Market in Review & Other Economic News

for the

Week Ending April 22, 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com

Market Temper Tantrum

Last Week was a perfect example of how irrational and volatile the markets can be. The week started up for the first 3 days and began Thursday up 400 points and then took a 700-point decline and continued down through Friday ending the week in negative territory. One reason for the 180-degree turn was that Fed Chair Powell made a statement that the Fed expected to make a soft landing with tightening the money supply and raising interest rates. Apparently, the markets did not believe him.

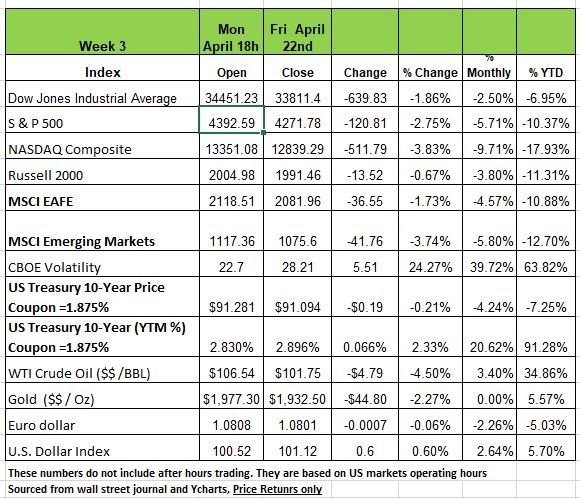

All 4 of the major indices were in the red for the week with NASDAQ leading the pack down -3.83% followed by the S&P 500 -2.75% the DOW -1.86% and the Russell 2000 -.067%. All 4 of the indices are down for the year as well.

This week's drop came as US companies' quarterly earnings reports continued to come in with mixed results and guidance as companies grapple with rising costs and supply-chain challenges.

With hopes of taming inflation, the Federal Reserve's Federal Open Market Committee may raise rates in May by a half-percentage point. Such a move, which was signaled Thursday by Fed Chairman Jerome Powell, would be larger than the quarter-point increase that was made at the last meeting. The potential for more aggressive monetary tightening has contributed to some trepidation from investors.

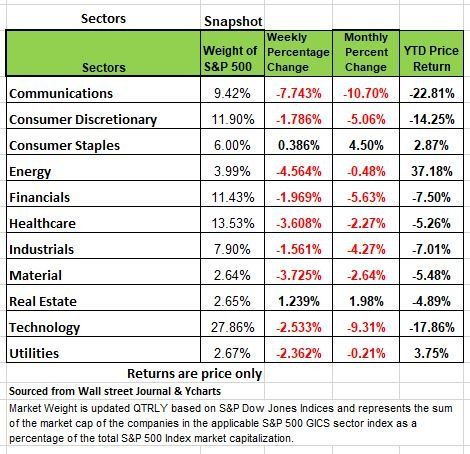

All but 3 of the 11 sectors fell this week. Communication services had the largest percentage drop, tumbling -7.7%, followed by a -4.6% slide in energy, a 3.7% decline in materials and a -3.6% drop-in health care. The 2 sectors in the black were real estate, up +1.2%, and consumer staples, up +0.4%.

Treasury bond yields rose across the yield curve last week as the bond selloff continued. The 10-year Treasury yield reached 2.97% its highest level since 2018 that was the last time the Fed tried to raise rates. The 30-year Treasury yield topped 3% for the first time since April 2019.

Inflation continued to pressure bond prices. To combat inflation, St. Louis Federal Reserve President James Bullard did not rule out a three-quarter-point rate hike at the Fed’s May meeting, which the Fed hasn’t done since 1994.

As mentioned earlier, Federal Reserve Chairman Jerome Powell spoke on Thursday taking a more hawkish tone regarding raising interest rates more quickly. This interview caused the equity markets to move down the DOW for instance was up 400 points on Thursday and then dropped 700 points after Powell’s interview. This continued to a massive market decline on Friday. The market now expects a half-percentage-point rate increase, or double rate hike, at each of the Fed’s next three meetings. The comments by Powell, Bullard and other Fed governors are leading the market to make assumptions and bringing added volatility to both Equity and Bond markets

The Feds Challenge

Rising prices and slowing demand have cast shadows on this year's economic outlook, especially as the Federal Reserve begins tightening monetary policy. Whether the situation will lead to a recession remains to be seen. Globally, there are signs that stretched supply chains are beginning to ease, potentially slowing the pace of inflation, which would be welcome news for investors and central bankers.

The U.S. economy is looking increasingly at risk of a slowdown. Persistently high inflation, the unknown impact of higher commodity and energy prices as a result of the Russia-Ukraine war, and indications that demand is softening have raised concerns about future economic growth.

The Federal Reserve began tightening monetary policy in an effort to control (reducing the money supply) which adds to the pressure. Whether the combination for raising rates and tightening money supply is enough to slow the economy significantly (into recession), remains to be seen.

As of now the mix of higher prices and slower demand suggests an economy that is under pressure from "countercyclical inflation" (when prices rise fast enough to slow economic growth). The toll of higher prices on demand can be seen in the Institute for Supply Management’s (ISM) March manufacturing and services surveys. The new-orders component of both indices (a proxy for demand) has failed to keep up with the price’s component (a proxy for inflation). This has pushed the spread to levels consistent with the recession that began in 2007.

Macro Overview

The ECB left its policy settings unchanged at its meeting on April 14, but given high inflation, ECB officials strengthened their guidance that net APP purchases are expected to end in Q3 without pre-committing to a more precise end-date. Many see this communication as consistent with forecast for APP (Average Physical Production) to cease in July, followed by 25bps hikes in September and December

Homes

Mortgage rates have increased 190 basis points (bps) since the start of this year as the Fed signals for an aggressive policy path ahead. However, existing home sales have been unexpectedly less sensitive to rate changes. U.S. housing starts rose in March to a 1.79 million annual rate, this is the highest rate since 2006. Multi-family construction was entirely responsible for the gain with construction up 26.2% in the past year. One explanation is the extreme supply-demand imbalance in today’s housing market. With the nationwide vacancy rate at 0.9%, the lowest since 1978.

However, single-family construction is down 4.4% over the past year and existing home sales are down 4.5% versus a year ago. The slowdown in single-family construction and existing home sales is largely due to 30-year mortgage rates above 5.0% pushing potential homebuyers back into the rental market hence making the multifamily sector

Investor Concerns

It seems that Bullish sentiment is now below 20% and Lipper is reporting equity fund outflows is now at the highest levels since September 2020. Much of this may be from people that left the workforce and took retirement and can also include concerns of the economy. Regardless investors could use some good news. Keep in mind that sentiment this weak has the potential to produce intermediate-term lows, try not to panic, markets will be looking at U.S. mega-cap company earnings this week to confirm the business outlook for the rest of the year

Oil Prices

The recent slide in oil prices continued, despite a strengthened effort to limit Russian exports to Europe and protests in Libya, both of which would threaten supply. Additionally, a greater-than-expected decline in US crude inventories exacerbated similar concerns. Fear regarding Chinese economic activity and ultimately demand weighed on prices, as WTI and Brent ended at $10.75 and $106.65 per barrel, respectively. Gold held in recent range, closing at $1932.50

Labor

The labor market has continued to improve rapidly, with the unemployment rate falling to 3.8% in February 2022 compared to 6.2% a year earlier. But this was due in large part to the governments subside which kept people out of work. Even with these low numbers, there is a massive excess demand for labor, with the latest data showing roughly 5 million more job openings than unemployed workers. Remember many have not yet returned to the workforce. This excess demand, combined with rising wages, fading pandemic effects on labor supply and the elimination of most pandemic assistance from the government should lead to further declines in the unemployment rate. Indeed, it is possible that, by the end of this year, the unemployment rate will have fallen below 3.4%, making it the lowest unemployment rate since 1953.

An aging baby-boom generation and limited immigration will continue to limit labor force growth over the next few years. This likely means a continued, chronic excess demand for labor which should maintain strong wage gains and help sustain relatively strong underlying inflation even as current supply-chain problems ease.

Value Stocks

After multiple years of strong outperformance of growth stocks, most notably during the pandemic in 2020, value stocks began to recover and a combination of high commodity prices and rising interest rates should boost the chances of a long-overdue rotation from growth back to value. Moreover, value stocks remain at historically low-price levels relative to growth and provides substantially higher dividends. This suggests that investors looking for income and wishing to maintain portfolio diversification may want to consider adding value stocks to their allocations.

Technical Perspective

The S&P 500 closed down for the 3rd straight week. As mentioned earlier last week was quite volatile across the board. So far this year the average stock from a technology-related sector (info tech, communications, and consumer discretionary) has been hit the hardest. On the contrary, the average stock from energy, utilities, materials, and staples is up on the year.

This has been an advantage for adaptive portfolio management. In other words, there have been equities that have had favorable characteristics so far in 2022, that happen to be a small percentage of the markets. An adaptive portfolio has had the opportunity to rotate into these areas.

The big concern for the markets right now, is that there have been equity areas that have been in favor YTD. Given all the volatility experienced this year, Friday was the first day where every S&P 500 sector was down at least -1.50%. In other words, every sector had an outlier day. Bonds, often considered the “conservative” asset, were flat-to-down on Friday, as were commodities, So the selloff was an indication to move to cash since this environment leave no place to hide

We have been dealing with a Bearish Market State since early February. As we have penned in the past volatility creates more volatility. The broad participation in the market’s selloff last week is a bit concerning. The best places in the market this year were impacted by the volatile swings last week. If this trend continues, most investors will struggle to find avenues that can protect their portfolio.

For those investors that have been convinced to pursue a passive portfolio strategy, you need to get use to the fact that your portfolio will be down. Dealing with and navigating a bear market environment is a dynamic process. As the market begins to show us where it wants to go, an Adaptive Portfolio can continue to make the necessary adjustments to limit the volatile portfolio swings.

The Week Ahead

Besides Corporate earnings reports the U.S. economic calendar is busy, kicking off with durable goods, consumer confidence, and new home sales on Tuesday. Wednesday brings the U.S. trade balance, wholesale inventories, and pending home sales. On Thursday the first look at Q1 GDP arrives, with expectations for growth of just 1% after a 6.9% pace the previous quarter. Closing out the week, the Core PCE Price Index is anticipated to show little evidence that headline inflation is slowing. Overseas, voter turnout could be the key to the French presidential election over the weekend. The European economic docket will be focused on Q1 GDP releases and April CPI figures. In Asia, the Bank of Japan convenes in the midst of the yen’s recent steep decline, and China’s April PMIs round out the week

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/