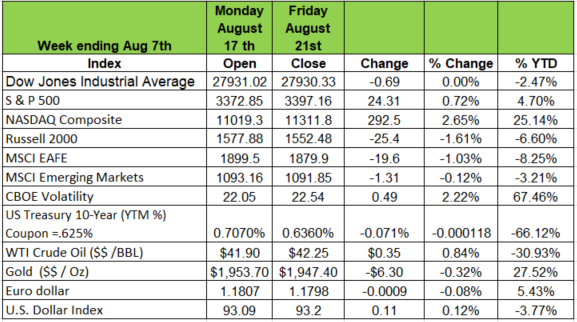

Week Ending August 21st

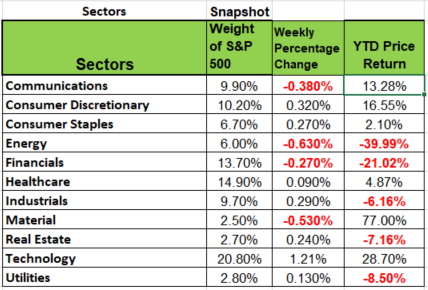

This past week most of the market indexes closed relatively flat with the exception of the NASDAQ closing the week up 292 points. The week started off on a positive note but when the Fed Minutes were released on Wednesday things stalled. Again, the technology sector has driven the majority of price appreciation of this index and the rest of the market. Of the 11 market sectors four of them were down, communications -.38%, Energy --.63%, Financials -.27% and Materials -.53% Combines these four sectors are down -58.12% for the year. The U.S. Dollar Index ($DXY) showed signs of life at the end of the week after registering another new 52-week low on Tuesday, dragging Treasury yields down. The big news was Apple crossing over the $2 trillion dollar valuation threshold. Target and Home Depot posted strong earning adding fuel to the market for those laggards struggling in this environment.

Fed Reserve

The Fed’s July meeting notes sounded an overall downbeat view on economic prospects and offered few policy clues for their next meeting in September. Government bond yields declined as the U.S. dollar hit fresh lows before rebounding sharply, while gold finished flat and oil drifted aimlessly after a large build in gasoline inventories. On the economic front, housing data continued to impress. Housing starts rose 23%, handily beating estimates, and existing home sales jumped nearly 25%. The median home price increased 8.5% as supply is still dwindling. Jobless claims numbered 1.106 million, quickly reversing last week’s brief break below the 1 million mark. In international news, Norway’s enormous pension fund, which has a 70% equity allocation, reported performance of -3.4% for the first half of 2020. Exports from Japan declined 19.2% in July.

Housing

Housing may be the saving grace of this economy. Home-builders started homes at a nearly 1.6 million annual rate in December, January, and February, before the Coronavirus and government-mandated shutdowns wreaked havoc. Those were the best three months since 2006 and showed that residential construction had finally fully recovered from the housing implosion that was a center point of the last recession. Then, during the shutdowns, home-building plummeted: housing starts bottomed at a 934,000 annual pace in April, before gaining in May, June and July, hitting an almost 1.5 million pace last month.

Typically, we expect to see about 1.5 million housing starts per year. This fundamental is based on a combination of growing population, (more people more housing) scrappage (nothing last forever) and destruction (fire, floods, etc)

In the ten years ending in February (March 2010 through February 2020) builders had only started 1.011 million units per year. Part of this was due to too many homes during the housing bubble and the only way to work off that excess inventory was to build fewer homes than normal. But, in our view, the inventory correction went too far. In the 20 years through February (March 2000 through February 2020), housing starts only averaged 1.265 million. Which was way too low. All of this suggests to us that home builders still need to make up for lost time, until the long-term average is closer to 1.5 million per year, which could mean reaching, and then averaging, a pace of something like 1.8 million starts for the next several years.

Economy and Market disconnect

Does the market really signify how the U.S. economy is doing? Is there any justification for the quick rebound and will it continue? What is driving the market? It’s not fundamentals, market behavior seems a bit illogical. What the potential downside if there is a pullback?

Let’s put things into perspective for a moment and use Apple as an example. On August 2 of 2018 Apple became the first company to break the Trillion-dollar valuation threshold with the stock price of $208.38 per share. By Dec 27th of 2018 (4 ½ months later) the markets took a dive and Apple was selling at $156.23 a share that translates to a 25% drop in valuation or $250 Billion dollars. This past week Apple surpassed the $2 Trillion-dollar threshold and closed the week at $497.48 a share. This translates to a price increase of more than 200% in just 20 months. On March 23rd the share price was at $212.61 it has more than double during this recession meaning it has increased its value by $1 Trillion dollars since we entered the recession in March. So, what’s our point. Is the company really worth $1 trillion more in the middle of a recession? Companies like apple are driving the indexes, and there is only a handful of them. The market and the economy are a bit disconnected. Right now, behavior is driving the market, not logic/fundamentals. With interest rates being kept so low money has nowhere to go besides the equity market and big players are using leverage to buy more positions propping up prices even more. Once this changes, (a rise in interest rates) the markets will drop and they could drop significantly if systems kick in and force sales of securities to meet margin calls. We will see another fast drop much like what happened in January of 2018. You need to keep money in the market, you cannot stick it under your mattress. So just be careful and make sure you are monitoring the RSI (Relative Strength Index) and the momentum of your holdings. In the end you want to minimize losses more than risk it all for a few more points in profit

Industry push back on ESG Funds in 401K plans

Do you remember the Miller Lite slogan? “Great taste, less filling.” That has been the philosophy of the DOL when it comes to securities in 401K plans. “Less risk, better performance” ESG better known as Environmental, Social or Governmental factor investments (Socially responsible companies) have become popular amongst institutional investors. Since the majority of the money in the market is coming from 401K plans, Institutional investors are looking toward 401K plans to offer more ESG funds for employees. This summer the DOL proposed a rule governing the use of mutual funds driven specifically by ESG factors. But the rule requires Plan sponsors to demonstrate they are not sacrificing financial performance for participants. Here is where the government has a complete disconnect with reality. Business owners (plan Sponsors) are focused on their business, their expertise is in their core competency (law, medicine, manufacturing) yet the liability of those investment choices fall on the owner. While many investment advisors often undertake that liability as a 321 fiduciary, most advisors do not look at the underlying investments and have no clue what the true risk is. In short, the plan sponsor many have issues if those investments do not perform and employee’s take action. The industry has push back primarily with the complaint that ESG is not a category (i.e. large cap, small cap)

ESG funds also use a ratings system that scores securities for their exposure to factors such as a company’s environmental impact, governance policies or how it treats employees or monitors its supply chains. The funds either underweight or eliminate securities that fund managers expect will have high risk associated with those factors, or tilt toward those that might have a positive impact. Lastly ESG companies often have lower margins. While being socially responsible to the environment is important, it does come at a cost and the bottom line is not always as green as you might think.

When you reopen your office these links may help

Below are some links to government websites with helpful information

https://www.cdc.gov/coronavirus/2019-ncov/community/guidance-business-response.html

https://www.osha.gov/Publications/OSHA3990.pdf

https://www.eeoc.gov/wysk/what-you-should-know-about-covid-19-and-ada-rehabilitation-act-and-other-eeo-laws