Who Should you Believe and the Economic Climate for the Week Ending

April 29th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com

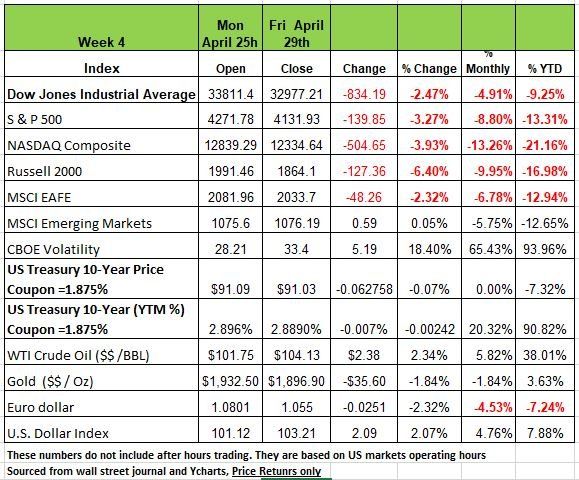

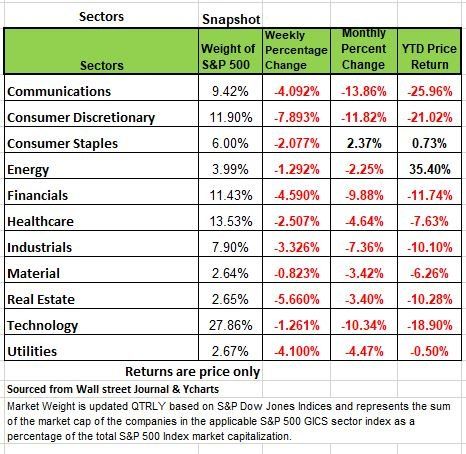

The markets got battered again last week most especially on Friday with the DOW dropping nearly1000 points on the day. All 4 of the major indices were in the red for the week with the Russell 2000 dropping the most for the week with a -6.4% drop, followed by the NASDAQ -3.93% the S&P -3.27% and the Dow at -2.4%. Much of the drop came from Amazon which had a price drop of nearly 14% on the week. We bring this up only because of weighing and how much a particular stock may influence an index. As we have penned in the past the top 50 companies in the S&P account for close to 90% of the index’s movement. Its important to know what your underlying holding are when investing. Needless to say all 11 sectors were down as well with Consumer discretionary Having the largest decline -7.9% followed by Real Estate -5.6 and communications, Financials and Utilities all down more than -4%. On a YTD basis the two sectors with positive returns are Energy and Consumer Staples Utilities is just barely negative at a -50 basis points.

The yield on the benchmark 10-year Treasury note(T-note) closed trading on Friday 4/29/22 at 2.94%, up 60 basis points (bps) from its 2.34% close on 3/31/22, this according to Bloomberg. The 2.94% yield stood 90 bps above its 2.04% average for the 10-year period ended 4/29/22. Bond returns are down significantly across the board this year. In fact, global bonds just posted one of their worst months ever, due largely to rising interest rates and bond yields. The Bloomberg Global-Aggregate Total Return Index of investment-grade debt declined- 5.48% on a total return basis in April, one of the largest monthly declines since the index's inception in 1990.

We think Bond yields are starting to normalize worldwide. As of 4/25/22, all of the outstanding investment-grade corporate debt yielded 0% or higher. No more negative-yielding corporate debt. Some negative-yielding government debt remains but it is relatively small. The Bloomberg Global Aggregate Negative Yielding Debt Index declined from $11.31 trillion on 12/31/21 to $2.78 trillion (all government bonds) as of 4/29/22. The index’s all-time high was $18.38 trillion on 12/11/20.

Climate

Negative economic data contributed to the sour mood on Wall Street on Friday. GDP number were released last week for Q1 and the economy contracted -1.4% ( on an annual basis), this according to the US Bureau of Economic Analysis, but that news was tempered by strong consumer spending, which is why Thursday’s market activity was positive.

Personal income and spending improved in March, even with inflationary pressures on consumers at high levels, March’s CPI number of 8.5% is fueling expectations that the Federal Reserve will need to raise interest rates by at least 50 basis points next week but some are betting on a 75 basis point increase. The trick is to raise enough to curb inflation and not stall the economy. As we have mentioned in the past, we think that inflation is a transitory issue and our argument is simple math when the denominator is higher the result is lower. Price inflation started in April of 2021, this happened off the low 2020 price levels when the economy halted. I guess we will find out how accurate we are over the next few months. Interest rates edged lower, with the 10-year Treasury yield ending near 2.89%.

But yields are hovering around the 3% mark this week.

The Federal Reserve (“Fed”) is expected to boost its federal funds target rate by 50 basis points moving it to 1.00% (upper end of its range) on Wednesday 5/4/22. Based on year-to-date performance figures, the poor showing in the stock and bond markets indicates that the markets have already priced in this rate hike, and perhaps more.

We feel that investors will be more interested in hearing the Fed’s guidance for June’s meeting and beyond.

Many attributed the contraction in GDP during Q1 to a widening trade deficit and slower inventory investment but still stoked recession fears in an economy hampered by high inflation and labor shortages.

Consumer spending and business investment remained solid, with durable goods orders rising 0.8% in March. The March Core PCE Price Index showed a slight easing from the prior month, but persistent inflationary pressures were evident as employment costs jumped by the most on record in Q1 and the personal savings rate plunged to the lowest levels since 2013.

U.S. consumer confidence fell slightly in April as more optimistic future expectations were offset by negative views on current conditions. Home prices surged 19.8% YoY in February, hurting new home sales in March, while pending home sales fell for a fifth straight month as mortgage rates continue to impact most home buyers. As we have mentioned in the past one of the main reasons for the high increases in home prices are a low inventory levels and that 25% of home sales are going to institutions such as Blackrock.

Commodity prices rebounded as crude oil gained 2.5% and natural gas jumped 12%. In Europe, GDP figures in Germany and the Eurozone showed modest growth in Q1, while inflation reached a record high for the sixth straight month. German business confidence stabilized at a low level as the CPI jumped 7.8% YoY in April.

In Australia, a swell in consumer prices fueled the RBA to raise interest rates to 3% this was a sign that the central bank was not playing politics and was serious. This may put more pressure on the Fed to raise rates by more than 50 basis points.

In Asia, the Bank of Japan pledged to buy an unlimited amount of bonds daily to keep rates ultralow, rather than the previous ad-hoc approach. Finally, Chinese stocks and the yuan tumbled initially on the country’s strict Covid Zero policy but finished strongly after leaders promised to boost stimulus and contain the outbreak. The concerns over Chinas policies may add more pressure to supply chain challenges.

Technical Perspective

We are living in a whole new world for investing. The old rules of portfolio construction are no longer valid. If 2022 is proving anything so far, it’s just that. That indexing / broad diversification doesn’t always work.

The traditional rules state that you reduce risk by diversification and that a “conservative” portfolio is made up of more fixed income products than equities.

Last Friday, the S&P 500 market index fell by -3.63%, which was the largest daily move (up or down), as the index put in a new low for the year. Twenty-year treasury bonds didn’t do much better, falling by -1.30% on Friday. Through Friday’s close, a moderate risk level portfolio blend of 60% stocks and 40% bonds would be down about -12% on the year. This is not all that encouraging.

The S&P 500, is often used as the benchmark for US equities, YTD the index is down -14%. This decline is mostly attributed to technology-related stocks. (Note that this applies to cap weighted index not equal weighted) The Information Technology sector is down -19% YTD, Consumer Discretionary (Amazon and Tesla) is down -22.5%, and Communications is off by -24.5%. These are the sectors that have led the markets to the extreme high over the last several years. They also became the market’s largest components (weight influence) which are now contributing most to the market’s decline.

Traditionally, the risk in the markets is thought to be offset by holding fixed income, or bonds. Typically, Bond and equities are negatively correlated, so if one is moving in one direction the other moves in the opposite direction. Last week Twenty-year treasury bonds were down -17% on the year. In other words, the traditional stable asset has been volatile.

Why Are Both Stocks and Bonds Volatile?

Right now, stocks and bonds have high correlation and are both moving in the wrong direction. Not only is the risk in the markets increasing, but the risk in many diversified portfolios has increased substantially. Rather than mitigating portfolio risk, bonds have only increased it, and the expectation is that the risk in bonds will continue to increase. One reason for this is that interest rates have been artificially suppressed for a long time. So, any increase in interest rates would cause current bonds to drop in order to achieve the same yield. So, if you have been holding bond with lower coupons the value has declined. (Prices drop yields increase)

The problem that exists is that many

advisors use turn key models made up of a mix of equities and fixed income products (funds) So these funds

, have stocks, which are going to be similar to the

benchmarks, and the equities are

overexposed to technology,

lower coupon

bonds In this type of environment,

with

inflation

as high as it is

interest rates will probably go up, and therefore bonds will go down.

The traditional definition of a bear market is a decline from peak pricing of -20%. The S&P 500 has not yet crossed that line in the sand but is showing all the signs of being bearish quite soon (volatility is high and long-term and short-term indicators have turned negative).

Technology-related sectors are in bear market territory, and other indexes like small cap stocks (Russell 2000) has long been in that bear market threshold. The point is that waiting until the S&P 500 declines by -20% to call it a bear market does very little to help investors.

So, the big question becomes “what can investors do about it?”

The markets are emotional, they are not efficient. But do not let an emotional market inspire an emotional decision. Markets have many moving parts and complexities that require systems and processes. In this type of environment, it is all about adaptive portfolio management. You want to minimize losses. Because huge declines in any given year puts pressure on portfolios to produce high returns to offset the declines. This could mean adding unnecessary risk

Not all sectors are experiencing the same pressure as technology, if you look at the chart above you will note that the consumer staples (Defensive sector) are relatively flat as is utilities. While energy is showing high return be weary of the fact it is mostly attributed to the Russia / Ukraine conflict

The answer to the question above is to use a process that looks at the reality of what is happening right now. Flexibility to adapt to a changing environment is key to minimizing losses. If the market continues to go down further, there will be other areas and investments that will move up. like commodities or currencies or things that can benefit from bear markets like inverse or buffered securities. So, the key going forward will be to adapt and adjust to whatever this market throws and take a negative and turn it into a more favorable position

All recessions are a result of the same thing, Bad decisions?

Are Debt Levels Far Too High for Aggressive Monetary Tightening and interest rate hikes?

All economic downturns have one thing in common, they were all the result of bad decisions and policies. The pending economic challenges upon us are no different. For the last decade we have been spoiled and enjoyed excessively low interest rates. As consumers, we have been conditioned to think that money is not worth more that 2% interest. With that comes a whole bunch of issues related to irresponsible financial behavior. Corporations treat the money poorly, they borrow excessive amounts of money, (Its cheap why not) and use it recklessly, stock buy backs to boost stock prices, making riskier investments, leveraging more than they should normally. Government is no different with fiscal policies by politicians as they continue to increase spending and creating programs that get abused.

As a society we have accumulated a massive amount of debt in the economy at all levels from government, businesses to consumers. Our U.S. government debt is over $30 trillion and expanding at a rate of $300-400 billion per month. (reread this and let it sink in) The average rate the government pays on debt is slightly above 2%. With rates rising on ten-year notes and over $6 trillion in bonds rolling over this year, a deficit ranging from $1.5 - 2 trillion, there will be a large amount of debt that will need to be financed.

The Fed will need to intervene eventually if they want to avoid a debt crisis. A rise in interest rates by 1% will cost the government $300 billion in additional interest.

Now let’s consider what is going on in the corporate debt markets. Over half of all investment grade bonds are rated BBB, so that means they’re just one notch above junk bond status. The concern here is that If the economy rolls over, many of these bonds will get downgraded and need to be sold because they will no longer be considered investment grade for most portfolios. This will most likely trigger a debt crisis. It is one reason the Fed bought corporate bonds in the February 2020 bear market to prevent a debt collapse. You can see the stress in the corporate bond and treasury markets. The Treasury ETF (TLT) has lost 19% of its value this year and the municipal bond market is down as well. The high yield corporate bond market is showing signs of stress. The Fed needs to tread carefully or else the bond market will lock up as it did in 2018.

There is always a cost that comes with poor decisions, we are not speaking of mistakes but continuous repetitive bad decisions that eventually lead to a position where you have to deal with the consequences.

Who should you believe?

If we go back and look at the opinions of economist from the last 3 economic down turns (1990, 2001, & 2008) none of them made a call that a recession was pending even though we were right on the cusp of one. The most egregious of them all was in November 2007, when the economists who participate in the Philadelphia Federal Reserve’s Survey of Professional Forecasters called for real GDP growth of +2.4% for 2008 (recession odds at the time were considered to be 3%). Not exactly what we would consider reliable.

So how can so many intellectuals be so far off the mark when we are all looking at the same information. We think that there are two main reasons, the first is that most of them (especially those in the Fed) are locked up in their cubicles hyper focused on data, numbers which are all lagging pieces of info. None of them are spending time looking at the behavior of consumers. For instance, when the government was dropping all of that helicopter money into people’s accounts, all you had to do was look on Michigan Avenue and the lines outside of Gucci, Louis Vuitton or any other high-end retailer to see how consumers were spending that money. If you just paid attention to the behavior of mortgage brokers and looked at the products they sold and the people they sold them to, you could have gotten a clearer picture of the landscape.

The 2nd reason is compromise. If you’re an economist for a large institutional fund, you need to give investors an incentive for them to part with their money. Who would give you money if you told them, they would have a high risk of losing part of it quickly? If you’re with the Fed you need to make sure the administration looks good, too much bad information might become a self-fulling prophecy. The Fed is no longer an independent, politically neutral entity. The bottom line is that it is hard to get an honest untarnished opinion, which is why we think so many are off the mark. This is not to say all economist are compromised, there are a handful of economists that are true to their profession, they are not hard to find you just need to read a lot and pay attention to their articles.

The Week Ahead

U.S. stocks are hovering at the lows of the year, and skittish investors receive little relief this week with the FOMC meeting, jobs data, and PMIs on the calendar. The Fed is expected to raise rates by 50bps on Wednesday, we’ll see if they do more, but more importantly, any decisions on reducing the balance sheet could agitate markets further.

The U.S., labor market updates will arrive with the JOLTS report Tuesday, ADP on Wednesday, and the monthly non-farm payrolls on Friday. With weekly jobless claims at historic low levels and openings still high, a strong addition of nearly 400K jobs is expected.

April PMIs may confirm what the flash data revealed in terms of price pressures weighing on the global growth outlook. Factory orders and nonfarm productivity figures round out the U.S. docket. Internationally, OPEC is expected to continue boosting oil production at the current rate of around 400K barrels per day, though most cartel members have failed to deliver the increases. EU nations including Germany will release retail sales and industrial production numbers, and Canada’s employment report and PMIs close out the week.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/