Economic Outlook

Week Ending Dec 25th, 2020

Week In Review

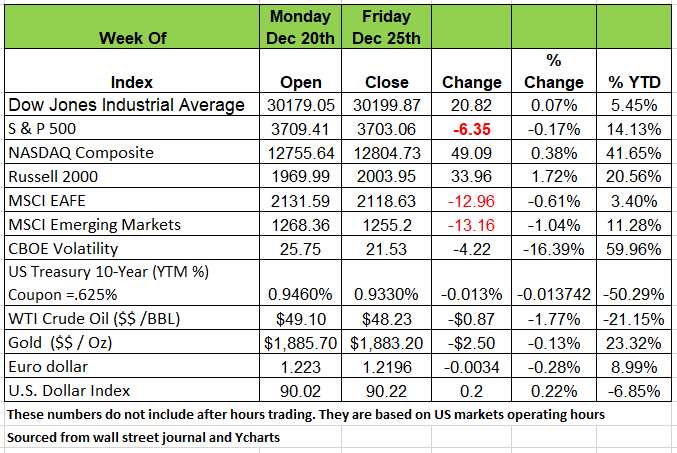

Last week was a short week on Wall Street with only 3 ½ days of trading. The market week ended on Christmas Eve 12/24. All the major indices were basically flat with the NASDAQ having the highest return of +49 points and the S&P Index down -6.35 point. Asian indices were down 12.96 point and Emerging markets down -13.96 point. Vaccines are being distributed around the country as a new strain of the virus is uncovered. There is one week left before the moratorium on evictions and foreclosures are lifted but for many larger northern cities the courts remain closed or with limited service so the timing of evictions will not happen immediately. The resurgence of the virus has caused another economic slowdown, perhaps a double-dip recession which will be released in January. We will likely see higher levels of layoffs and unemployment as January unfolds. Recent comments by Fed Chair Powell has assured financial markets that the Fed has their back. Likely the deteriorating state of the economy will elicit more Fed money printing as their balance sheet grows. Financial markets are “all-in” with that ideology and are “addicted” to it. But what happens when the money train stops? Lastly many Americans are much humbler this holiday season compared to years past, with over 20 million people still out of work and families keeping a distance from one another in fears of catching the virus.

The Real “New Normal”

The vaccines are here and are being distributed. That’s the good news. But there are too many who still believe that the post-pandemic, the economy will go back to its 2019 “normal.” The reality is that life as we knew it in pre-pandemic times may be gone for a while. The post-pandemic “normal” will be quite different from its pre-pandemic predecessor. The Commercial Real Estate (CRE) market is just one example, companies are abandoning office space at a spectacular rate. Source: “US Office Space Dumped After Success of Working From Home,” FT, 12/24,20, p. 7.

The business office market may take years to recover, if ever. So will the businesses that support them. Let’s take a look at downtown Chicago. How many restaurants cater to employees working in the loop? Taxi drivers taking people to and from the office, Transit systems and the number of employees needed to service the trains and busses are now reduced. How about the boutique store that caters to the latest fashion trends of the business person? Stationary supplies, Xerox machines etc., the list goes on.

In addition to this we are seeing a change in the movie industry. All the major theater chains are struggling for survival with revenues down

-94% Y/Y. (This may impact the salaries of many Hollywood actors) Live theater as well, as live concerts may take a while before the public decides to head back out in droves but more importantly will investors take the risk of dumping millions of dollars into a production that may not draw the attendance necessary to justify the risk. Source Bob Barone Ph’D Economist Forbes Contributor

How's your fund really weighted

If you are like most people you probably have a portfolio that consist of a number of Index and ETF (Electronically Trade Fund) funds. If your fund is supposed to track and Index and you think it is diversifying your investment you may be in for a bit of a surprise. While the index does diversify risk somewhat it may be heavily weighted to specific stocks. The two most popular types of funds are market cap weighted & equal weighted. A market cap weighted fund has more holdings in larger valued companies, such as Apple, Amazon and Google. While these companies are hitting record numbers in their valuations, they carry the majority of the movement in market cap weighted index funds. An equal weighted fund is much more diversified and each security carries the same weight in the fund the weight is measured by the amount of dollars invested in each stock. The funds get reset each quarter to adjust for price changes in each security. While these funds are not retuning the same numbers as the market cap weighted funds right now, they will not experience the same drop when the markets experience a correction. So, depending on your appetite for risk, make sure you understand what is in your portfolio and if it fits your needs. Source: https://www.wsj.com/articles/market-cap-index-funds-vs-equal-weight-index-funds-how-they-compare-11604854873

Walmart Accused in Lawsuit of Fueling Opioid Crisis

The U.S. Justice Department is suing Walmart, alleging the company helped fuel the opioid crisis in America.

The civil complaint claims Walmart violated rules for dispensing opioids and its duty to detect and report suspicious orders. The complaint stated that Walmart was “woefully understaffed” to review such orders, and managers put “enormous pressure on pharmacists to fill prescriptions”. This tends to be a recurring theme at the retail giant, which settled lawsuits in the past for not paying overtime and other forms of employee abuse.

Given the scale of the violations on a nationwide level, Walmart failed to follow basic legal rules of the Controlled Substance Act which helped fuel a national crisis according to the DOJ. Walmart responded to the suite by stating that the investigation “is tainted by historical ethics violations, and this lawsuit invents a legal theory that unlawfully forces pharmacists to come between patients and their doctors, and is riddled with factual inaccuracies and cherry-picked documents taken out of context.”

Home Sales

For the first time in five months, existing home sales in November fell by 2.5% from October, according to data released by the National Association of Realtors. The rate of existing-home sales fell 2.5% from October on a seasonally adjusted basis. The slowdown was about in-line with consensus and wasn’t necessarily unexpected after October’s pending home sales, which measures contract signings that have not yet closed and is a leading indicator for existing home sales, dipped 1.1%.

The main culprit for the dip is likely insufficient supply. There are “definitely not enough homes for sale,” according to Lawrence Yun, NAR’s chief economist,

Supply is at an all-time low, according to NAR figures, with just 2.3 months’ worth of housing inventory for sale.

What’s Next: Despite the monthly fall, year-over-year sales are up and—reflecting the emerging notion of a “K-shaped recovery”—the market for expensive homes is booming, with sales over $750,000 up 80% over last year. Source https://www.barrons.com/articles/trump-doesnt-like-the-stimulus-plan-why-the-stock-market-doesnt-care-51608727906?mod=hp_LEAD_1_B_4

Over confidence

There are countless books written on how to make money in the market. Most of them are written by academics or people that are making more money selling the book and giving advice than they do by following their own strategies. The average reader will eventually find out why. During times of low interest rates and high stock returns (price only) some believe that it makes sense to leverage one’s assets to take on more positions (risk) in specific stocks that are seeing unusual price growth. When things are going well, one can be thought of as smart, or really good at this game, which leads to many other problems.

Over confidence is a bias that many people experience when entering the market during a wave of positive growth, this is especially true of non-professional managers that have not had enough experience in investing to distinguish between luck and skill. Market returns like the ones have experienced over the past two years are anomalies. While we are lucky to be in the market during such times of unusual growth one needs to be especially prepared for what might follow. If you’re not financially savvy and understand the fundamentals evaluating of a good company or know how to read a balance sheet or Profit and loss statement, you might just be caught without a chair when the music stops.

If we go back to January of 2018 investors were feeling the euphoria of the market in 2017. The S&P 500 had a price only return of 19.42%. Everyone was thinking we were in for another great year.

Low interest rates and good market momentum led many investors to leverage their portfolios. Then in mid-January the market started to slide, those with over leveraged accounts started to see systems trigger sell orders on their portfolios to satisfy margin calls. This started a selling frenzy which just had a snowball effect on the market both sophisticated and unsophisticated investors were caught in the middle losing a lot of money. While there are a number of stories of people that have made a lot of money using this strategy and turned their financial situation around, there are 10 times the number of those that lost everything. What goes up fast usually drops faster. Be careful if you have made money this year don’t be too greedy, take your profit and be grateful. Source:https://www.wsj.com/articles/investors-double-down-on-stocks-pushing-margin-debt-to-record-11609077600?mod=hp_lead_pos4

Brands betting on working from Home

Many of the brands that we have grown to know are betting heavily on the future of the work-from- home employee. As Grocery store sales surged during the pandemic so have many of the brands that stocked the shelves of those stores. Consumer-product companies are betting on continued growth of their products by expanding factories and revamping production lines, wagering that work-from-home habits will outlast the coronavirus pandemic. Emerging trends like men not shaving or grooming themselves as frequently to the upswing in casual clothing, easy to prepare home lunches and coffee are just a few of the items we are seeing an uptick in usage. Kimberly Clarke paper division is shifting production of toilet paper for commercial facilities to provide more inventory for home use.

Millions of Americans spent much of the year working from home. While a multitude of employers are planning to reopen their offices, many have said they would let employees continue working remotely once the pandemic subsides. The question then becomes, will they? We do not think so and here is why.

There is added stress to working from home especially if you have a partner that is working remotely too. According to the national law review there has been an increase in couples filing for divorce by 34%. If you’re single, you lose the social interaction of colleagues, opportunities to meet new people and to share a drink after work. Networking over lunch would become too inconvenient. But more importantly the lack of changing your environment and ability to leave your work at the office will be cutting into one’s life too much. Working remotely is not healthy, while it may appear great for some at first it will get old quickly. Companies will have a difficult time training employees and keeping structure and establishing quality standards. While some may think they are saving money by reducing overhead expense the top line will suffer more. Its one thing when everyone is doing it in an emergency for survival it’s another when growth and competition enter the picture

However, according Global Workplace Analytics, a telecommuting research-and-consulting firm, they estimate that roughly 25% of U.S. workers will be home at least several days a week by the end of 2021 a significant increase from just 4% prior to the pandemic. Source: https://www.wsj.com/articles/consumer-brands-bet-working-from-home-is-here-to-stay-11609065000?mod=hp_lead_pos5

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/