Overview of Markets

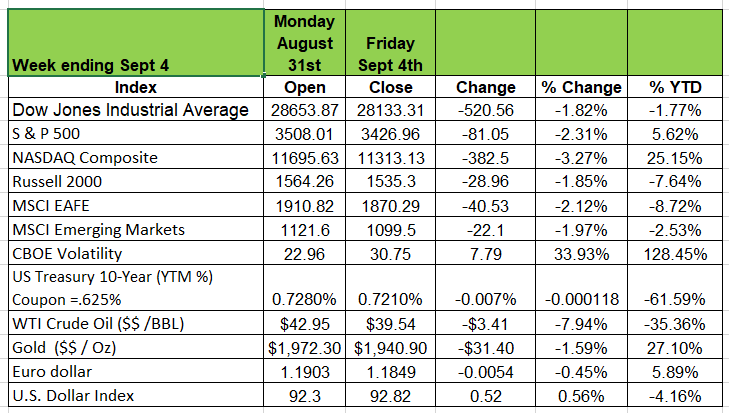

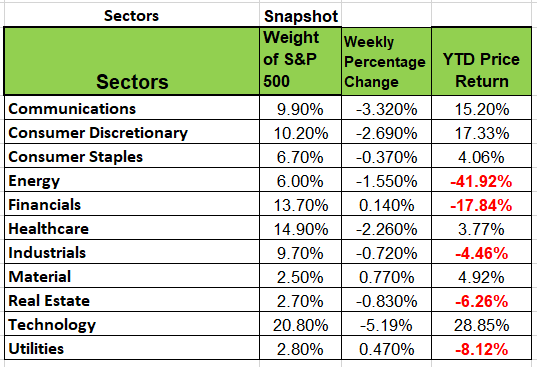

The week ending September 4th was volatile to say the least. The VIX (also known as The Volatility Index, measures the implied expected volatility of the US stock market) increased by 7.79 points last week. All major indices were down last week with the DOW closing the week with a -520.26 points and the NASDAQ composite down -382.5 points. The week started off with the split of Apple and Tesla shares and the restructuring of the DJIA components, adding SalesForce (CRM 5.95% weight) Honeywell(HON 3.89% weight) and Amgen (AMGN 5.8% weight). 9 of the 11 sectors were down for the week with technology, communications and energy having the largest drop. While Materials and utilities eked out minimal gains. On Friday the Dow had a swing of 875.07 points between the high of the day and the low closing the day down -207.74

Despite equity weakness, gold prices dropped -1.59%, and U.S. government bond yields propped up the financial sector. Domestic data continued to illustrate a faster recovery than expected. The August nonfarm payrolls report showed 1.2 million new jobs created and a decrease in the un employment and underemployment rates to 8.4% and 14.2% respectively. In Addition, the weekly jobless claims came in better than expected at 881k, albeit still uncomfortably high. Over 29 million Americans are still claiming benefits across all programs, so the ongoing economic impact of COVID-19 grows deeper. The ISM manufacturing report posted its strongest headline since November 2018, lending support to the industrials sector. Furthermore, the ISM services met expectations at 56.9, growing for the third consecutive month.

S&P Rebalances

Anticipation of TESLA stock being added to the S&P 500 caused the stock to rally quite a bit over the last few weeks with hopes that mutual funds & ETF’s would acquire large positions in the electric car company. But late Friday the indices declined to add the company to the S&P Index. Instead adding Etsy (ETSY), Teradyne (TER) and Catalent (CTLT) they will replace H&R Block Coty and Kohls which will move to the S&P midcap 400. Will Tesla’s stock see a sell off this week? Wait and see!

Increasing Debt Layoff’s and an overvalued Stock Market

The US is about to join a club that a handful of nations belong to. Japan Italy and Greece are countries with debt loads that exceed their countries economy (GDP) The US debt has reached its highest level since WWII (debt to GDP ratio) and it is projected to exceed that level next year as a result to the governments response to the COVID pandemic. The Congressional Budget Office (CBO) said that the federal debt held by the public is projected to exceed 100% of the U.S. GDP. The surge in borrowing has not worried investors as the markets has recovered and surpassed Source: https://blogs.wsj.com/economics/2020/09/03/newsletter-soaring-debt-big-layoffs-and-a-booming-stock-market/

U.S. trade deficit jumps to 12-year high in July

The U.S. trade deficit surged to its highest level since 2008 in July amid a record increase in imports.

The data suggested that trade could be a drag on economic growth in the third quarter.

The deficit jumped 18.9% to $63.6 billion, the highest since July 2008, the Commerce Department said. Source:https://www.cnbc.com/2020/09/03/us-trade-deficit-jumps-to-12-year-high-in-july.html

Oil falls after Saudi cuts prices, China slows imports

Oil prices fell on Monday after Saudi Arabia made its deepest monthly price cuts to supply for Asia in five months and as uncertainty over Chinese demand clouds the market’s recovery. Source https://www.reuters.com/article/us-global-oil/oil-falls-after-saudi-cuts-prices-china-slows-imports-idUSKBN25Y017

High Frequency and Other Relevant Data

Restaurant activity is off 70% in NYC (WSJ, September 3, “Even Top Restaurants Fight for Survival"); Chicago numbers are not as bad as NYC. The city of Chicago has been more accommodating to restaurants to find creative ways to serve patrons. However, with winter fast approaching, restaurant operators will be challenged to find safe and creative ways to serve its customers.

TSA counts have flattened of late (source TSA.Gov). Note that last year’s data shows a fall-off in TSA counts in July and August, so the flattening may be seasonal. Nevertheless, the most striking thing about this graph is the fact that air travel remains stuck at about 25% of its prior year levels. It isn’t any wonder why we see that the airlines have threatened to lay off a significant number of pilots (UAL -2,850; DAL -1,941) and huge numbers of ordinary workers (UAL -36,000; AAL -17,500) if Congress doesn’t come through with additional funding by October 1. (Stay-tuned!) Other large companies have also announced significant layoffs including MGM (-18,000), and KO (-4,000).

When you reopen your office these links may help

Below are some links to government websites with helpful information

https://www.cdc.gov/coronavirus/2019-ncov/community/guidance-business-response.html

https://www.osha.gov/Publications/OSHA3990.pdf

https://www.eeoc.gov/wysk/what-you-should-know-about-covid-19-and-ada-rehabilitation-act-and-other-eeo-laws