Weekly Market Review for April 7th 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

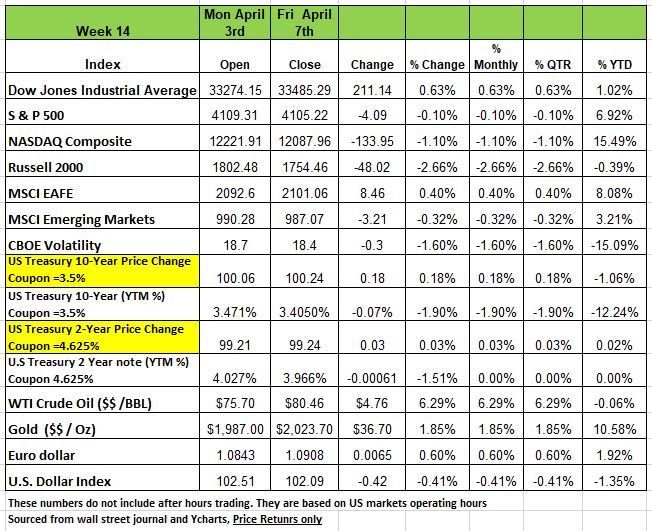

Last week was a short week with the markets closed on Friday in observance of Good Friday. It was also the beginning of a new month and Q2. Of the four major indices last week only, the DOW ended the week in positive territory with a +.63%. The other 3 indices declined with the S &P 500 shedding -0.1%, the NASDAQ -1.1% and the Russell 2000 -2.66% as investors began the new month and quarter on a cautious note amid weaker-than-expected private-sector job gains for March, but gains led by utilities and health care helped minimize the overall drop.

The slight decline came as ADP's monthly measure of private payrolls showed a 145,000 increase in March, well below expectations compiled by Bloomberg for an increase of 210,000 However the March employment data that was released last Friday by the US Bureau of Labor Statistics came in at 236,000.

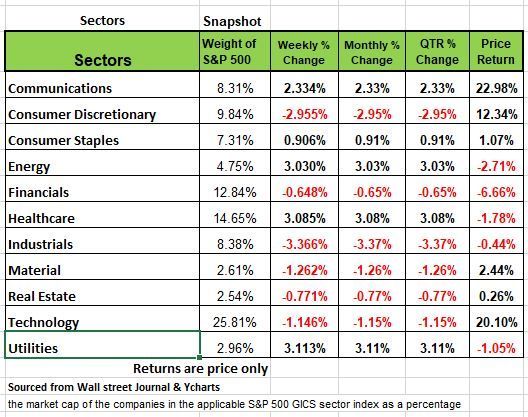

Returns in the sectors were divided 6 of the 11 sectors were down for the week with Industrials leading to the downside with a -3.36% decline, followed by a -3.0% decline in consumer discretionary and a -1.26% drop in materials. Other sectors in the red included technology -1.14%, real estate -.77 and financials -.65%.

On the upside, Energy, Utilities and Health care climbed slightly more than +3% each Communication services +2.3% and Consumer Staples+.9%.

This week, Q1 earnings reports will start kicking off. A number of heavyweight companies are expected to release results on Friday, including UnitedHealth Group (UNH), JPMorgan Chase (JPM), Wells Fargo (WFC) and BlackRock (BLK).

Average earnings growth slowed slightly to 4.2% YoY, a positive sign for inflation but still above the Fed’s comfort level. In other news, the U.S. services sector slackened much more than forecast in March as prices paid fell to the lowest in three years and new orders plunged. That release, along with a manufacturing sector that continued to contract at a quicker pace, stoked fears of a broader economic slowdown.

U.S. Treasury Bond yields were mostly down across the yield curve last week. Only shorter-dated treasury yields turned positive by the end of the holiday-shortened trading week. Treasury yields spiked during the abbreviated trading session on Friday in response to the release of the March jobs report.

The unemployment rate dropped from 3.6% in February to 3.5% in March. Overall, traders believe the March jobs report increases the odds of the Federal Reserve hiking rates 25 basis points at the May meeting. According to the CME’s Fed Watch tool, the odds of a May 25 basis point rate hike jumped from 49% on Thursday to 67% post Friday’s jobs report.

The U.S. Dollar

As a kid my friends and I used to play a game known as “King of the HILL”, a fairly common game among young kids. The objective of the game was to reach the top of the hill while keeping others from taking that position. The game was an example of humana behavior to be on top and control the hill. America has been the King of the economic Hill for a long time and as a country we have gotten all to comfortable with being on top, thinking that no one will ever knock us off the pedestal. Arrogance is truly one of the components that can cause a country to not do what is necessary to stay competitive or on top of the economic hill.

There are a number of examples of Economic and societal collapses throughout history. Just take a look at the Incan and Roman societies and how quickly they disappeared. The Ottoman Empire fell apart, the United Kingdom saw the pound lose its reserve currency status.

So, anyone who says the US, and the dollar, couldn’t face the same fate doesn’t pay attention to history, because we know that in some way shape of form history will repeat itself or as some may say rhyme.

So, the question becomes, will it? Russia, China, Brazil, and other countries, like Saudi Arabia, all seem to think they can find a way to replace the dollar and undermine US dominance on the world economic stage. Maybe independently they will have difficulty, but America may just help them with little effort.

We should take a look at what made America strong, it was a culture that created our Constitution. The rule of law, private property rights (especially to inventors through patents), democracy (and free elections) these are what made America different and ushered in two hundred years of supercharged human progress. While we admit some of the early contributors to our success played a little dirty it was more of survival of the fittest that led to this success.

While the US ran up large debts to fight wars, it was debt that was necessary to preserve our way of life. But we also managed to grow our way out of that debt as well. At the same time, our monetary system kept the value of the dollar fairly strong and stable relative to other currencies. The combination of all of this led to deep and robust capital markets, and a dominant 60% representation by the dollar in foreign currency reserves and nearly 90% of global financial transactions.

But over the last 25 years the US reversed course, printing too many dollars, undermining entrepreneurship with higher taxes, over regulations and growing the government way too much. The narrative is to expect the successful to foot the bill by raising taxes to pay for outrageous spending which will cause the dollar’s standing to diminish.

It appears that we are clearly on that path today. Federal government spending has reached an all-time high of 25% of GDP in the past three years, state and local spending is near 20%...so, combined, government controls 45% of US output. Not to mention the size of the debt we have. This is not a good scenario.

Famed economist Milton Friedman stated, the more the government is involved, the higher the price of things and the lower the quality. More importantly, for the dollar, the Federal Reserve has embarked on an experimental “abundant reserve” monetary policy that has flooded the financial system with more liquidity relative to GDP than at any time in US history. In 2007, the Fed’s balance sheet was 5% of GDP, today it is more than 30%. And remember GDP is not a constant number. Back in 2007 GDP was $14 trillion, in 2021 it was $23 Trillion. So, do the math.

There has been massive government involvement in the economy, from the pandemic to the bank bailouts in addition there was excessive money creation all leading to the perfect storm for a decline of the currency.

However, the good news is that before this happens to the USA, think about what might replace the dollar. It cannot just go away something must take its place. It would have to be a currency managed by a country that has better policies.

Remember what made America a powerhouse. it was not just our natural resources, but its human resources and freedom. China, Saudi Arabia, and Russia may have resources, but they are not free. Dictatorships do not provide incentives. We do not think that it will be any these countries, although if China continues to control the majority of production in the world and its culture shifts it may be a contender to replace the dollar quicker that we think. While it is highly unlikely to happen in the next 20-30 years. However, that’s not to say it won’t happen in the lifetime of the next generation. Bad policies always lead to bad outcomes. The question of how long before the bad outcome becomes so apparent is not known. Besides, the blame will be placed on the people in office at the that time, not the real culprits.

The U.S. Dollar’s dominance will only stay dominant if the US does the responsible thing by keeping its fiscal and monetary house in order. Politicians more concerned about getting reelected and creating a narrative that the public is a victim and handing out money, is not responsible.

Limiting government spending, keeping tax rates low, and returning to a “scarce reserve” monetary policy are suggestions.

The problem we see is that politicians have used the last two “crisis” periods to expand the size and scope of government, not shrink it. The U.S is fortunate in that it has not had a major crisis, one that truly shakes the country to its core in a long time. We do not know what it is like to go hungry or really struggle as a society. Source Brian Westbury

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

This week we want to take a look at a specific commodity, Gold. Gold futures (/GC) continued their recent advance, rising 2% and positive five of the last six weeks. Gold prices have been in a wide range since the pandemic’s start, trading between $1,700 and $2,000 and now pressing the upper bound for the third time.

The first run set the all-time high at $2,089. The MACD is confirming bullish momentum, with its highest reading since the historic high. A technical bull flag pattern points to a potential target near $2,165. Whether it achieves that could rest on the state of the U.S labor market and its influence on the Federal Reserve’s decision at the May meeting. If the Fed hikes rates again it could put pressure on gold. If they decide to pause, it will likely cause weakness in the U.S. dollar and may boost gold prices.

The Week Ahead

This week the focus turns back to U.S. inflation numbers, with CPI due on Wednesday and producer prices the following day. The jobs data revealed some softening, but the labor market remains tight and keeps a rate hike in May on the table. Disappointing inflation reports would only strengthen the case for the Fed to tighten policy further. The minutes from the last FOMC meeting will also add color to how seriously a pause was considered in light of last month’s banking crisis.

Banks, Q2 earnings season kicks off on Friday with reports due from the large U.S. banks, where investors may gain insights into the health of their balance sheets and how much they benefitted from inflows. Also on Friday, retail sales and consumer sentiment will reveal how the American consumer is holding up.

Finally, watch the results from this week’s 10 and 30-year Treasury auctions given the recent rate volatility. Overseas, there is little data coming from a shortened week in Europe and the UK, outside of the ECB meeting minutes. In China, a busy week starts with March inflation data later tonight, where consumer prices are expected to hold steady while PPI continues its deflationary trend. The country’s trade data is anticipated to have declined around 7% YoY. In central bank news, Canada is forecast to hold rates steady at 4.5%

Major economic reports (related consensus forecasts, prior data) for the upcoming week include Monday: February Final Wholesale Inventories MoM ( 0.2%, 0.2%); Wednesday: April 7 MBA Mortgage Applications (n/a, -4.1%), March CPI MoM (0.2%, 0.4%), March CPI YoY (5.1%, 6.0%), March Monthly Budget Statement (-$302.0b, -$192.6b); Thursday: April 8 Initial Jobless Claims (235k, 228k), April 1 Continuing Claims (1814k, 1823k), March PPI final Demand MoM (0.0%, -0.1%), March PPI Final Demand YoY (3.0%, 4.6%); Friday: March Retail Sales Advance MoM (-0.4%, - 0.4%), March Industrial Production MoM (0.2%, 0.0%), April Preliminary University of Michigan Sentiment (61.9, 62.0)

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/