Twin Deficits, Labor, The Irresponsible Media & Other Economic News for the Week Ending July 2nd 2021

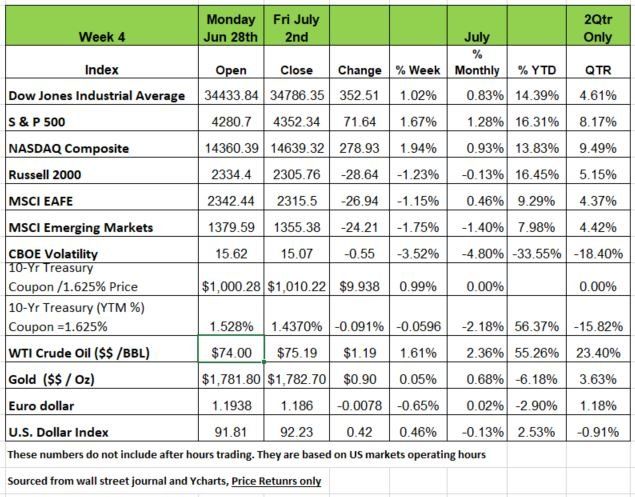

Last week marked the end of the month, quarter and first half of 2021.All of the major indices were up for the 2nd quarter and the half way point of 2021. The S&P 500 and the Russell 2000 leading the way for both the 2nd quarter and the halfway point. But the market was not all that great for the month of June. The DJIA was down .8 basis points for the month, the NASDAQ was the big leader in June posting a price return of 5.49%

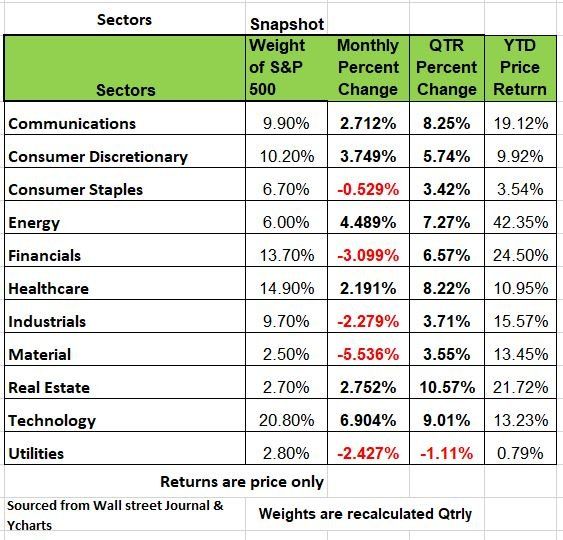

For the week ending July 2nd, U.S. equities finished higher heading into the long holiday weekend, posting gains for a second-straight time on a weekly basis. Information Technology stocks led the way with a 6.9% increase followed by Energy and Consumer Discretionary. All this amid a decline in Treasury yields despite a stronger-than-expected June nonfarm payroll report that appeared to keep the Fed’s taper timing concerns at bay.

Gold gained a little ground, crude oil prices ended basically flat with choppy trading as an agreement on oil production among OPEC and its allies, seems to be unsettled

In other economic news, the trade deficit widened by a slightly smaller amount than estimated, and factory orders came in slightly stronger than expected. Markets in Europe and Asia finished out the week mixed.

U.S. Treasury bond yields fell across the yield curve last week with steeper declines on the long end of the yield curve. Treasury yields trended down most of the week on weaker volume leading up to Friday’s June jobs report.

Treasury yields were lower on Friday in response to the mixed jobs report data. Nonfarm payrolls increased 850,000 in June versus a consensus expected 720,000 as gains in the private sector were higher than expected. Despite the headline beat in jobs, the unemployment rate rose by 0.1% last month to 5.9%. Civilian employment declined in June by 18,000, which contributed to the increase in the unemployment rate. The unemployment rate is expected to decline as the extra unemployment benefits are reduced at the state level and expire at the national level in September.

Major economic reports for the upcoming shortened holiday week include Tuesday: June Final Markit US Services PMI, June ISM Services Index Wednesday: MBA Mortgage Applications Initial Jobless Claims, June 26 Continuing Claims (3350k, 3469k), July 4 Langer Consumer Comfort, May Consumer Credit Friday: May Final Wholesale Inventories.

What is a Twin Deficit?

Many have not heard the term known as the "twin deficits" and whether the record-breaking size of those two deficits, combined, mean the US dollar is about to plummet.

When people talk about the twin deficits, they are talking about the budget deficit and the trade deficit. Combined, these two deficits combined equaled 22.8% of GDP in the year ending in the first quarter 2021, easily the highest on record. Before the pandemic, the record high was 12.8% of GDP back in 2009. Before the Financial Crisis, previous peaks included 8.7% in 2004-05 and 8.0% back in 1985-86.

They are called the "twin" deficits from Keynesian economic theory. Suggesting they should go together. The idea is that if a country runs a larger budget deficit, it should have higher interest rates, which should drive up the value of the dollar. In turn, a higher dollar means more imports (we can buy more stuff!) and lower exports (foreigners buy less because it costs them more to get dollars).

However, the theory fell apart in the 1990s, when the budget deficit fell (it was actually a surpluses under Clinton). If the theory held, you'd expect the trade deficit to shrink, too. But that didn't happen. In fact, the current account deficit, which is the most comprehensive measure of the trade deficit, hit a new peak at 3.9% of GDP in 2000, even higher than the peak of 3.3% in the late 1980s.

What this showed was that the Keynesian theory of the twin deficits don't have to move in tandem. What really matters isn't whether the government runs a larger or smaller budget deficit; what matters is the set of policies the government is implementing.

Now, ask yourself, since the onset of COVID, since when the budget deficit has soared, has the US adopted policies to improve its long-term growth potential? Have we cut tax rates? Have we deregulated? Have we reigned-in or reformed government spending programs or made them more actuarially sound? No, we have not, unfortunately. What we have done is spent future taxpayers' money like there is no tomorrow to generate some extra economic growth in the short-term.

The pandemic-related policy set in the US is not as dollar-friendly or investment-friendly as what we did in the 1980s or 1990s. However, because every other country has done similar things, the US is a relative safe-haven for economic activity versus others.

The labor market is still producing “recessionary” results

While many may be thinking that the IC (Initial Claims) numbers reported last week was positive news for the economy. It really wasn’t. The total number of new claims dropped -28K from 502K to 474L week ending June 26th. At anytime in history these number would signify a serious economic environment. To put things in perspective the pre pandemic norm was 200K.

We seem to be struggling with politics as the states that eliminated the extra $300 weekly benefits from the Federal Government now must fight in court as to whether or not this is lawful.

During the period from May 15th to June 19th those states that had opted out had a -19.4% drop in unemployment compared to -3.9% for those states that took the benefit. What is also happening is that employers are forced to deal with bad behavior from employees. In one retail chain a number of employees (8) scheduled to work over the holiday weekend decided not to show. No notice no called in. Typically, this behavior would be cause for termination, but with staffing so low this behavior is being tolerated. Now it looks like the tail is wagging the dog. In addition, continuous claims (CC) are hovering above +$14MM, normal would be in the vicinity of 2MM. We really won’t know the short-term impact on the economy but until the unemployment rates drop, we will not get back to normal.

Bond Markets

Bond market yields fell on the employment news as the underlying data showed labor markets are softer than what financial markets had expected. (Remember as prices increase yields drop) In addition, we continue see massive liquidity in the Reverse Repo market, nearly $1 trillion at quarter’s end. A Repo is the Overnight interest rate at which different market participants swap treasuries for cash to cover short-term cash-needs. The repo rate is helping to ensure banks have the liquidity to meet their daily operational needs and maintain sufficient reserves

So, since banks are holding on to its cash, they are actually lending the money back to the Treasury. A sign that money is not being loaned to business for growth and helping stimulate the economy.

When you hear the Fed Chair Powell talk about “Taper” he means a slowing, not a cessation, liquidity will continue to be added – just less rapidly;

With this much liquidity the banks flush with cash, there is little prospect for a reversal anytime soon (QT – Quantitative Tightening where the Fed actually shrinks its balance sheet and removes liquidity), it would appear that there is little prospect of interest rates rising anytime soon.

The Irresponsible Media

COVID-19 was the world's first Social Media pandemic, where fear was spread in a way we have never seen before. So much misinformation was tossed around as factual by the media, both mainstream and social that most individuals lived in fear unnecessarily. To put the pandemic in perspective, we want to share some basic information, based on data that was factual.

What this data has consistently shown since the beginning of the pandemic was that those individuals most at risk were a small subset of the population. Those 65 years and older make up only 16.3% of the population, but have accounted for nearly 80% of all COVID-19 deaths as of 6/30/21. The other factor in this data which has not been separated out yet is that most of those deaths were individuals with a compromised immune system. Meaning that they had a medical issue such as cancer, severe diabetes or heart problems and were at the end of their life. We do not want to mislead you that no healthy individual suffered or died from the virus, a number did, but those number are very low. We also do not want to minimize the death of anyone. Just that there was no consistency in the way information was reported from state to state let alone in the world.

In our opinion, the most effective way to have handled this event should have been by focusing resources on the most vulnerable individuals, instead of locking down the entire country. We believe it would have resulted in better outcomes from both a public health and economic perspective. It is highly likely that locking down the economy will be viewed as one of the most damaging public policy mistakes in history.

The shutdowns destroyed supply chains, put millions out of work, hurt the young by eliminating in-person learning, damaged mental health, caused the delay of important screenings for other health problems, and led to a government spending spree of over $5 trillion. The amount of fraud committed was unprecedented and still continues to plague our system.

We are now dealing with the costs of those shutdowns and while we can't assess the long-term sociological problems, we do know that the economic data continues to improve. The question of paying back the debt is another issue and challenge.

The Internal Revenue Service has released its Down and Dirty Tax Scams list for 2021.

This year's "Dirty Dozen" can be broadly separated into four categories:

Pandemic-related scams like Economic Impact Payment theft;

Personal information cons including phishing, ransomware and phone "vishing;"

Ruses focusing on unsuspecting victims like fake charities and senior/immigrant fraud; and

Schemes that persuade taxpayers into unscrupulous actions such as Offer In Compromise mills and syndicated conservation easements.

"We continue to see scam artists use the pandemic to steal money and information from honest taxpayers in a time of crisis," said IRS Commissioner Chuck Rettig. "We provide this list to alert taxpayers about common scams that fraudsters use against their victims. At the IRS, we are dedicated to stopping these criminals, but it's up to all of us to remain vigilant to protect ourselves and our families."

Other news

China’s regulators went after more tech firms that have recently listed shares in America, having yesterday removed Didi, a giant ride-hailing firm, from Chinese app stores. The Full Truck Alliance, dubbed “Uber for trucks”, and Kanzhun, which offers an online recruitment service, were the latest to come under the gaze of the Cyberspace Administration of China. It says the firms may have broken data security laws. Tech stocks wobbled on the news. Last week Didi raised $4.4bn in the biggest American listing of a Chinese firm since 2014.

OPEC+, a group of oil-exporting countries and their allies, resumed talks today after it failed to reach an agreement on its oil output policy. On Friday the group voted to up production by 2m barrels a day from August to December 2021. But the United Arab Emirates rejected the vote; on Sunday Saudi Arabia called for “compromise and rationality” to secure a deal

The Week Ahead

A holiday-shortened week still offers a busy calendar. Tuesday kicked off with the U.S. ISM Services PMI, on the heels of last week’s NFP report that showed sizable job gains in leisure and hospitality.

Today we take a look at minutes from the June Fed meeting, and the dollar’s rise may suggests significant monetary policy divergence from the rest of the world.

Australia also announces its latest rate decision as the RBA contends with a strong economy despite slow vaccination efforts and ongoing lockdowns.

The U.S. JOLTS Job Opening report will add some additional color to the labor picture, while consumer credit is anticipated to be little changed.

European data includes German industrial production, EU economic sentiment and forecasts, and insights from the most recent ECB meeting. The week closes with Canada’s employment report, where vaccination rates are high, but shutdowns may hamper workforce improvements.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/