Fraud, Unfilled Jobs & other Economic News

Week Ending February 26th 2021

Markets Recap

February closed the month on a low note, with all of the major indices in negative territory for the week but ended up flat for the month. The Russell 2000 had the largest return on the month with 6.14% increase in prices only.

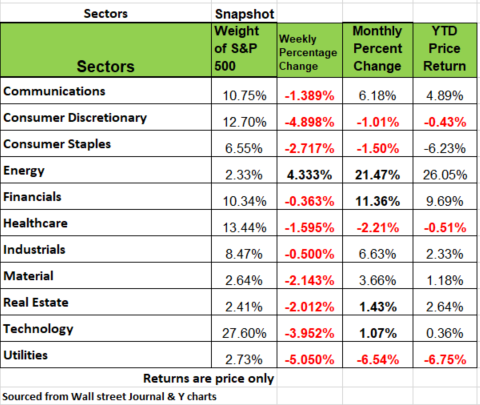

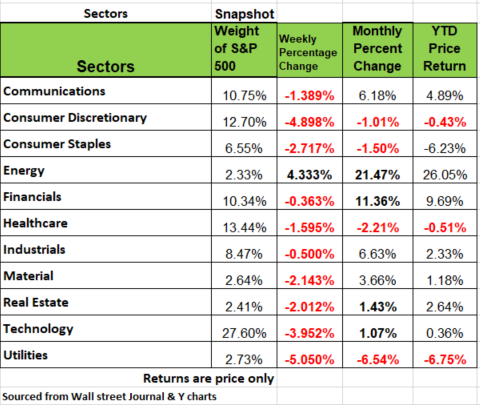

Energy, Financials, Industrials and communications led the 11 sectors with the highest price returns

Four sectors ended the month in negative territory, see chart below.

Bonds promising dependable coupons lost value as investors decided they would rather own assets with upside. It was the worst month for 10-year and 30-year U.S. Treasury debts since November 2016, as well as the worst month for gold which closed at $1733 /oz. This pushed yields higher, which moved inversely to prices.

Meanwhile, commodities such as copper soared, delivering its best one-month performance since…November 2016. Oil and iron ore were also way up in February.

The main economic news of the day was the release of the latest personal income and outlays data from the Bureau of Economic Analysis. January was the month when many Americans got their $600 checks—and was also the month when many enhanced unemployment benefits were restored to workers.

As a result, disposable personal income jumped by more than 11% compared to December.

Consumer spending rose by 2.4%. That’s the strongest month for consumption since May, but the uptick was only worth about 17% of the increase in income.

That’s why the personal saving rate jumped above 20% for the first time since May, up from 13% in December.

Some economists worry this “excess saving” represents inflationary tinder that will lead to “overheating” once vaccinations allow for widespread reopening. While there almost certainly will be a post-pandemic spending boom, it won’t be nearly as big as implied by the raw difference in income and spending over the past 12 months.

Factories can’t keep up

The unemployment rate in the U.S. is still high even though we saw a significant drop in new claims last week. In the week ending 2-22 IC (initial Claims) fell to 710K down from 842K the prior week and the PUA (Pandemic Unemployment Assistance dropped to 415K down from 513K. While most of these claims are in the leisure sector, we have significant job opportunities in manufacturing that cannot be filled.

One issue is that most manufactures used past experiences/practices in economic downturns to slash expenses and laid off workers. But this past recession was anything but typical. With governmental orders to quarantine Americans found themselves spending money on just about anything they could to keep themselves busy, from home improvement projects to recreational toys, companies have been working overtime to meet customer orders. In addition, with so much money being infused into the economy by the government many workers don’t feel the need to work. Now factories are finding themselves with a shortage of workers, some of these jobs are skilled some not so much but potential employees are not jumping on these opportunities. We have taken away the incentive. Source: https://www.wsj.com/articles/consumer-demand-snaps-back-factories-cant-keep-up-11614019305

Personal Income rises

Personal income grew 10% in January in second largest rise on record, and spending rose 2.4%

Household income, which includes the amount of money Americans received from wages, investments and government programs rose 10% in January from December. The increase was the second largest on record, following last April’s gain, when the federal government sent helicopter money in the form of pandemic-relief payments. The average Household income rose 13% since February 2020, the month before the pandemic shut most of the economy.

January’s increase in household income was almost entirely due to federal pandemic-relief aid included in a $900 billion stimulus program signed into law in late December. The package included one-time cash payments of $600 and a special weekly unemployment benefit of $300 that the government started sending to households. Millennials should take note as the burden will fall on them and the generations to follow Source https://www.wsj.com/articles/consumer-spending-personal-income-january-2021-11614293378

Fraud

States across the country have collectively received millions of unemployment insurance requests that officials believe to be tied to fraud. Generally, the fraud occurs in states with large cities such as IL, NY, CA or LA.

There are different types of unemployment insurance fraud, including when someone knowingly continues to collect unemployment benefits after returning to work. Generally, the state does not find out until the company pays its quarterly taxes and the social security numbers are cross referenced and match up.

States have grappled with a significant rise in unemployment insurance fraud during the pandemic, sometimes tied to identity theft, in this form of fraud, criminals steal a victims’ identity and then apply for Unemployment or PUA benefits. The worse part for the victim of identity theft is that they may also be responsible for the tax due on the money, they never received.

According to the FBI Sometimes victims of identity theft often discover they have been targeted when they try to file for genuine jobless benefits, then receive notification from the state unemployment office, receive an Internal Revenue Service form noting the payments, or get a notification from their employer, who has contested the claim. Source: https://www.wsj.com/articles/covid-19-fraudsters-keep-targeting-jobless-claims-what-does-it-mean-for-workers-and-the-data-11614284081

Tax increases

What is the definition of fair? Does it change based on the circumstances? According to Webster's dictionary the word “Fair” is marked by impartiality and honesty : free from self-interest, prejudice, or favoritism.

Should the government follow this definition when it comes to taxation? Should wealthier individuals pay more simply because they think they can afford it?

If yes then should students with higher scores take lower grades to help prop up poorer students’ grades?

If Not why the difference?

We bring up this point because the Governors in New York, Minnesota, California are urging higher income and capital-gains taxes to fortify pandemic-weakened budgets. Lawmakers in New York and California are also considering wealth tax proposals such as a mark-to-market tax on the wealthy, which would require them to pay capital-gains taxes as assets appreciation, even if they haven’t received the gain from a sale aka unrecognized gains. . This would apply to landowners with properties that may not produce the revenue to pay such a tax

A handful of State officials across the U.S. have grappled with the budgetary effects of the coronavirus pandemic. Now, some are proposing tax increases.

Prominent proposals include calls to raise billions of dollars across several states through taxes on the income and capital gains of higher earners.

Unlike the federal government, states cannot easily borrow to plug budget holes. According to an estimate from Moody’s analytics, after accounting for existing federal aid, states might need to come up with about $56 billion in spending cuts or revenue increases to balance their budgets through the fiscal year that ends for most states in June 2022. Source: https://www.wsj.com/articles/tax-hikes-for-high-earners-are-on-the-table-in-some-states-11614162600

America's Appetite for the Truth

Any claim you can imagine can be put into words. The first and only evidence for a claim sometimes is who’s making it. How much your trust the source.

The New York Times, once the bastion of truth in journalism reported in January that Capitol Hill policeman Brian Sicknick was killed by a fire extinguisher blow to the head during the riots on January 6th. A statement by his family, though, carefully avoided the issue of cause.

A report disclosed later offered details that seemed inconsistent with the Times account. A local CBS station reported that Mr. Sicknick died of a stroke unrelated to the riots. So, in order to save face, the New York Times has since issued an “update” saying the manner of his death remains unresolved.

So, what happens when our politicians jump into this practice? They fuel the fire that divides us as a nation. Congressman Adam Schiff jumped off the cliff with the Russian collusion hoax in the 2016 election. Many reporters jumped with him. Source: https://www.wsj.com/articles/all-the-adam-schiff-transcripts-11589326164 Hillary Clinton to this day hangs her hat on the impossibility of proving a negative when it comes to Trump’s alleged Putin ties. Where there’s smoke, there’s fire, she insist. Never mind that Mrs. Clinton paid Christopher Steele to create the smoke in the first place.

But there was no blowback from the media at all and worse no remorse from her.

The same applies to Trump, he's no angle, his claim that the election was stolen, caused havoc at the capital. He used the same tactic in 2016 before the election and was surprised to win. Trump himself miscalculated that his election lies would be the ultimate proof that there’s no such thing as bad publicity for his brand. It backfired.

Distrust of the media, and the media’s own disavowal of the supposedly tired idol of “objectivity,” is a huge factor. If no disinterested authority exists who can be trusted to refute a lie without fear or favor, it begets lying.

Most of this practice comes from creating sizzle, because it’s the sizzle that sells, not the steak.

So many people out there, including people in positions of authority, are just willing to say anything, regardless of whether it has any relationship to the truth or not. It also fuels their childish need for attention.

But Parents of the boomer generation saw first hand the damage passion and unreason could do to the world. The Nazi party used propaganda to lure its citizens from a democratic state into a dictatorship in order to facilitate persecution, war, genocide in its quest to rule the world.

So, what’s required to combat this trend? We as readers need to adapt a form of coolness, skepticism and a distrust of a narrative without evidence from all sources. Social media has intoxicated most of us and created a form on insanity. But until we hold both our politicians and reporters accountable this trend will remain in vogue and continue to rot away at our society. If you are wondering what this article has to do with economics', think of the impact this has on your financial decisions.

Source

https://www.wsj.com/articles/what-altered-the-publics-taste-for-lies-11614380110?mod=trending_now_opn_5

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/