What's your Financial personalty, The Whistleblower & Other Economic News for the Week Ending Oct-1-21

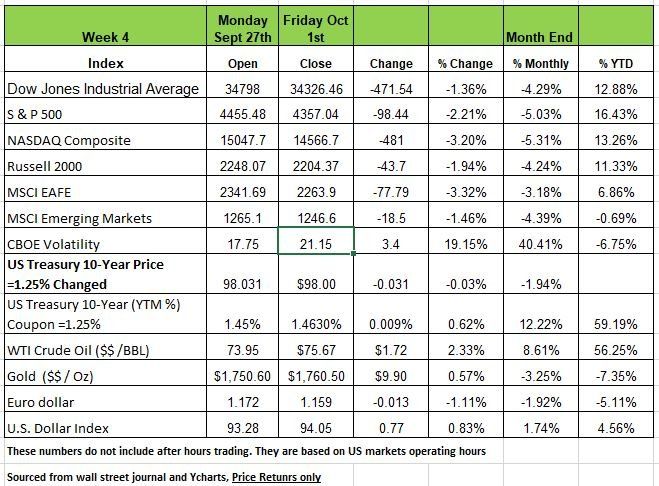

The S&P 500 Index returned -2.21% during the week as selloffs on Tuesday and Thursday caused a negative return for the month of September resulting in a -5.03% drop. September was the worst month and snapped a seven-month positivity streak. Selloffs were due to inflation fears, largely caused by the supply chain meltdown, and communications from the Fed that it may begin rolling off quantitative easing by the end of 2021.

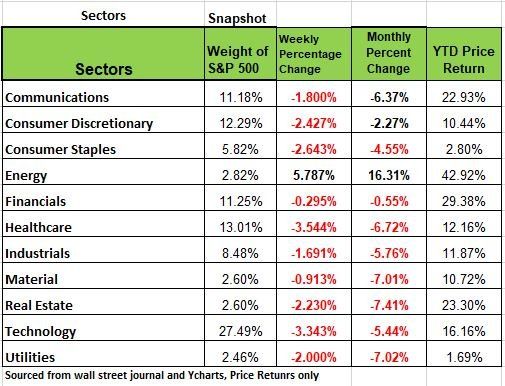

10 of 11 S&P 500 sectors posted losses, with technology, healthcare, and consumer discretionary all tumbling 2- 4%. Energy stocks jumped 5.5%+ as oil prices rose modestly. The only sector with positive price returns.

The U.S., a government shutdown was averted until at least early December, but the October 18 debt ceiling deadline still looms along with efforts to pass infrastructure legislation.

Economic data was mixed. U.S. inflation sits at a 30-year high, as the PCE price index climbed another 0.4% in August and 4.3% YoY. All signs point to price pressures lasting well into 2022. Consumer confidence slumped to a 7-month low amidst more costly cars and appliances.

The ISM Manufacturing Index rose in September to 61.1% from 59.9%, while regionally, Chicago PMI slowed to 64.7 from 66.8. Durable goods orders in August lifted 1.8%, exceeding expectations, while pending home sales jumped 8.1% as greater inventory offset continued surging price growth. Unemployment claims ticked up for a second straight week to 362,000.

Overseas, elections in Germany and Japan produced predictable results. Eurozone inflation hit its highest level in 13 years at 3.4% in September, while German consumer prices rose 4.1%, a 30-year high. The ongoing energy crunch caused Germany’s import prices to leap 16.5% YoY in August, and manufacturing PMI in the EU’s largest economy slipped to 58.4 in September from 62.6.

China is also dealing with power shortages, causing factory activity to slip into contraction for the first time since February 2020

U.S. Treasury bond yields were mixed last week with yield curve steepening as the long end of the curve held on to gains. The 10-year Treasury yield spiked to 1.56% before settling near 1.46% to close the week as global central bank leaders grapple with stubbornly higher prices exacerbated by supply constraints

On Thursday, second quarter GDP was revised up from an annual rate of 6.6% to 6.7%. Consumer spending and business investment were the largest positive contributors, while inventories were the weakest component. On Friday, personal income and consumption spending data showed the growth in personal consumption outpaced the growth in personal income during the month of August.

Personal Income is up 6.1% in the past year, whereas spending has grown 11.6%. Personal income growth was led by increases in private sector wages and salaries, which is 6.7% above pre-COVID levels.

Financial planning

Most of us know we should save money. But when it comes to actually doing it, most avoid it. People tend to fall into two camps: planners and ad libers (those that shoot from the hip). Ad Libers typically save when they can, such as when they get a big bonus or commission, perhaps they may put a small amount into an employer sponsored retirement plan, hoping that everything will work out in the long run.

Planners generally know what they’re saving for, how much they need to put away, and how long it will take them to reach their goals.

Which type sounds most like you? According to a survey from Schwab, only 33% of Americans have a written financial plan. Of the rest, almost half said they didn’t have enough money to make a plan worthwhile. Others said it was too complicated, or they didn’t have time to develop a plan. (Really not having time?)

In the rush of daily life, planning for anything more than a few days in advance can seem like a headache or climbing Mount Everest. It’s natural to wonder: Does financial planning really matter? We think it does. Here are five reasons why:

1. A written financial plan increases confidence. Sixty-five percent of people with a written financial plan say they feel financially stable, while 45 percent of planners felt “very confident” they would reach their financial goals, compared with only 18% of non-planners. However, having a plan means nothing if you do not follow it.

2. A financial plan can lead to better habits. Financial planning isn’t just about investing, the basics of a plan will show potential vulnerabilities, but will also help identify un necessary spending. Many sound financial decisions are more easily explained in quality-of-life terms (such as the security that life insurance offers, or the peace of mind that having an emergency fund can provide. Especially since the pandemic) There are healthy money habits and there are good investing habits; a written financial plan can lead to both.

3. A financial plan can help even if you don’t have much money saved. The most common reason cited for not having a plan is “I don’t have enough money.” This is a misconception. Planning even in small steps doesn’t take large sums of money to start. In fact, financial planning can have a profound impact on lower-income households, by helping people improve their saving and budgeting habits.

4. A financial plan can be tailored to help every personality type. A plan can help identify what type of person you are with regard to financial planning, and can provide tips on taking the next steps toward your financial goals based on your personality type.

For example, “The Dreamer” personality type has a bit more cavalier attitude toward money, life should be lived—not planned. Yet Dreamers may find that a bit of planning can significantly help them achieve the freedom to live the way they want.

5. A plan helps you create an investment portfolio. A choice of investments, portfolio or financial products ideally are the result of a plan (note they’re not the plan itself). One of the first principals for long-term objectives is “Establish a financial plan based on your goals.” Investment products—like stocks and bonds, are the tools that are used to potentially realize the goal. They’re part of a larger puzzle. A financial plan can also include retirement, insurance, tax, and estate planning, as well as strategies Effective plans use some or maybe all of these tools, the financial plan is the playbook.

Financial personality type

What’s your financial personality type? Here are the six types, with the percentage of people surveyed in 2019 who matched them:

Dreamer (43%): Dreamers are the free spirits of our world, who shake their head in confusion at all those who schedule their lives to the last detail.

Improviser (18%): Improvisers are typically quite self-sufficient, with a deep desire for independence and doing things their own way.

Organizer (11%): Admit it—you love lists. Categorizing and organizing everything from your sock drawer to your personal finances gives you a warm, fuzzy feeling.

Architect (10%): A master of both creativity and logic, the Architect is the rare individual who not only imagines the future, but designs solutions to make it happen.

Maverick (10%): Unafraid and unapologetic, Mavericks are those rare individuals who would rather reshape their world than try to fit in it.

Philosopher (8%): Taken from the Greek word meaning “lover of wisdom,” Philosophers enjoy thinking about and solving problems.

Debt

It was bound to happen – the Fed is losing control of inflation. Money printing never works. There’s a cost to money printing and that cost is inflation. If there was no cost, every pandering politician in the world would use their “free money” to shower their electorates with all sorts of goodies (entitlements, cash handouts, etc.).

Modern Monetary Theory (MMT) is crackpot economics. There is no free lunch nor is there a “magic money tree.” The Fed has been printing money, “quantitative easing” since late-2008. They have purchased so many assets (mostly Treasury bonds and mortgage-backed securities) with their created-out-of-thin-air-money that their balance sheet has exploded by a factor of 10, from $800 billion to $8.4 trillion. Up until recently, the Fed was able to direct the money they generated into the financial system, creating giant asset bubbles, bonds, stocks, real estate (you name it) that mostly enriched the already well-off who own most of the assets.

The U.S. is running $3 trillion annual deficits (both last year and this fiscal year). Think about just how large that number is? If you had one dollar for every second of time it would take more than 30K years to reach that number. The National Debt is now $28.8 trillion and will quickly approach $30 trillion once the so-called debt “ceiling” is lifted, as has always been done in the past. The Fed’s role in all of this has been to bankroll (monetize) the deficits. They’ve been the biggest purchaser of Treasury bonds in these $3 trillion deficit years.

Inflation

Much of the media’s inflation hysteria is due to base effects, i.e., the fact that prices nose-dived during the initial months of the pandemic due to lockdowns. A return to pre-pandemic prices makes it look like there has been inflation because the denominator is artificially depressed. The Y/Y changes in the CPI expressed as annual rates is misleading. If we exclude 2020 and use 2019 as the base, it is clear that there has been an acceleration in the CPI to the 3% area. While this is somewhat elevated by recent standards, it is nowhere in nosebleed territory as the media would have the populous believe.

Furthermore, much of the inflation is commodity based (Lumber is the poster child). Prior to the Evergrande collapse, China’s economy was already slowing. August retail sales showed up at +2.5% Y/Y. That number was +8.5% Y/Y in July, and the consensus estimate for August was +7.0% (a huge miss). On a M/M comparative basis, August was -5.0% on top o f July’s -3.2%. The three-month trend is a whopping -27% (annual rate). Construction there is down -3.2% YTD, and steel output is at a 17-month low. Since China is the largest consumer of commodities, the significant slowdown there implies the end of the commodity upcycle. We expect downward price pressures to emerge.

As far as wage inflation is concerned, the Atlanta Fed’s wage tracker, the gold standard for monitoring wage issues, is in a very mild uptrend. But all the wage growth is in 10% of the jobs pie (16–24-year-olds, unskilled, high school education, in the leisure/hospitality sector). The other 90% of the job holders are not seeing wage growth acceleration.

Economic Slowdown

A critical/negative impact on the economy’s Q4 growth is the end of the eviction and mortgage payment moratoriums. The 11 million renters who are behind on their rent must now use their cash to pay that rent; most of them must also begin to pay back rent. As a result, that rent and back-rent will no longer be available to consume. While the government is still offering relief many landlords and not supporting all tenants. But if so much money was given out there really shouldn’t be any people behind in their rent. we don’t like to generalize but should we bail out people who act irresponsibly with the money they received during the pandemic?

Nearly every Fed September survey says the economy has slowed and continues to slow dramatically.

In looking at China’s Manufacturing PMI, it fell into contraction (49.6 September vs. 50.1 August; 50 is the demarcation between expansion and contraction) for the first time since the lockdowns of early 2020. China’s real estate sector makes up 30% of its GDP, and with the Evergrande default, (we suspect that is not the only company) an implosion in that sector has already started. That means China won’t be needing the raw commodities it has been so voraciously consuming, and commodity prices should retreat. That will help quell the “stagflation” narrative.

Labor Markets

Initial Unemployment Claims (ICs) in the state programs stopped improving in mid-August and rose substantially in mid-September as seen on the right-hand side of the chart. ICs are a proxy for new “layoffs,” and is another indicator of economic softness.

Continuing Unemployment Claims (CCs) looks like a winner, as CCs fell from 12.1 million to 5.0 million (i.e., -7.1 million). That was fast

Unfortunately, this didn’t happen because employment improved. It happened because the PUA Programs ended in early September. PUA CCs, alone, fell by -8.6 million between the weeks of August 28 and September 25. The latest data for state CCs is for the week of September 11. We expect to see a continuation of the fall in this number as the remaining weeks of September are reported.

Is this good news? While consumption will fall because these programs ended, data analysis clearly shows that the PUA programs dis-incented lower wage and lower skilled workers from working.

Why work when the government pays as much or almost as much as a 40 hour work week?

This has caused worker shortages in many service-related industries, causing employers to raise starting wages to attract workers. But that appears to be where it ends. As noted above, the Atlanta Fed Wage Tracker shows rising wages only in that skill/age subset which represents about 10% of the working population. Now that the federal programs have ended, we believe that the available jobs will start to fill, as most need some sort of paycheck in order to live. Thus, our expectation is that the official employment data for the immediate months ahead will be rather robust, but not fast enough to halt the economic slowdown that is currently in progress.

Housing

Housing, a substantial contributor to U.S. GDP, appears to have peaked some months ago. That shouldn’t be a wonder as home prices have risen 20% Y/Y. That’s where the real inflation resides:

Housing starts peaked in March

New home sales peaked in January

Mortgage purchase applications peaked in January (and are down -18% since)

Existing home sales did rise in August, but they are still well below their Q4/20 levels

Source Bob Barone PhD economist

Whistleblower

Sunday night 60 minutes aired an interview with Frances Haugen, a former product manager hired to untangle many issues facing Facebook. She was hired help protect against election interference on the social media tool, but she had grown frustrated by what she saw as the company’s lack of openness about its platforms’ potential for harm and unwillingness to address its flaws.

She is scheduled to testify before Congress on Tuesday. She has also sought federal whistleblower protection with the Securities and Exchange Commission.

In a series of interviews, Ms. Haugen, who left the company in May after nearly two years, said that she had come into the job with high hopes of helping Facebook fix its weaknesses. She is a well-educated individual with degrees in computer science as well as an MBA from Harvard. She soon grew skeptical that her team could make an impact. Her team had few resources and she felt the company put growth, revenue and user engagement ahead of what it knew through its own research about its platforms’ ill effects on its users and society.

Toward the end of her time at Facebook, Ms. Haugen said, she came to believe that people outside the company, including lawmakers and regulators, should know what she had discovered.

Ms. Haugen said that she believed in the products the company offer and felt a lot of empathy for Mark Zuckerberg. But also went on to add that the platform functions best of creating division, and was in large part a contributor to the capital riots on January 6th.

“If people just hate Facebook more because of what I’ve done, then I’ve failed,” she said. “I believe in truth and reconciliation—we need to admit reality. The first step of that is documentation.”

Health Care

The Health Care sector includes hospitals, nursing homes, health care equipment and supplies, health care services (e.g., dialysis centers, lab testing) managed-care plans (e.g., health maintenance organizations, or HMOs), health care technology, pharmaceutical, biotechnology and life sciences companies.

There is no topic more political than Healthcare in America. Heading into the 2020 election, the Democratic Party’s health care proposal seemed to be major source of the angst. President Joe Biden’s proposed “public option”—a more affordable, or free, alternative to private health insurance—and enhancements to the Affordable Care Act (ACA) raised questions about the sustainability of profit growth in the health care sector.

We already know the negative effect on the population since the ACA was passed. Premiums have skyrocketed by 400%. But there are also benefits to the law many lower income individuals had gain easier access by expanding Medicare. The main issue with the ACA model is that it requires 100% compliance from the public and we know America struggles to comply with many rules/laws.

However, the potential for renewed outperformance is based on the long-term upside, including an aging global population and a growing middle class in emerging markets, all of whom will demand more extensive drug treatments and medical care over time.

Valuations are relatively attractive, and balance sheets in the sector are generally in good shape, increasing the possibility of higher dividend payments, share-enhancing stock buybacks, and M&A.

However, there are still risks. Any legislation to control drug prices or raise corporate taxes could weigh on pharmaceutical companies’ profits (though promising pipeline drugs can mitigate these risks).

Positives for the sector:

Strong balance sheets, with ample cash for dividends and M&A;

Positive long-term demographics trends, including an aging global population and a growing middle class in emerging markets;

Return in demand for elective procedures, drug sales, medical equipment and diagnostics;

Valuations are attractive relative to the sector's historical average.

Biotech and pharmaceuticals have strong drug development pipeline.

Supreme Court rejected latest challenge to ACA.

Negatives for the sector:

Extended-care facilities have seen a decline in enrollments and are likely to see higher costs related to virus mitigation requirements.

Defensive sector during an economic expansion—though this was not an impediment in the previous cycle.

Risks for the sector:

Prescription drug price controls and other regulations;

Target of anti-competitive regulation;

Reversal of the 2017 corporate tax cut;

Surge in COVID-19 could reduce demand for elective medical care;

New competition by Amazon

The Week Ahead

The S&P500 ended September with a nearly 5% drop, breaking a 7-month winning streak. Overall, Q3 ended with a slight gain, but October seasonality could bring additional volatility. In Senate testimony last week, Fed Chair Powell reiterated that the U.S. economy had met the test for tapering, but remains a long way from maximum employment, a key requirement for raising rates. That makes this week’s NFP release on Friday an important data point, along with the ADP private payrolls report on Wednesday. Other U.S. economic updates are sparse this week, with factory orders on Monday and ISM Services PMI on Tuesday. Today’s OPEC+ meeting is crucial for oil traders, as producers debate whether to boost production beyond the existing deal of 400K barrels per day in the wake of increased demand due to soaring natural gas prices. The international calendar is highlighted by Australia’s central bank statement and services PMIs from the Eurozone. Canada will release its PMI on Thursday and the employment report on Friday. Lastly, now that October has arrived earnings season for Q3 is just around the corner

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/