If the Economy has Recovered, then...& Other Economic News from the Week Ending Oct 8th 2021

After all of the mudslinging and threats Congress reached an agreement to raise the debt ceiling effectively through December 3, avoiding default for now but setting up another showdown before year end. The U.S. economy created jobs at a much slower than expected pace in September, with non-farm payrolls rising by just 194,000 versus estimates of 500,000. Government payrolls declined, while the NFP and ADP reports both showed gains in private sector hiring. The unemployment rate dropped to 4.8%, and new jobless claims fell sharply to 326,000. Overall, the numbers reflect a remarkably tight labor market, as wages increased sharply in certain sectors by 0.6% MoM and 4.6% YoY.

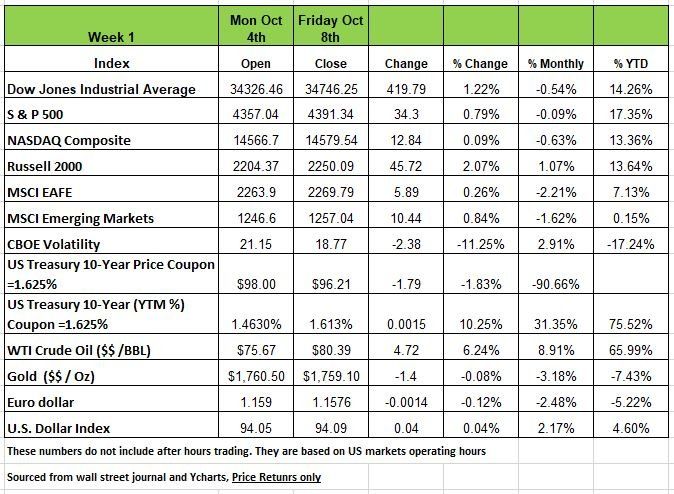

Friday’s disappointing jobs report had a fairly benign effect on the markets. U.S. equities managed modest gains after the debt ceiling crisis was temporarily postponed. The S&P500 Index gained .79% outpacing the Nasdaq Composite by .70% while the Russell 2000 & the Dow returned 2.07% and 1.22% respectively

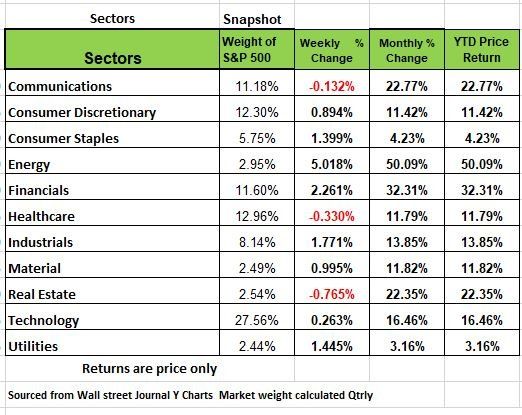

8 of 11 S&P500 sectors rose, led once again by energy shares which rallied another +5% and has now jumped nearly 20% the past 3 weeks as Crude oil futures traded above $80 per barrel for the first time in nearly 7 years. This coming as OPEC+ decided not to boost oil output.

Financial stocks lifted 2%+ as the 10-year Treasury yield continued to trend higher, closing near 1.6%.

Treasury yields rose significantly over the course of the week on growing concern for inflation, a debt ceiling resolution and disappointing job data. Yields continue to rise slightly on Friday, despite only 194k new jobs being created compared to expert consensus expectations of 500k. The unemployment rate dropped to 4.8% from 5.2% but the labor force participation rate dropped to 61.6% from 61.7%. The week jobs report has led investors to believe it is less likely the Federal Reserve tapers bond purchases, which is still expected to occur by the end of this year.

Major economic reports (related consensus forecasts, prior data) for the upcoming week include Wednesday: October 8 MBA Mortgage Applications (n/a, -6.9%), September CPI MoM (0.3%, 0.3%); Thursday: October 9 Initial Jobless Claims (325k, 326k), September PPI Final Demand MoM (0.6%, 0.7%); Friday: October Empire Manufacturing (25.0, 34.3), Retail Sales Advance MoM (-0.2%, 0.7%), October Prelim. U. of Mich. Sentiment (73.5, 72.8).

The Economy Has “Recovered”

Q2’s real GDP caught up to that of Q4/19. In a sense, we are now in an economy that has “recovered.”

By definition that is what we have done, gotten back to where we were before the pandemic

But what exactly are we celebrating about?

Here is what we see for the immediate future that just gives us some concern:

There is still a lot of labor issues with the economy. We are are still 5 million jobs short of our pre-pandemic high. We do hope that much of that slack will be taken up over the next few months since the special (dis-incenting) unemployment programs ended in early September.

The data we are using is provided by the Department of Labor through the week ended September 25 and the week ending May 15 as the base, the Opt-Out States (those that didn’t pay the federal $300/week unemployment supplement) reduced their unemployment levels by 52.7% (with their trend accelerating in September) while the same statistic for the Opt-In States was less than half (23.8%).)

The BLS employment surveys were taken the week of September 12-18. We believe that it was too early to see those benefit recipients as already re-employed. However, we do hope to see significant job creation for both October (not released until November 5) and November numbers (release date December 3).

Because both the PUA and the special $300/week supplement both ended in early September as did the rent moratorium for 11 million households, we do expect Q4 consumption (and therefore GDP) to show weakness. Clearly, the Atlanta Fed sees what we see.

We do think the Fed will begin its “taper” before year end. They can no longer ignore the record level of excess reserves in the banking system. Remember, they will still be expanding their balance sheet until mid-2022. That means QE will continue for 9 more months! But we don’t connect the “taper” with any move to raise interest rates.

That move, we think, won’t come until the pandemic is a distant memory. Powell himself has directly told the media that the “dot-plot” (the individual views of the FOMC regarding where the Fed Funds rate will be in the future) don’t forecast policy, and Rosenberg Research has done quantitative work that shows that the “dot-plot” is a very poor forecaster of what lies ahead.

What GDP growth will look like is yet another question. Prior to the pandemic, 2% appeared to be the economy’s non-inflationary potential. We don’t see how the pandemic has significantly changed that economic potential. Remember, the Fed began to reduce its balance sheet in 2018 (i.e., negative QE as opposed to “taper”), but had to pivot (the now famous “Powell Pivot”) when economic growth stalled.

The rest of the world’s industrial economies are also struggling. The slowdown in China which now faces major issues in their real estate sector, a sector which accounts for 30% of their GDP. Europe is now facing a significant energy shortage which is sure to have a major impact this winter.

So We’ve “recovered.” But we don’t see that anything has changed to alter the anemic growth path of the pre-pandemic economy. In fact, quite the opposite. Demographics were already slowing growth, and the pandemic inspired many who were over 65 but still working to retire and many approaching 65 to take early retirement. Retirees don’t spend like those in their working years.

Then there is the skyrocketing level of growth sapping debt both in the private sector (corporations) and public (federal debt). For these reasons, we believe that any rate increases by the Fed are still a long way off. Source Robert Barone, Ph.D. Economist

If Banks Aren’t Lending…

Something just doesn’t make a whole lot of sense. In our opinion the expansion of the Fed’s balance sheet is having little positive economic impact, as the funding is stuck in the banking system.

If we just think about it for a second, going back to economics 101 a banks role in our economy is to help fund businesses. They make money off lending to businesses that use that capital to expand and drive growth. But what if banks are not lending these reserves? Then what is happens to all the money the Fed puts into the economy just becomes redundant.

The business media believes such money creation has the potential to cause “systemic” inflation, and we often read commentary referring to the rapid expansion of the money supply as an inflation potential. Thus, another reason why interest rates have moved up of late.

But because the banks aren’t lending, the velocity of money has fallen. Thus, so far, there hasn’t been an economic or an inflationary impact. In the end, the Fed can create an infinite amount of bank reserves, but if the banking system isn’t lending, there is little economic impact. It’s like the Fed printing paper money but placing it into a vault where it lies idle.

Total bank commercial and industrial loans, prior to the pandemic, were growing at a 5% annual rate. Then came the pandemic, and, bank loans skyrocketed as companies drew down their lines of credit to stuff their balance sheets with cash, not knowing what might lie ahead. They did this because many had the 2008 experience of banks freezing those lines as the Financial Crisis unfolded. Since the beginning of 2020 to the latest September 2021 data, growth has slowed. In doing the math & calculating the growth rate (from March 2020 to late September2021) is 3.3%.) Keep in mind that pre-pandemic, economic growth was struggling to get to 2% annually. So, with slower lending, we don’t see how the economy can achieve the 6.5% Q4 GDP consensus forecast.

Learning from others

We are not sure of the logic behind the current administration philosophy, but you have to admire the audacity of pitching higher taxes and more social welfare as the path to national revival, especially when the global evidence is the opposite.

The result of the Presidents expanded entitlements is likely to be reduced incentives to work and invest, leading to slower economic growth, lower living standards, and less fiscal space for essential public goods like national defense.

We all need to think things through and look to see what happened to others that applied similar philosophies. That’s the lesson from Europe’s cradle-to-grave welfare states, which Bernie Sanders explicitly pitches as models. Most have older populations than the U.S., but this alone doesn’t account for their lower labor participation rates and much higher structural unemployment.

European jobless rates tend to be much higher than in the U.S., especially for the young. In 2019 labor participation was 62.6% in the U.S. versus 49.7% in Italy, 55% in France, 57.7% in Spain, 59.3% in Portugal and 61.3% in Germany.

Europe’s lower rates of labor participation have contributed to slower growth. While the U.S. economy was slow to recover from the 2008-09 recession amid the Obama policy uncertainty, U.S. GDP growth still averaged 2.3% from 2010 to 2019, surpassing Italy (0.27%), Portugal (0.86%), Spain (1.07%), France (1.42%) and Germany (1.97%). But more importantly what happens when you just don’t have any more money to give to those that relied so heavily on government support. Remember the situation with Greece? People were about to riot on the streets because the Greek government had no money to give people (who by the way retired at age 50) Source: https://www.wsj.com/articles/the-entitlements-of-u-s-decline-joe-biden-europe-11633556687?mod=hp_trending_now_opn_pos2

Industrials

The Industrials sector includes aerospace and defense (e.g., airplanes, defense equipment) building products, electrical components and equipment, construction machinery, and services including transportation (e.g., airlines, railroads, trucking), construction, engineering and professional services.

With the economic recovery and projected growth, the markets have been trading as would be typically seen in a nearly and now expansion stages of the business cycle, which would be positive for this historically pro-cyclical sector. Additionally, prospects for an increase in infrastructure and clean-energy investment will likely support the machinery and building materials industries.

Transportation and air freight have benefited from a return in demand as economies reopen, though higher fuel costs may temper some of this.

The aerospace and defense industry continues to face significant headwinds amid expected low airliner demand, production issues, and uncertainty surrounding the political appetite for defense spending. But the fundamentals of the sector overall remain positive. While the path of the economy is providing a nice macroeconomic tailwind for the sector, valuations are a bit extended.

Positives for the sector:

Capital expenditures are likely to increase if global growth continues to improve.

The sector tends to outperform in the expansion phase of the business cycle.

Many companies have solid fundamentals amid risings earnings expectations.

Strong global trade and increase in online shopping are spurring demand for transportation.

Negatives for the sector:

Aircraft demand is picking up, but supply issues persist.

Valuations are relatively unattractive

Higher fuel costs are a headwind for the Transports and Air Freight industries.

Risks for the sector:

While we’re currently neutral on the sector, if there is a stronger-than-expected surge in global growth or massive infrastructure stimulus, then it could perform better than expected.

The Week Ahead

Global central banks continue to express concerns about higher prices but insist interest rate hikes are still far off, preferring to taper bond purchases first. On Wednesday investors will parse through the minutes from the most recent FOMC meeting for additional clues on policy changes. Most notably, this week brings inflation data, highlighted by U.S. CPI on Wednesday and PPI Thursday, which are expected to be flat to slightly lower. Germany reports wholesale prices, Japan brings PPI, and China delivers CPI and PPI throughout the week. Also, on the international calendar, the Eurozone will publish economic sentiment numbers and Australia releases employment figures. On the labor front, U.S. job openings are anticipated to tick up to yet another record high. This week will feature the first major Q3 earnings reports, with the large money center banks releasing numbers on Wednesday and Thursday . Financials have been the second strongest sector the past few weeks, boosted by rising yields. Closing out a busy week, U.S. retail sales will reveal how back-to-school shopping fared and if stores were able to stay stocked in the face of supply chain disruptions. The first look at October consumer sentiment also drops Friday.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/