Weekly Market Review for August 14th, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

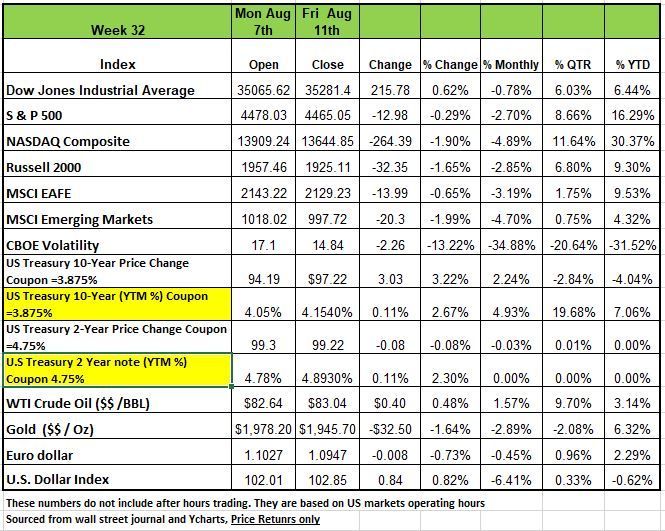

Three of the 4 major indices were down for the week with the DOW being the only index to post a positive return. The S&P 500 index fell slightly, losing -0.3%, the Russell 2000 returned a -1.65% and the NASDAQ posted a -1.9% return last week as data showed US consumer prices rose modestly in July and the tech and materials sectors lost ground.

The US seasonally adjusted consumer price index, a measure of inflation, rose by 0.2% in July, right on expectations from a survey compiled by Bloomberg, following a 0.2% increase in June. Core CPI, which excludes food and energy prices, also rose by 0.2%, as expected, after the same gain in June.

The report also showed the rate for core CPI slowed to 4.7% from 4.8%. While this is still well above the Federal Reserve's 2% goal, the slower rate boosted investors' hopes for the Federal Reserve's Federal Open Market Committee to pause interest rate increases.

Treasury yields rose significantly over the course of the week as the expectations for longer term interest rates remained elevated. On Monday, Kansas City Federal Reserve Governor Michelle Bowman said that additional rate hikes “will likely be needed” and New York Fed President John Williams implied that it would be necessary to keep a restrictive policy “for some time.” This caused Treasury yields to rise moderately on Monday before pulling back again on Tuesday and Wednesday as investors were seeking the perceived safety of Treasurys. Poor economic news globally led to persistent demand for the 10-year Treasury auction as data out of China showed that its exports dropped by the most since 2020 and imports contracted as well. Treasury yields then rose significantly again on Thursday as the Consumer Price Index rose 3.2% year-over-year for the month of July, which was lower than expectations of 3.3%, but an increase from the previous month. The market implied Federal Funds Rate following the June 12, 2024 meeting began the week at 4.751 and rose to 4.873 by the end of the week as investors worry that inflation will remain more persistent than expected and that the Federal Reserve will not cut rates as quickly as expected

The technology sector had the largest percentage drop off the week, sliding 2.9%, followed by a 1% decline in materials, a nearly 1% fall in consumer discretionary and slip of less than 0.1% in financials. All other sectors were in positive territory for the week, led by a 3.5% rise in energy and a 2.5% boost in health care, but the decliners more than offset them.

Tech was weighed down by chip-makers, with shares of NVIDIA (NVDA) down 8.6% on the week, Micron Technology (MU) down 7.9%, ON Semiconductor (ON) down 7.6% and Advanced Micro Devices (AMD) down 7.1%.

International Flavors & Fragrances (IFF) led the drop in the materials sector, shedding 20%. The flavor and fragrance company reported Q2 adjusted earnings per share and revenue below analysts' mean estimates and reduced its 2023 sales guidance.

Also in materials, shares of Sealed Air (SEE) fell 14%. The company reported Q2 adjusted earnings per share above analysts' mean estimate but its net sales for the quarter missed the Street view. Sealed Air also cut its guidance for 2023 adjusted earnings per share and revenue.

On the upside, the energy sector's climb came as crude oil futures rose. Gainers included Valero Energy (VLO), up 9.6%, and Marathon Petroleum (MPC), up 8.6%.

The health care sector was boosted by an 18% weekly jump in the shares of Eli Lilly & Co. (LLY) amid the medicines company's acquisition of DICE Therapeutics.

Next week, retailers including Home Depot (HD), Target (TGT), Walmart (WMT) and TJX (TJX) will be releasing their latest quarterly results. Other companies scheduled to release results include Cisco Systems (CSCO), Applied Materials (AMAT) and Deere (DE).

The economic calendar for next week features July US retail sales and import prices on Tuesday and July housing starts and industrial production on Wednesday.

Back when I was a young child, I remember hearing my parent state how crazy kids were. That their behavior was insane, and society was falling apart. But my parents were not the only ones saying that I remember my friends’ parents and even schoolteachers making those same comments. Of course, they were really just addressing the young adults of the 1960’s, specifically between 1968 and 1972. It was a tumultuous time in America, a lot of social upheaval was occurring. We had the Viet Nam War, The sexual revolution, women’s liberation movement the drug culture and rock and roll was “brain washing kids” But we seemed to have lived thought that and America survived and flourished.

Back in the late 1990’s two men Neil Howe and William Strauss did a study that explained that time in America as well as other times throughout American history when such drastic changes occurred. They wrote a book title “The Fourth Turning” The book was basically a study on how American Society has historically changed every 80 years. These changes impact both the social and economic conditions of the U.S.

According to the theory, historical events are associated with recurring generational personas (archetypes). Each generational persona unleashes a new era (which is called a turning) lasting around 20–25 years, in which a new social, political, and economic climate (mood) exists.

The theory states that a crisis recurs (has occurred) in American history after every saeculum, (a length of time roughly equal to the potential lifetime of a person or generation, or the complete renewal of a human population). which is followed by a recovery. During this recovery, institutions and communitarian values are strong. Ultimately, succeeding generational archetypes attack and weaken institutions in the name of autonomy and individualism. This eventually creates a tumultuous political environment that ripens conditions for another crisis. In short, when the dominant generation fades away it is replaced by the next up and coming generation.

It is a four-generation cycle of renewal, stabilization, decline and crisis in Anglo-American history. Each generational “turning” takes about 20 years, so a complete cycle takes roughly 80 years.

Every Fourth Turning has ended in a dramatic crisis. It’s not just a hold-your-breath moment where we watch to see what happens. It develops over a few decades and then climaxes over a few years. Nothing is off limits. Everything we consider foundational to society is at stake. Some of it doesn’t survive. This Sounds very scary and dramatic to older people that are set in their beliefs and values.

The 80-year time frame is based on the life expectancy of a generation. (20 years to a generation) These changes are significant and generally happen when a generation passes away.

So, what’s the point? According to many believers of this theory we are currently in the Fourth Turning. Baby Boomers (born between 1946 and 1960) are in the last stages of their life and have less influence and impact on society than they did in the 1960’s. This is not a start here and end there type of idea its gradual. Many think the precursor was in 2001 with the terrorist attacks and continued crisis on the war on terror with the “catalyst” being the financial crisis of 2008 and the ensuing Great Recession. The 2016 election was the first regeneration, which sorted the country “into two significant partisan and irreconcilable camps.”

Stoic philosophers used the term “ekpyrosis” based on an idea that the universe periodically destroys and rebuilds itself. This seems a bit extreme but that may be on your point of view.

Of course, Americans are living longer now than they have throughout history, so the 80 years is not an exact number, but the theory is intriguing enough to talk about. Is it possible we are now living in the destructive phase? What impacts will this have on economics? Could America shift to a new economic model and what will this mean to society? Will basic universal income become part of our new model?

Will our society have more people depending on aid? Will open AI have a destructive effect on us.

These are intriguing questions that will change they way we live and work in the coming decades. Source https://www.wsj.com/articles/the-fourth-turning-is-here-and-end-times-3439006b

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Is the Technology Run Slowing Down?

The month of August has put a pause to the rally that the markets have experienced so far in 2023, particularly for larger technology stocks. Is this a digestion of the large gains seen this year in the sector? Or is market strength beginning to rotate?

For the most part, technology-related stocks have been by far the best performers in 2023. As Ned Davis Research writes in their August 11th update:

“The technology sector’s year-to-date performance through July was its second-best start to a year since our sector data begins since 1972. Relative to the S&P 500, [the sector’s] outperformance was the sector’s best to begin a year on record.”

The last two weeks have brought the sector’s relative strength to a slowdown. Large technology stocks like Apple, Microsoft, and Nvidia (which collectively make up 16% of the S&P 500’s market capitalization) have each declined by -9% or more from their respective peak levels over the past month, after experiencing substantial rallies this year.

These declines have sparked a growing concern among investors, or at least reduced the high levels of optimism we saw last month. Ned Davis Research also points out:

“The pullback of the big tech stocks has [resulted in a] quick decline in investor sentiment. The Hubert Nasdaq Sentiment Composite has fallen out of its extreme optimism zone and is at its lowest reading since mid-March.”

Investor sentiment is generally considered a contrarian indicator, meaning that high levels of optimism often precede pullbacks, whereas high levels of pessimism precede rallies. Another sentiment indicator, the AAII Investor Sentiment Survey, posted in mid-July, more than 50% of survey participants were bullish on the markets (the highest level since April 2021). Now, as of last week’s survey results, that number sits at 44%, which is still above historical averages.

As for the idea of market rotation, most of the recent weakness seen in technology-related stocks is coming from the Information Technology sector, particularly in its largest components. Sectors like Information Technology, Communications, and Consumer Discretionary are still highly ranked according to our risk-adjusted rankings.

One area where there has been some market rotation in strength is with the Energy sector. Just one month ago, Energy was ranked as the second worst S&P 500 sector (out of eleven sectors). Now, it has moved up to being the fourth highest ranked sector, just below the three technology-heavy sectors. Energy is now exhibiting some more positive technical aspects, such as trending above some key moving averages and breaking out of its pattern of lower highs.

Remember pullbacks are a normal part of markets. Technology stocks have seen huge, historical advances this year, after experiencing significant declines in 2022. To put one technology-related stock into perspective, Amazon being up nearly 60% in 2023 is only significant when you ignore the fact that it was down -50% in 2022. A 60% rally off of a -50% decline is nowhere near breakeven.

Technology stocks are still leading the markets. Declines in some of the heavy hitters like Apple and Microsoft are a cause for some concern. Markets are in a vulnerable position when just a few sectors have carried it, and then start to experience suboptimal characteristics. This could all be a part of a normal pullback, but that remains to be seen.

Energy stocks have gained some momentum over the past month and the sector is one of the few that does not exhibit too much correlation to the overall market. That is one of the few areas where there has been a clear rotation in relative strength.

As a final note, the number of consecutive trading days without an outlier (a trading day beyond +/-1.50%) is now up to 67. This seems like a movement is due. Source Brandon Bischoff

The Week Ahead

As the dog days of summer wrap up, the global macro engine rolls on with a slew of top tier data to parse in the week’s first half. Late tonight, China will release its industrial production and retail sales numbers for July on the heels of last week’s disappointing trade and inflation reports. Japan’s preliminary Q2 GDP and Australia’s wage price index and central bank meeting minutes also land today.

By the time most of you read this we will have gotten much of the information listed below

Tuesday, U.S. retail sales are expected to accelerate from the prior month, and earnings reports from giants Walmart, Target, and Home Depot may add more color to how consumers are holding up. This may impact markets interpretation on the Feds position on interest rate increases. Whether or not the Bank of England will raise rates in September may hinge on Wednesday’s UK CPI release, along with the unemployment, average earnings, and retail sales figures arriving throughout the week.

Also on Wednesday, the minutes from the July FOMC meeting may shed light on what appears to be a growing split between committee members on further tightening versus pausing, based on recent public appearances. Other U.S. events include industrial production, regional manufacturing surveys from New York and Philadelphia, and housing starts and building permits. Overseas, Europe will feature economic sentiment assessments, Q2 GDP updates, and final CPI readings for July.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/