Will the Markets End the Year on an Up Note

& Weekly Market & Economic Review

for the Week Ending November 25th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

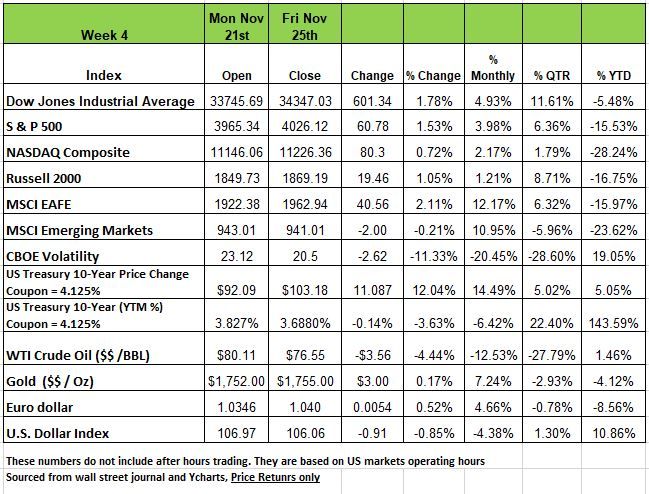

A three-and-a-half-day week of trading produced price gains of +1.78% in the DOW, +1.53% in the S&P500, +1.05% in the Russell 2000 and the NSADAQ ended with a +.072% increase, as investors were encouraged by indications in the Federal Reserve's latest meeting minutes released on Wednesday that most of the central bank's policy makers hope to slow the pace of interest rate increases soon.

With just 3 trading session left in the month of November the Dow is up +4.93% for the month and 11.61% for the Quarter and the S&P500 is up +3.98% for November and +6.36% for the quarter.

Investors also were encouraged by housing data as a report from the Commerce Department showed sales of new single-family homes in the US rose 7.5% in October from September, surpassing economists' expectations for a month-to-month decline. In addition, the Mortgage Bankers Association said mortgage application volume rose for the second week in a row as rates edged lower. So, home buyers are settling on smaller homes or pushing the limits of their credit line in hopes that they will be able to refinance in the near future at lower rates.

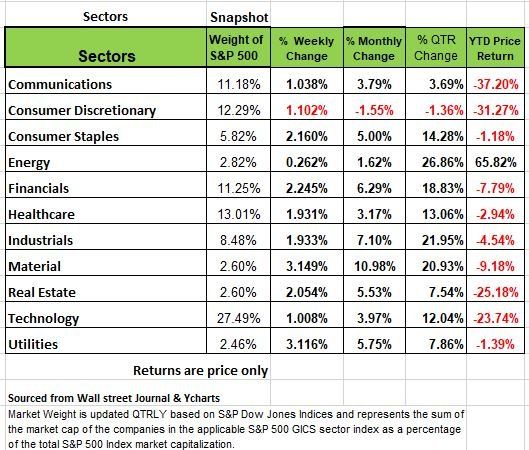

All the S&P 500's sectors rose this week. Utilities had the largest percentage increase, up 3%, followed by a 2.9% rise in materials and a 2.2% boost in financials. The smallest gain was in the energy sector, which eked out a 0.3% increase.

Next week's economic calendar features several closely watched reports including final Q3 gross domestic product on Wednesday, the October personal consumption expenditures price index on Thursday and nonfarm payrolls and November unemployment on Friday. But many investors will be paying attention to preliminary sales that kick off the holiday season. Black Friday and Cyber Monday deals are hoping to drive consumers into the retail stores looking for opportunities of discounted inventory items that plagued many retailers most of the year.

U.S. Treasury yields fell, but the Fed minutes reminded investors that the terminal funds rate could exceed 5%, up from 4.6% at the prior meeting. While the shortest maturities slightly rose over the shortened week. Federal reserve officials grabbed headlines with dovish tones early in the week. Federal Reserve Vice Chair Lael Brainard expressed views that overtightening is a larger risk than the reverse while Atlanta Fed president Raphael Bostic said the Fed should end its hiking cycle after 75 to 100 bps of further tightening.

U.S. economic data reflected the strains of higher inflation and interest rates, as flash PMIs fell to 2.5-year lows and remained in contraction territory for the fifth straight month. Jobless claims rose to a 3-month high and continuing claims climbed, signs of some labor market cooling. Durable goods orders rebounded in October, while new home sales, which are volatile month-to-month, jumped unexpectedly despite high prices.

The U.S. consumer stayed resilient, as early Black Friday results showed a record $9.12B spent online, up 2.3% YoY. But remember increased prices attribute to these number otherwise sales were flat. Flexible payment plans were a big driver of sales, consistent with recent reports of rising consumer credit. This should be a warning sign of potential defaults in the months to come.

Overseas, Germany’s producer prices dropped in October, but YOY PPI remained high at 34.5%. Business activity improved slightly in the Eurozone’s largest economy, and consumer sentiment stabilized after the German government finally agreed on legislation to cap household gas bills.

News That impacts the Markets

Last Monday LendingTree reported that 65% of U.S. workers were living paycheck-to paycheck in September 2022, up from 60% for the same period a year ago, this from MarketWatch. https://www.marketwatch.com/story/millions-of-working-americans-are-living-paycheck-to-paycheck-and-running-out-of-cash-as-another-recession-looms-11666838538?mod=search_headline

Higher consumer prices are eating into personal savings. The personal savings rate (savings as a percentage of disposable income) stood at 3.3% in Q3'22, its lowest level since the Great Recession (2008-2009). To make things even more challenging, declining U.S. home prices wiped out $1.3 trillion in home equity in Q3'22, the largest quarterly decline on record, this will cause major challenges for Americans with Home Equity loans or in need to getting one.

On Tuesday of last week Moody's reported that its global speculative-grade default rate stood at 2.5% in October. The ratings firm puts the historical average default rate at 4.1%. Its baseline scenario sees the default rate increasing to 2.9% in December 2022, and then rising to 5.0% by October 2023. Moody's recorded 71 defaults over the first ten months of 2022, up from 46 defaults a year ago and expect the default rate to continue increasing throughout 2023

Last week FIFA kicked off the World’s largest sporting event with the World Cup tournament, but not without some controversy as the host country Qatar ruled against the sale of beer unless in the premium suites. The U.S tied both England and Wales in their first two games of the tournament.

The crypto world continues to unravel in the wake of the collapse of the FTX platform as other block chain currencies start to file for bankruptcy. The most recent is Block Fi. Too many of these companies have lost billions of dollars which was tied to FTX. FTX has been in the news as the founder and partner have taken assets and traded them without customer knowledge or consent. We have voiced our opinion in the past and our skepticism to a currency not back by a sovereignty. While we acknowledge the value of the underlying technology, but the amount of resources needed to generate and run these systems are expensive energy drains and as we know throughout history given the opportunity people with manipulate anything that is related to money. The current crypto environment is the equivalent of the pet rock of the 70’s.

More turmoil in China over the last several days as the COVID cases begin to mount as the weather begins to change. Chinese authorities tightened controls in reaction to rare nationwide protests against the country’s zero-tolerance approach to Covid, dispatching large groups of police to prevent fresh gatherings as state media reiterated support for leader Xi Jinping’s stringent pandemic strategy. The economic consequence for most Chinese is significant as many that are ordered to stay home are not paid like Americans were. Millions of Chinese workers have no money to buy food and basic essentials. This has resulted in the protest. Wall Street is going to be more concerned about supply chain issues for many U.S. companies.

If you’re a news junkie and listen to any of the financial channels, be aware of the sensationalizing of information. With the holiday season everyone is going to be addressing sales both Black Friday & Cyber Monday. These number tend to be over emphasized by the media and either give the investor over confidence or fear if the news is below expectations. Be careful with misdirection a recent article in Bloomberg stated that “The Stock Trader's Almanac reported that, since 1950, the S&P 500 Index has posted a positive return 80.56% of the time from the Tuesday before Thanksgiving to the second trading day of the following year”. This seems to be designed to give novice traders confidence that the markets will do well this holiday season.

Past patterns are no indication of this year’s results. Even more important: it’s not just how much consumers are spending that matters, but how much the economy is producing, which is the ultimate source of future purchasing power.

If you are looking at your investments, focus on the fundamentals, monetary policy, corporate profits, and the current price of the stock. It’s these fundamentals that determine the path of markets in the next year. The near future is flashing many warning signs.

With results in from 97% of S&P companies for the third quarter, according to FactSet, it looks like corporate profits are up only 2% from a year ago. We would not be surprised at all if the GDP report (due Wednesday morning) shows economy-wide corporate profits fell in Q3 and, given bottom-up earnings estimates so far, continue to decline in Q4.

The stock market depends on two important factors. Profits and interest rates. As the Federal Reserve has lifted short term rates, the entire yield curve has risen, and higher interest rates have been a big drag on stocks. Why? Well one of the functions interest rates play in stock evaluations is to take future cash flows and bring the present value. A zero-interest rate means a zero discounted cash flow number a high interest rate is the opposite. But more importantly when interest rates were so low, investors put more money into equites as they were unable to get any yield in the fixed income market. As money flows to more secure fixed income products the flow is out of equities and into fixed income, if there is not enough buying on the equities side prices can only go up so much

In addition, stocks look like they’ll also have to grapple with stagnant to declining earnings. This is why we think the recent rally does not signal the end of a bear market, just like the rally from mid-June through mid-August, which ended with the S&P 500 peaking just north of 4300.

We think it is highly probable that the market will test the low of 3577and possibly go lower before the next year is over. The next few weeks will provide more information from the FMOC and the direction of the county’s economic indicators.

The Job Market Riddle

The global economy is stuttering, and some of the world’s biggest employers are already laying off thousands of employees, Facebook and Amazon are just two examples. We have written in early articles that the labor force shortage caused employers to hoard employees, over hire. Now those employers are starting to shed much of this excess payroll. Almost three years after pandemic hit and shut down the world economic system, companies around the world still complain that they can’t get the talent they need. The key word here is talent. The U.S. worker has changed in attitude, they are no longer grateful to have a job and earn money and their tolerance for doing a their job well has diminished considerably.

Many economists are scratching their heads wondering where people not working are getting income. Many younger adults have moved back home to live with parents, many have gone off the grid, working for cash (hair stylist for example) Immigration has decline and is a large source for employment pool and many took early retirement. Although those that retired have started to come back to work part time to help offset the decline in their retirement account this past year. Still the labor pool remains a challenge for employers in this post pandemic era.

While the balance sheets of most corporations are healthy there are still a significant number of companies that are not so healthy and are carrying a lot of debt. The increased cost of debt will make it difficult for many to meet their debt obligations and as we just mentioned above expect the default rate to increase over the next several months. Those companies if they do not go under will be forced to reduce payroll. Increasing the unemployment rate and maybe easy the labor shortage. But with that comes other challenges. Consumer spending is down, and credit card debt is up, we do not know how much longer the trend can maintain this pace but expect a shift in the near future.

Many CEOs believe that the labor shortages will likely last beyond the pandemic, and into the next downturn. Deeper forces, such as changes in population and immigration, are shrinking the pool of workers companies can hire from which is also changing the employment landscape. The tight labor market is also driving up wages, the question of whether it will continue to add to the cost of goods and be more systemic has yet to be determine. If interest rates remain high and labor tight, there will be a reduction in new investments and capital expenditures, unless those investments address the labor shortage issue. On a positive note, many employers are also revisiting the prerequisites for hiring. Many companies are not requiring college degrees which could be a benefit for younger adults with limited resources to higher education.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

It was a short, low volume week for the markets. It has now been 11 trading days since the S&P 500’s wild +5% outlier day. Surprisingly, the markets have traded sideways through last Friday. It would have been typical to see more outliers following the biggest up day since March of 2020. As a result, volatility has been declining, bringing back some feelings of normalcy among investors.

This could be a consolidation, or a digestion, of the advance. Or this could be the quiet before a storm? Bear markets will do whatever it takes to confuse the masses. Time will tell which is the case.

Markets from a Technical (supply and demand) Perspective

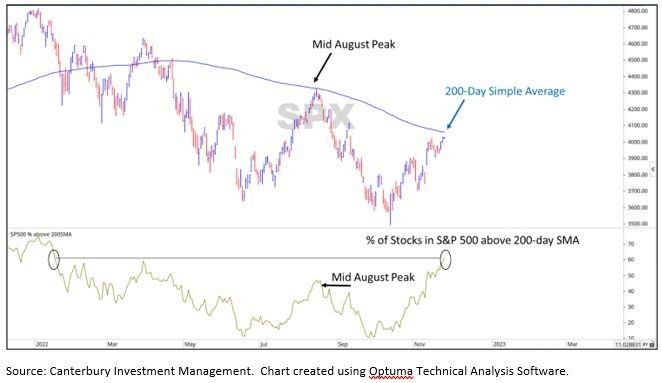

From a market technician’s perspective, the S&P 500 is at a pivotal point. The market is nearing its critical 200-day moving average. The 200-day moving average is considered, by many, to be the point that determines the difference between a bull and a bear market. As a result, the 200-day moving average can often become critical points for support or resistance. The S&P 500 tested the resistance, at the moving average on August 17th and failed to break through. The same was true a few days ago on November the 15th.

One thing that is different this time around is the number of individual stocks, within the index, above their respective 200-day moving averages. The chart below shows the S&P 500 with its 200-day moving average. The chart also shows the percentage of stocks, within the index, above their 200-day moving averages. You can see that there is a much higher percentage of index components today above their 200-day moving average than there were back in Mid-August, which was the last time the index tested the moving average. This is the highest percentage of S&P 500 stocks above their 200-day moving average since January. This is one positive development.

This high percentage of stocks above the 200-day moving average is primarily being led by non-technology related sectors such as Industrials, Energy, and Financials. Each one of those sectors, as a whole, is above their respective 200-day moving average, while Information Technology, Communications, and Consumer Discretionary are all below their 200-day moving average. These are the more cyclical and economic sensitive sectors

As a word of caution, leading sectors such as Industrials, Financials, Consumer Staples, and Basic Materials have all seen parabolic run-ups (larger than normal advances) over the last several weeks. Each is nearing its own individual points of price resistance. Pay close attention to whether, or not, these sectors can break above these important price points. If they do break higher, then it will be important to see if they can successfully stay above those price levels. The former points of resistance should be the new support levels. Support would need to hold to confirm a change in the trend, from bearish to bullish.

The Week Ahead

This is a big week of economic activity coming off the post-holiday week. First highlighted by the U.S. jobs report and another inflation update. The trend towards layoffs has picked up steam recently, but with almost two openings per job seeker, the data is likely to take time to filter into the official employment report.

The Fed will be watching for any material changes in Friday’s report, as well as the preceding JOLTS and ADP releases. FOMC Chair Powell speaks Wednesday at the Brookings Institution, with the focus on the economic outlook and labor market. Slightly hawkish commentary in line with November’s FOMC remarks are likely but should not move the fed funds futures curve much.

On Thursday, the Fed’s preferred measure of inflation, the Core PCE Price Index, is anticipated to ease slightly but remain elevated despite how much growth has stalled. Other U.S. events of note include consumer confidence, the revision of Q3 GDP, pending home sales, and ISM Manufacturing PMI. Additionally, investors hope that holiday supply chains aren’t derailed by a potential railway strike, as union leaders try to reach a deal before December 9. On the international calendar, Europe’s November CPI may reveal some signs of improvement as energy prices have come down, while China’s PMIs are expected to linger in contraction as protests erupt across the country because of lockdown restrictions.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/