Week Ending August 28th

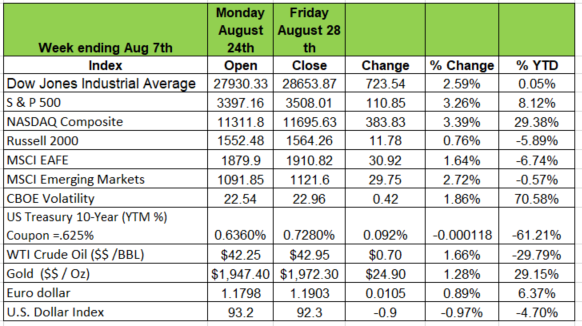

All The major indexes with the exception of the Russel 2000 are in positive territory with YTD returns. The Dow cross that threshold last week climbing 723.54 points (2.59%) bring its YTD returns to .05% The S&P has an 8.58% YTD and the NASDAQ is at an astounding 29.38%

The Russel 2000 is still in negative territory with a -5.89%. Once again, we want to stress the impact of the technology sector on these indexes, especially the NASDAQ. The economy is still struggling and many companies have filed for bankruptcy protection. But more importantly is the small business owners on main street USA that is having the most difficult time. We do not believe that the worst part of the recession has hit us yet so the response of the market may be a little misleading

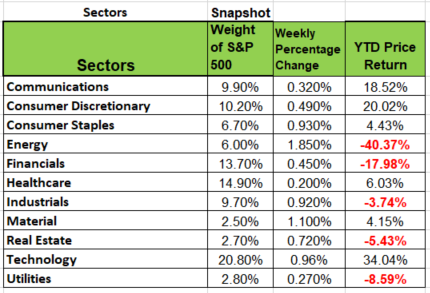

All 11 sectors had positive returns last week, but 5 of the 11 are still negative for the year, with Energy and Financials having the worst performance. Technology and Consumer Discretionary are areas with the strongest YTD returns 34.04% and 26.81% respectively.

The Fed

Fed chair Powell’s Jackson Hole speech introduced a significant change in the committee’s interest rate policy, planning to keep short-term rates near zero even if inflation exceeds the 2% target. This increases the likelihood of the Fed’s benchmark rate staying ultra-low for years to come. This development sent yields at the longer end of the curve higher for the week, continuing their recent upward trend. Perhaps bond investors are anticipating higher inflation possibilities, but an attempted dollar rally failed miserably, and gold prices shook off a Thursday selloff to end the week little changed.

Illinois worst State Fiscally

In a recent article in Barons "Is Your State in Financial Trouble" The State of Illinois was ranked dead last amount the other 50 states. The key metrics are Debt of unfunded liabilities as a percentage of GDP, Jobless rate, rainy day fund as a percentage of revenue FY 20/21 short fall, Bond ratings and yield spread over AAA rated bonds Even before the loss of revenue from the COVID lock down, the state of IL was in serious trouble. The state needs to pay 223 points above the rate of a AAA bond. The state has a junk Bond rating. It is the only state to have borrowed from the municipal liquidity facility (https://www.federalreserve.gov/monetarypolicy/muni.htm) 30% of the states debt is unfunded as a percentage to its GDP. It has the 2nd highest jobless rate only behind MA.and the only state with a zero balance in its rainy day fund. Why is this so important? Because the state has no choice but to continue to raise taxes. The current advertising the state is promoting to move to a progressive tax is very misleading. We currently have a flat tax in IL so there is no unfairness. Everyone pays the same percentage. What the messaging is doing is using sales tax as part of its metric to get voters to pass the bill. This will drive more business out of the State and increase the burden on those still living here.

Restaurant protocol

Is going out to eat now too much of a hassle

Most of us have gotten use to wearing a mask in public especially when we enter retail establishments, grocery stores, clothing stores, etc. Restaurant workers deserves the same level of protection as any other public serving employee. Last week Governor Pritzker announced that restaurant patrons will now be required to wear a mask at the table while interacting with any of the staff. This meaning giving your order, asking for refills of beverages or any communication to staff. Will this hassle impact your decision to go out. This past weekend was the first time the law was to be enforced, but many patrons were not wearing their masks and from the breif observation not many operators were making a big deal about it. But moving forward this practice may impact a persons decision to go out and affect an already struggling industry

DOL

Well its school season and with that there are many challenges for families across the country with young children. The Department of Labor has released rules under the FFCRA Z(Family First Corona Virus Response Act. There are over 100 questions pertaining to a employee’s right to take paid leave off.

Please go to the linked below for full details as to how this may pertain to you or your staff

https://www.dol.gov/agencies/whd/pandemic/ffcra-questions

98. My child's school is operating on an alternate day (or other hybrid-attendance) basis. The school is open each day, but students alternate between days attending school in person and days participating in remote learning. They are permitted to attend school only on their allotted in-person attendance days. May I take paid leave under the FFCRA in these circumstances? (added 08/27/2020)

Yes, you are eligible to take paid leave under the FFCRA on days when your child is not permitted to attend school in person and must instead engage in remote learning, as long as you need the leave to actually care for your child during that time and only if no other suitable person is available to do so. For purposes of the FFCRA and its implementing regulations, the school is effectively "closed" to your child on days that he or she cannot attend in person. You may take paid leave under the FFCRA on each of your child's remote-learning days.

99. My child's school is giving me a choice between having my child attend in person or participate in a remote learning program for the fall. I signed up for the remote learning alternative because, for example, I worry that my child might contract COVID-19 and bring it home to the family. Since my child will be at home, may I take paid leave under the FFCRA in these circumstances? (added 08/27/2020)

No, you are not eligible to take paid leave under the FFCRA because your child's school is not "closed" due to COVID-19 related reasons; it is open for your child to attend. FFCRA leave is not available to take care of a child whose school is open for in-person attendance. If your child is home not because his or her school is closed, but because you have chosen for the child to remain home, you are not entitled to FFCRA paid leave. However, if, because of COVID-19, your child is under a quarantine order or has been advised by a health care provider to self-isolate or self-quarantine, you may be eligible to take paid leave to care for him or her.

When you reopen your office these links may help

Below are some links to government websites with helpful information

https://www.cdc.gov/coronavirus/2019-ncov/community/guidance-business-response.html

https://www.osha.gov/Publications/OSHA3990.pdf

https://www.eeoc.gov/wysk/what-you-should-know-about-covid-19-and-ada-rehabilitation-act-and-other-eeo-laws