The Markets in Review & the Economy

from the Week ending November 18th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Weekly Recap

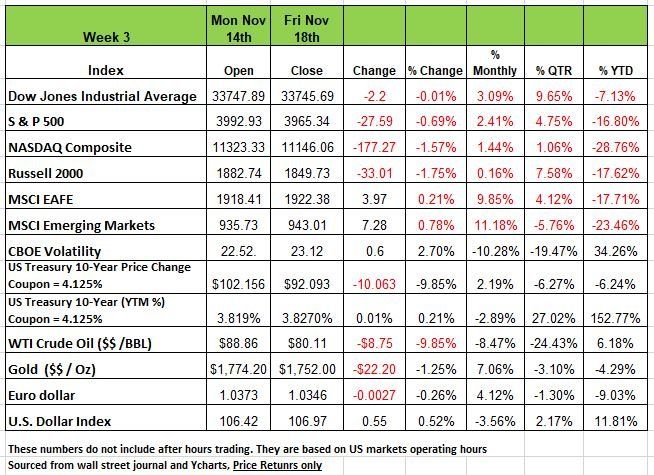

Last week was one of ups and downs as U.S. equities finish a bit lower. The Russell 200 how the largest decline of -1.75% followed by the NASDAQ with a -1.57% The S&P -.69% and the DOW was basically flat with a -.01%. Much of the movement came as optimism waned for a Fed policy shift after several Fed Presidents voice opinions on interest rates.

Crude oil traded as if an impending recession is a forgone conclusion, plunging 10% to $80 per barrel. Stability in the U.S. dollar and fading supply concerns pressured the commodity.

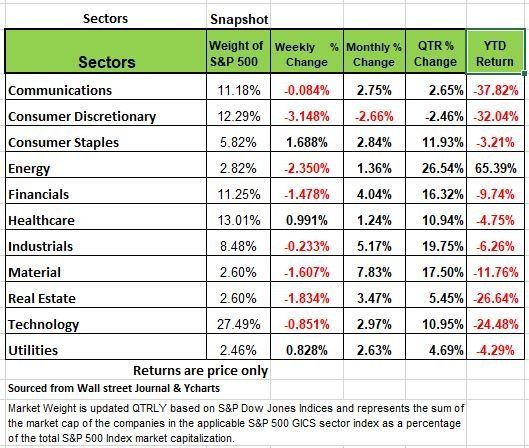

The week's drop also reflects a paring of the excitement over slower-than-expected inflation that fueled the rally for the week ending 11-11-22. Among the 11 S&P 500's sectors, only 3 post gains: Consumer staples rose 1.7%, followed by a 1% increase in health care and a 0.8% rise in utilities. Consumer discretionary sector had the largest percentage drop last week, sliding -3.1%, followed by a -2.4% drop in energy, a -1.8% decline in real estate and a -1.6% slip in materials.

U.S. Treasury yields eased slightly, but comments from several FOMC members suggested that the federal funds rate is going at least another percentage point higher, as the tightening campaign thus far has had “limited effects” on observed inflation. The coupon on the 10 yr. Treasury is 4.125% so with the price rising the yield has dropped signaling that investors are looking for some safety and think that inflation will taper, and the fed will slow down rate hikes, However the 2 years Treasury has a coupon of 4.375% and is selling at a discount increasing that yield to 4.514%

Last week’s economic data for the U.S. was mixed, with producer prices slowing their ascent in October dropping -5.6% (annualized) from June to October, on a MoM basis .02% with a consensus of .04% but it is still up 8% YoY. So the question is which narrative will you focus on a lagging or leading indicator.

Regional manufacturing reports reflected persistent inflation pressures. Industrial production contracted by 0.1% MoM as capacity utilization decreased. Retail sales jumped 1.3% in October on strong vehicle purchases, but Q3 household debt surged at the quickest pace in 15 years as credit card usage rose.

Unemployment claims remained low despite an increase in layoffs, particularly in the tech sector. U.S. housing starts and existing home sales slumped once again as reduced affordability weighed on buyers, evidenced by median home prices continuing to rise despite high mortgage rates.

In international news, UK inflation reached a 41-year high of 11.1% YoY in October, while retail sales rebounded only slightly from September’s drop. Finance minister Hunt forecasted the economy would shrink by 1.4% in 2023 as he introduced numerous tax increases and reduced public spending.

In China, regulators issued sweeping plans to prop up the beleaguered property sector, while October’s industrial production and retails sales figures missed the mark. China’s pivot from zero-covid policy appears to be imminent, yet surging cases into the winter is likely to create further policy and economic uncertainty. Lastly, Japan’s economy unexpectedly contracted in Q3 as the yen’s historic slide hampered growth.

Debt Markets

As we have mentioned in previous articles when something is cheap and in abundance there tends to be a recklessness in the way we treat such products. Money is no different and we are about to see the consequence of that behavior in the near future. Currently the U.S. economy seems like its sending mixed signals about the future direction of inflation even as the Federal Reserve (Fed) attacks it with aggressive rate hikes. Inflation data is signaling that it should have peaked, these include negative to zero real GDP growth over the past three quarters, slowing business investments, a collapsing housing market, slowing retail sales, weakness in manufacturing activity, low consumer confidence and seven consecutive months without a positive leading economic indicator reading. Any textbook definition would state that the United States is already in a recession.

If the Fed continues maintains an indifferent policy response, it will likely drag out weak economic conditions well into 2024 and stretch and deepen the default cycle. These defaults will be seen in many poorly run organizations (Zombies companies) that can barely meet their current interest payments let alone the principal. The challenge is understanding the resolve of the Fed and the expense of being so tunnel visioned.

If we experience a long and deep recession in the U.S. it raises the probability of increasing defaults in credit markets. This based on the premise that the Fed will not be more accommodative with rates. Poor operations, a habit of cheap easy money over the last decade is starting to see consequences. There are Several factors that suggest the next default cycle could be more distinctive, credit-specific and impact multiple industries, most specifically technology. The stress in this cycle is driven by unforgiving high interest rates, as opposed to historic cycles triggered by a specific sector-related issues. The biggest concern for credit is the Fed itself and the possible lack of what we refer to as a typical monetary and fiscal policy response that occurs when the U.S. economy undergoes a recession. This may mostly be due to fears of reigniting above-target inflation, driven by an unpredictable consumer and political driven decisions, flooding the economy with more money to consumers.

Despite growing headwinds for the economy, there are some strong positive financial results we see across a large portion of the credit market. For instance, most debt issuers are heading into this slowdown in good financial shape, (unlike 2007) with strong balance sheets and historically high earnings. Given solid credit fundamentals, we view yields and discounted bond prices as offering the most attractive opportunity to portfolios in over a decade, the discount on some shorter maturities with low coupons gives investors the opportunity to profit on the back end of a bond buy, but just be aware of downside risks that remains while the economy continues to absorb the full extent of policy tightening.

Investing during a High Inflation slow Growth environment

Normally, inflation is a result of too much economic activity—a case of surplus cash chasing around an insufficient supply of goods. This is exactly what happened during the pandemic, the government flooded the economy with cash, and consumers ran to buy items they normally would not buy and guess what Inflation reared its ugly head.

However, the conditions we are experiencing now seem to contradict most economic rules. Being in an inflationary environment with a slowing economy seems like a recipe for trouble. In theory, it should be that a slowing growth leads to slowing price gains. But this is not what has happened, as annual inflation rates have stayed high, thanks to a mix of government interference, a reduced labor force and a most interesting shift in consumer spending patterns, and supply chain problems.

This has been a problem for anyone trying to protect the pot that holds their life savings. Portfolios shrink in value as does the purchasing power of your dollar. This year the markets have taken a beating and most especially for those investors with portfolios on auto pilot, meaning they are invested in index and ETF’s not knowing the underlying securities in those funds and are over exposed to certain sectors. Managing your money require efforts, you do not need to become a professional but need to have enough knowledge to make sure you are not misguided, by buying into a theory that does not work. During Bull markets, like we have experience over the last 10 years (excluding 2022) it was easy to do little and watch your portfolio grow. But a good wealth manager can minimize the downside during environments like the one we are in. They pay attention to their clients portfolios and know what their needs are.

It is easy to get distracted by noise and forget why your investing, Allocating your assets needs to be thoughtful and in alliance with your ability to handle risk, not just your appetite for it. The last several years with artificially suppressed interest rates have given the typical investors over the age of 60 poor returns and those holding bonds with low coupons over the last few years have seen those securities drop in value, just look at how much someone holding a 10-year Treasury the beginning of the year declined in value.

When you're assessing stocks, consider paying attention to these measures:

Strong profit margins: This is a measure of how much profit a company makes after accounting for its costs. EPS Earnings per share are a good way to look at a company's profit

High free-cash-flow yield: These measures how much cash a company has available for things like dividends after accounting for its costs and debt service. It is calculated by dividing its cash flow from its market capitalization. A higher yield is generally a sign of financial health.

Low volatility. This is self-explanatory, but even in today's wildly swinging markets some stocks are simply less volatile than others. Standard deviation is a good measure of this metric

Positive forward earnings revisions. This captures what companies are reporting in terms of their earnings expectations for the coming months. Granted, the share of S&P 500 companies reporting positive three-month earnings revisions has shrunk significantly this year, from nearly 70% of the index's stocks around the start of the year to about 30% of the stocks as of mid-September.

Consider dividend payers Dividends, when reinvested, can significantly boost total returns over time, making dividend-paying stocks an attractive option for younger investors alike. For older investors you should be getting something for your risk and not rely on price movement only. Develop a portfolio that generates income

If you want to reinvest it then you can evaluate your entry point. Everything in this business is based on your entry point and your exit point. Be aware of this. In these environments defensive sectors such as Consumer Staples Healthcare and Utilities are safer plays

For those in need of fixed income this particular year was difficult. As we mentioned earlier with interest rates rising older bonds are declining. But one cannot eliminate fixed income for their portfolio if you are adding bonds to your portfolio consider the following ideas

A bond barbell is a tactical strategy that focuses on bonds with two different types of maturities—short-term and longer-term. Today, we prefer maturities of three years or less for the short-term holdings, paired with maturities in the seven- to 10-year area. By concentrating on a combination of short- and intermediate- or long-term bonds—while avoiding what's known as the "belly" of the yield curve, i.e., maturities in the three- to seven-year range—the maturity allocation can somewhat resemble a barbell

A bond ladder is a portfolio of individual bonds with staggered, or "laddered," maturities. While a bond barbell is more of a tactical strategy that may depend on the shape of the yield curve and future Fed policies, a bond ladder is a type of "all-weather" strategy that is meant to help provide predictable income with the flexibility to reinvest bonds as they mature.

If you have a portfolio that is on auto pilot take a moment to think about switching to a more active strategy. If you have an advisor that is against that maybe consider looking for a more hands on manager. That is what you are paying them for. But one other major problem with auto pilot portfolios is the rebalancing component. Rebalancing is used by selling off securities that have done well and buying those that have not done so well to bring your allocation mix into balance based on your risk tolerance. Computers should never rebalance your money, you and your advisor should evaluate and make decisions together that makes sense, especially as your needs change.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Volatility is what defines a bear market, and we know that all bear markets are volatile. Mostly driven my fear. Volatility remains high, and the markets have put in a series of lower highs and lower lows, which is the textbook bear market pattern. The mega-cap, technology stocks that have carried the markets higher over the last few years are the same ones that now lead its decline.

Remember volatility will go in both directions, and the direction will be unpredictable. This year there have been just as many outlier days to the “upside” as there have been to the “downside.” As the market goes through various swings, it is crucial to manage portfolio fluctuations, and keep them limited to normal volatility levels.

Compared to all the volatility experienced this year, last week was a quiet week in the markets. Last week marked the first calendar week, since early September, not to feature a single outlier day (a trading day beyond +/-1.50%). Prior to last week, the S&P 500 had gone ten consecutive weeks with at least one outlier day and eight of those weeks had at least two outlier days.

We are now forty-seven weeks into 2022. Only eight calendar weeks have had no outlier days, and there has yet to be two consecutive weeks with no outliers. This week, the week of Thanksgiving, is a short week. Markets are closed on Thursday and only open half-day on Friday. So we’ll see if the markets can go another week without an outlier, although it probably would not have much significance. Just remember markets are inefficient and volatile.

Investor Sentiment

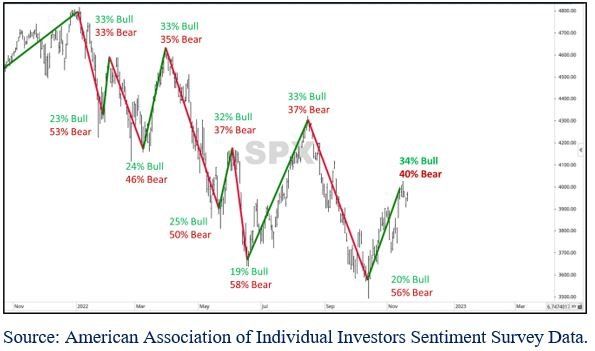

The chart below is an updated chart of Investor Sentiment, which was shared a few weeks ago. As a reminder, the Investor Sentiment Survey is a poll conducted by the American Association of Individual Investors, where participants are asked if they feel “bullish, bearish, or neutral” about the markets. This is a “contrarian” indicator. It has been shown that investors typically feel more bullish near peaks and bearish near troughs. This aligns with the swings seen in the S&P 500 so far this year. At the previous relative market peak, in August, only 37% of investors had been bearish. At the markets low in mid-October, only 20% indicated they were bullish, while 56% were bearish. Right now, after the market’s recent rally, there has have been a shift in sentiment. Now, only 40% of investors are bearish, as opposed to the 56% that were bearish a month ago. Source Brandon Bischof

The Week Ahead

A shortened week awaits with the U.S. markets closed Thursday for the Thanksgiving holiday followed by an abbreviated session on Friday. But there’s plenty packed into the economic calendar before the festivities get underway. Most of the action occurs Wednesday, starting with the latest flash PMI readings from Europe, the UK, and the U.S. Durable goods orders and new homes sales are also on the U.S. agenda. The main event will be the minutes from the most recent FOMC meeting, which could shed light on how concerned the Fed is about lags in monetary policy and their economic impact. Investors now seem more comfortable with where the peak in rates may be next year and that the pace of hikes is likely to slow in December and beyond. It seems likely the Fed will keep rates in restrictive territory for some time, but that is a 2023 problem. In Europe, the ECB meeting minutes are featured along with Germany’s producer prices, business and consumer sentiment, and a final Q3 GDP update. Finally, core CPI data in Japan will be released, and although it still lags the rest of the world it continues to plague the central bank’s attempts to reduce import costs.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/