Dysfunctional Markets plus other Economic News

Week Ending March 12th 2021

Are the Markets a bit Dysfunctional?

The Treasury sell-off continued last week with President Biden signing the latest coronavirus relief bill into law, raising the yield on the U.S. 10-year Treasury to its highest level since before the pandemic. For those wondering, yields rise as prices drop, so the market is selling a 10 yr Treasury (a coupon of 1.12%) at a significant discount. The yield on the 10-Year Treasury closed the week at 1.63%, up from 0.91% at the end of last year. This appears that U.S credit markets are confused if not out right dysfunctional. Much of this may be due to Fed Chair Powell to acknowledge the Fed’s intention as well as the European Central Bank and the Australian Bank’s announcement of new easing programs.

To make things a bit more dysfunctional the REPO rate (interbank bank interest rate for reserve requirements) went into negative territory, meaning a bank got paid for borrowing money from another bank. The Feds silence on expiring capital rules may have contributed to this.

Last April when the pandemic was paralyzing the nation, in order to ease liquidity strains, the Fed exempted the banks from having to hold capital against their portfolios of Treasury securities. That exemption expires on March 31, and the Fed has been silent on whether-or-not it would extend the exemption. In addition, March 31st is the end of the Qtr, when institutions must report their capital ratios, as a result in order to hedge against a worst-case outcome, bond dealers dumped more than $65 billion /25% of their treasury holdings while banks sold off an additional $38 billion. So these events came together with the $1.9 Trillion stimulus bill approval and the Treasury auction looks to have had an effect of a rate spike.

Recap of last week

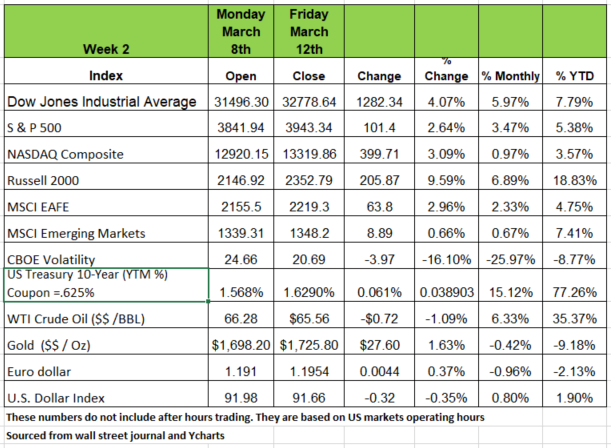

Last week was quite interesting, all the major indices were up significantly with the Russel 2000 leading the way with a 9.59% price return Last year was the year for the NASDAC and 2021 seems to be the year for the small cap stocks. The Russell 2000 is up 18.83% YTD price returns only. All the major sectors we in positive territory and only Consumer Staples and Utilities and in the red for the year. Energy and Financials are the leaders this year so far with Energy having a 40% price return and Financials at 17%

As the economy begins to heal we will see more of a drop in consumer staples as Americans spend more time out of their homes.

Mixed Messages

Initial jobless claims for the week ended March 6 were 712,000, which was better than expected and the lowest level of initial claims this year. The University of Michigan Consumer Sentiment Index, meanwhile, rose to its highest level in a year on the relief bill and the increasing availability of vaccines.

However, if we dig deeper into the numbers, we need to note that the while IC (initial claims) fell by -47K the +709K number are a measure of new job losses. So, we are still laying off hundreds of thousands of works each week, in addition Wall street ignored the +42K in PUA (Pandemic Unemployment Assistance) which is for the 1099 worker, self employed individual.

Continuing Claims (those on some unemployment program for more than a week) jumped more than +2.0 million to 20.1 million the week of February 20 (latest data). Re-openings are sure to help, and perhaps the March data won’t be so dire. But they certainly are dire enough to conclude that the “V”-shaped recovery has yet to begin.

The latest JOLTS (Job Openings and Labor Turnover Survey, a monthly survey from the BLS) was another headline touted by the media, as job openings rose +165K to 6.917 million. But true to form the media left out a few important facts, that hiring fell -110K and that hiring has been down for 3 months in a row and in 4 of the last 5 months. Openings up; Hiring down! One would think that with all the unemployment, there would be applicants galore, fighting to get a job. I wonder if current unemployment benefits are a disincentive?

How does Average Income Rise with so Many out of Work

In addition, news reports indicating that the “income” of Americans grew 5% in the face of the pandemic, this is factually accurate information, but quite misleading. The income “growth” was not “earned.” It was a gift, and the recipients’ expected (“permanent”) income going forward has not been enhance.

In fact, given the unemployment levels discussed above, earned income is a lot lower than pre-pandemic. Under such conditions, we believe that much of the new “stimulus” will be saved. This is in keeping with Milton Friedman’s “Permanent Income Hypothesis,” where changes in a consumer’s “permanent income, rather than changes in “temporary” income, drive changes in consumption. Source Bob Barone PhD Economics

NFL May Change its Rules

There’s a bold change to the rule that governs overtime games in the NFL being considered. It’s unorthodox. It’s a little bit crazy and it has the endorsement of a Nobel Prize-winning economist Richard Thaler from the University of Chicago, who says it will make football more fun—and fairer.

“It is very thoughtful and a clear improvement over the current rules.” Says Thaler

The problem with the current overtime structure is that it’s unfair. It begins with a coin toss, and the winning team gets to decide if it wants the ball. The winner always wants the ball because it dramatically improves its chances of winning:

The proposal—dubbed “spot & choose”—aims to eliminate that luck factor. The coin gets flipped. One team gets to pick the starting field position for the first possession of overtime. Then, knowing that field position, the other team then decides if it would rather play offense or defense at that spot.

It’s not as complicated as it might sound. It may be the simplest and fairest method for two parties to split anything, like how two friends can fairly divide a piece of cake. You cut it and I’ll choose my piece first

Can Congress & the IRS learn something here. Tax me more but I’ll tell you where to spend it?

Mortgage rates

According to Freddie Mac, the average rate on a 30-year mortgage rose to 3.05% the week of March 12th. While that is higher than historic lows reached last summer, homeowners with rates above 4% could still benefit from refinancing. The national average for associated refinancing fees is nearly $3,400 with taxes. While that number is based on a percentage of the average home price it would be different if you have a more expensive home. Take a look at the origination fee it that may be negotiable. Also look at the total cost for the Refi, if you cannot offset that fee within 18 months and you are unsure if you are going to stay in your home for a long period of time think twice before pulling the trigger. But if you plan on staying in your home for a long period of time it may pay to Refi and if you can be disciplined to still use the same payment you will reduce the principal quicker Source:https://www.wsj.com/articles/mortgage-rates-are-rising-read-this-before-you-refinance-11615557620

Bitcoin

The price of gold is dropping, the narrative of inflation is coming at us hard and the market has raised the value of Bitcoin to over $61,000 per unit.. If this isn’t enough to make you scratch your head than I am not sure what will.

We are living in a strange time, strange by our definition is that nothing is making much sense. High unemployment rates, increased spending by the Federal government, Fears of inflation and the markets continue to be bullet proof.

But as in the past the balloon feels like its expanding just a little too much, and we’re not quite sure how far it will go before we feel the pop.

COVID One Year later

This week will mark the one-year anniversary of the lock down of America over the COVID virus. What was expected to be a short economic hiccup turned out to be a lot more for many Americans. Nothing that has happened over the past 12 months has made much sense.

China, where the virus started has seemed to control the outbreak and profit economically. The stock market has hit new highs while America struggles with high unemployment. Many people have increased their income by not working and Americans seemed to adapt to new conditions. The media continues to sensationalize the “New Normal” while others expect a “V” shaped recovery, they just can’t agree on the timeline so the we through other letters of the alphabet to confuse or manipulate the public even more. Bitcoin went from $5,100 to $61,000 while gold jumped $200/oz then came back to $1700 zone.

The technology sector returned a hefty 56% return in price only as Consumer Discretionary sector increase 63.56%. How did this happen with so many Americans out of work? America took its first attempt at distributing basic income to the public.

Americans are resilient, we are capable of adapting, which we did. Companies improvised in order to service its customers and maintain its life line. Yes, many small enterprises went out of business, but the bottom line many of those go out of business did not operated their business well, they were not efficient and were hanging on to a thread before the pandemic, it was just inevitable.

Week Ahead

This week, the Fed meets on Tuesday and Wednesday and is widely expected to leave interest rates unchanged. Major economic reports for the upcoming week include

Monday: March Empire Manufacturing (14.5, 12.1);

Tuesday: February Retail Sales Advance MoM (-0.7%, 5.3%), February Industrial Production MoM (0.4%, 0.9%);

Wednesday: March 17 FOMC Rate Decision – Upper Bound (0.25%, 0.25%), March 12 MBA Mortgage Applications (N/A, -1.3%), February Housing Starts (1,565k, 1,580k);

Thursday: March 13 Initial Jobless Claims (703k, 712k), February Leading Index (0.3%, 0.5%

Solving Procrastination with Calculus

Ok so maybe I am having trouble finding interesting things to write about, but a recent article in the Wall Street Journal caught my attention. Chances are if you understand calculus you are probably not a procrastinator since you had to endure the pain of understanding it in the first place.

But for most people that procrastinate the avoidance of a specific task is usually measured by the amount of pain or discomfort the task generates to the procrastinating individual.

However, if you use a little math/logic to overcome this behavior it may help you. Calculus is a field in mathematics that allows one to study things that are continuously changing. To understand something that changes over time, we need to think about not just the quantity at any given moment but the rate at which the quantity is changing, the rate at which that rate is changing and so on.

For example, to understand the trajectory of an airplane moving through the sky, we need to think not just about where it is now but the rate at which it’s moving, otherwise known as speed, and the rate at which the speed itself is changing, otherwise known as acceleration. Finding the rate at which something changes is called differentiation. Integration is the reverse process.

The problem, for most procrastinators, is that thinking about one’s current pain level in isolation, rather than your total pain over time. If you think about the total pain that will accumulate until you finish an unpleasant task, the amount isn’t increasing by starting, on the contrary, its decreasing. The total pain is increased by procrastinating, since the stress of not having done the task hangs over you and accumulates.

The only way to decrease the total remaining pain is to start working at the task, so that some of the pain is in the past.

The “fundamental theorem of calculus” essentially tells us that integration and differentiation are inverse processes. If you have a quantity that changes over time, the rate at which the total changes depend on whatever the quantity is right now.

In terms of procrastination, this means that the amount of future pain decreases by one’s current pain level. Thinking about it this way allows one to see current pain as a good thing, since it’s being subtracted from the future total.

But another angle is to look at the Benefit from a growth perspective, like studying or exercising. Taking the time to invest in yourself leads to exponential benefits once you reach a point, its no longer a pain to engage in the task as the shift becomes a reward.

Make sense? If not don’t worry you’re not alone and can continue putting things off!!

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/