Did the Markets just do a "Head Fake"?

An investors Guide to a Recession

& Other Economic News

for the Week Ending May 25th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

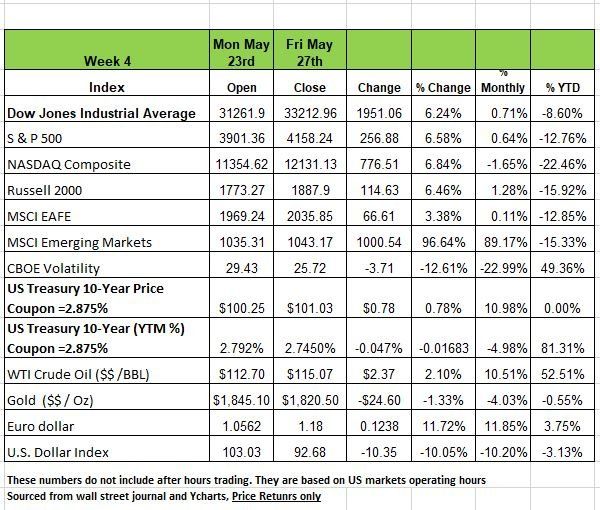

After 8 weeks of downward movement, the markets finally achieved a positive upward move and it did so with a vengeance. The last week the markets showed any positive movement was the week of march 25th Since then negative economic news has put downward pressure on stocks. All four of the major indices produced more than a 6% increase over the last 5 days. But will this trend continue is too early to tell.

The Street breathed a sigh of relief after the release of the Federal Open Market Committee meeting minutes on Wednesday which suggested that the FOMC might pause rate hikes later this year to avoid a hard landing (RECESSION). The reversal in equities markets was underpinned by the "bad news is good news" trade following the release of disappointing housing market data and a downward revision to Q1 GDP.

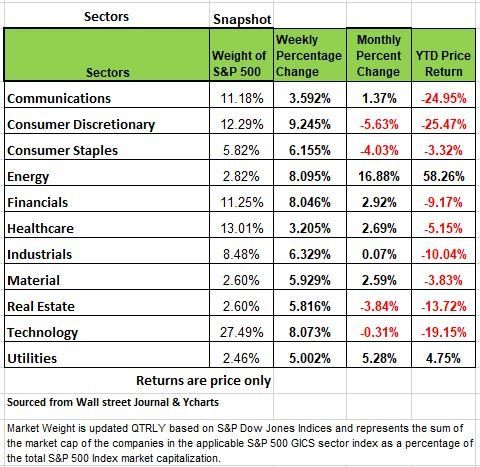

All of the 11 sectors in the S&P 500, performed well with consumer discretionary outperforming the other 10 with a +9.24% gain over last week's close. The energy financials and technology sectors were all up over +8.0% for the week.

Bond yields fell across most of the curve for the third straight week marking their lowest levels in over a month. Yields tumbled on Tuesday (prices increased) as investors renewed demand for safe-haven treasuries after negative earnings news created caution around advertising and consumer spending. In addition, new home sales numbers disappointed after reporting a 0.591 million annual rate, well below the consensus expected 0.749 million and marking a 27% drop from a year ago. The spike in the average mortgage rate to 5.24% paired with higher-priced homes and broad-based inflation has cut demand. The release of Fed minutes on Wednesday left yields little changed. Most US policymakers view half-point rate hikes as appropriate at the next two meetings but left the door open for a pause in early fall. Officials believe expedited tightening in the coming months would leave the Fed “well-positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustment.”

Head Fake

Last week’s market rebound gave many investors a sign of relief and that the worst was behind us. The media added to this sentiment that perhaps the markets reached its bottom. Don’t be fooled. If you have not already moved much of your portfolio to cash and have some profits based on your cost basis you might consider a shift unless you can stomach the volatility. As we have penned in the past volatility is a two-way street and when there are extremely outliner days (more than a 1.5% swing) the signal is one of concern and lack of confidence. We have always advocated they need for the investor to know and understand the underlying assets in their portfolio. This does not mean you have index or ETF funds but that you know which companies are in those funds and the weight it carries in the fund and hence overall performance. If your advisor is not able to provide you with that information just google the ticker symbol. You can get that information off of your most recent quarterly statement. Once question we always ask our clients is “Would you be more upset if your portfolio lost money or if you lost out on making money because you got out too soon. The big mistake that most clients make is not establishing an expectation or required return on their investment and hence they tend to use the S&P 500 index as a benchmark as to how well their portfolio has done. Often Regret aversion comes into play and investors moving into these funds after the fact. This may bring a lot of short-term joy during times of upwardly moving markets, but what happens during times like this. Volatility is the red flag.

Volatile markets typically do not end so quickly.

Investment should be based on the strength of a company’s financial health, not stock movement. Which is one reason why indexing can be harmful.

Strong growth means healthy corporate earnings, a stable labor market, low corporate defaults and bankruptcies, all of which support the performance of equities and high yield credit. Typically, in the 12 months before a recession, we tend to see that rate hikes have tightened financial conditions and slowed economic growth. This environment tends to see lower-risk, longer-duration assets outperform riskier sectors. It is at this point, several months out from recession, that investors should look to become more defensive. Sir John Templeton famously said, the four most costly words in investing are “This time is different.”

However, what may be different this time is the role of government, the more government interferes with a free market, the more disruptions and extreme shifts we are likely to see so perhaps the difference is the 12-month lead time to a recession.

An Investor’s Guide to a Recession

There is no shortage of experts running in front of the camera to share their thoughts on where our economy is heading. The media in all forms focus on one agenda to scare the living S… out of us. Misinformation is their creed, So, we thought that perhaps this might be a good time to clarify exactly what a recession is and is not.

A recession is not—and has never been—defined as two consecutive quarters of negative GDP. In fact, the 2001 recession we had only one quarter in which GDP contracted also, despite GDP contracting for two consecutive quarters in the mid-to-late-1940s, there was no recession. So, the contraction in first-quarter 2022 GDP doesn't necessarily mean a recession is beginning. It is not defined by the market dropping by 20% and heading into “Bear territory”

Recessions are always defined by past economic activity; it has to be since none of us can predict the future. At times, but not always Americans can feel the pressure of a recession when they are in the middle of it and do not need an official declaration. The authority in the U.S. that determines the state of the economy is the National Bureau of Economic Research (NBER), and they define a recession as "a significant decline in economic activity that is spread across the economy and that lasts more than a few months."

There are four main components of the economy that the NBER uses to evaluate whether the United States is in a recession or not. The four indicators that make up The Conference Board’s Coincident Economic Index (CEI):

· real personal income less transfer payments;

· nonfarm payroll employment;

· wholesale and retail sales;

· and industrial production.

The CEI tends to track the business cycle in real time, (the cycle has 4 stages Trough the lowest point, Expansion then Peak and Contraction) peaking at the start of recessions and finding a trough at the end of them. While the media would like to intensely focus on whether or not we are in a “Recession” and if we are in a “Bear market” is a bit misleading in that the healthy of the economy has only these two choices.

Recessions are not a matter of "if" but simply a matter of "when." But the News media will portray them as a catastrophe, so that the average consumer and investor becomes frighten, often references extreme conditions such as the 1930’ & 2008. Fear sells. But the reality is every economic cycle ends in a recession, allowing any excesses to be wrung out and make way for the start of a new cycle.

But as human beings we all have some experiences that are not good and the worse they are, the more ingrained they are in our memory and become our reference point in the future. Much like

muscle memory, the past couple of recessions paint a rather unpleasant situation.

Both the COVID-19 pandemic in 2020 and the global financial crisis in 2007-2008 sent shockwaves throughout world asset markets and spawned multiple, lasting crises. Those anomalies are much different from the natural cycle, which can go unnoticed by the consumer.

The issue that we have now unlike any other time in history is Government interference. Much like the 2008 recession and more so during the pandemic the Federal Government spent money recklessly. In addition, the Federal Reserve has become politicized this can be seen by the artificially suppressed interest rates for the last 12 years.

Typically, the Fed hikes rates (sometimes aggressively) to combat inflation and/or growth that’s overheating, we then see unemployment increase, the labor market weakens, incomes fall, and overall growth slows. This is how the cycle has operated historically.

Pay attention to the Red Flags

It is important to pay attention to specific leading economic indicators (LEI) for clues as to where the economy is headed at any point in the cycle, this is most important when a recession seems to be on the horizon. The (LEI) from the Conference Board is a combination of key indicators that historically have move in advance of the next business cycle. These indicators cover the labor market, stock prices, and consumer/business confidence, among others. For example building permits and unemployment claims are just two LEI's. The LEI’s measure both the level (strong / weak) and trend (stable /worsening) for each indicator. These are perhaps the best indications of both the strength and durability of the phases of each cycle.

We want to mention that whenever examining the LEI it is equally as important to look at the “trend” of the indicator as much as the “level”. Individual components shouldn't be looked at in isolation, and their strength in level terms often isn't enough for a comprehensive analysis of inflection points, even in the run-up to recessions.

As an example, in 2007 many of the indicator levels were “strong” but their trend levels were weakening, sliding. Figuring out the economy is much like building a jigsaw puzzle by taking various pieces of the economy and trying to create a picture, the challenge is that the individual pieces often change quickly and sometimes dramatically, which can give you a completely different picture. Another challenge seems to be the depth of the recession and the length. Some can be extremely painful and take a long time to resolve itself.

The Week Ahead

U.S. markets were closed Monday, making the upcoming week a short week of trading and this week the economic calendar focuses on the employment picture. According to Goldman Sachs, large-cap companies are signaling “improved labor availability”, while BofA noted that mentions of labor shortages are decreasing on earnings calls. Whether these conditions trickle down to smaller companies, where finding workers has been more problematic, remains to be seen.

The trio of jobs reports kicks off Wednesday with JOLTS job openings, followed by ADP private sector growth on Thursday and the monthly non-farm payrolls on Friday. Wages and prices are likely to be most scrutinized in these accounts. Elsewhere, May’s ISM manufacturing and services figures will offer further insights into supply and demand. Consumer confidence and factory orders round out the domestic agenda.

Overseas, the OPEC+ group is expected to stick to only moderate production increases even as G7 energy ministers call for more oil. In Europe, final PMI numbers and May inflation rates will be updated, while in Canada the BOC is expected to follow March’s rate hike with another 50bps boost.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/