Economic Outlook

Week Ending January 8th 2021

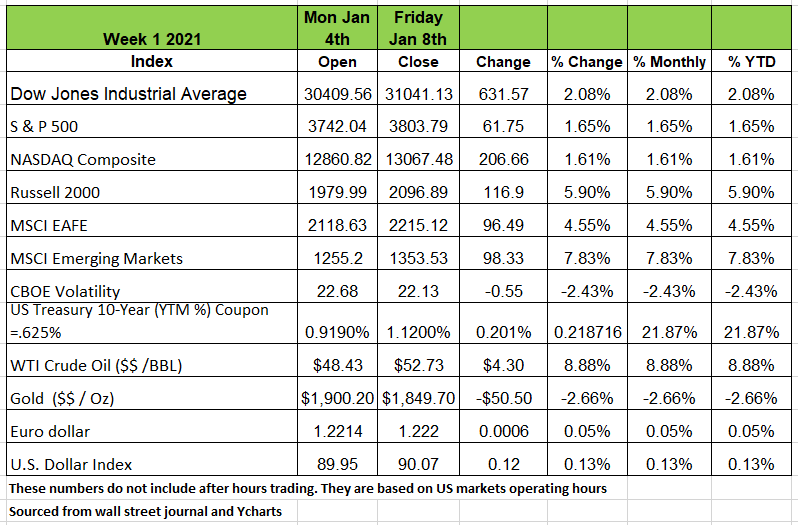

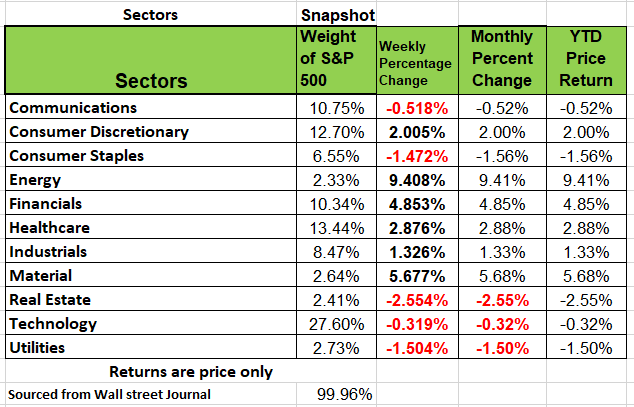

The market seems to be resistant to bad information. Even with a number of citizens starting a riot at the nation’s capital the market kept going up. The December employment numbers came out and they were not good. Overall employment fell in December. The Payroll Survey released last week showed a fall of -140K (consensus: +71K, a big miss). All of the major indices had positive returns with the Dow up over 600 points or 2.08% and 5 of the 11 sectors were down last week with Real Estate having a drop of 2.55%. Energy was the big winner last week with that sector increasing 9.41% after the Saudi’s announced a cut back on production. Equity valuations remain at nosebleed levels with the justification for those levels being ultra-low interest rates. Low interest rates are used in discounted cash flows for valuations

Could we be heading into another Bubble

The largest Single-Family Rental (SFR) owner is Invitation Homes (IH) which is owned by Blackstone. IH owns nearly 50,000 properties throughout 14 markets in the United States. During the Home Mortgage crisis of 2008 Blackstone saw an opportunity to buy homes at below market value. A smart move as the company now is the largest landlord of single-family homes.

The Covid-19 pandemic sparked a race for space among Americans, and home prices have surged to records. The gains have outpaced wage growth, straining affordability despite historically low borrowing costs. There haven’t been so many single-family homes under construction in the U.S. since 2007, yet many of these new houses won’t be for sale. Many other Investors are building tens of thousands of houses expressly to rent in a bet that Americans will keep flocking to spacious suburban living even if they can’t afford to buy homes. Does this sound like a potential Bubble?

Bitcoin

I feel compelled to address the parabolic rise of Bitcoin. Last March Bitcoins low was $3,966 as of this writing, it is at $40,287 that is more than a 1,000% return in less than 10 months. While some consider it a currency, it is not regulated by any government or backed by anything of substantial value. The concept of bitcoin emerged as a way transact commerce without have a paper trail to avoid taxation from governments. While the underlying technology is sophisticated and may prove valuable in the future. The rise in price of bitcoin is driven by a frenzy to own something that has a high demand and low supply. But what happens when more supply enters the marketplace. Do you know who controls it? If you have invested in bitcoin and have made money with it takes your money and run

Inflation

The Fed has promised to keep interest rates at near zero until 2024. This tactic is in hopes of stimulating economic growth. We have seen in years past that cheap money can lead to bad financial behavior, even from smart businessmen. Inflation is expected to be around 2.4% in 2021, but we think it may go higher.

So, what exactly is included in inflation and how is it calculated. Housing (home ownership & rentals) makes up 23% of the calculation, Food and non-alcohol beverages 16%, Recreation and Culture 13% Transportation 11%, Furnishing and equipment 9%, Alcohol and Tobacco 8% Healthcare equates to 6%, Insurance & Financial services 6%, Education & Childcare 4%, Clothing & footwear 3% Communication 2%

The Fed takes a survey from different parts of the country and does a calculation based on price movement/trends YOY. There are several factors that can cause inflation which I won’t bored you with but in this environment, we believe that inflation will be much higher, our rationale is that too many businesses lost revenue last year and will increase prices to meet financial obligations. As an example, the James Bond movie that was set to be released last April is losing $1mm a month in interest cost. So the price of a ticket will have to go up in order for the film to make money or breakeven if it doesn’t attract a large audience. Restaurants will be increasing the price of menus items to offset their loses. We have already seen the price of Oil jump with the Saudi’s announcement that they would reduce production to increase demand. While single family homes prices have jumped 15% apartment rental have plunged with an exodus on city living, but will people move back to the city? We believe they will especially single people their social life depends on it and Landlords will need to make up for their losses.

The question now becomes how high will inflation go and will the Fed be able to keep their promise on interest rates?

Forecasting inflation is more of an art than a science, while we use mathematical formulas, we still have to determine the human component in decision making in raising prices.

Jobs Growth

Employment is the key to getting out of the economic hole the country is in. Last month hiring came to a screeching halt with employers cutting 140K more jobs. The consensus was that we would have +71K . that's a big miss. While the unemployment number remains at 6.7% that is not inclusive of people that had their unemployment benefits expire. Now we face the issue of government intervention. How much money do we give to the unemployed before it becomes an entitlement and there is no motivation to go back to work. How many generations from now will be stuck footing the bill for all of this? While we need to help people we need to make it a priority to get them employed Source: https://www.wsj.com/articles/december-jobs-report-coronavirus-2020-11610080447New Paragraph

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/