The State of the Economy

&

Weekly Market Review for Dec 16, 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

Not a great week in the markets as we experience the 2nd week in a row of negative price declines. All of the indices took a 180 degree turn after Fed Chair Powell’s Press Conference following the last FOMC meeting of the year

The NASDAQ dropped -2.07% followed by the S&P500 - 2.08% the Russell 200 -1.85% and the DOW -1.66%. Much of this was driven amid worries about how high interest rates may climb and whether not a bad recession will impact the U.S.

The decline came after the Federal Reserve increased its benchmark lending rate by 50 basis points, moving to a range of 4.25% -4.5% not a big deal since this was expected by the market, however what took the market by surprise was the FOMC raising its median rate outlook for 2023 to 5.1% up from the estimate of 4.6% meaning another 75 bps in rate increases and that the FOMC would hold rates at that mark longer before making any rate pivots. In addition, the Fed also address its projections for the country’s GDP to be lower along with inflation remaining higher for a longer period of time, this spooked investors.

This was also followed by weaker-than-expected readings on US retail sales and industrial production only added fuel to investors' worries.

November US retail sales fell 0.6% in November, the consensus estimate for a 0.2% decline, marking the largest monthly drop this year. US industrial production also fell unexpectedly for the second month in a row amid decreases in mining and manufacturing output. The fall in manufacturing output marked the first monthly drop since June.

The yield on the 10-year Treasury fell again as prices continued to rise with more money seeking safer havens.

All but one of the sectors declined last week with Energy being the lone gainer with a +1.7% return Consumer discretionary led the slide with a drop of 3.6%, followed by a 2.7% decline in technology, and drops of 2.5% each in financials and communication services

Next week's economic calendar will be heavy on housing and inflation data.

Early in the week, investors will receive the National Association of Home Builders index for December as well as building permits, housing starts and existing home sales for November. Later in the week, new home sales for November will be reported on Friday, though the personal consumption expenditures -- or PCE -- price index, a key inflation reading, is likely to receive the most attention on Friday.

Inflation

Last week was filled with mixed reactions to the CPI number which was released on Tuesday. For the month of November, the MOM data came in a .1% (one tenth of one percent) for the YOY number ending November (22) that number was 7.1%, down from 7.7% in October. These numbers gave the markets confidence that the Fed would decrease its hawkish attitude with rate increases. In fact, the DOW jumped significantly on the news with +800-point increase in pre trading but settled the day up + 103. However, less than 24 hours later after Powell’s comments the markets realize that the Fed is pushing the economy too hard and into Recession, as the equity markets tanked with the Fed press conference. The DJIA tumbled -1,188 points (3.5%) from its Tuesday closing level (S&P 500 -4.2%, and Nasdaq -4.9%), as the Fed’s hawkishness seemed to appear unwarranted.

To the best of our knowledge, we do not believe there has ever been a cycle in which the Fed continued to tighten monetary policy with so much strong evidence that the Recession has already begun, and inflation is on the wane. Paul Ashworth, Chief North American Economist for Capital Economics, titled his comments on the recent CPI report “Stick a fork in it, inflation is done.” Stating the Fed should move to the sideline after one more increased of 25bps in February. https://www.bnnbloomberg.ca/cooling-us-inflation-and-its-impact-on-fed-toplive-voices-

Given the emerging weaknesses in the economy, Economist Bob Barone sees a continuation of disinflation over the next few months, turning to outright deflation when BLS’s realizes its flawed methodology and recognizes the downtrend in rents. Remember inflation is a process, it’s a measure of price changes from one period to another. Disinflation is a slowdown or stabilization in that change not a negative change in prices. Having 0% rate of inflation doesn’t lower prices, it just maintains them. Deflation is a drop in prices over the period of measurement, if we could have that without huge employment losses, that would be a welcome sign of relief. Unfortunately, employment losses usually accompany deflationary environments and higher unemployment is a primary element of a Recession.

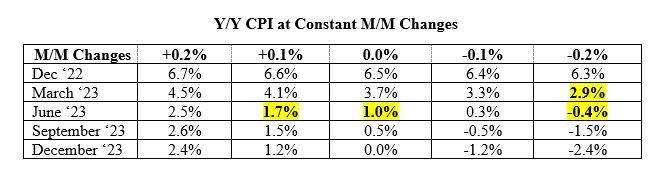

Below is an experiment that Economist Bob Barone did looking at Y/Y CPI (which is what the Fed is focused on) Bob used different changes in the monthly index to calculate the YOY CPI ending at each quarter, this based on the assumption that is a constant change in the MOM number.

If a M/M growth in CPI of +0.1% is repeated every month, the table shows that the Fed’s 2% YOY inflation goal is attained by next June (+1.7%). If, as we think, we will be seeing negative monthly CPI readings, that 2% Y/Y goal will be achieved early in Q2 next year depending on the severity of the deflation metric. The incoming data suggest zero or negative near-term M/M readings, especially as the rents segment of the CPI recognizes the downtrend there.

It wasn’t too long ago that the Fed couldn’t get inflation up to its 2% goal. We believe that scenario will begin again in 2023 or 2024 the latest. The reality here is that the inflation number will not be constant MOM and we think will vary between +0.1% and -0.1% and we are confident that the inflation situation YOY will drop significantly before mid-year of 2023. The big question will be at what cost to the economy mostly with employment. If this number jumps too high it will have a downward spiral effect on the economy and GDP.

For a number of years the markets were fixated on the acronym T.I.N.A. (There Is No Alternative), meaning that equities was the only place to put your money, since Bond interest was so low. The 60/40 portfolio model provided poor returns for investors. This was the philosophy when stocks were moving up and the Fed had interest rates pegged near zero. Stock prices rise when there is a higher demand for the stock, between the popularity of Index funds, ETF’s and low interest rates in fixed income, stock prices rose to beyond reasonable values.

However, with the rise in Bond coupon rates and a concern for safety more money is flowing in the fixed income segment which is and will continue to impacting stock prices.

Keep in mind Recessions always bring bond yields down (and their prices up). In fact, long-term bond yields seemed to have peaked in October (the 10-Yr Treasury was 4.225% on October 19 and closed Friday (December 16) at 3.488%, a fall of nearly ¾ of a percentage point. The good news is if you are holding any of these bonds that you purchased at lower price as interest rates begin to decline you will have a nice profit on those Bonds should you decide to sell them.

Health of the Economy

As we enter the final stretch of 2022, the U.S. economy is running low on gas and is heading into strong headwinds in 2023.

Economic data released this week showed a picture of declining industrial production, manufacturing and services PMIs and retail sales. The Fed delivered more hawkish messaging after last week’s FOMC meeting, downplaying recent progress on inflation and maintaining its higher-for-longer stance on monetary policy.

In its updated Summary of Economic Projections, the Fed stated that it still sees inflation elevated for longer period of time than what the markets see, economic growth is cooling quicker than expected and unemployment is rising quickly. We expect to see a large jump in the unemployment rate in January once the BLS reconciles its data from its overly aggressive seasonal adjustments throughout 2022. The outlook laid out by the Fed is perplexing; both inflation and labor markets are showing clear signs of cooling, wage growth is softening, and shelter inflation which accounts for 30% of GDP has probably peaked.

Recent surveys by the NY and Philadelphia Regional Federal Reserve Banks also painted a downbeat picture. The NY Fed survey came in at -11.2 for December vs. +4.5 for November. This number measures the difference between companies who say they are expanding vs. those that say they are contracting. That means that 44.4% of those surveyed said “expanding,” while 55.6% indicated contraction. This was the fourth negative reading in the past five months.

At the Philly Fed, the survey number was -13.8. This survey averages +13.6 during business expansions. This was the fourth month in a row of contraction, the longest negative streak in nearly seven years. In addition, the average workweek shrank (-8.9 points), and employment intentions also contracted (-1.8). We had negative readings on new orders, unfilled orders, delivery times and prices paid and received, good news from an inflation perspective. Unfortunately, not so good for the overall economy. Lastly the ISM Manufacturing PMI also slipped below the magic 50 mark into contractionary territory at 49.0 down from 50.2 in October. The peak was March 2021 at 63.7.

Retail sales declined -0.6% in November. The Wall Street consensus was for a fall of -0.3%, so a big miss. On a Y/Y basis, retail sales are up +6.5%, but inflation is up +7.1%, so, on a real (volume) basis, sales have fallen. Some of the categories showed large negative readings M/M: auto sales were off -2.3% and down in two of the last three months, furniture/home furnishings fell -2.6%, and building materials sank -2.5% which is no surprise given the trauma in housing market.

Sales of electronics fell -1.5% and are negative for seven months in a row. This is the longest losing streak in the data back to its 1992 inception. Gasoline sales even fell -0.1% (but this is good news for consumers as it is a result of falling prices). Online sales, the growth area in retail, were down by -0.9%. The Johnson Redbook same store sales for November cratered -2.9%.

Industrial Production fell -0.2% in November. The fall would have been much larger except for the large rise in utility output (+3.6%) due to unseasonably cold weather. Manufacturing output was down quite a bit -0.6% (consensus was +0.2%) and mining declined -0.7%.

Now that the supply chain is nearly back to normal and auto manufacturers have been able to get chips for the past few months, it appears that pent-up demand has been exhausted (as seen from the falloff in new car sales of -2.3%). Motor vehicle output fell -2.8% in November. Given the NY and Philly Fed surveys mentioned earlier, Industrial Production is likely to continue to fall again in December. We are not expecting too much good news this holiday season and numbers will surely disappoint in January once released. Maybe now some of the pundits like Treasury Secretary Yellen will admit the Recession is here. Source Economist Bob Barone.

The Week Ahead

The last full trading week of the year features several second-tier data points, but investors expect Friday’s PCE Price Index to be the week’s highlight. The Fed’s preferred inflation gauge fell in October, and further easing may help determine the scale of future rate increases. FOMC members are once again free to speak to the press following last week’s meeting, which could influence this week’s macro flows. The technical setup for U.S. stocks is not ideal heading into year-end (see tweet here). In the U.S. there’s a deluge of housing data along with consumer confidence, durable goods orders, and personal income and spending figures. Also keep an eye out for earnings announcements from Fedex and Nike, each considered bellwethers in their respective industries.

Overseas, the Bank of Japan meets later today, and while the U.S. dollar’s swoon has taken some pressure off the weak yen, the central bank is not likely to take any action. In Europe, German producer prices are expected to diminish further, while consumer and business sentiment reports round out the region’s light calendar. Monthly Canadian CPI and GDP updates are also on the international docket.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/