The State of the Economy

&

Weekly Market Review for Oct 7th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

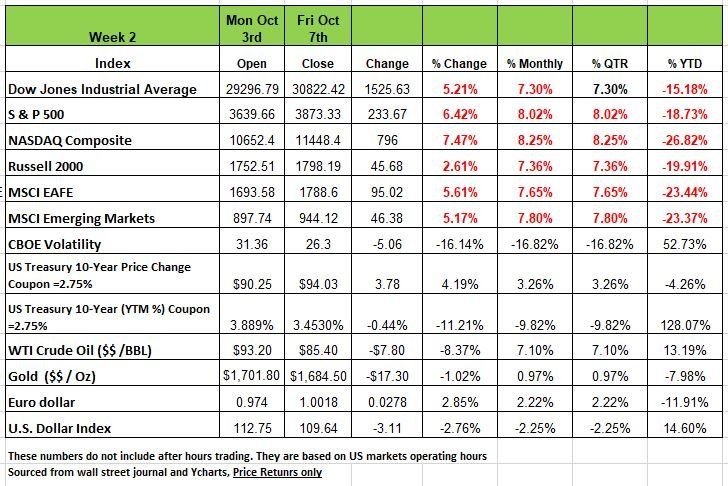

As poorly as the last half of the week performed the markets still etched out gains for the first week of October with the Russell 2000 taking the lead with a +4.63% return Followed by the DOW +1.99% the S&P +1.51% and the NASDAQ at +.073%. The previous week ended the month and the quarter on a very sour note. But Monday and Tuesday saw positive inflows into equities until the jobs report came out and the markets realized that the Fed would not let up on its objective to squash inflation and keep raising rates. Crude oil spiked 16% after OPEC announced nominal production cuts of 2M barrels a day, the biggest since the pandemic’s start. The U.S. dollar and Treasury yields rose sharply as the resilient labor market and hawkish Fed rhetoric kept another large rate hike probable in 4 weeks’ time. U.S. non-farm employment increased 263K in September, with private payrolls accounting for all the gains. The unemployment rate fell to 3.5%, largely due to a drop in the participation rate, and wages rose 0.3%, signaling persistent inflation pressures and in turn probable rate hikes. indexes tumbled 3-4% following the release realizing a Fed Pivot was not probable

Fixed income continues to post jarring losses as yields, particularly short-dated yields, continue to rapidly rise. (Prices drop Yields rise) The September non-farm payroll data from last Friday did nothing to alleviate the assent of yields. As mentioned above the strong jobs data amplified expectations for more rate increases from the Federal Reserve. Mr. Christopher Waller, member of the Federal Reserve System Board of Governors, spoke to his alma mater at Kentucky on October 6th and insisted inflation is far from the FOMC’s goal. More concerning, he stated it did not appear “likely to fall quickly.” He went on. “This is not the inflation outcome I am looking for to support a slower pace of rate hikes or a lower terminal policy rate than projected in the September 2022. The markets seemed to digest this and the jobs data last Friday. Price action was strong and to the downside, suggesting markets are inclined to expect the Federal Reserve to remain tight until “it breaks something.”

NOISE IS LOUDER IN BEAR MARKETS

Noise is a distraction; it prevents you from focusing and staying on course for your objective. The media is source for most of the noise we must try to block out, which can often cause us to derail from our course. Fear is a big emotion often generated from noise and the other is over confidence. The markets “popped” upward on Monday and Tuesday, two outlier days giving some investors hopes of a market rally based on an assumption the Fed would pivot with its interest rate track. Then the markets did a 180 and we saw another outlier day, on Friday this time to the downside. The decline wiped away almost all of advance seen in the early part of the week.

What happened last week is an example of the counterintuitive nature of markets. On Friday, the September jobs report was released. What exactly were the details of that report? Well for starters, the US economy added 263,000 jobs versus only 255,000 expected. Additionally, the unemployment rate fell to 3.5%, from 3.7%. All of this would seem like good news, but in the eyes of the market, good news was actually bad news because apparently investors are now expecting the Fed to move forward with rate hikes thinking that we have a stronger economy. Investors were hopeful that a bad or slowing jobs report, counter to what actually happened, would discourage the Federal Reserve from proceeding with aggressive rate hikes in November.

So, the question is “does the positive jobs report warrant a nearly -3% swing day in the markets?” News creates what is we refer to as “market noise.” Market noise is defined as the day-to-day fluctuations caused by short-term news events. The impact of a news event is largely dependent on the market environment when the news occurs. In a market environment that is unstable bad news is magnified, if the news came out and we were in a Bull market the news would be minimized.

In a bull market, the news cycle tends to have a much lesser impact on the market’s movements. As an example, President John F. Kennedy was assassinated in the middle of a bull market. That day, the S&P 500 fell -3% and was back at a new high within a week. The news doesn’t drive the markets, but rather creates noise that cause a knee jerk reaction. This is what happened on Friday, that market “noise” tends to be much louder in a bear market and softer in a bull market.

Markets are driven by supply and demand, which are in turn driven by the emotions, beliefs, and convictions of investors. During a bull market, the battle between supply and demand is steady, and feels “boring.” However, during a bear market, the senses of investors are heightened, and any news event can cause a panic response, usually in a negative direction. Humans are emotional and we are very emotional about money especially when there is a lot on the line. The markets become irrational because as humans (traders) trying to process so much information quickly we tend to err on the side of caution which really ends up being a little reckless, irrational.

Starter Homes Harder to Find for Young Couples

Is there anything inherently bad about a small 100-year-old houses getting replaced by a larger, modern one? I am sure that many planners, historians, and economists would say there is something bad about insisting that communities remain the same forever. But one thing that is consistent in life is Change. Tastes change. Consumer demands and demographics change. Americans have changed, on average, we have become wealthier over time, capable of affording more housing than the typical family could three generations ago.

But the reality is that most communities effectively ensure that the only viable replacement for a starter home on expensive land is a new home that’s much larger and more expensive. Young couples starting a life/family are finding it difficult to buy a home without the help of their parents and if they are not fortunate enough to have someone to help, then their choices become limited if they want to live in a good area with a good school system.

We seem to have an affordable housing crisis. In order to find enough space a couple may have to be willing to move into a transitioning area, one that is a bit more edgy for their taste.

Americans used to plant roots, find a community that suited their needs. For most they stayed in their home for life. But Americans changed their focus when homes became real estate investments, and couples would upgrade to something bigger once the equity in the home increase along with the value of their home. We have become a culture of wanting more. So, developers took advantage of this opportunity and purchased small homes on decent size lots to build McMansions. There is nothing wrong with this except that the marketplace in many areas around the country have eliminated what is known as a starter home. Just look at any of the home makeover shows on TV. Fix and Flip and outprice. Low interest rates fed this mentality

Communities are getting facelifts and there is nothing wrong with this, but there in a consequence. Perhaps the starting place for a new couple is not in a single-family home but in something that looks like a townhouse, or condo.

Maybe with interest rates rising there will be a slow down on the number of houses being torn down or fixed up and flip. Maybe the housing market is entering a new cycle. Source https://mail.google.com/mail/u/0/#inbox/WhctKKXgpPHWrrBfPpMvMZmhlLTlCGwqJBzbVzFTlnLNQsXtfNpXFRFPJMLcgqZJqlGfCmG

State of the Economy

Make no mistake the current economic environment and what’s to come is a self-inflected wound the question is how bad and how long it will take to recuperate for the bad behavior. We are in a Bear Market across all assets classes there is really few places to hide in this environment and, for the first time, equities are simultaneous in a Bear Market with Bonds.

That’s because the Fed normally raises interest rates when the economy is expanding, not when it is contracting. The normal relationship between fixed-income prices and equity prices is that when one is rising the other is falling, and this has historically led to the idea that that an investor’s portfolio should have both asset classes for balance. But this Fed is different tightening into the teeth of a Recession and the result has been Bear Markets in both asset classes.

Given that the Fed employs 300-400 economists, they must see what we have been writing about. Perhaps they are motivated by hurt pride; they were criticized for their “transitory” inflation call and are now out to slay the inflation dragon. Unfortunately, they are gazing through the rear-view mirror using past inflation as their guide instead of looking at what’s ahead. And, it turns out that much of the inflation was, indeed, “transitory,” but with a 16-month time frame caused by people spending on consumer goodies and not paying rent.

Perhaps they see the equity and housing price bubbles growing too rapidly are out to prick those, to prevent another 2008

And it is highly likely that there is a political agenda, the mid-term elections are rapidly approaching, and congress can’t accept the fact that it is responsible for the problem by giving away so much money.

Keep in mind that the Fed itself had a lot to do with the inflation as the money supply grew at double digit rates (via Quantitative Easing) for much of 2020 and 2021. Now we have Quantitative Tightening with negative money growth – another worry as far as Recession is concerned.

The Media has more than its share of pundits arguing that we are not in a recession and who are we to argue, so below is some information that leads us to our conclusion, you decide

Incoming Data

- From the labor market report, we see that the workweek was stagnant at 34.5 hours. It’s been flat or down every month since March. YTD, hours worked are down at a -1.2% annual rate. First hours worked fall, then layoffs occur. That’s why hours worked are a leading indicator and payrolls are a coincident one.

- Real (inflation adjusted) average weekly earnings have been flat or negative in nine of the last 11 months. They are -3.4% Y/Y.

- Corporate default rates are on the rise; they’ve doubled since July. According to Moody’s, corporate “distress” is now at 2011 levels. Moody’s says defaults may occur in up to 6% of corporate America.

- The dollar’s surge in value has caused the world’s major central banks to run down their foreign exchange reserves by over $1 trillion (that’s -8% of their total reserves) to defend their currencies’ values from the uber-hawkish Fed. The British pound fell to as low as $1.03 (was $1.30 not long ago), and the euro to $0.95 (was $1.15). [Our view is that if this continues, there will be a groundswell to get rid of the dollar as the world’s reserve currency.]

- U.S. imports fell -0.5% in August (down six months in a row). Demand is falling. Also, this means lower foreign exports and lower foreign production (the world’s economy is slowing).

- In August, German factory orders fell -2.4% M/M and Swedish Industrial Orders were down -4.2% M/M. Eurozone Retail Sales were off -0.3% (vs. -0.4% in July) and are down more than -2% Y/Y. In the Eurozone, the Construction PMI was 45.3 (50 being the divide between expansion and contraction).

- Taiwan’s exports fell -5.3% Y/Y in September. This was the first such decrease since June 2020. (Note: the consensus was for a rise of +2.4%! So this was quite a shock.) And tech related orders in Taiwan are down -13% from their peak.

- In the U.S., YTD through August, total energy consumption is off at a -9% annual rate. (Perhaps OPEC’s oil production reduction of -2 million bpd may not get them to their desired $100/bbl. price!)

Inflation

- Vendor delays in all the Fed Regional Bank surveys are back to pre-COVID levels as are prices paid and received.

- Commodity prices are in a Bear Market. From their recent peaks: Lumber: -70%; Aluminum -40%; Iron Ore: -35%; Copper: -30%; Energy: -23%; Ag Products: -20%; Textiles: -16%.

- Trans-Pacific shipping rates are now $2,265/container. In September 2021, they were $20,586/container. That’s an -89% fall!

- Recent WSJ headlines:

- Costco Waits on Price Cuts Even as Freight Rates Slide

- Conagra Predicts Relief on Food Costs

- Housing is the most interest sensitive sector. Every metric there says Recession (chart). Prices have started to fall (Redfin, FHFA, and Case-Shiller surveys) as mortgage rates breach the 7% level. In the Great Recession, home prices contracted 25%. Some similar scenario is likely in this cycle.

So, you can believe the financial pundits, or you can interpret the data yourself. Be attentive to your money, while you may not like finance or understand it think about the amount of money in your portfolio and whether being on auto pilot is a good idea. The declines you may have experienced this year will take a while to recoup not to mention the lost increases for the years trying to play catchup. Source Bob Barone Ph’D economist

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Market Technical ’s

Monday and Tuesday began with a “bang” in the upward direction. This +5.7% rise on the S&P 500 over two days was the largest start to October since 1990. Historically, October is a “bear market killer” and is the month when most major market lows are put in, before the market heads higher. Now, that could be purely coincidence. There is no reason to believe that the bear market is over, until the market proves it wants to head higher.

The market pop seen Monday and Tuesday eliminated oversold conditions. That is not great news considering how the market finished the week. After heading higher on two outlier days, most of the gains were given back at the end of week, causing the overbought/oversold indicators to be neutral. So, even though the market is close to its low, it is no longer oversold. In fact, many stocks have registered new lows, and the Advance/Decline Line (which measures market breadth) is lower.

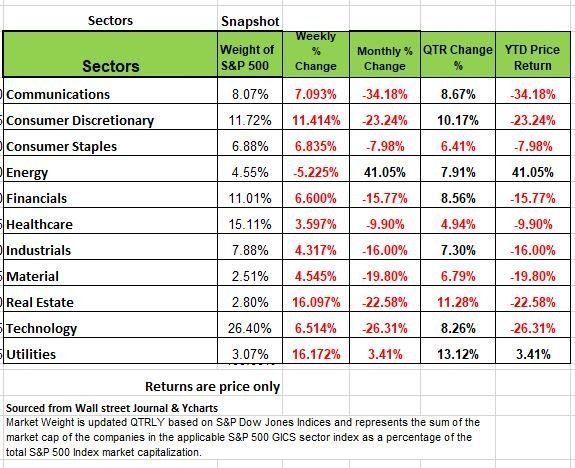

Market leadership continues to rotate. The Energy sector is currently ranked first of the S&P 500 sectors and remains uncorrelated to the overall markets. More “defensive” oriented sectors like Utilities and Staples are starting to slip, but, every sector outside of Energy is in a bear Market State.

Do not get overly emotional or concerned about the day-to-day fluctuations of the markets. More importantly, do not get hung up in the day-to-day reasons for why the markets fluctuate in a particular direction. Market noise is louder in a bear market, where investors will overreact to news events in either direction. We saw the market have a +3% up day last week, as well as -3% down day. These fluctuations are common given the market’s high volatility.

It is more common to hear news about the equity markets, but the thing that has been most impactful to investors, particularly conservative ones, is the bond market. Right now, and unlike most bear markets of the past, we are in a bear market for both stocks and bonds. The equity markets have fluctuated in both directions, as prices have moved in a step pattern, down. Bonds, on the other hand, have continued to drop like a knife. Even more concerning, with rising interest rates, as long as inflation remains high, there would be no reason to believe that bonds would go back up, even if markets were to rebound.

Managing a bear market is a difficult process. There are many fluctuations and events that occur throughout the bear that can cause investors to panic buy or panic sell. Managing a bear market is about navigating those fluctuations adapting portfolio holdings to match new market conditions. Like every bear market, this one will eventually end, and a new bull market will begin. The key is to continually put your portfolio in a position to benefit from volatile markets, instead of being punished by them. Source Brandon Bischoff Canterbury

The Week Ahead

The Fed finds itself in a real quandary now. Rising interest rates have failed to stymie the labor market, while both shelter and wage inflation persist. Additionally, the Atlanta Fed GDPNow model implies that economic growth accelerated in Q3, potentially reversing two straight negative quarters. Without some hard evidence that their actions have influenced anything but the struggling equity markets, the Fed cannot begin to think about a pivot in its restrictive policy.

This week’s focus turns from jobs to the U.S. inflation data, with the PPI release Wednesday followed by CPI on Thursday. Expectations are for increases of 0.2% MoM and 8.1% YoY for consumer prices, numbers that would only bolster the central bank’s case. Wednesday will also see the release of the minutes from the last FOMC meeting, and it’s another busy week of committee member appearances to parse.

The U.S. calendar concludes with retail sales and consumer sentiment on Friday, along with the beginning of Q3 earnings season. Many of the large banks will report, and investors will be keen to see how the surging U.S. dollar has impacted corporate profits and CEO outlooks.

On overseas calendar the UK reporting employment figures and monthly GDP while the Bank of England’s gilt buying intervention is set to expire at week’s end. In China, stimulus measures have proven to be little help against harsh lockdowns, which will likely keep inflation readings tame and imports data weak.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/