Weekly Market Review & Economic Landscape

for August 7th , 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

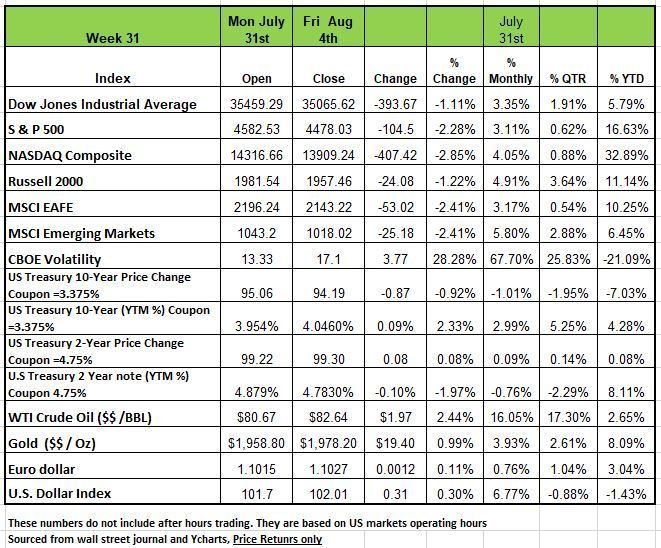

The first 4 days of August proved that perhaps July was a bit ahead of itself on the economic conditions of the U.S and the future decisions of the Fed with respect to more interest rate hikes. All four of the major indices were down with the NASDAQ having the largest decline of -2.85% followed by the S&P -2.3% the Russell 2000 -1.22% and the DOW coming in at -1.11%. Much of this movement came off a negative rating by Fitch downgrading the U.S credit rating from AAA to AA+.

Longer-term Treasury's sold off last week, and yields climbed on a looming increase in the Treasury’s debt supply and a downgrade of the nation’s credit rating from Fitch Ratings. Fitch downgraded the US’s credit rating due to the nation’s rising deficits, high debt levels, and an “erosion of governance.” Meanwhile, the Treasury also announced last week that it increased its third quarter borrowing estimate, increasing debt issuance to fund the widening deficit.

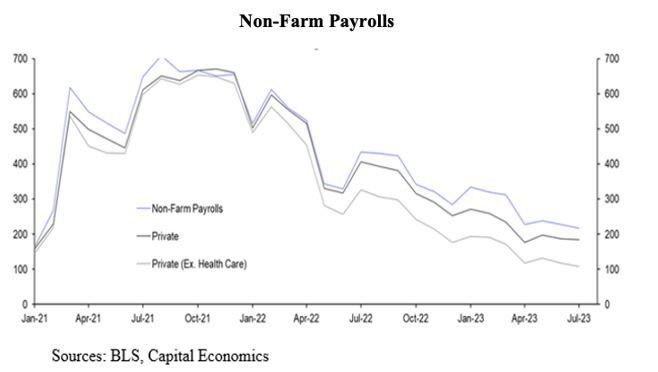

In addition, July nonfarm payrolls missed expectations.

July jobs data released Friday showed fewer people than expected began working last month as an acceleration in service industry gains was partially offset by a slowdown in the goods-producing sector. But the unemployment rate inched down to 3.5% last month from 3.6% in June and 3.7% in May. Perhaps indicating more people are still not in the labor force.

Other economic data released last week showed the ISM Manufacturing Index missed expectations, contracting in July for the ninth straight month. Services also missed expectations in July but expanded, albeit slower than in June, continuing the dichotomy between manufacturing and services

Some companies' quarterly results added to investor concerns. Among them, technology giant Apple's (AAPL) fiscal Q3 revenue barely met the Street's consensus estimate. Semiconductor and wireless telecommunications company Qualcomm's (QCOM) fiscal Q3 revenue missed analysts' mean estimate amid declines in its semiconductor and licensing businesses.

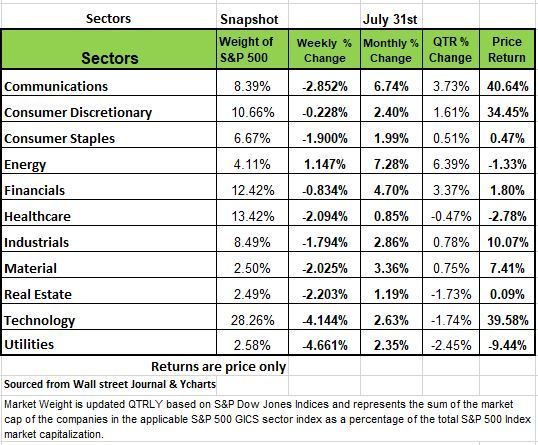

By Sector ten of the 11 sectors that make up the S&P were in the red last week with Energy posting the only positive return of +1.14%

The utilities sector had the largest percentage drop of the week, falling -4.7%, followed by a -4.1% slide in technology and a -2.9% drop-in communication services. The decliners in utilities included Consolidated Edison (ED), whose shares fell -6.6% as the energy delivery company reported Q2 adjusted earnings per share and revenue below year-earlier results and analysts' mean estimates.

Apple's shares weighed on the technology sector, sliding -7.1%. Finance Chief Luca Maestri warned that the company expects fiscal Q4 revenue for its Mac and iPad products to fall by double-digits year-over-year because of "difficult compares, particularly on the Mac,” according to a Capital IQ transcript. Qualcomm was also among the technology sector's decliners. The company's shares shed -6.2% amid the fiscal Q3 revenue miss even as its adjusted earnings per share for the quarter came in above analysts' mean estimate.

In communication services, shares of Electronic Arts (EA) declined -11% as the game developer preliminarily reported fiscal Q1 net bookings -- an adjusted revenue figure -- slightly below analysts' mean estimate and forecast the current quarter's adjusted revenue as well as earnings below Street views.

On the upside, the energy sector's gainers included APA Corp. (APA), which reported Q2 adjusted earnings per share and revenue above analysts' mean estimates. Shares rose 4.3%.

Next week's earnings calendar features Eli Lilly (LLY), United Parcel Service (UPS), Walt Disney (DIS) and Duke Energy (DUK). Two big economic reports this week will include key inflation data, with the July consumer price index set to be released on Thursday and the July producer price index expected on Friday. The markets will react to these numbers either positively or negatively as many will judge the Fed next interest rate decision on these numbers.

For those of our readers that had investments back in 2008 we would like to you think about how you felt when the markets crashed. How much was your portfolio damaged and how long did it take to recover those losses. Would you have valued some guidance that would have allowed you to minimize those declines?

Some people referred to that economic crisis of 2008 as a black swan event (defined as an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences). They are often characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight. But everything is obvious in hindsight, in 2007 a number of investors saw the inevitable, Michael Burry was one such investors that was portrayed in the movie the Big Short.

We want to be clear that no one can predict a market outcome, but at times warning signs about a situation should not be ignored or dismissed because others think it is unlikely. The path of the economy can be seen in the economic data that typically points to the direction the economy is heading.

So perhaps last week’s market decline was a sort of warning shot to investors.

Last week’s credit downgrade sparked a selloff in bonds and stocks, halting the markets summer climb and growing confidence that the country escape a recession.

Markets seemed to have deflected the Fitch downgrade of U.S Treasuries to AA+ because the rating is based on long-term issues (like the size of budget deficits), while the markets are mostly about short term like next week with some lip service to next quarter.

The major financial market mover last week was always going to be focused on the employment report. The +187k Non-Farm Payroll report slightly disappointed a market looking for +200k. to some this does not sound like a big deal, but Friday (August 4) produced a one-half percentage point drop in the popular equity indexes, and, concurrently, more significant downward moves in Treasury yields.

The yield fall occurred despite the U3 Unemployment Rate falling to 3.5% from 3.6% (from a lack of growth in the labor force). This is likely to weigh on the Fed’s September decision process regarding rates as the Fed secretly wants to see a U3 of 4.5%, but politically they can’t say so!

Because Q2’s GDP growth was on the high side of sentiment (+2.4%), and Payrolls are still moderately positive, many Wall Street economists have thrown in the towel on their Recession call and have adopted the “soft-landing” mantra (i.e., slowing economic activity, enough to conquer inflation, but no economic contraction). Of course, they work for institutions that want you to give them your money so many need to be positive. We think there is a possibility of a soft landing but feel a recession is still unfolding and the next several weeks will give us more evidence on the direction of the economy.

If we take a closer look at the details of the employment numbers, we can see that the numbers don’t quite represent strength in the labor force. Prior to the employment release, markets were worried about an overly strong report (his would cause the push the Fed to raise rates higher) this was based on Wednesday’s ADP report that showed significant strength in their employment survey (+324k). However, those numbers were driven by the Leisure/Hospitality sector, which showed up as +201k. In Friday’s Non-Farm Payroll report, the sector showed up as +17k, and in the April-July period, ADP’s count in this sector is a massive +783k, while the Non-Farm Payroll number was a more sensible +75k.

BLS doesn’t survey small businesses like ADP does, but the 708k difference does appear to be quite out of line with reality. Some have speculated that the ADP seasonal adjustment process is flawed. We observe that the ADP report has been out of whack with Non-Farm Payrolls ever since they retooled their survey last spring.

So, was this a strong or weak employment report? Looks solid at first glance, but not so when evaluated more closely:

1) The workweek fell -0.3% from June (-0.1 hours/week).

2) BLS revised May and June lower by -49k.

3) The Birth/Death model automatic add-on (not counted) was +102k (which comes from a trend-line growth over a long-period of time and is not sensitive to the current economic backdrop).

Economist David Rosenberg had some thoughts on this :

“…when you adjust for the decline in the workweek, payrolls actually slid -125k on an equivalent ‘worker hour’ basis. Then count in the two-month revision of -49k [to May and June Payrolls] tack on the Birth-Death distortion … [and] account for the surge in multiple job holders, and the ‘real’ number was -394k.”

This is quite a difference from the +187k starting point. The chart below shows total payrolls (blue), the private sector (ex-government), and the private sector less the health-care sector. Note the steep downtrend since October 2021.

After analyzing the payroll data, both the equity and fixed-income markets decided that the numbers were actually weak. So, equity prices continued their week-long downdraft while bond yields fell (prices rose) as markets concluded that the Payroll Report, alone, would not push the Fed to raise rates in September.

The raw (Not Seasonally Adjusted) data for July actually show that Non-Farm Payrolls contracted by -819k (that’s not a typo). Thus, it is hard to imagine anyone calling the jobs report “strong” (but the media did!). Regarding this number, Rosenberg observed that the July 2019 Not Seasonally Adjusted number was similar, but that resulted in a Seasonally Adjusted number of only +82k. Contrast that to the +187k that is BLS’s latest Seasonally Adjusted number. While seasonal factors can change, we have a hard time believing that those factors will change that rapidly. And, as observed by Rosenberg, the fact that the payroll data has had negative revisions for seven months in a row one has to be wary of the quality of the original data. Source Economist Bob Barone Ph’d

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Long-term Treasury yields grabbed attention last week with breakouts above key resistance levels. For the 30-Year Treasury Index (TYX), technicians may have anticipated the move up to $43, corresponding to a yield of approximately 4.30% on the 30-year Treasury bond, based on the prior consolidation. The distance between support and resistance can form an assumption of expected movement should there be a breakout, either down through prior support at $38 (3.80%) or conversely up through $40.50(4.05%) as was the case last week. On the heels of strong economic data and the Fitch downgrade, TYX reached a YTD high of$43.26 (4.326%) before pulling back Friday. The speed and magnitude of this move in yields is worth noting as it can hold important implications on the macrolevel.

The Week Ahead

A few important items merit attention this week, including U.S. inflation numbers and FOMC member speeches. A cool CPI report on Thursday could reinforce the economic soft-landing thesis and the potential end of the Fed’s rate-hiking cycle. However, some Fed Members are stating that more increases are warranted. Treasury auctions on Wednesday and Thursday may put additional pressure on bond prices after last week’s selloff and corresponding spike in long-term rates. Other U.S. releases include consumer credit, small business sentiment, and August’s preliminary consumer sentiment. Earnings season is winding down but look for announcements from Disney and UPS to potentially move the needle in those sectors.

Overseas, it’s a busy week for China with trade data and inflation figures against the backdrop of slowing growth and more potential government stimulus. Today, the Bank of Japan Summary of Opinions is released after last week’s surprise policy decision on yield curve control. In the UK, economy activity has held up better than expected given such high inflation. But with more rates hikes looming in the fall, Friday’s Q2GDPnumbers might be the growth peak for this year. Lastly, the light European calendar includes industrial production and investor sentiment readings.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/