The Short Game and its problems

& other Economic insights the Week Ending Feb 18th 2022

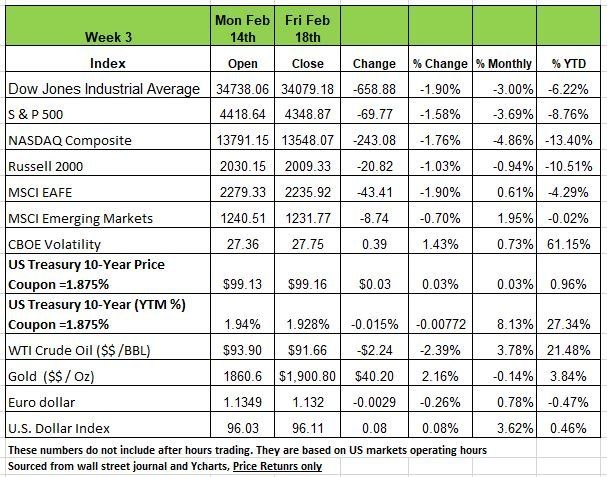

All of the major indices were last week amid mounting tensions between Russia and Ukraine and the potential effects of the Fed’s tightening in US monetary policy. The media can’t seem to move on and throw more fear on the fire as to what the Fed may do. Experts are quoted as stating the Fed will rise rates in March by at least 50 bps while others think it will raise by 25 bps but will do so 7 times over the next 18 months. This guessing game has led to a sell off on stocks that have out performed expectations. Meanwhile, investors continue to worry about how the US economy will handle rate increases that are expected soon from the Federal Reserve's policy-setting committee amid rising inflation.

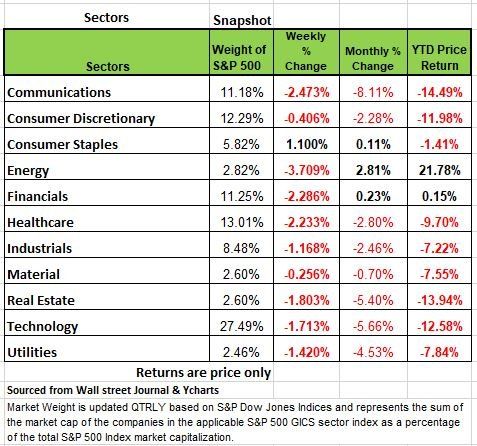

All but one sector fell this week. The energy sector had the largest percentage drop, down 3.7%, followed by a 2.5% slide in communication services and a 2.3% decline in financials. The lone sector in the black was consumer staples, up 1.1%.

On the upside, the gainers in consumer staples included shares of Kraft Heinz (KHC), which rose 11% as the food company reported Q4 results that topped Street consensus estimates. The company also forecast organic revenue growth this year and said it expects consumption to be stronger compared with pre-pandemic levels.

The US markets were was closed Monday, so it’s a short trading week for the 4th week of February

The 10-year Treasury yield dropped back below 2%, settling near 1.93% as reaction to January’s FOMC minutes was more dovish relative to expectations. As we have mentioned previously the markets were expecting a .50bps increase and that now looks to be less likely. Inflation pressures persisted, with U.S. PPI jumping 1% MoM in January, twice the anticipated level, and soared 9.7% YoY.

Consumer spending was strong despite higher prices as January retail sales rebounded sharply, rising 3.8%.

In the housing market, mortgage rates continued to rise, and new home construction fell 4.1% in January on tight labor and materials, but permits to build lifted to the highest levels since 2006.

Record-low inventory boosted January existing home sales by 6.7%. U.S. industrial production leaped 1.4% in January, reversing the prior month’s decline as capacity utilization rose to 77.6%.

Earnings

We are no longer in a “what have you done for me lately world” it’s now a “what will you do for me next Quarter”. Our demands or expectations on performance have increased significantly and even those companies that have outperformed expectations are being penalized by the market. 84% of companies have reported earnings for Q4 so far, with 52% surpassing earnings expectations by a significant number. But even those companies that performed well were not treated with appreciation by investors. While many “experts” think that corporate earnings will continue at a healthy pace of 8% growth, the market seem hesitant to embrace that much optimism. Companies that are projecting modest growth are being beaten up by the market.

Forecasting

At the end of last year last year many fund managers were projecting that the S&P 500 would rise to above 5,000 and the Dow Jones Industrials average would climb over 40,000. There are many reasons for these projections but few have to do with Fundamentals, (remember many of these companies want to attract your money, that is how they increase their revenue since they charge a fee for their services) or economic conditions. Since then, however, equities have dropped, with (now realized) fears over Russia invading Ukraine in addition to the jump in inflation a problem than the Federal must deal with more aggressively and experts are all over the map by guessing how many rate hikes the Fed will make. The markets don’t like uncertainty. The key to making money in an environment like this, is to be wise with your money. Make sure you understand the underlying holding if you’re investing in ETF’s or an index fund. Predicting the outcome of the S&P 500 or any other market index can only be done if you know for certain that the inflows will exceed the outflows and will be enough to reach those objectives. Patience and calm will lead to opportunities and sticking to a plan of buying at the right price, will lead to larger gains down the line.

The Short Game

Playing the short game refers making decisions that often give you immediate satisfaction. The longer you play the short game the more difficult it become to shift to the long game.

Recently many of the large financial institutions have adjusted their predictions of Q1 GDP for 2022. Goldman Sachs adjusted its forecast from 2.0% to .05% that is a 1.5% adjustment in lower production. They have also modestly adjusted their forecast for the rest of the year.

What is the reason for these experts to be off by so much?

Fiscal support by our government boosted real disposable income of our population by 5% on average in 2021, this above pre pandemic trend. But following the lapse of the expanded child tax credit, disposable income has likely dipped below trend. We think it will remain an average of 1% below the pre-pandemic trend in 2022 even after penciling in strong gains in labor income.

Why because we are short term thinkers, many of us refused to work and now that things are leveling out people will not have the revenue that they became accustom.

Jan Hatzius of Goldman Sach’s wrote, ‘this decline should weigh on consumer spending. It is a large part of why we expect growth to slow to only slightly above potential by the end of the year. However, the impact should be cushioned by the spending of excess savings built up during the pandemic that still total nearly $2.5 trillion. “

While Goldman and other large financial institutions are still optimistic (they need to be, remember they also want to manage your money) overall, the problem with their assumption, as noted by the WSJ article on Jan 9 of 2022, is that the bottom 90% of Americans don’t have much in savings. The $2.5 trillion belongs almost entirely to those in the top-10% of earners in our society. The ones that worked and kept on earning. But when it comes to GDP growth it’s the bottom 80% that drives our economy.

But here is where we think we made some big mistakes and why we think it’s a significant issue for our country. The vast majority of the growth we have enjoyed in the U.S. over the last decade was due in large part to a variety of manipulations, artificial inputs from the Federal Government which are not sustainable.

With increasing federal expenditures: including bailouts are a nothing more than a function of increased debts and deficits and massive monetary interventions. The economy appeared to grow during this period, economic growth would have been negative without those debt increases.

Think of it this way, you have a credit card with a high credit limit you go out and buy all new furnishings for your home and spend on vacations, the interest is low so you keep spending, then rates go up and now all of your income is spent on making the minimal payment nothing to principal nothing to maintain your current monthly living needs. It may appear to many that you were making a lot of money, but you were not, just borrowing to create an illusion.

So, after more than a decade of monetary and fiscal interventions totaling more than $43 Trillion and counting, our economy is no better off than it was 10 years ago. In fact, its worse once you incorporate the debt.

If you grew up with depression era parent you might recall their attitude toward money. Most were frugal, they were savers. Today we do not behave that way, money is disposable. “We want it now” When the stimulus money hit consumer accounts, they spend it rather quickly, which led to a ‘rush’ of economic activity.

Consumers use the funds to make discretionary purchases creating demand.

In anticipation of demand, companies boosted “inventories.”

The boost in “inventory stocking” boosted manufacturing metrics and was outsourced and back logged which contributed to the supply chain issues

Now that cycle is beginning to reverse. Stimulus payments to US households are evaporating going from $2.8tn in 21 to $660bn, and there is no buffer from excess savings for the bottom 90%

There is a huge inventory build in retail products, while the upcoming US consumption projections will most likely lead to cuts in GDP growth & corporate EPS.

In addition, the increase in economic activity led to the inflationary rise, it is a self-inflicted wound but as we mentioned earlier compared to 2019 its really 4.4% increase.

While the current administration is taking credit for saving the economy or for the incredible growth it’s not all that accurate. No mention to the amount of debt it incurred and that the debt far exceeded the growth. Not really that smart a move.

In addition, we think its highly unlikely, that the administration will accept responsibility for the coming economic issues. We are not in anyway trying to scare anyone just to be honest in our evaluation of the situation, to share our observations with you so that you can make the best decision possible with your money

The helicopter money that drove economic acceleration, and fueled earnings growth is over and moving toward economic deceleration, maybe if we are lucky just stagnation, but that is dependent on the consumer. This should not come as a surprise, given simple math, we knew that this would be the case when the government sent checks to everyone.

The big question now is whether the Fed will accelerate that economic deceleration into an economic recession by being too aggressive in an attempt to control inflation that we still believe will normalize by end of summer. Source:https://www.wsj.com/articles/americans-finances-got-stronger-in-the-pandemicconfounding-early-fears-11641736069

The Long Game

Playing the long game means taking the necessary steps, now, to set yourself up for long-term success. It means not sacrificing long-term gains for short-term wins. Unless something unexpected happens. Playing the long game is not always easy, it means making some short-term sacrifices. For instance, if you want to lose weight, you develop a meal and exercise plan but you if make some short-term decisions like eating sweets you satisfy a short-term need and the expense of the long-term goal.

This happens in finance and politics all too often. Playing the long game means deferring greater rewards down the road. But its now easy for many because we have created a “I want it now culture”

There is enough evidence out there on personal finance that I do not need to go into about why saving for the future is so important. But what about on a global scale? Is the U.S. playing the long game? It appears not, as our country has become so dependent on imports especially from China that we can feel the pain from the short game.

We are writing this because of the current Russian Ukraine issue. Eight years ago, Russia annex Crimea. The response, the European Union and the U.S. hit Moscow with punitive economic measures. But many of those sanctions were more targeted, aimed at individuals or entities such as those tied to the Russian military and its annexation of Crimea.

Russia has also been sanctioned for interfering in overseas elections, cyber attacks and other questionable behavior. Has it stopped them? No not at all.

Russia has been playing the long game and has positioned itself to buffer future economic sanctions Such as the U.S. cutting off Russian banks’ access to the dollar and employing novel export controls that the U.S. and the E.U. might impose. Russia has trimmed its budget, beefed up foreign exchange reserves and sought to diversify its trade portfolio to become less dependent on the EU for export revenues. And the bulk of Russia’s export revenue comes from mineral products such as oil, natural gas and coal. This dependence seems to make energy exports an attractive target for sanctions.

But the EU is too reliant on Russia for energy. More than a third of the E.U.’s natural gas imports come from Russia. That is not a small number. The U.S. and Europe can’t really sanction against Russian exports of oil and natural gas directly, in that doing so would increase already high energy costs in Europe and the U.S. In addition, would E.U really support the U.S. agenda if it came down to that? Not long term.

Russia has also expanded its ties with China. These efforts include opening a major gas pipeline to the country in 2019. Natural gas exports to China have grown since then but are still small compared with Russia’s other big gas buyers.

While newly proposed sanctions are more far-reaching, Moscow has also had time to retool its economy, making it more resistant to punitive measures. Russia has used its oil and gas revenue to build up its stock of gold and foreign currency reserves since the 2014 issue.

Moscow could use these to help support the ruble, if any of sanctions cause the currency to collapse, or to help cover government expenses.

Here’s the point you can’t win the long game if you’re playing the short game. Both China and Russia have been playing the long game and are now allies, while the U.S. neglected what both countries were doing.

We have no idea how all this will play out but know one thing for sure, we need to get back in the long game. Source: https://www.wsj.com/articles/how-well-could-russias-economy-withstand-sanctions-11645106401?tpl=cb

The Week Ahead

As discussed earlier the big issue for the markets is the tension over The Ukraine-Russia conflict and investor sentiment, will world leaders fear a breakdown in diplomatic relations that may lead to imminent invasion.

U.S. equities are already in a vulnerable position, with YTD returns at -8% to -14% for the major indexes and sustained volatility, not to mentioned that many stocks are overpriced. U.S. markets were closed yesterday in observance of President’s Day, but it’s a and busy week of data kicks off Tuesday with flash PMIs and consumer confidence. After last week’s strong retail sales numbers, major retailers such as Home Depot, Macy’s, and Lowe’s will report earnings and provide color on how inflation is affecting consumer behavior. On Thursday, the first revision to Q4 GDP is expected to uptick to 7.1% from the initial estimate of 6.9%. More housing data drops with new and pending home sales, leading into the most important release of the week, Friday’s Core PCE Price Index. With CPI and PPI having already come in above expectations, the Fed’s preferred inflation measure is likely to see a similar move higher, adding fuel to speculation of a 50bps rate hike in March. The durable goods report will also be issued Friday.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/