A Changing Economic Landscape

&

Weekly Market Review for Oct 14, 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

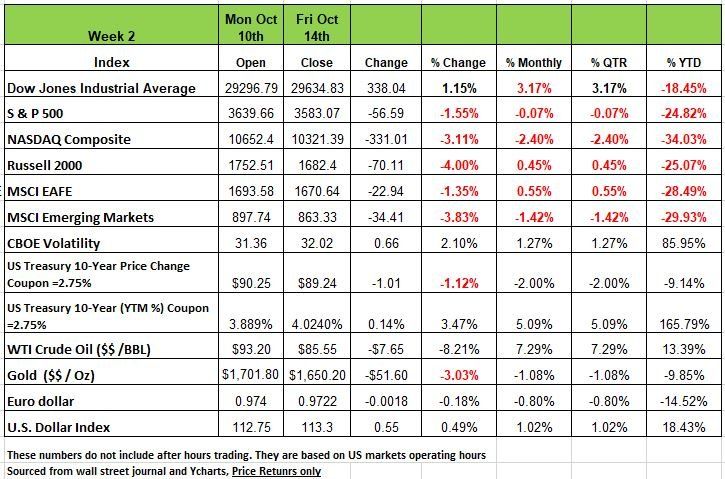

What a crazy week of market activity. The DOW had a 5% swing on Thursday alone, the S&P was slightly more volatile for a one-day swing of 5.5% from Trough to Peak. All this came on the news that the Consumer Price Index (CPI was hotter than expected). YOY was +8.2% however it was the MOM +.04% number that spooked investors and trigger the early day sell off before reversing up by days end. But for the week the DOW was the only major index with a positive return at +1.15% while the Russell 200 dropped -4% followed by the NASDAQ -3.11% and the S&P experiencing a -1.55% decline.

The week's decline came as the S&P 500 fell -2.4% Friday alone this after Q3 earnings reports from banks including JPMorgan Chase (JPM), Morgan Stanley (MS) and Wells Fargo (WFC) showed mortgage lending has been falling amid climbing interest rates. The reports also showed banks have been setting aside more money to cover future potential loan losses while consumers have been relying more on their credit cards.

The concerns raised by the bank reports came even as quarterly earnings by consumer staples companies including Walgreens Boots Alliance (WBA) and PepsiCo (PEP) were better than expected Investors are watching this quarter's earnings reports closely to see how inflation and the higher rate environment are impacting consumers and companies

The September “core” CPI, which is ex-food and energy, rose 0.6%. The “core” CPI is up 6.6% year-over-year, the highest in four decades, leading some pundits to suggest inflation is stickier than expected. We are no in agreement with that too much

U.S. Treasury bond yields rose across the yield curve last week, led by outsized gains on the shorter-dated end of the yield curve. Last week, the 2-year and 10-year Treasury yields hit their highest levels since August of 2007 and October of 2008, respectively, and remain inverted, which has historically been and economic recession indicator. The swings in the Bond market have left many investors frustrated as fixed income products have traditionally been considered a “safe-haven” for the cautious investor. Falling Bond Prices have resulted in rising yields much like falling equity prices have resulted in higher Dividend yields, but the weak may just have difficulty looking at falling portfolio values regardless of the yield

The consumer discretionary sector had the largest percentage drop of the week, down -4.1%, followed by a -3.2% slide in technology, a -2.6% decline in utilities and a -2.4% drop in real estate. Other decliners included materials, communication services, energy and industrials.

Three sectors still rose week over week, led by consumer staples, up +1.4%. The other gainers were health care, up +0.8%, and financials, up +0.2%.

Is a new era of Economic conditions on its way

There has been nothing but turmoil in financial markets this past year and growing evidence of stress in the world economy. Some pundits think that these are just the normal signs of a bear market and a coming recession. Of course, they have an objective to get you to give them your money. Don’t get me wrong money can be made in any market environment, including this one what you need to understand is that it is highly unlikely that you will make money every time in every market environment. You are going to have down years, but the smart advisors minimize the downside risk.

But this article is not about profiting in a Bear Market. It’s about changes in the world economic system and what seems to be a painful emergence of a new rule in the world economy. A shift that seems to be similar to the rise of Keynesian economics after WWII, or the pivot to free markets and globalization in the 1990s.

This new era we seem to be entering has a double edge sword on the one hand it seems to be focused on issues such as ageing and “climate change”. Younger generations seem to be focused on equity and fairness. But it also has some serious dangers, from financial chaos that involves excessive borrowing, broken central banks and out-of-control public spending. Let’s just keep it simple, bad decisions lead to bad problems, and really bad and reckless decision’s lead to worse potentially unfixable problems.

The disturbances in the markets are of a magnitude not seen for a generation or two. For the first time since the 1980’s Global inflation is in the double digits. Of course, we acknowledge the Russia Ukraine conflict is a major component of this issue. The Federal Reserve is cranking up interest rates at the fastest pace since the 1980s, with the dollar at its strongest level in more than a decade, it is causing chaos outside America. Money is flowing out of international financial institutions into U.S. Treasuries to get yield. Causing liquidity issues and a depressed foreign currency. If you have an investment portfolio or a pension, this year has been gruesome. Global shares have dropped by 25% in dollar terms, the worst year in 3 decades, and government bonds are on course for their worst year since 1949. These are supposed to be safe investments. Alongside some $40trn of losses, there is a feeling that globalization is retreating due to China, global supply chain challenges from the pandemic. Not to mention the fractured energy system over Russia /Ukraine and an inevitable China/Taiwan problem.

Since globalization that emerged in the 1990’s the world now shares the pain and economic consequences of bad decision. Historically when one economy shifted down money moved to another that was healthier. The financial crisis of 2008 and the pandemic proved that there was no place to hide in an integrated world economy. Since the 2008, Economic growth around the world has been mostly sluggish, inflation was low for several reasons technology being a prime reason. But the private and public sectors did little to stimulate more activity, so central banks held interest rates at rock-bottom levels and bought huge volumes of bonds at any sign of trouble, extending their reach ever further into the economy.

On the eve of the pandemic central banks in America, Europe and Japan owned a staggering $15 trillion of financial assets. This is a staggering number. It is significantly higher now.

The extraordinary challenge of the pandemic were handled poorly, and worse consumers proved to be irresponsible by not paying rent and looking for any excuse not to work or contribute to the productivity of the economy. Just the buy side part of it. The trillions of dollars spent on supporting people, drove demand and consumers with money in their pockets and at least 40 hours a week of extra free time unleash today’s inflation. Wild government stimulus, bailouts, fraud on both a massive and marginal levels, led to temporarily skewed patterns of consumer demand along with lockdown-induced supply-chain tangles in China. That inflationary impulse has since been turbocharged by the energy crunch in Eastern Europe and the Saudi’s reducing output. The Feds, other central banks and politicians created this problem. One bad decision followed by another, rising rates, and reducing the money supply at the same time may just have a negative long-term impact on economies.

We have discussed the issue of cheap money in the past and the consequences of thinking just in the short term. There is a mounting amount of debt that has been accumulated by large corporations and governments, rising interest rates will make it more difficult to meet those debt obligations for some. As a society we have also conditioned people to believe that being irresponsible is ok, someone will bail you out. The safety net has gotten so wide that governments will struggle as much as poorly run businesses and households.

There is a concern of a financial system meltdown. This almost happened in 2008. The systemic issues were not fixed just diverted to probably sometime in the future. We are not sure if it would have been better to have let things fail in 08, but the conduct has not change that much and at some point, the continued poor fiscal behavior will lead to a day of reckoning.

The inevitable shift to a digital currency, a tense geopolitical environment not just between Russia and Ukraine, but also between China and Taiwan, a potential shift of the dominance of the U.S. dollar away as the world’s currency, are just a few things that will change the economic landscape of the world in the next decade. Source: https://www.economist.com/leaders/2022/10/06/a-new-macroeconomic-era-is-emerging-what-will-it-look-like

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

The market’s day-to-day fluctuations during a bear market are random. No one knows whether a day will finish up, down, or sideways. Just like last Thursday. The S&P 500’s morning futures were up over +1.00% until news of worse-than-expected inflation broke. As the market opened, the index sank to -2.25%, with the technology-heavy Nasdaq falling more than -3%. To the surprise of many, within two hours of trading, the many indexes were up, and the S&P 500 finished the day up +2.60%. Friday saw the opposite occur, with the index falling -2.40%.

Why? Markets are emotional, and noise is louder in a bear market.

The daily fluctuations of the markets have been random, and the daily volatility has come in both directions. If we include Monday’s close ( October 17th, the 199 trading days in 2022), 66 of them have been “outliers.” As a reminder, an “outlier day” is a single trading day ending greater than +/-1.50 %. Of those 66 outliers, 34 of them have been to the downside and 32 of them have been to the upside. So, based this year with daily fluctuations, one could expect to see an outlier day once every 3 days, and it is a coin flip whether the outlier will be up or down. In fact, the longest amount of time the S&P 500 has gone this year without seeing an outlier day is only 11 days.

You may find this surprising, but there has not been much of a difference between the number of “up” outliers and “down” outliers, nor has there been a big margin between the magnitude of the outlier day. The average “up” outlier is +2.21% and the average “down” outlier is -2.45%. Investing only during the “up” outlier days would have returned +101%, while investing only during “down” outlier days would have returned -57%. However, with compounding, large negative days have a bigger impact. Cumulatively on the indexes. Outlier days have accounted for -14% of the S&P 500’s total decline this year.

Some Technical Notes

Volatility comes in waves. Over the last two weeks, the S&P 500 rallied more than +5% in the first two days of October and followed it up with six consecutive down days that erased the index’s gains. Then came Thursday’s large up move and Friday’s large down move. All-in-all, the S&P 500 is flat over the last two weeks ending Friday and has total upward fluctuations of +8% and total downward fluctuations of -8%. That is a lot of volatility for a zero return.

This “sideways” volatility comes with the news and reactions of the jobs data, inflation, and the Fed. One could take it as a slight positive that given all the bad news and Fed speculation, the market has gone sideways near its June low point. It appears that the sideways move is the market attempting to make a low, but it also has yet to show that it wants to have any sort of sustained rally. We will see how the markets react during what many are expecting to be a bad earnings season.

So, how will the market react if earnings are good and how will they react if they are bad? Well, as the data shows, it could go in either direction, but regardless expect the markets to remain volatile.

On a positive note, and take this with a grain of salt, there is an old technical research firm called “Lowry Research.” Their data shows that the most common theme near the bottom of a bear market is a series of days where the volume of advancing stocks accounts for 90% of the total volume of the exchange. According to expert market technician, David Vomund, that has now occurred three times this month after Thursday’s move. David says that “having three 90% volume up days near the June low is constructive.”

Markets are volatile, whether we are talking about stocks or bonds, especially this year. It has become clear that this isn’t the “V” bottom -20% drop and a quick rally to a new high that we have seen twice now in the last five years (see December 2018 & Covid 2020). This market has shown a pattern of lower highs and lower lows. We do know that the number of outlier days is not slowing down just yet. Volatility is expanding, not contracting. That is a bear market characteristic. In addition, the media and their pundits are preaching a recession in 2023, so what will happened then is anyone’s guess. But the best advice we can give you is to turn off the noise (TV, radio) and think things through before reacting. Source Brandon Bischoff

Opinion

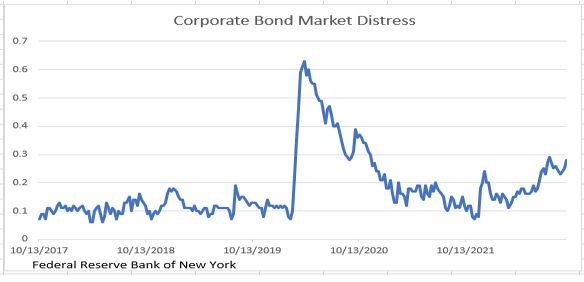

Nearly every Fed tightening cycle results in unexpected economic drama in some important economic sector. The Great Recession had the financial crisis (Lehmann Brothers bankruptcy, and significant banking sector capital issues from holding AAA graded mortgages that weren’t worth the paper they were printed on).

Over the past two weeks, we’ve seen the near bankruptcy of several U.K. pension funds. During the years of low interest rates, in order to generate enough cash to make required payments to pensioners without delving into principal, U.K. pension funds leveraged (borrowed money) to buy enough bonds to make those payments. Many borrowed in dollars. The rapid rise in interest rates (engineered by the Fed) put bonds into the worst bear market in modern history. And the rapid fall in the value of the British pound (from $1.22 in early August to as low as $1.03 near September’s end) compounded the problem. The value of the bonds in those pension funds were hit hard, and margin calls put them in danger of bankruptcy. Only the fast action by the BoE in supporting the value of the pound prevented a calamity.

As in nature, there is always more than one cockroach! We don’t have any special knowledge, but believe that if the Fed continues its uber-aggressive tightening, there will be other fallout

The chart above shows the rise in distress in the corporate bond space. Problems could arise there. The chart below shows the rapid rise in total consumer credit as U.S. households borrow on their credit cards to (temporarily) maintain their living standards as inflation has risen faster than their incomes.

Rising delinquencies could play havoc, especially in the shadow banking space.

We don’t know if, when, what or where something significant will break. But using history as a guide and years of ultra-easy money and near zero interest rates, the rapid move of interest rates to levels not seen in decades and with more to come, it is likely that something vital will break. When that happens, the Fed will have little choice but to “pivot.” Maybe buying Bonds, at current levels is a smart move.

The Week Ahead

In the minutes from the last FOMC meeting, several members expressed concern with the pace of rate hikes given the “highly uncertain global economic and financial environment.” This week, earnings season heats up, which should provide a glimpse into how corporations and consumers are holding up and if inflation is starting to relent.

Goldman Sachs, Netflix, Tesla, Proctor & Gamble, and American Express are some of the big names scheduled to report. These companies tend to set a tone for the sector. Also coming this week is the U.S., regional manufacturing surveys from New York and Philadelphia. They are expected to remain in contraction territory but may reveal softening price pressures. All this may just be speculation. Housing starts and existing home sales for September will be released as mortgage rates have surged to 20-year highs.

The international calendar kicks off with China’s Q3 GDP, expected to have expanded to 3.6% growth YoY, but we take this with a grain of salt, since retail sales are forecasted to slip from the prior month. The UK will announce September CPI amid the turmoil of the new government’s fiscal plans, and retail sales on Friday. Other events of interest include Canadian CPI and Eurozone economic sentiment information.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/