Weekly Market Review for November 13th, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

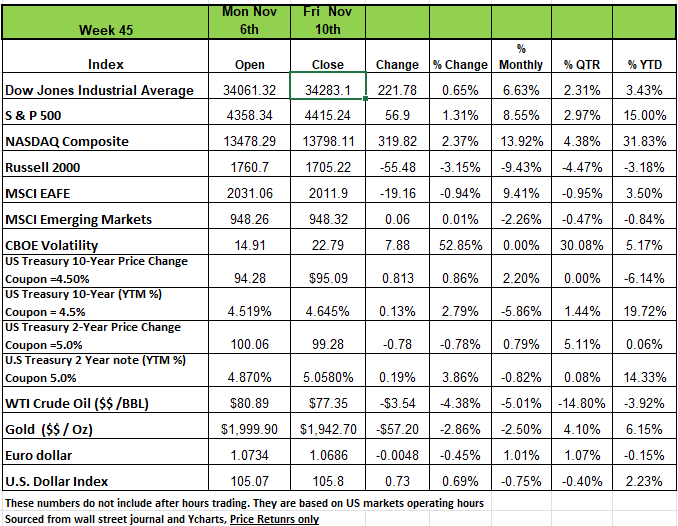

Three of the 4 major indices ended last week in the Black with the Russell 2000 posting the only loss on the week with a -3.15% decline. The DOW barely posted a positive return with a +.66% return the NASDAQ posted a +2.37% and the S&P +1.3%. The gains were led by the technology and communication services sectors. The S&P (The market benchmark) ended Friday's session at 4,415.24, up from last Friday's closing level of 4,358.34. The index is now up 15% for the year to date. But keep in mind it was only two weeks ago that the markets were giving back most of its YTD gains.

The S&P 500 recorded its largest weekly increase of the year as comments by Federal Reserve Chair Jerome Powell and a weaker-than-expected October jobs report helped ease investor worries about rate policy. The relief rally continued for much of last week, with the S&P 500 achieving its eighth consecutive daily increase on Wednesday.

The daily winning streak came to a halt on Thursday as Powell warned that the central bank's Federal Open Market Committee is "not confident" that it has achieved a stance of monetary policy that is sufficiently restrictive to bring inflation down to its 2% target over time.

"If it becomes appropriate to tighten policy further, we will not hesitate to do so," Powell said causing the markets to rethink its rate cuts in 2024

US stocks resumed their climb on Friday as investors appeared to calm their nerves and focus on corporate earnings reports.

Treasury yields fluctuated throughout the week, ultimately finishing higher with the exception of the 30-year. Yields jumped on Monday as traders considered the potential for more tightening from the Federal Reserve. Monday’s Treasury moves were the largest one-day increases for Treasury yields in weeks. Economic data releases on Tuesday saw the trade deficit climb to almost 5% in September, though it remains near a three-year low. Yields fell on Tuesday and Wednesday as the Treasury held a $48 billion auction of 3-year notes and a $40 billion auction of 10-year notes, reaffirming buying interest in government debt.

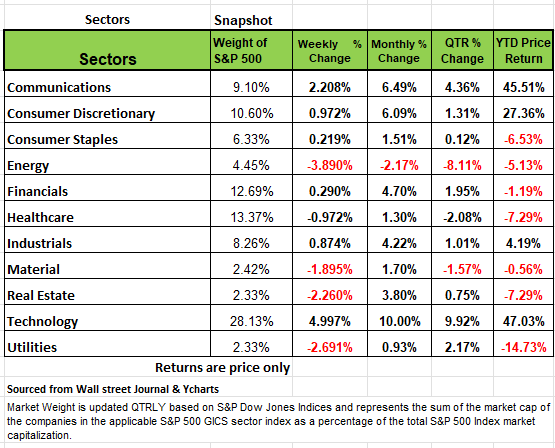

The technology sector had the largest percentage gain of the week, up +4.9%, followed by a +2.2% increase in communication services. Other gainers included consumer discretionary, industrials and consumer staples. However, there were still five sectors in the red, led by a -3.8% drop in energy, a -2.6% decline in utilities and a -2.1% slip in real estate.

The technology sector's gainers included shares of Nvidia (NVDA), which rose +7.4% as BofA Securities said it expects the chipmaker to post fiscal Q3 results above analysts' consensus view when the company releases its quarterly results later this month.

In communication services, shares of Take-Two Interactive Software (TTWO) rose +6.5% as the video game publisher reported fiscal Q2 net bookings near the high end of its own guidance and said it plans to release a trailer of the next installment in its popular Grand Theft Auto series in early December.

The energy sector's drop came as crude oil futures also fell on the week. Decliners included EQT Corp. (EQT), down nearly -13% on the week, and Marathon Oil (MRO), down -8.6%.

If you take a closer look at the chart below you will notice that 6 of the 11 sectors are in the red for the Year with Utilities Real Estate and Healthcare posting the largest YTD declines. Perhaps this is a sign of things to come

CONSUMER PRICE INDEX (CPI) FOR OCTOBER 2023 IS PROJECTED TO RISE 3.3% YEAR-OVER-YEAR

All eyes will be focused on the release of Octobers CPI number on Wednesday. The median estimate (year-over-year, not seasonally adjusted) for the consumer price index (CPI) for the month of October 2023 is expected to be 3.3%. If 3.3% is the actual year-over-year increase in the CPI, it will mark the first decline in the consumer price index relative to the previous month since June 2023. In September, the YOY consumer price index rose by 3.7% (not seasonally adjusted), This compared to the median estimate of 3.6%, so hotter than expected. During the last 12 months, the increase in the CPI surpassed the median estimate in 3 months, it matched the median estimate in 2 months, and fell short of the median estimate in 7 months.

Over the past 60 months, the increase in the CPI has surpassed the median estimate 50% of the time, matched the median estimate 17% of the time, and fell short of the median estimate 33% of the time.

October’s median estimate of 3.3% is based on 6 estimates collected by FactSet. These CPI estimates range from a low of 3.20% to a high of 3.32%, for a spread of 12 bps. This spread is smaller than the trailing 12-month average spread between the low and high estimate of 55 bps and lower than 60-month average spread between the high and low estimate 50 bps. The median estimate (YOY, not seasonally adjusted) excluding food & energy (Core CPI) is 4.1%. The U.S. Bureau of Labor Statistics (BLS) will release the CPI and Core CPI numbers for October tomorrow (November 14).

Mortgage rates decline

The contract rate on a 30-year fixed mortgage slid 25 basis points to 7.61%, the lowest level since the end of September, according to the Mortgage Bankers Association. The group’s index of mortgage applications for home purchases increased 3% in the week ended Nov. 3, the data out last Wednesday.

The second-straight weekly decline in mortgage rates is the first since mid-June and offers modest relief for a struggling housing market. Still, mortgage rates remain uncomfortably high and are discouraging many homeowners who have locked in rates at much lower levels from moving. That’s put pressure on supply and kept prices elevated.

Many professionals believe that we’ve seen the peak in mortgage rates and anticipate a steady decline over the next two years, however they do not think that rates will fall below 6% until 2025 which is a lot higher than the 4.1% average over the last decade. That will keep affordability stretched and dampen any potential of a major recovery in housing activity.”

The Federal Reserve’s decision last week to hold interest rates steady for a second straight meeting is offering some hope for the housing sector. While policymakers reaffirmed they will keep borrowing costs elevated in the near term, real estate stocks rallied last week on speculation the central bank could be nearing the end of its tightening cycle.

That outlook has helped bring the 10-year Treasury yield down from the peaks reached in October. Mortgage rates tend to move in tandem with government yields.

The MBA’s overall index of applications, which includes purchasing and refinancing, rose 2.5% last week from the lowest level since 1995. Refinancing activity also edged up.

The MBA survey, which has been conducted weekly since 1990, uses responses from mortgage bankers, commercial banks and thrifts. The data cover more than 75% of all retail residential mortgage applications in the US. Source https://www.bloomberg.com/news/articles/2023-11-08/us-30-year-mortgage-rate-tumbles-by-most-in-more-than-a-year?srnd=premium

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Liquid security or market index is driven by the law of supply and demand. Contrary to what others may think, changes in supply and demand are driven by the emotions, or the beliefs, and convictions of investor confidence. We also know, that those emotions can change quickly and unpredictably.

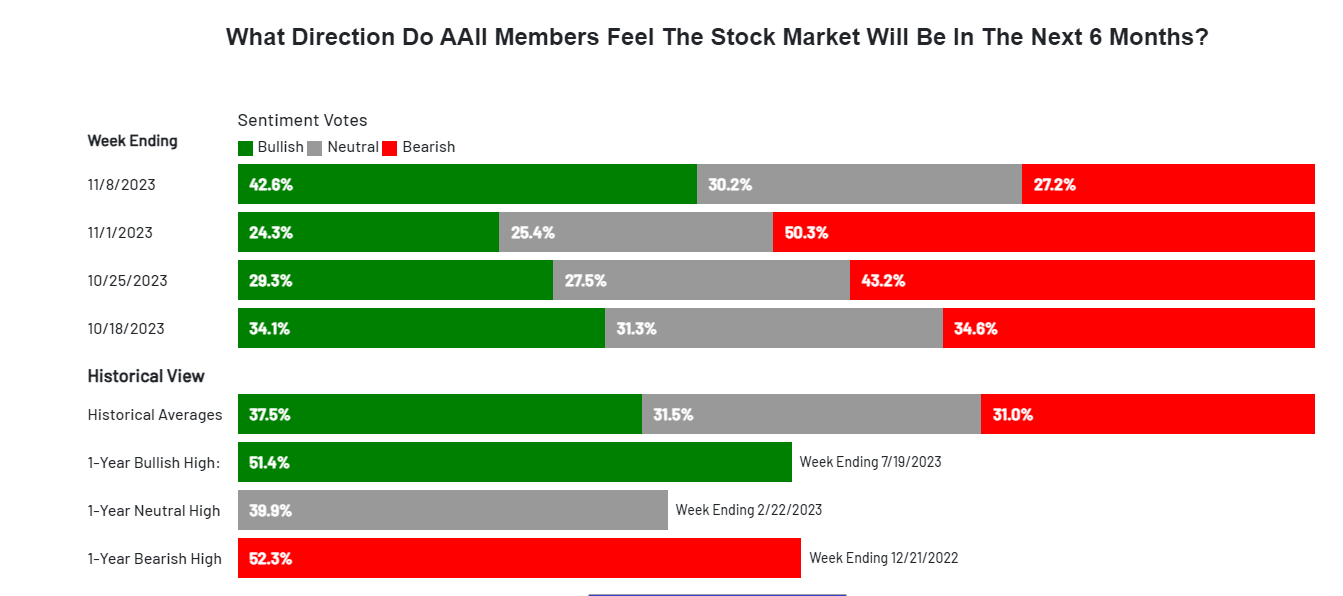

If we look at the latest Investor AAII Sentiment Survey. The most recent study (published every Thursday) which surveys investors as to whether they are Bullish, Bearish, or Neutral on the markets, showed a rather large shift in market outlook.

If we look at last Thursday’s study we can see the percentage of bullish investors jump from 24% to 42% (+18.3%) and the percentage of bearish investors fall from 50% to 27% (-23%). In one week

The AAII sentiment survey dates back to 1987 and has now been conducted for 1,892 weeks. The 18% jump in bullish sentiment is the 22nd largest single-week increase since the survey’s inception, and the decrease in bearish sentiment is the 4th largest single-week decrease.

It appears that the small rally over the last two weeks was enough to dramatically change the moods of investors. It should be noted that investor sentiment is a contrarian indicator. According to the American Association of Individual Investors, “a contrarian indicator tells investors that it may be a good time to go in the opposite direction of the herd.” In other words, high levels of pessimism can precede rallies and high levels of optimism can precede declines.

The Week Ahead

The economic calendar is much busier this week, highlighted by U.S. inflation and China’s monthly data dump. Additionally, a potential U.S. government shutdown looms this Friday. After Fed Chair Powell squashed hopes of interest rate relief, investors will be on the lookout for inflation trends in Tuesday’s CPI and Wednesday’s PPI reports. Headline CPI is expected to ease to +3.3% YoY from +3.7% and tumbling oil prices may provide more downside momentum into year end, along with more clarity on whether the Fed is done raising rates. U.S. retail sales have consistently surprised to the upside this year, with only two negative months, and October’s figures will arrive midweek. Key earnings reports this week include Home Depot, Target, and Walmart, each adding insight into the resiliency of the U.S. consumer. Target’s CEO recently commented that spending trends were slowing. The domestic agenda also includes regional manufacturing surveys and industrial production figures. Although U.S. mortgage rates have dipped slightly of late, home prices remain sky-high due to low supply. The NAHB Housing Market Index, along with starts and building permits, will be revealed at week’s end. Overseas, the UK releases employment, inflation, and retail sales data against the backdrop of a slowing economy. Late Tuesday, China’s industrial production, retail sales, and fixed asset investment figures for October arrive. Modest improvements are expected but the recent trade data has raised doubts about domestic demand.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/