officials worried that they might still have to trigger a recession to get inflation all the way down to their 2% target.

This perspective gained some support in Friday’s jobs report which showed a stalling out in a long trend of falling wage growth. However, a broader analysis suggests that non-labor-market factors will continue to reduce inflation in 2024, giving the labor market time to normalize without the pain of recession. While there are plenty of shocks or policy mistakes that could disrupt this path, the mostly likely scenario is a continued slide in inflation to the Fed’s 2% target without a near-term recession – an outcome that should support both U.S. bonds and stocks.

Many think that the progress on inflation since June 2022 has been remarkable. Back in June of 2022, the, not-seasonally-adjusted headline CPI inflation hit 9.1% year-over-year – that was the highest reading since November 1981. This 9.1% encompassed increases of 10.4% for food, 41.6% for energy (remember a barrel of oil was negative in May of 2020 and then surged north of $100 in June 0f 2022) and 5.9% for everything else. We need to keep in mind that a large part of this issue was a self-inflicted cause by several factors including the government, supply chain issues and the Russia Ukraine Conflict. First, and most impactful component of inflation we gave people more money not to work than they earn when they did work, second, we told landlords that they could not evict anyone for being in arrears on their rent. The extra money people had in their pockets drove demand on goods. Especially home prices and urban residents fled to more suburban areas.

Over the past 18 months, all of these impacts have faded so that, by last November, year-over-year headline CPI inflation had fallen to 3.1%, composed of a 2.9% increase in food prices, a 5.4% decline in energy prices and a 4.0% increase for everything else.

One reasonable inference from the fall in inflation so far is that food and energy have seen the most significant declines and so should not be relied upon to cool overall inflation further. That being said, we do not think there will be a resurgence in these areas either. In particular, a broad measure of global economic momentum, the Markit Global Composite Index, only rose marginally between November and December and remains well below its long-term average. This suggests that neither food nor energy prices are likely to be boosted by strong global demand growth any time soon.

Supply, of course, is another, less-predictable matter. The very unsettled situation in the Middle-East has already led to disruptions of cargo ships in the Red Sea. If this were extended to the Persian Gulf, it would clearly have a major impact on global energy prices. In addition, while gasoline refiner margins have fallen back to more normal levels since their peak in the summer of 2022, they remain vulnerable to weather-related or other disruptions.

But if food, energy and core goods aren’t contributing to higher inflation today, what is sustaining inflation above the Fed’s 2% target? The short answer is rent, owner’s equivalent rent and auto insurance. Indeed, in November, these three categories, which comprise 36% of the CPI basket, accounted for 89% of year-over-year CPI inflation.

Crucially, all of this is likely to fade sharply in the year ahead. Rent and owners’ equivalent rent were up 6.9% and 6.7% year-over-year, respectively, in November. However, actual rents on new leases, according to Zillow, were up just 3.1% and had increased at just a 2.0% annualized rate over the prior six months. This slower inflation in new leases is gradually feeding into the more lagged and smoothed CPI series and should drive CPI rental inflation down in the months ahead.

In addition, average rents are still significantly higher relative to disposable income than before the pandemic, forcing renters to take a tougher line with landlords. Moreover, with a record-high, one million plus multi-family housing units under construction in recent months, supply should also act to depress rents going forward. All of this suggests that year-over-year inflation in rents and owners’ equivalent rent could be cut in half in the year ahead. This, on its own, would cut CPI inflation by more than 1%. However, keep in mind that just because inflation comes under control, we are not going to see price go backward to pre pandemic levels. Since January 2020 price have risen 19.0% so what you were able to buy for $100 pre pandemic is now costing you $119.01 and this for many families is going to be a burden.

Average hourly earnings for all workers rose 4.1% year-over-year in December, somewhat higher than the 3.9% consensus expectation. This also means that year-over-year wage growth has not fallen over the past three months following a very steady decline over the prior year and a half.

To some extent this may reflect the exercise of bargaining power by workers with the impact of the auto settlement showing up in a notable uplift in durable manufacturing wages. However, these wage increases could also just be seen as reasonable compensation for the inflation that workers have endured over the past two years.

Perhaps most importantly, we estimate that productivity in the non-farm business sector rose 1.8% year-over-year in the fourth quarter. Broadly speaking that should allow wages to grow 1.8% faster than consumer prices without labor’s share of national income rising and putting extra upward pressure on consumer inflation. Provided productivity growth remains strong, year-over-year wage growth has now fallen very close to a pace compatible with the Fed’s 2% inflation target.

Moreover, in time, we actually expect wage growth to slow further than this. Real GDP growth is slowing while job openings continue to fall and monthly quits have returned to pre-pandemic levels. Given all of this, we expect wage growth to slowly diminish with businesses absorbing at least some of their higher wage bills rather than fully passing them on to consumers. Because of this, when the benefits of lower inflation from housing and auto insurance run out, the impact of higher wages on CPI inflation may well be lower than it is today. Source David Kelley JP Morgan

A Technical Perspective

Technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

There is an old saying “So goes January, so goes the Year.”

Markets dipped last week as the calendars turned over into a new year. The selloff was primarily led by technology-related stocks. Our team hinted at the possibility of technology-related stocks pulling back last week, stating that “from a charting perspective, a few of the big technology names are at or near resistance levels. It would not be surprising to see them pullback off resistance levels.”

From a seasonal perspective, January is viewed by some as one of the most important trading months of the year. There is an old phrase in investing that goes something like “so goes January, so goes the year.” This so called “January Barometer” is the belief that investment performance can be gauged or predicted by whether or not the month of January is positive or negative. So far, markets are pulling back in January, although Monday saw a positive day for large technology stocks this does not mean it will continue.

The January Barometer, a term coined by Yale Hirsch, is preceded by another commonly heard market phrase, “the Santa Clause Rally.” The Santa Clause Rally, also coined by Yale Hirsch, is the tendency for markets to rise in the six trading days following Christmas, which usually ends in the first few days of the new year. Keep in mind that this “rally” is usually on lower volume (lower conviction) due to the time of year. This year, following an over-extended rally in November and December, the Santa Claus Rally did not happen.

Chartered Market Technician, Ryan Detrick, posted some stats on different times when the Santa Clause Rally did not occur. Previously, this had only occurred 15 times since 1950. Two of those occurrences were in 2000 and 2008, when the markets experienced significant bearish trends later in the year.

While all these statistics are interesting and phrases like “Santa Claus Rally” and “January Barometer” are easy to remember, keep in mind that they are not laws in markets. Most would tend to agree that they could be coincidental and due to a number of varying factors.

Investor Sentiment

As of the end of 2023 we mentioned that nearly 50% of investors surveyed in the Investor Sentiment Survey were bullish. After the market’s decline last week, we were surprised to see that sentiment remained largely unchanged. In fact, bullish sentiment rose a little bit, while bearish sentiment fell a few points. Sentiment tends to fluctuate in the same direction as the markets. It’s a contrarian indicator in that more investors will have positive views near market peaks, and more pessimistic views at market troughs. Right now, investors are mostly positive. We will see if that continues throughout January.

The Week Ahead

After digesting better-than-expected employment data, this week U.S. investors turn their attention to the latest inflation figures. U.S. CPI will be released Thursday, with PPI to follow on Friday. If inflation remained subdued in December, that could bolster the thesis contending the Fed could start reducing rates as soon as March, though the U.S. economy’s resiliency would seem to argue against it. In addition, recall that core inflation at 4% is still running at twice the Fed’s target. Forecasts call for a 0.2% CPI increase MoM and 3.2% YoY, versus 0.1% and 3.1% prior.

There are 10- and 30-year Treasury auctions this week, which should act as a good demand pulse given that rates have fallen since last month’s sales. Other U.S. data emerging this week include consumer credit numbers and small business sentiment. Additionally, fourth quarter earnings season kicks off Friday with reports from banking giants JP Morgan Chase, Bank of America, and Wells Fargo. Internationally, inflation updates from Japan, China, and Australia will garner attention. Japan’s Tokyo Core CPI will be released later today, with wage growth data following Tuesday. The Bank of Japan is looking for upward wage pressure before flipping interest rates to positive territory. In China, deflation is the main concern, which may pressure leaders to enact stronger stimulus measures. That country’s trade balance figures and new loans are also tentatively scheduled for this week. Meanwhile, the UK’s

monthly GDP report lands Friday, with recession concerns intensifying. Lastly, the European calendar features German factory orders and industrial production, along with Eurozone investor confidence.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/