Wall Street Main Street and the Disconnect plus other Economic News

Week Ending March 5th 2021

Week in Review

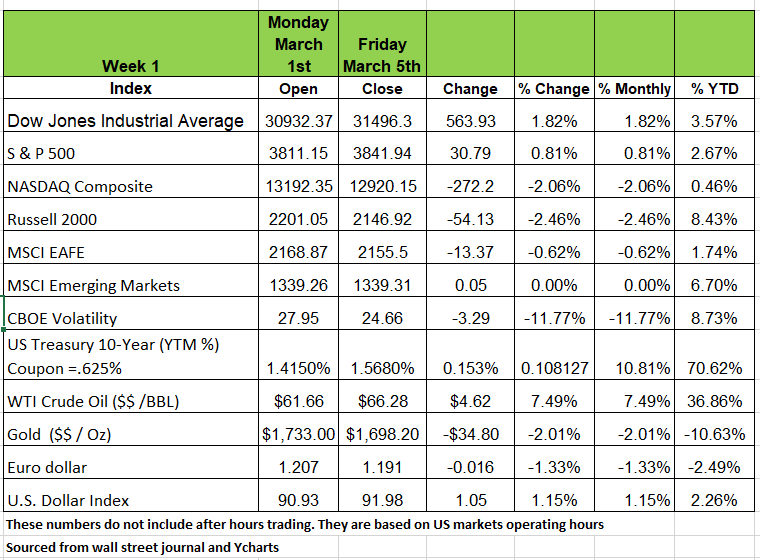

The markets were split a little last week with the Dow up 1.82% and the S&P up.81%. The NASDAC & the Russell 200 both down more than 2%. Gold continued its drops falling below $1700/oz and Crude spiked the most rising 7.49% as the Saudi’s cut production again. The big news is focused around interest rates

Fed Chair Powell put his foot in his mouth last week, the Fed can’t let rates rise much further without a serious risk of a double-dip recession. And, in fact, they need to lower them. In the latest Fed Beige Book, a compendium of economic observations from the 12 District Banks, eight of the 12 banks indicated flat to falling economic activity in their regions.

Here are some typical comments:

· SF Fed: “…labor markets deteriorated somewhat…”

· KC Fed: “…consumers pulled back in February…”

· Richmond Fed: “…Retail Sales…declined…”

· NY Fed: “…the regional economy declined modestly…”

Disconnect Between Wall Street & Main Street

One’s perception of the U.S. economy may vary greatly depending on which side of the fence one stands. There certainly does appear to be a disparity between what big business is seeing versus the average American. The Conference Board's Measure of CEO Confidence rose to a 17-year high in Q1'21, according to one media outlet.

The measure currently stands at 73. A reading above 50 points reflects more positive than negative responses from CEOs. The January survey revealed that 82% of CEOs expect economic conditions to improve over the next six months, up from 63% in the September 2020 survey.

Forty-five percent of CEOs expect to increase capital spending, up from 25% in the September 2020 survey. A recent survey by Money and Morning Consult, however, found that 68% of adults say they need another stimulus check from the government to get by, and 39% of those polled claimed they need the additional financial support "a lot," according to their own release.

Overall, respondents said that the $600 checks sent out this past December were not enough. Seventy-seven percent of adults say they need the checks to exceed $1,000 and 36% say they need more than $2,000 to make ends meet.

President Joe Biden's American Rescue Plan is seeking $1,400 payments. There is still a disconnect between Wall Street and Main Street. We hope to see it dissipate in the months ahead now that the rollout of the COVID-19 vaccines has accelerated. But some of the numbers are still ugly. High number of people not working lots of jobs not being filled, money being sent to the public

Another round of Helicopter money

The 1.9 Trillion stimulus package has passed the senate and is going back to the house, so it appears that more money is on it way to the public. How will the public use this money, is yet to be seen. Should it go to back rent and mortgages, or buying some form of entertainment when you’re stuck in the house. The Fed is stepping out of bounds and the consequences /penalty may not been seen for a few years to come. The big question is do you care. We seem to have develop a culture that has a strange attitude about money, as long as “I don’t have to pay its fine” but economics always affects everyone. It’s a universal impact. Prices go up or jobs get eliminated.

Political Solutions always have long term consequences

Back in 1978, the Full Employment and Balanced Growth Act gave the Fed a dual mandate, promote maximum sustainable employment and stabilize prices. For those old enough to remember inflation was 7.59% and unemployment was over 6%. The objective was to get both down to 3%.

Since then, this has morphed into a target of “full” employment –as defined by an economy where everyone who wanted a job could get a job. Because inflation remained below 3% for a long time, the Fed has reduced its target for inflation to 2%

During the recovery from the 2008-09 Financial Panic, former Fed Chairwoman Janet Yellen shifted focus from the simple unemployment rate to targets that included broader measures of unemployment such as discouraged workers and part-timers, the rate of job openings, the share of workers quitting their jobs, labor force participation, and earnings growth.

Fed Chair Jerome Powell, under political pressure, believes equality (or “equity”) should also be a policy priority. As a result, the Fed is now focusing more on the health of the labor market for those who fall behind when the labor market lags, but benefit the most from a tight labor market.

We don’t understand how anyone thinks this is a job for the Fed. It’s a totally political play and the Fed is supposed to be independent of politics.

The COVID shutdown problems can’t be fixed with throwing money around. It’s the wrong tool for the job. In February 2020 (pre-COVID shutdowns) all the employment indicators were showing massive success in broadening the labor force and raising wages.

It seems like the Fed does not understand its function and thinks it can fix any problem with more money. It’s the wrong prescription. The economic problems of 2020 were not caused by a lack of money, they were caused by COVID-19 and the related lockdowns.

In other words, if unemployment is caused by something other than tight money, then the Fed is the wrong entity to fix it. COVID shutdowns are the problem, and opening up is the solution.

Distributing the vaccine as fast as possible is the best stimulus.

The Fed is creating long-term problems. The guideposts for monetary policy do not need to be updated for political reasons.

The US economy met all the conditions that the Fed and Jerome Powell were looking for prior to COVID. This should make it apparent that zero percent interest rates and a massive expansion in both government spending and Fed bond buying are not the answer.

The Fed can't fix a virus or try to

Employment is still the key

Our economic condition still seems like its on life support with the federal government acting as the respirator fore the economy. The 3rd round of Federal cash infusion is about to be released with a price ticket of $1.9 trillion. Like the two previous rounds of stimulus, we won’t see the impact of them until April or May. When the money does enter it will boost retails sales slightly and like before give a bump to GDP. What the Government is missing is that they are spending the money incorrectly and they are not creating incentive to work. If the government really wanted to boost the economy the spending would go into infrastructure or new development. This would employ more people and keep giving to the GDP each year. Helicopter money are we call it is a onetime bump and the more that goes to savings the less that goes to create jobs.

Bankruptcies are at a low

The first few months of the new year showed a reduced number of corporate bankruptcies filing than in Jan 2020. In fact, BKs were slowing for much of the last half of 2020 due to the Fed’s propping up of zombie companies. A zombie company is one that can barely make its debt interest payments not any of the principal. So why so low. The Fed has also been buying the debt of many of these companies, supporting the poorest managed organizations. These companies have racked up close to $2.6 trillion of debt. Approximately 19% of the companies in the S&P 500 are zombies. Think that’s ok? Think again, these companies had problems before the pandemic, the pandemic just made it a little worse and they still owe the money. At some point this will come back to haunt us. If you are in an index fund make sure you know exactly what is in that fund, chances are these companies are in some of your investments.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/