Weekly Market Review for

May 30th, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

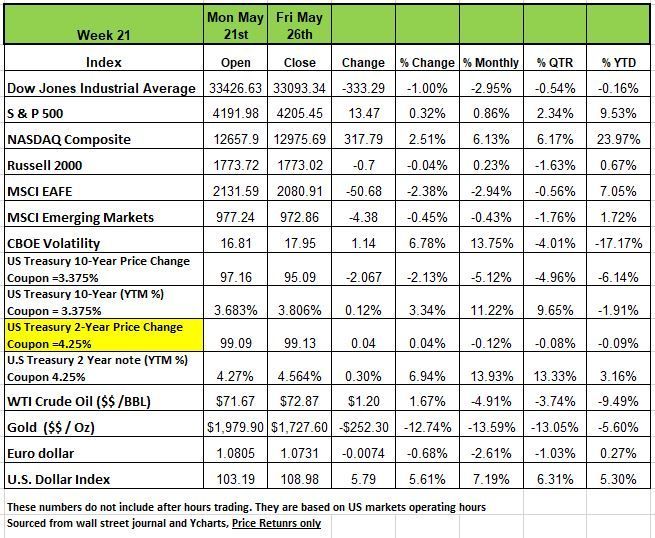

Last week was the last full week of May and it was quite an interesting week. The DOW and the Russell 2000 posted negative returns for the week -1% and -.07 respectively. The big movers were Nike, P&G and Travelers. The NASDAQ was the big winner for the week moving up +2.51% followed by the S&P 500 rising for a fifth consecutive +.032%

In economic data, Q1 GDP was revised higher to 1.3% from the initial estimate of 1.1% but was still down from a 2.6% growth rate in Q4. Housing data was mixed as new home sales fell and pending home sales were flat in April. The purchasing managers' indices measuring the manufacturing and services sectors of the economy both declined from April, lowering the composite index to 53.0 from April's 53.4.

Last week, US Treasury yields increased on the back of resilient US labor data and uncertainty about the interest rate outlook ahead. Progress on US debt ceiling negotiations also contributed to the highest yields since March, with the 2-Year and 10-Year US Treasury yields rising to 4.59% and 3.82%, respectively. The market implied probability of a 25-basis-point increase in the Federal Funds Rate during the June 14th meeting began the week at 18% and had risen to 69% by the end of the week.

In the UK, the 10-Year UK Gilt yield closed higher to 4.33% on the back of persistent inflation data.

Oil prices initially surged last week as investors interpreted comments from Saudi Arabia as potential signals for production cuts, but they pared back later in the week after Russia suggested that additional OPEC+ cuts were unlikely. Ultimately, WTI and Brent crude closed higher at $72.67 and $76.95/bbl, respectively. Meanwhile, gold prices fell last week as the US dollar strengthened, ending at $1963/troy oz.

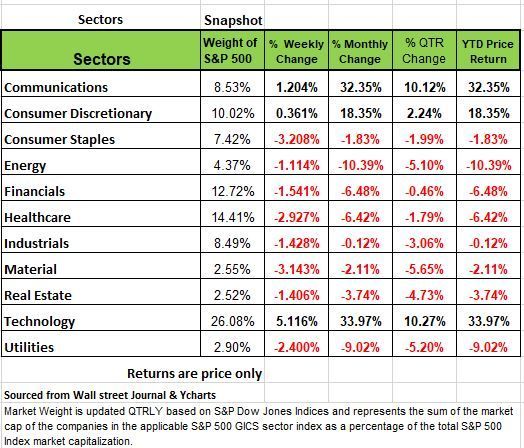

Three of the 11 major sectors were in the black for the week, with Technology posting the largest return followed by Communications and Consumer Discretionary.

The big move in Tech rose amid an earnings-fueled rally in Nvidia (NVDA) late in the week, tipping the sector 5.1% higher on the week. Shares of Advanced Micro Devices (AMD), Broadcom (AVGO) and Monolithic Power Systems (MPWR) ended the week with outsized gains. Communications services rose 1.2% and consumer discretionary was up 0.3% for the week.

Consumer staples stocks tanked as mixed earnings from the retail sector and a frenzy in shares of Target (TGT) this week contributed to a 3.2% loss in the sector. Target shares traded at their lowest level in nearly a year as the company dealt with the backlash from its LGBTQ-themed store displays and last week's disappointing quarterly results.

Materials was the second-biggest decliner with a -3.1% drop, healthcare lost -2.9% and utilities were down -2.4%. The financial sector lost -1.5%, real estate and industrials each fell -1.4% and energy declined -1.1%.

In the financial sector, pressure on regional banking stocks pivoted to the insurance sector. Allstate (ALL), Travelers (TRV), and Arthur J. Gallagher (AJG) were at the bottom of the pack, offsetting gains for Zions Bancorp (ZION) and Charles Schwab (SCHW).

Industrials were in the red as stocks in the defense sector took a drubbing Thursday as a result of calls by lawmakers to probe price gouging by defense contractors. However, losses in the entire sector were mitigated by strength in airline stocks.

Energy stocks resumed their losing streak as oil prices fell sharply on Thursday when Russian Deputy Prime Minister Alexander Novak dismissed the likelihood of OPEC+ production cuts at the June meeting. Novak's remark wiped out gains after statements attributed to Saudi oil minister Abdulaziz bin Salman towards oil speculators.

Probability of outcomes

One of the biggest problems we have today is that the information presented to us is done so in such a way that we often forget the probability of that sensationalized information happening.

I think one of the main problems that people run into is that they don’t think in terms of probabilities. This is understandable because as humans we are conditioned to act quickly and respond, mostly emotionally, to the information we have been presented with. For instance, we often have a deterministic view of investments. If a chart says the security will go up; therefore, the security will go up. But what we should do is to think in terms of probabilities, assign expected values to each outcome, and make our decisions on that basis.

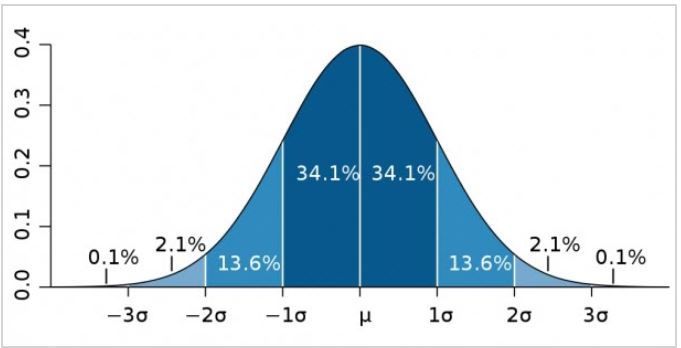

In finance classes we often study probability using a Bell curve with a normal distribution. Basically, we find the mean, calculate the standard deviation, and determine the probability of outcomes as shown in the image below.

One standard deviation has a 68% chance of occurring, 34% positive and 34% negative, 2 standard deviations have a 95% chance of occurring and so on. However, we know that reality is equally distributed.

Estimating probabilities is not easy especially when you have multiple variables that are constantly changing. We often rely on computers to do it for us such as with the World Interest Rate Probability (WIRP) screen on Bloomberg, this will tell you Fed rate hike probabilities based on where interest rate futures are trading at a given point in time.

Probability outcomes are hard to determine. How do you figure out the probability that XYZ company will beat earnings? And even if it did, what is the probability that the market will increase the price of that stock? We have seen plenty of cases where stocks prices drop even with the company beating earnings estimates.

Gamblers rely on probability all the time when it comes to placing bets, especially those that play Blackjack or Poker. Blackjack player, like face cards—because they are good for making 20s and 21s—but you hate small cards because the dealer will continue to hit until they have 17, and small cards will help them get there.

When people think of counting cards, most people think it’s a matter of counting all the cards in the shoe. Not at all. A card counter is just keeping track of how many face cards come out because, occasionally, they will all be concentrated in the back of the shoe. And, as long as you are allowed to vary your bet size, you can bet bigger when all the face cards start coming out.

So, what you are really doing is assessing your probabilities. If you know that you have a 70% chance of winning the hand instead of a 49% chance, then you will naturally bet bigger. It’s very simple.

The media has distracted us from thinking in terms of probabilities simply because it is constantly sensationalizing information especially if the issues trigger an emotional response. While the chances are so remote the focus on it occurring is all that the media talks about regardless of the probability. such as the Debt ceiling.

What is the probability that the US will default on its debt?

Let’s keep in mind that historically it never occurred. The US always works it out in the end. So, is the probability zero? One would think yes, but then we start to think of all the information we hear or read and how polarized we are in D.C. Just because the debt ceiling is not raised does this mean that defaults are guaranteed. But what exactly is a default?

When you think of a default on an obligation it means the debt holder does not get paid. Companies delay payments all the time on invoices and prioritize their obligations, loans and insurance are always paid first, since the consequence of not paying these bills is worse than not paying a vendor on time. The same thing applies to the government.

But the media needs to create more drama and by creating drama we begin to think that the probability increases, maybe the probability is not zero. Maybe the probability is 5%.

Is five percent is big enough that you should think about hedging that possibility. And then you have to do some fancy options math on what puts you can buy that will hedge that 5% probability.

What if the probability isn’t 5% but 40%? That is a whole different situation. Then you need to look at the cost of hedging and the potential loss on the table. You don’t want to spend too much to protect the downside if your total exposure is maybe a few thousand dollars.

None of this is easy. If it was easy, everyone would do it. But keeping the emotions out of it helps a lot more, be logical and don’t let the drama cloud your mind.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

The S&P500 Index (SPX) is up 9.5% so far this year. Although historically Mondays tend to have the worst performance, Tuesdays through Fridays average out to be very similar. This year, however, the strongest gains are coming at the end of the week, especially on Fridays. The chart’s vertical lines show the weekend breaks, with some large bullish moves right before them.

Of the 9.5% YTD gain in SPX, 7.6% is attributed to Fridays. Including Thursdays, it’s up to 12%, meaning the remaining 60%of trading sessions netted a 2.5% loss. Last year, Wednesdays were the best performing day of the week in a down market.

When investors have a positive longer-term outlook, they tend to expect good news over the weekend, like most of 2020 and 2021, leading to better end-of-week performance.

The Week Ahead

S&P500Index futures opened modestly higher on Sunday evening. U.S. markets are closed today for the Memorial Day holiday, and there are bank holidays in most of Europe and the UK. This week’s main event is Friday’s U.S.jobs report, one of the last puzzle pieces to fit in before the June FOMC meeting. The JOLTS and ADP reports will provide additional color leading into it.

The U.S. calendar also includes consumer confidence and ISM Manufacturing PMI. Overseas, flash CPI estimates for May will filter in from the Eurozone, while the ECB releases its financial stability review and minutes from the May meeting. Australia’s consumer inflation release and China’s PMIs complete the international docket.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/