Read the Fine Print, Women Shifting priorities, National Debt Debate

& Other Economic News

for the Week Ending Sept 24 2021

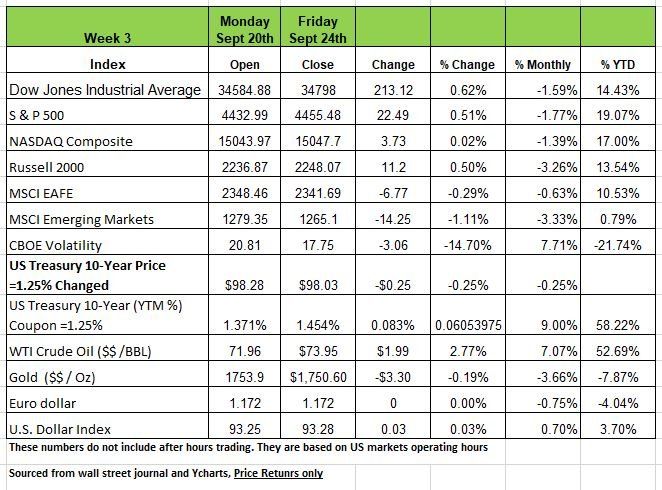

The markets start last week of on a sour note with the DOW dropping a little more than 900 points during intra day trading and finally closed down -600 for the day. For those who haven’t heard, global markets slumped because a large Chinese real estate development company, Evergrande, was reported to be approaching bankruptcy. For many, this news was a flashback to the great financial crisis of 2008. Back then, a collapsing real estate sector almost took the U.S. and global banking system down, starting with the Lehman Brothers investment bank. Now, the fear is that Evergrande could kick off China’s “Lehman moment.” In other words, many were starting to worry that we could be facing another global financial crisis.

By Thursday the Chinese government made it clear that Evergrande would meet their financial obligations to foreign debt and the markets rebounded. This does not mean that all is fine. Evergrande has to fulfill foreign debt obligations which eased market concerns leading to a bounce back. 3 of the 4 major indices ended the week up around +.50%

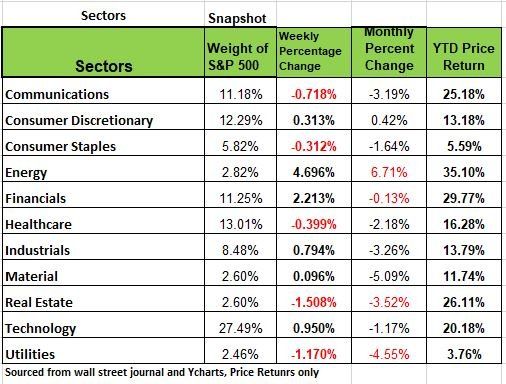

5 0f the 11 economic sectors ended the week in the red with real estate and utilities down the most.

U.S. Treasury bond yields finished higher last week led by an increase in treasury yields on the long end of yield curve. Treasury yields started the week lower as the fallout in the Chinese real estate sector stoked a risk-off sentiment among investors. On Wednesday, Federal Reserve Chairman Powell addressed the media after the Federal Open Market Committee (FOMC) meeting. Though no current changes in monetary policy came out of the meeting, there were noticeable adjustments made to the Federal Reserve’s outlook.

The Federal Reserve’s view on interest rate hikes has substantially changed. The Federal Reserve’s “dot plot” is now split on 2022 interest rate hikes, with half forecasting an increase while half do not. Initially on Wednesday, the yield curve flattened on the news as investors do not find rate hikes in 2022 likely. By the end of the of the week, the long end of the yield curve had substantially steepened as investors repositioned their assets

The Fine print

The digital revolution has brought so much convenience and speed to our lives, but that does not mean you should use every service that is packaged to make life easier. Digital buy now, pay later services are surging in popularity. While they offer consumers appetizing convenience, these services will also leave many users with regrets.

Companies such as Affirm and Klarna Bank AB enable shoppers to purchase products online, have them delivered as usual, then pay for their order in installments. That seems like a good idea, especially if your cash flow does not allow for you to pay for it in full at the moment. But often these services come with interest. These app-based version of layaway—making small payments for an item over time—has skyrocketed in usage among both consumers and retailers. Afterpay Ltd., one of the most popular platforms, said sales among its U.S. merchant partners will increase by $8.2 billion this year thanks to payment plans.

What many people fall prey to is the advertising, for those individuals with challenges obtaining credit cards these services often charge high interest rates and use technology to lure people into purchases that are often outside the buyer’s affordability range. Most of us do not take the time to read the small print or terms and conditions and just click accept not knowing exactly what we are getting into. Last year, a California oversight board required several of these companies to refund consumers hundreds of thousands of dollars. As the popularity of these app grow so will the number of complaints and problems. If you feel it is necessary to use one of these apps take the time to read the small print and understand exactly what you’re committing to. Source: https://www.wsj.com/articles/when-to-buy-now-pay-later-and-when-to-just-pay-now-11631957401

National Debt and your legacy

There are many Americans that don’t have children and really do not care the financial condition of the country and the impact on future generations. This may also include those that came to America to make money and return to their home land in better financial health. But for most of us we are facing a financial disaster and unfortunately sweeping the problem under the rug won’t work anymore.

Congress is once again dealing on whether to raise the national debt limit, which has been modified nearly 100 times throughout our history

The question is whether this Congress, like others, will take responsibility to enact measures that address our national debt. It’s doubtful they will, but there is no debate that America is far better off with a debt limit than without one.

The U.S. has the largest national gross debt in its history as a percentage of GDP. It’s even larger than the debt incurred during World War II. Unlike that debt, which was episodic, a price necessary for survival against German quest for World domination, today’s is structural and growing rapidly.

The Medicare and Social Security Trustees recently issued a report showing that the two largest government programs continue to careen toward insolvency. (See article below)

Gross debt represents all debt held by the public as well as intergovernmental debt, which includes debt owed by one part of government to another, such as the Fed buying Treasuries.

Our Gross Debt checks in at 125% of GDP, or the equivalent of $221,314 for every American household. Translated another way it represents about three years of median household gross income.

Every U.S. citizen should be alarmed by these facts. Unless you’re an advocate of Modern Monetary Theory or believes that bondholders won’t demand repayment at some point, it is clear the national debt threatens our future prosperity and security.

Almost every fiscal-discipline measure in the postwar era has been tied to or forced by actions raising the debt limit.

The Budget Control Act of 2011 contained almost $1 trillion in deficit reduction over 10 years through enforceable caps on discretionary spending. This law also forced a vote on a Balanced Budget Amendment to the Constitution, which regrettably failed.

Debt-limit critics argue that the limit is poorly designed, since it operates only at the end of the budgeting and appropriations process. They are correct. But until Congress reforms the Budget Act of 1974, it will remain the only vehicle by which the U.S. limits debt.

Critics also maintain that raising the debt limit creates a risk of default on our sovereign debt. Since Treasury Secretary Alexander Hamilton’s Report on the Public Credit of 1790, it remains national policy to honor our sovereign debt with our full faith and credit. Although historians may quibble, aside from President Franklin D. Roosevelt’s move to take the nation off the gold standard in 1933 and an administrative error in 1979, America has never defaulted on its sovereign debt. But again, it never had such a massive mountain of obligations.

Social Security Worries

While one arm of the government keeps spending away, another area is struggling. It’s just amazing how we manage things. For the last 20 years we have been hearing from actuaries that Social Security was in bad shape. But it is in worse shape than you may think and the clock is ticking away.

The Social Security program established in 1935, provides retirement income for certain U.S. workers. It was later expanded to cover most of the workforce. Today, it remains America’s pension plan & the financial lifeline that many people use to stay afloat in their old age.

For about one in five married couples & nearly half of single seniors, it’s 90% of their income.

The program’s Old-Age & Survivors Insurance (OASI) Trust Fund is now expected to be insolvent in 12 years. This is a year earlier than anticipated. The pandemic has impacted our society in many ways & the Fund is no exception. According to the most recent annual report, its finances have been “significantly affected” by the pandemic & a rapidly aging population.

The ratio between contributors & beneficiaries has been shrinking for decades. For example, in 1941, there were about 42 workers for every Social Security recipient. Today, that figure is around 2.5 workers per beneficiary.

According to Census Bureau estimates. The tipping point will occur in 2033, when Americans over the age 65, outnumber those 18 & under. This will be the first time in our history this will happen.

The impact on our society will be challenging, but this is a result of medical innovation extending life expectancy (a good thing) & much lower birth rates (two working spouses) over the last few decades.

What may be more devastating is that many Americans have no retirement savings. It’s believed that around 40% of all older Americans only receive income from Social Security, and we know that participation in company sponsored retirement plans is not as high as it needs to be.

But expanding the program will only lead to higher taxes & less money to reinvest into the economy. In addition, only 51% of our population is a naturalized citizen, the other 49% is made up of those that became citizens, hold a green card or are here illegally. The point they do not all hold high paying jobs.

The difficulty here is to what extent do we hold a person accountable for their choices, many people do not make enough to save for the future.

The burden on the rest of society will be staggering. So, if you are reading this & have not set up a retirement account or are not participating in your employer sponsored plan, Think it through. It’s a bad gamble not to plan & put something away.

Shifting priorities

A new study by McKenzie and Leanin.org, is showing just how restless and burned out many professional women are. Thousands of men and women surveyed this summer for the seventh annual Women in the Workplace study reported burnout at even higher rates than last year (by then, it was only several months into the pandemic). But women appear to be feeling the exhaustion more acutely. About 42% said they felt burned out often or almost always, compared with 35% of men. Among female team managers, more than half described themselves as burned out, while 41% of their male peers did.

One-third of women said they are considering leaving or downshifting their careers—either temporarily or altogether, while 27% of men said the same. And 40% of both men and women said they had contemplated switching to another employer.

The findings come from one of the most comprehensive pandemic-era surveys of working women and men, in which researchers at McKinsey and Lean In polled more than 65,000 North American employees. And they suggest that women—as well as many men—are having a collective moment of reflection over what they want from their work lives.

One major reason, is that women feel they are still shouldering much of the unpaid work at home. Female managers, have also become linchpins in supporting many other employees though the pandemic. Across the board, people who reported to women felt their boss checked in on their well-being more often and helped them navigate work-life challenges ensuring their workloads were manageable.

When you add it all up, it’s not surprising that women are thinking, What’s the return on investment of my job, what’s the best use of my time? Especially when many feel that their efforts go largely unrecognized in performance reviews or. Source: https://www.wsj.com/articles/womens-careers-covid-19-toll-11632506362?mod=hp_lead_pos10

Financial Sector

Our next segment on the economic series is focused on the financial sectors. The Financials sector includes banks, savings and loans, insurers, investment banking, brokerages, mortgage finance companies and mortgage real estate investment trusts.

The Financials sector still has many favorable attributes, but several red flags have emerged of late. Macroeconomic conditions remain favorable for cyclical value stocks, which are heavily represented in the financial sector. However, this interest-rate-sensitive sector may already have priced in much of the expected near-term rise in interest rates, as investors rushed into one of the best performing sectors over the last 12 months.

Rising rates may again become a tailwind for the Financials sector, it could take some time for this to happen amid concerns of the COVID delta variant and uncertainty around the path of U.S. monetary policy and inflation.

In general, companies in the financial sector still boast strong balance sheets, with ample capital to

with stand even a significant rise in loan defaults, according to the latest Fed stress test. While the expiration of stimulus payments likely will contribute to an uptick in loan defaults, reserves for a large spike in loan loss were set aside last year—and not needed. Many banks are now able to reverse some of those reserves, which were booked as expenses.

However, despite a rise in longer-term interest rates in the past year, a surge in cash deposits combined with stagnant loan growth is weighing on its bread-and-butter net interest margins (the money they earn reinvesting cash in the short-term money markets, and/or the difference between the rate they pay to depositors and the rate they charge for loans).

Valuations are still attractive relative to other sectors—but forward earnings expectations have flattened out. Unless forward estimates turn higher, any significant price rise in the financial sector would increase the price/earnings ratio—eroding the attractiveness of its valuations

Many of the sector’s favorable attributes—strong financial position, cyclical tailwinds with higher interest rates, and attractive valuations—drove Financials’ outperformance during the past year. However, investors’ enthusiasm[GW1] for the sector had become too frothy, pushing it to an overbought level that historically has been followed by price consolidation.

There are notable risks (see the risk bullets below). It still has strong underpinnings, and many of the issues noted above could be resolved in the coming months. However, from a three- to six-month tactical perspective, we think outperformance of the sector is less likely.

Positives for the sector:

Strong financial position, as reflected in the latest Fed stress test, allowing banks to increase dividends;

The sector has attractive valuations relative to its historical average and other sectors, but earnings growth expectations have flattened out.

High loan loss reserves are being released due to low default rates amid strong economic growth (supports earnings growth).

Negatives for the sector:

High cash levels and low loan demand are hampering revenues—though improving consumer and business confidence could renew loan growth.

Shares may have outpaced the rise in interest rates.

Strong recent inflows into the sector may be reversing after being overbought.

Risks for the sector:

The Fed unexpectedly tapers its bond-buying programs and raises short-term interest rates in response to an inflation surge, threatening economic growth.

Interest rates plateau or decline on weaker-than-expected economic growth.

There is a significant increase in banking regulations

The Week Ahead

Last week the FOMC said they see GDP rising just 5.9% this year, compared with a 7% forecast in June, while their inflation expectations jumped to a 3.7% increase from 3%. With prices potentially remaining elevated and the labor market moving back towards full employment, questions remain on how quickly tapering may be completed and how early rate hikes may appear. Futures markets have priced in the first-rate increase for December 2022. There are multiple speeches by FOMC members sprinkled throughout the week to be parsed. This week also brings a rare meeting of the G4 central bank governors hosted by the ECB. Elections in Germany and Japan add further interest to the international calendar, along with the developing Evergrande situation.

The U.S. data dump kicks off today with the durable goods report, followed by consumer confidence on Tuesday, pending home sales on Wednesday, final Q2 GDP and Chicago PMI on Thursday, and the week closes with the PCE Core Price Index and ISM Manufacturing PMI.

Other economic releases of note include Australia’s monthly retail sales, China’s manufacturing PMI, Germany’s monthly CPI, and Canada’s monthly GDP estimate.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/