Week Ending July 31st

A new metric to keep an eye on

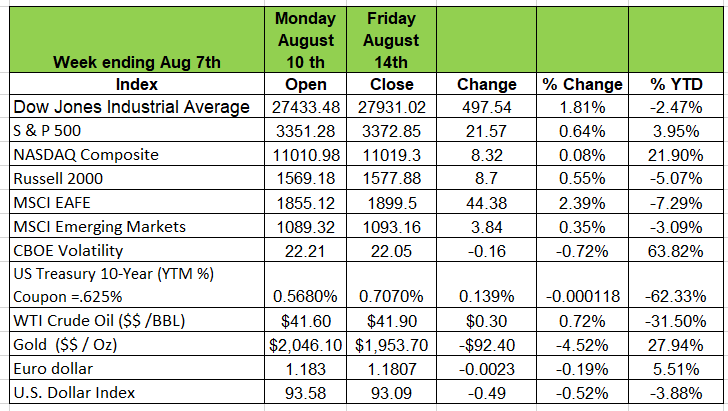

This week we decided to add the Dollar Index (DXY) to the list of indexes we will follow. The DXY measures the strength of the US dollar to a basket of other currencies. These include Euro dollar (EUR) 57.6% weight Japanese Yen (JPY) 13.6%, British Pound (GBP) 11.9%, Canadian Dollar CAD 9.1%, Swedish Krona (SEK) 4.2% Swiss Franc (CHF) 3.6%.

Often referred to as a basket of U.S. trade partners' currencies. The Index goes up when the U.S. dollar gains "strength" (value) when compared to these other currencies. China is not included in the index. The DXY started the year at 96.85 and was at a high in March at 102.82. As mention in last week’s news-letter the drop of the strength would impact US Imports. The low we have seen the DXY was in 2001 when it was at 71.8 and at 75.97 the beginning of 2008.

Are the Markets recovering???

Have the markets recovered? Do the prices of many stocks justify their value? Does the market signify where the economy is going? The French philosopher Voltaire wrote “Uncertainty is an uncomfortable position. But certainty is an absurd one.” Perhaps there is some wisdom here.

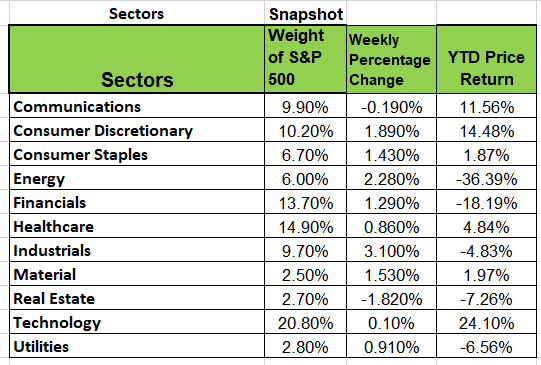

If we look at the sector performance on our chart you will see that YTD, Technology has been carrying the S&P index. It has the highest weight of stocks 20% and is where the majority of price returns are 24.1%. But is it justified? The math does not seem to add up and if we see another waive of the virus in the fall, the sector will not be strong enough to carry the rest of the other sectors. Think of Wile coyote chasing the road runner as he goes off the cliff only to realize there is no ground under him. If your portfolio is on auto pilot perhaps it’s time to re-evaluate. Look at the underlying investment’s in your funds. Don’t go off the financial cliff, turn the dividend reinvestment function off, look at what you are buying.

Watch out Out Inflation is coming back

The prices consumers pay for everything from apparel to airline fares rose much faster than expected in July, signaling demand is springing back after dropping sharply during the height of the coronavirus pandemic. With supply /inventory down from lack of production prices for homes and autos have spiked. No real surprise there. The consumer-price index jumped a seasonally adjusted 0.6% last month from June, , double the rate economists predicted. Rising energy prices offset declines in some food prices to drive the index higher, but even backing out those two more-volatile categories still leaves core consumer prices up 0.6%. Economists were expecting a 0.4% increase in core CPI. https://www.barrons.com/articles/dont-look-now-but-inflation-may-be-awakening-from-its-long-slumber-51597242832?mod=hp_LEAD_1

The industrial sector continued its recovery in July, posting the second largest monthly gain (June 2020 being the largest) going back to 1959. However, that improvement is measured from a low baseline. Industrial production has made up roughly half of the decline seen in March and April. While there is still some ways to go before a full recovery, the details of last week’s report were positive.

Within manufacturing, auto production surged 28.3% in July, following 100%+ increases in May and June, as car and truck factories continued to resume operations. With the July jump, auto manufacturing now stands just 1.4% below year-ago levels, and is virtually even with where the index stood back in February.

Meanwhile, non-auto manufacturing rose 1.6% in July, also a multi-decade high. While some sectors of the economy - like restaurants, bars, and hotels - remain at serious risk, the factory sector appears better positioned for further recovery.

Simon properties finalized plans, along with partners, to buy retail brands Brooks Brothers and Lucky Brand. Further, the Wall Street Journal reported a possible deal where Simon and Brookfield Property Partners are negotiating to purchase J.C. Penny’s retail operations out of bankruptcy. Royal Caribbean announced poor quarterly results but managed to rally 16% after surprising with strong 2021 bookings that buoyed the chances of a return to profitability by next year. They also laid out a sizeable liquidity cushion that should keep the company solvent for 14-16 months even with little improvement in demand.

Cisco Systems Inc. fell over 10% last week after announcing poor quarterly results due to hardware sales falling 16% as customers delayed orders. CEO Robbins: “As you move down the customer stack, things just get weaker and weaker as the customers get smaller and smaller because they just don’t have the financial wherewithal.” Robbins statement underscores some of the financial weakness many small/mid-size firms are feeling from this pandemic and economic shutdown.

It’s going to take years for the US economy to fully heal from the economic disaster brought about by COVID-19 and the government-mandated shutdowns which continue to limit economic activity across the country. When we talk about a full recovery, we don’t simply mean getting real GDP back where it was in late 2019; a full recovery comes when the unemployment rate gets back below 4.0%, and we don’t see that happening until at least late 2023. Yet last week’s key reports on the economy clearly show we’re recovering

Healthcare contributions

IRS issued Revenue Procedure 2020-36, which increases the affordability threshold for ACA employer mandate pay or play purposes to 9.83% for plan years beginning in 2021 from 9.78% for 2020. For a copy of Revenue Procedure 2020-36 please click on the link below. https://www.irs.gov/pub/irs-drop/rp-20-36.pdf