Economic Outlook

Week Ending Dec 31st, 2020

The Year In Review

2020 Brought heartache to Main street and joy to Wall Street. It was an exhausting year mentally, physically, financially and socially. Here’s a quick look back to see what we dealt with.

The year opened with fires ravaging through Australia killing thousands of people and animals. Congress present the Senate with articles of impeachment, but the President was later acquitted by the Senate. Britain officially left the European Union; the impact will take a while to be realized.

A virus emerged from Wuhan China that crippled the world economy, the U.S. shut down on March 16th for 2 weeks bringing the U.S. economy to a screeching halt, and many cities around the country still have heavy restrictions because of a resurgence of the Virus. Social distancing became the new normal, even with family members. We have redefined our social life, business practices by embracing zoom. We changed our grooming habits with salon closures, fashion statements are now defined by the waist up. Parents became school teachers to their children, there was a run-on toilet paper and disinfectant in supermarkets.

Millions lost their jobs, while others learned to work from home. Food banks saw record numbers of families looking for help. Congress enacted the CARES Act giving those that lost their jobs and additional $600/week on top of unemployment benefits, providing many with more money by not working than they did while employed. Household income rose by 2% and consumer spending went through the roof, so the CDC issued a moratorium on evictions and foreclosures.

Sporting events played to empty arenas; We lost icons Kobe Bryant, Chuck Yeager, Baseball legends Joe Morgan, Bob Gibson, Tom “Terrific” Seaver, Whitey Ford, & Lou Brock, Actors Sean Connery Chadwick Boseman & Carl Reiner, Musician Eddie Van Halen, Congressman John Lewis and legendary GE CEO Jack Welch.

Oil prices went into negative territory, as inventories hit all-time highs. Healthcare workers became our heroes for the risks they took treating us, but Nursing homes became a death trap for many seniors. We saw drive thru or drive-in style funeral services. Fires ignited in CA again destroying homes, crops and lives.

Harvey Weinstein whose behavior fueled the “MeToo” movement, was convicted of rape and sexual misconduct. Riots broke out in Hong Kong over controversial control by China and even larger riots erupted throughout the U.S over the death of George Floyd by a police officer. People protested to defund police departments and corporate America decided to take a closer look at its culture & business practices to expand diversity at all levels.

Supreme Court Justice Ruth Bader Ginsburg passed away and Amy Coney Barret replaced her seat on the high court. Social distancing led many Americans to mail in their ballots for the election giving the country the highest voter turnout in history. Joe Biden was elected as the 46th President of the U.S.A. However, accusations of fraud were investigated and are still being dealt with as President Trump has yet to concede the election. Social Media giants Facebook, Twitter and google face investigations by the government over questionable business practices. People fled high rise apartment living and gobbled up homes at an astounding rate, boosting the prices of existing homes by 15%.

Cities like New York and Chicago that were once bustling with people at all hours of the day, became ghost towns over night as small business owners dealt with a knockout blow from state mandated restrictions.

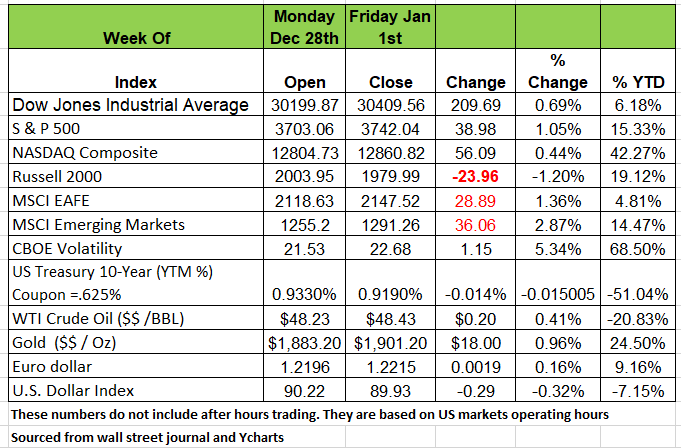

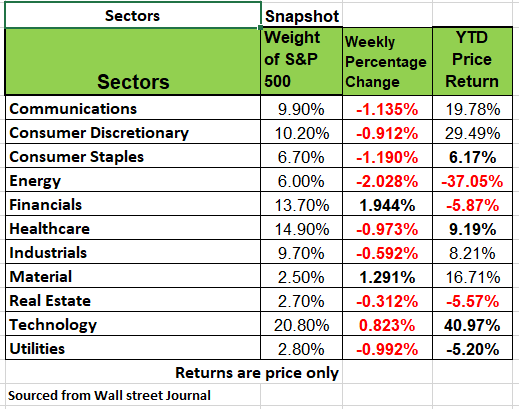

Wall Street however, has been exceptionally interesting for investors. The Dow hit its peak on Feb 12th at 29,568.97 and closed at 18,591.93 on March 23rd. dropping close to 11,000 point in just over a month. Stocks then soared to new highs with the Dow closing the year at 30409.56, returning 6.18% during the year. The S&P 500 Index increased 15.33%, the NASDAQ 42.27% & the Russell 2000 19.12%. Pretty amazing numbers considering GDP dropped and unemployment soared.

Mortgage rates fell to new lows, Bitcoin, quintupled in price from March to $28,971 at year-end. Gold jumped from $1,471 in March and is now hovering at $1,900/oz. Copper, silver, lumber, wheat, and soybeans have all exploded as well, to more than 5-year highs.

Federal Reserve calculation of future inflation expectations, projects CPI inflation to be 2.0% annualized over the next five-year period. That's an increase from the 1.8% expected a year ago and much higher than the 0.8% projected back in mid-March.

The monetary base has expanded by $1.6 trillion since February, the M2 measure of money has grown 25% in the past year, and the Fed says it doesn't plan on lifting interest rates until at least 2024.

Meanwhile, the federal budget deficit soared last year, hitting $3.1 trillion in the Fiscal Year 2020, which ended in September, and looks likely to remain very large in FY 2021, as well. The United States, and other governments around the world, face huge fiscal issues in the years ahead.

Every penny of government spending is taxed or borrowed from the private sector. And these transfers of wealth and income from current and future taxpayers to the government distort the economy in massive ways. It's more than just deficits and debt. Those that think Modern Monetary Theory (MMT) allows the Fed to print money to finance this debt with no consequences are delusional.

Mervyn King, the former head of the Bank of England who says MMT is neither modern, monetary, or a theory. It's been tried before, by the Romans, the Weimar Republic, Zimbabwe, Venezuela...all with disastrous results. So, the question now becomes timing.

In the mid-2000s, people bought homes they couldn't afford with interest rates that were artificially low. Now, the government is doing this. This may be manageable for the time being, but we advise that you pay attention, disasters rarely come with a warning.

This past fiscal year, net interest on the US federal debt was 1.6% of GDP versus 1.7% in 2019 and about 3.0% in the 1980s and 1990s. Yes, you read that correctly: in spite of soaring national debt in 2020, as well as a plunge in GDP, the interest burden was smaller as a share of GDP than it was the year before, and roughly half of where it was 30-years ago. But the Principal burden on the tax payer is far greater now.

As a result, although the budget deficit is not good and not sustainable in the long-term, the US is not Argentina, yet. Just because the doctor tells you the problem with your weight isn't fatal today, doesn't mean it won’t be down the line. Take a look at New York, Illinois, California and other states, how many people and business are fleeing because of over taxation and other unfriendly business environments.

New Paragraph

Can Municipalities keep Public Transportation Safe

Municipalities around the country have lost millions of dollars due to the pandemic and the reduction of people using public transportation. Some cities like NYC have tried to step un and clean the busses and trains during the day but the cost becomes prohibitive for such a large transportation system as well and time consuming to maintain some schedule that the public can rely on. So that leaves technology as the next step such as to filtering out the air better with modern equipment. Many virologists believe that the transmission of the virus is more likely to be through the air than on a surface. Perhaps we deserve caution in both areas. Source: https://www.wsj.com/articles/how-does-new-york-keep-transit-riders-safe-from-covid-19-trial-and-error-11609678802?mod=hp_featst_pos3

The Week Ahead

The first week of 2021 features a slew of Tier 1 data like the December U.S. jobs report and PMI reports, but fresh portfolio flows and the Georgia runoff election are likely to drive price action throughout the early days of the year. The latest betting market odds suggest a 60% probability the Republicans maintain control of the Senate, so volatility would likely increase if Democrats unexpectedly sweep the election, raising the likelihood of substantially higher tax levels.

Economists expect the employment report to highlight a stalling labor market recovery, which should not be a surprise given the drama in Washington over the latest relief bill.

What to expect in 2021

Many economists have been mistaken last year as well as years prior to what would happen to the economy. Hindsight is 20-20 and most academics are great at evaluating what happened and why. One thing is certain most states and local municipalities’ have been beaten up badly financially. With many states like New York, Illinois and California losing their tax base they have little choice but to increase the tax rate. In the state of IL. we not only operate with a budget deficit each year approximately $4 billion but we also have a huge pension obligation that continues to grow at 3% per year. The state and the city of Chicago have little choice but to increase the tax rate on properties, income and other taxable items that currently generate revenue. As residents we are being choked by poor leadership and misled by the media as to the definition of “fair”. At some point in time home property values will plummet because the tax rate will be too high. High rise commercial buildings are empty, so those values have diminished. We believe that inflation will increase at a higher level than what the Fed expects simply because too many businesses need to make up for lost revenue. While home rent may have dropped significantly and is a big component of housing in the inflation calculation, keep an eye on all cost from restaurants to clothing.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/