Why we Think Unemployment will soar & Other Market News

for the Week Ending June 3rd 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

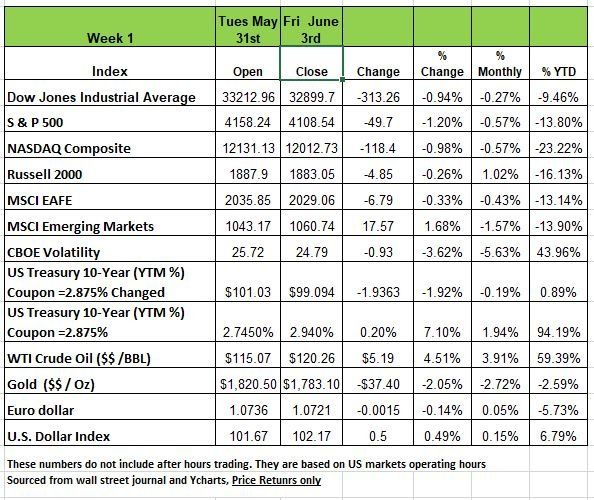

Last week was a short week due to the Memorial Day weekend. It’s the start of summer for many, meaning summer work hours (early finish on Fridays) All of the indices were negative for the week just around -1%. with The S&P 500 index declined 1.2% and the Russell 2000 just -.26%. The markets took a turn when the jobs reports were release as the market saw this as an excuse for the Fed to keep hiking rates.

The charts below show to YTD performance for the indices ranging from -9.46% on the DOW to -23.22% in the NASDAQ

Investors started the month looking for direction on how well the US economy is handling higher rates and prices. However, quarterly earnings have been mixed, with some companies still reporting results above expectations and others falling short of street estimates in addition to weaker-than-anticipated guidance amid economic challenges.

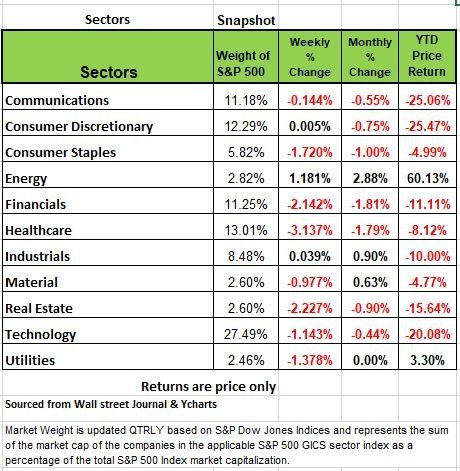

By sector, health care had the largest percentage drop of the week, down 3.1%, followed by a 2.2% decline in real estate and a 2.1% loss in financials. Other sectors in the red included consumer staples, utilities, technology, materials and communication services.

On the upside, energy climbed 1.2% while industrials and consumer discretionary eked out gains of less than 0.1% each.

Treasury yields rose significantly over the course of the week as expectations for 50 basis point rate hikes during the next four Federal Reserve meetings increased. Investors have been looking for signs that the Fed may scale back the pace of rate hikes to only 25 basis points later in the year, however, statements from Fed officials are dashing those hopes. Treasury yields rose significantly on Tuesday and Wednesday as Fed Governor Christopher Waller said that until he sees signs that inflation is coming down he will support 50 basis point rate hikes. St. Louis Fed President James Bullard said that the Fed is “on the precipice of losing control of inflation expectations” while San Francisco Fed President Mary Daly said that the Fed should not pause until the target rate is about 2.5%. Fed Vice Chair Lael Brainard doesn’t support pausing rate hikes in September, while Cleveland Fed President Loretta Mester said that 50 basis point rate hikes are still possible in that month.

Yields remained flat on Thursday before rising moderately again on Friday as the Change in Nonfarm payrolls was 390k, compared to consensus expectations of 318k. This led investors to believe that the economy is still running hot and that the Fed would still use significant rate hikes to curb inflation. The market implied probability of a 50 basis point rate hike rose to 100% for each of the June and July meetings, while the same probability for the September meeting rose from 43% at the start of the week to 67% by the end of the week.

Why we think unemployment will soar

Last year we discussed the issue of Zombie companies in the S&P500. The term was coined in Japan to describe companies that could barely make the interest payments on their loans let alone the principal. Approximately 20% of the top 500 companies were considered zombie companies in 2020. Poor management distracted by over valued stock prices due mostly to unrealistic expectations led many CEO’s to think they were golden, when in fact they were creations of easy credit, beneficiaries of central bank largesse. That the era of unconventional monetary policy is now over, these companies are now facing a challenge like never before.

When interest rates are at or close to zero, it’s very easy to get credit, and under those circumstances, the difference between a well-run company and a poorly run company is less obvious. But with rates increasing significantly poor management will be easily spotlighted.

The ranks of these zombie companies have swelled in the last 12 years, comprising roughly a fifth of the country’s 3,000 largest publicly-traded companies and accounting for about $900 billion of debt.

We think that their time may be running out.

Because these firms that once counted on virtually unfettered access to the bond and loan markets to stay afloat are now being turned away as investors are bracing for a recession. The spigot is now closed to all but the most creditworthy issuers. The fortunate few that can still find willing lenders face significantly higher borrowing costs as the Federal Reserve continues to raise interest rates to tame inflation. In addition with surging input costs poised to eat away at earnings, it’s left a number corporations in America with little margin for error. The end result could be a prolonged stretch of bankruptcies unlike any we’ve seen in recent memory. In addition, a number those CEO’s will be joining the ranks of their former employees on the unemployment line. Source: https://www.bloomberg.com/news/articles/2022-05-31/america-s-zombie-firms-face-slow-death-as-easy-credit-era-ends

Goodhart’s Law

One of the most notable economists over the last 50 years is Charles Goodhart, a professor at the London School of Economics. One of his theories known as Goodhart’s Law has become an important concept in the realm of finance and economics. The premise of his theory is based on metrics. “When a measure becomes a target, it ceases to be a good measure.” What does this mean?

Basically, once as we begin to base our decisions not on the merits of the evidence at hand, but on a shorthand symbol of that evidence (outcome), that metric becomes less effective at representing the actual evidence.

This can also lead to perverse incentives, take the bounty the British government created when it controlled India in the early 1900. In order to control the over population of poisonous Cobra snakes, the British Government offered a bounty for every Cobra that people killed. As the population of Cobras diminished people began breeding the snakes in order to profit from the situation.

The is a financial parallel here in the recent proliferation of ESG funds of dubious design; they’re Wall Street’s version of cobras bred in captivity.

We can take the S&P 500 as an example often used as the benchmark for market performance. But with the popularity of index investing, it has falsely distorted the metric.

More broadly, though, think about how investors largely use a stock price as a shorthand symbol of a company’s value and per share metrics for what it has earned over a period of time. These prices are distorted because of index investing buy side only. In addition, many corporate leaders and employees are rewarded entirely on the performance of these sorts of shorthand metrics and, as dividends have become less meaningful over time, they have become the end-all be-all to investors. So many people focus only on the price, nothing else. Hence, we have made the metric the target, a useless measure of performance.

A new Beginning on the horizon

Roman philosopher, Seneca the Younger was known for some of his wise quotes on life. One such quote that may be relevant to the investing world is “every new beginning comes from some other beginning’s end,” This deceptively simple idea, that every end leads to a new beginning, is relevant to understanding the volatility across the markets in the last several months: The end of a liquidity cycle is the beginning of a coordinated global tightening cycle.

While this may seem daunting to think that the days of easy money and the “everything rally” are over, this ending marks the start of a new environment that will come with its own opportunities. This new environment will have its pain points and investors will have a learning curve. But for poorly managed and overvalued companies this will mostly likely resulted in a rude awakening. Portfolio performances of the last few years will not likely to continue in the near future. Simply because too much money flowed into equities since interest rates were so low- and fixed-income products were not producing any yield.

As money flows out of equities and into the higher interest rate products we will see equity price decline

The new environment will feature dispersion across asset classes, portfolio performance, companies and sectors. It will require a different approach than the traditional portfolio of stocks and bonds. Perhaps alternative type of investments. More importantly it will require knowledge of the economy creativity, high-conviction investing and a renewed look for uncorrelated assets. If ultra-low interest rates and balance sheet expansion benefited beta strategies (outperforming the benchmark), monetary tightening will require more active, thoughtful and selective investing. The conversation you should be having with your investment manager is what you need and how to achieve that with minimal risk.

A Technical Perspective

The market index, the S&P 500, added two more outlier days to close last week, bringing the yearly total to 38 days (out of 107). (Remember an outlier day is a movement of +/-1% ) After rising +1.84% on Thursday, the index gave up the small gain for the week and fell by -1.63% on Friday. This has been the new normal, and volatility continues to show through in the markets.

It should come as no surprise that volatility, remains high. As a reminder, a VI (Volatility Index) reading on the S&P 500 below 75 is generally considered “low risk.” Conversely, a reading above 90 on the market index is considered high risk. Right now, the volatility of the S&P 500 is 133, just a few points away from its high mark of 141. Volatility has not begun to cool off and will not go down until we begin to see a reduction in the frequency of outlier days.

The Energy Sector

If you have filled up your tank recently, it should come as no surprise that energy has been by far and away the best performing sector for the year. Year-to-date, the S&P 500 energy sector is up more than +50%. The rise in the sector has occurred on high volatility (the sector boasts a volatility of 175), but the rise in energy has been orderly, nonetheless. In general, energy has always been more volatile than the S&P 500, given that the sector by definition is concentrated in one area and had mostly been in a bear market from 2014 through 2021.

So far in 2022, the energy sector has experienced 50 days beyond +/-1.50%, including an 8% drop in one day. For the S&P 500, the split between “up” outlier days and “down” outlier days has been nearly 50/50. For energy, nearly two-thirds of the outlier days have been to the upside. In other words, energy is volatile, but just like the price of gas, the majority of volatility has been to the upside.

Bonds

In our recent video, found here, we referenced an observation we made back in January. That observation was that inflation has gone up, and one would expect interest rates would have to go up to match inflation, and therefore bonds would fall (bond pricing and interest rates typically have an inverse relationship). In 2022, that is exactly what has happened, even with a falling stock market. Bonds have done basically nothing to offset the volatility in stocks.

When stocks have fallen, so have bonds. When stocks have rallied, well, bonds really have not and a balanced (50/50) portfolio of SPY (S&P Index Fund) and TLT (20 year Treasury Fund) has not done well.

So its wise during this environment to know the underlying risk and value of the securities you invest in.

Market Leaders

Currently the top ranked sectors, are Energy, Utilities are currently the only sectors in the black for the year but as the economy worsens, we expect Consumer Staples and Healthcare to perform well. Typically, these are considered the defensive sectors during challenging economic environments.

We discussed interest rates in terms of bonds, but we believe it is conventional wisdom that most investors would assume rising rates would be good for the financial sector. After all, if interest rates go up, banks might be expected to have higher net interest margins. But with many companies over leveraged we feel that banks might be more vulnerable to defaults, especially on the credit card side of their business.

Our goal in this environment is to create stability within our portfolio’s, regardless of the market’s large fluctuations we actively manage and look to minimize downside. Source Brandon Bischof Canterbury Investments.

The Week Ahead

With inflation at 40-year highs and the personal savings rate having plunged to a 14-year low, the challenge over the summer months will be how quickly that spending power might be drawn down, and the potential effects on the wider economy. This Friday brings another CPI update, and although estimates suggest a second straight decrease in YoY headline inflation, much more progress is needed to bring prices under control. Additionally, consumer credit is expected to contract from April’s record high, a further sign of households feeling the pinch. This week also features Treasury auctions and the first look at June consumer sentiment. Overseas, the focus will be on interest rates, with the ECB meeting on Thursday and likely outlining the plan to raise rates in July and September. Australia’s central bank is expected to boost its benchmark rate by 40bps to 0.75%. In Europe, German factory orders and revised EU GDP round out a light calendar. China releases a slew of data, including services PMI, trade balance results, and inflation figures.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/