Recession Risk

Weekly Market Review for May 22nd, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

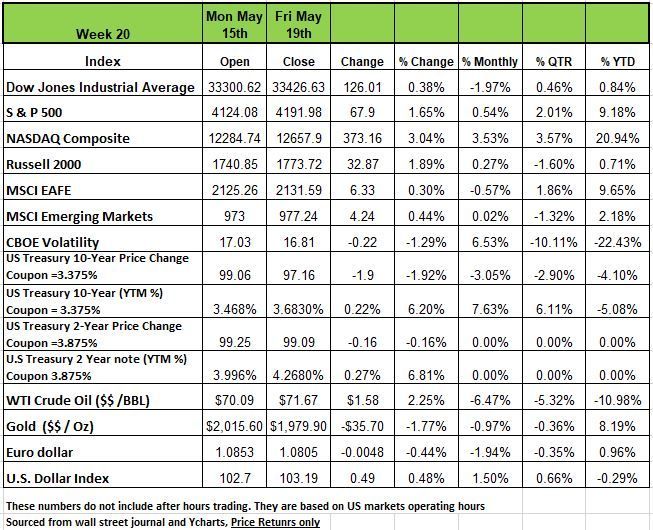

All four of the major indices ended the week of May 19th in positive territory with the NASDAQ posing the largest gain of +3.4% followed by the Russell 2000 with +1.89% the S&P index rose +1.6% this and the DOW +.89% Most of the week’s gains were week as gains led by the technology, communication services and consumer discretionary.

The climb came amid encouraging guidance from some companies and hopes that Congress will reach an agreement on the US debt ceiling soon, though those hopes dimmed a bit on Friday after negotiations halted.

U.S. Treasury bond yields increased across the yield curve with headlines on the talks. The reported “pause” in debt-ceiling negotiations on Friday stole headlines away from comments made by U.S. Federal Reserve Chair Jerome Powell, during a panel discussion at a research conference in Washington D.C., current Fed Chair Jerome Powell indicated that the benchmark interest-rate target range might not need to rise due to banks tightening credit standards. Chair Powell also indicated that the Fed hasn’t decided on additional rate hikes in the future and bringing down inflation will be a slow process.

Investors had been more optimistic on Thursday after House Speaker Kevin McCarthy said a vote on a debt ceiling deal could come this week. However, the debt ceiling remains a concern as Treasury Secretary Janet Yellen warned that without a deal to raise the borrowing limit, the US government may be unable to pay its bills on time by June 1. But which bills exactly is she referring to, this has become a fear tactic that the media seems to be taking advantage of since we know that the U.S. brings in enough revenue from taxation to pay most obligations such as Bonds due. Perhaps some of the government’s wasteful spending will be put off until there is a resolution.

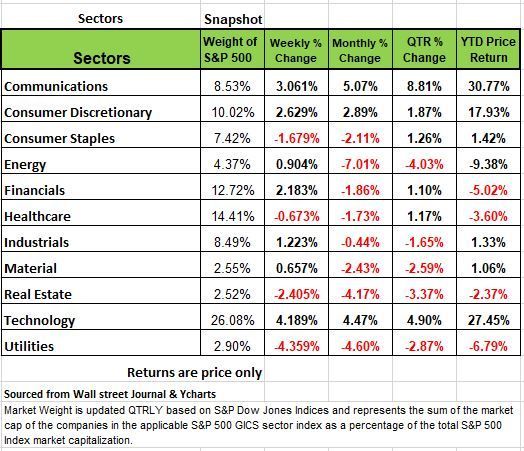

By sector, technology had the largest percentage increase of the week, up +4.2%, followed by a +3.1% rise in communication services and a +2.6% boost in consumer discretionary. Other gainers included financials, industrials, energy, and materials.

The utilities sector led to the downside with a -4.4% drop, followed by a -2.4% decline in real estate, a -1.7% slip in consumer staples and a -0.7% drop-in health care.

While there is a rise in the Seasonally Adjusted (SA) numbers for April’s Retail Sales +0.4% over March’s, there is a downtrend in the Not Seasonally Adjusted (NSA) data which posted a -2.4% fall vs. March. This was the worst showing for any April in the last five years (excluding the pandemic of April 2020). Nominal sales (NSA) were down -1% (-$5.8 billion). So, given +5% Y/Y inflation (per the CPI), sales were off -6% in real (volume) terms.

Home Depot, a bellwether of U.S. Consumer spending, posted the worst revenue miss in more than 20 years, missing expectations by more than $1 billion (actual $37.26 billion; expected $38.34 billion). The company guided its revenue outlook lower by -3.5% and its EPS by -10%. Sales of big-ticket items were off -6.5% from year earlier levels, and the company said its inventories remained bloated (+13% higher than in Q1/22). This leads us to believe that if consumers are buying homes, they do not have enough money to make changes.

Also last week retail giant Target’s announced it had missed revenue missed expectations. Target sales slowed in discretionary categories in March and decelerated further in April.

There is a big boost in credit card balances (+$148 billion in Q1) especially given the 25%+ rate of interest another sign that consumers do not have the income to pay down their monthly purchases which they have yet to change. We are also seeing a spike up in delinquencies for both auto loans and credit cards. There is a significant rise in delinquencies in the age group between 18-29 and 30-39, those with the most student debt, which will restart this fall in Sept/Oct with monthly payments between $200-$400/month for some 30 million borrowers.

There are 43 million Americans who owe $1.6 trillion in student loans to the government, (Keep in mind the government loans are different from private loans) 30 million of which are on the payment plan since they either completed their education or stopped attending school. 13 million are still active students. While the Supreme Court is considering the constitutionality of Biden’s student loan forgiveness plan regardless of whether of the outcome many American families have made sacrifices to put their children through school, forgiveness just adds to the governments debt and does not address the issue of the rising cost of education in the country for future generations. There is a reason why college education has gotten out of control and the simple answer is its simply the government’s fault, in order to get more funding each year these institutions need to show that they need it to qualify for more money and hence raise the cost far above the annual inflation rate.

In other signs of economic stress in the Retail Sales:

Sales at the gas pump fell -0.8% in April and are now down six months in a row. This is a good thing, especially for transportation. The gasoline price component of the CPI has fallen -12% from a year earlier, but nominal sales are down -15%, so, in volume terms, this is a “real” -3% decline in usage. Since the automobile is a central part of American life, when it is driven less, it is a sign of money issue for the avg person. The summer will be the real test since many Americans take family vacations by car if the consumption is down consumer may be forgoing those vacations.

Similar for food at home. Grocery sales were off -0.2% in April on top of a -0.3% fall in March and have been negative in four of the last five months. In the CPI, food at home prices were up +1.7% in the December to April period. At the same time, sales at grocery chains fell -2.3%. This signals that the typical American family is “trading down,” buying store and generic brands instead of the advertised (higher priced) leaders.

In the post-pandemic economy, the “reopening trade” saw consumers flock back to restaurants. With April’s “food away from home” CPI at +1.6%, the +0.6% growth in nominal restaurant sales translates into -1% in volume terms. In addition, the January to April sales trend is at a -5.4% annual rate. Clearly, the “reopening” upsurge is now in the rear-view mirror.

In addition, nominal sales of clothing (apparel) were off -2.3% in April on top of a -2.0% fall in March.

While the “banking crisis” is no longer making the headlines, an important economic issue is being ignored. We already know that higher interest rates caused losses in bank bond portfolios (lower coupon bonds dropped in value) but what is not being addressed is that these rates will also have a significant impact on their loan portfolios. Those loans that are out are performing poorly, but more importantly is the risk now associated with those loans, most especially with the Commercial Real Estate loans (CRE). We see Commercial Property Prices going lower from here as the Recession unfolds resulting in rising loan default losses. Already, lending standards have become much tighter. But as businesses struggle to meet payment obligations more banks will be vulnerable to significant losses.

Lastly, we see signs in the Manufacturing sector are pointing to Recession as seen from the ISM Manufacturing PMI which has been at or below the 50-demarcation line between expansion and contraction for seven straight months. In addition, hours worked, the workweek, and overtime hours all point to a significant slowdown in this sector.

Our conclusion is that we are seeing a weakening consumer and strains in the banking system imply economic trouble. It is highly probable that inflation will be turning into deflation by 2024. But how much damage will be done to the economy and how long it will take to repair it will be the question on every investor’s mind. Source Economist Bob Barone P’hD

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Japan’s Nikkei 225 Index Futures (/NKD) surged past their 2021 highs to levels not seen in over three decades. Lots of positive news spurred the rally, now in its sixth consecutive week. GDP expanded for the first time in three quarters, partly due to reduced Covid-19 restrictions spurring increased tourism. Japan also happens to be the largest holder of U.S. Treasury debt at over $1.1T, so diminished default concerns fueled equity investors. Governor Ueda has also doubled down on dovish monetary policy, for now. Will this strategy have some legs for the country is too early to tell, but for the time being it is helping that market. The momentum carried the weekly MACD and RSI indicators to their highest points in two years, adding confidence to continued advances for now.

The Week Ahead

The debt ceiling deadline will remain at the forefront, with talks having stalled late last week as President Biden attended the G7 meetings in Japan. On the economic calendar, the action begins Tuesday with global PMI releases. Most closely watched will be Germany, which has had a slew of bad data recently, and the U.S., where the economy only seems to be gradually losing momentum. On Wednesday, headline inflation is expected to drop in the UK, but lower energy costs are being more than offset by soaring food prices.

The minutes from the May FOMC meeting may reveal more detail about how many more rate hikes may be needed. In a speech last Friday, Chair Powell signaled that he is weighing a pause in June. Thursday brings the second estimate of Q1 U.S. GDP, which is not expected to deviate from the disappointing +1.1% first reading, as well as pending home sales. The Tokyo inflation data for May could provide the Bank of Japan with a nudge towards normalizing monetary policy. A busy Friday wraps up the week, highlighted by the U.S. Core PCE Price Index for April. Expectations are flat MoM but forecast to tick down to +4.4% YoY. Personal spending figures are expected to rise, keeping inflation fires active.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/