Markets & Economic News for the Week Ending

'Feb 14th 2022

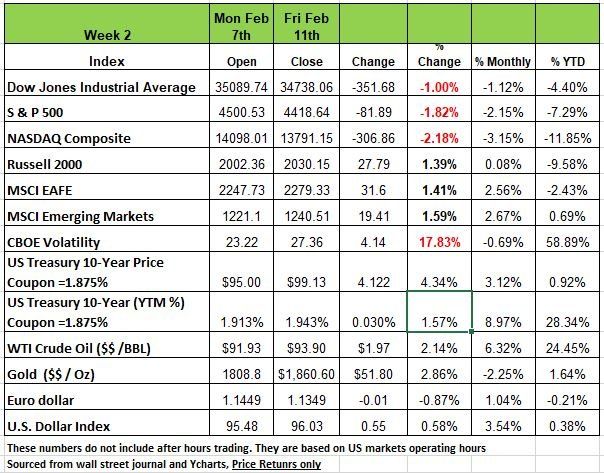

3 of the 4 major indices closed down last week with the NASDAQ having the largest decline of -2.18%. The S & P 500 index fell 1.8% last week on rising US consumer costs and tensions between Russia and Ukraine escalated.

The market benchmark ended the week at 4,418.64, down from last week's closing level of 4,500.53. The index is now down -2.1% in February and has fallen 7.3% so far this year.

The S&P posted gains on Tuesday and Wednesday as some better-than-expected quarterly earnings reports continued to come in and a decline in COVID-19 cases across the US prompted officials to relax some restrictions. However, Thursday came with the US Bureau of Labor Statistics reporting the US CPI for January hit its highest level since February 1982. The reading showed consumer price inflation rose to a 7.5% annual rate in January YOY. Higher than expected and compared with a 7% rate in December,

prompted questions over the potential size of interest rates that is expected next month from the Federal Reserve's FOMC. More on this below

On Friday, the US State Department urged Americans to leave Ukraine and "exercise increased caution due to crime, civil unrest, and potential combat operations should Russia take military action." That alert sent the index down 1.9% for the day, which also pushed it into the red for the week.

The 10 year Treasury exceed a 2% yield last week as investors began seeking safety over return.

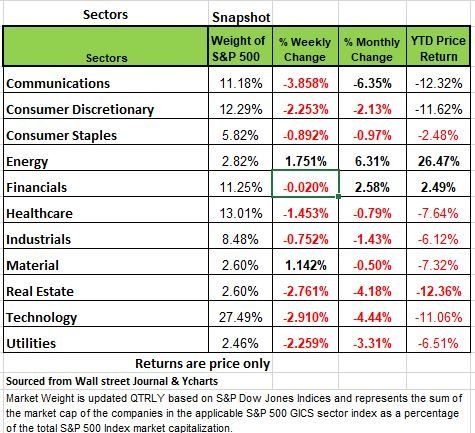

9 of the 11 sectors were in the red last week led by the communication services sector having the largest percentage drop of the week, down 3.85%, followed by a decline of -2.9% in technology, a slip of -2.7% in real estate & declines of -2.3% each in utilities and consumer discretionary.

Two sectors ended the week in positive territory: Energy climbed 1.7% while materials gained 1.1%.

YTD Energy and Financials are the only two sectors with positive price returns with 26.47% & 2.49% respectively. The energy sector's advance of 6.3% came as crude oil futures rose on the tensions with Russia and Ukraine.

Inflation!! Are you tired of it?

The big news last week was again related to Inflation. January inflation numbers came in a bit hotter than expected. The CPI YOY came in at 7.5%, this number was a bit higher than the consensus which was predicting 7.3%. But more of a headline was from St Louis Fed President James Bullard who said that interest rates need to be at 1% by July. This sent markets into a more volatile state. We have been writing for a while that the artificially suppressed interest rates over the last 12 years will have a consequence and it looks like that consequence is on the horizon.

From a Behavioral perspective, we have been concerned about the habits that have been created over the last decade from having such low interest rates and markets don’t like change too much, so fasten your seat belts as we believe this will be a very bumpy ride.

The financial markets are agonizing over how far and how fast the Fed will use its tools to fight inflation. At the end of 2021, the futures market in federal funds was pricing an increase of 75 basis points for all of 2022. Now the market is pricing in 150 - 175 bps. That is a significant increase and that will impact pricing of securities significantly, not to mentioned some financial stress to those companies that are highly leveraged and need to borrow to satisfied cash flow or to roll over debt.

We believe that the hikes are warranted and that the inflation we are seeing is self-inflicted as a result in large apart of poor monetary and fiscal policy. We been living in a low interest fantasy land for way too long. Yes, consumer prices are up 7.5% from a year ago, the fastest gain since the 80’s, but that’s because we gave too much money away to people during the pandemic. That money was used to drive higher demand of products, instead of saving money or paying rent, they spent it.

The other piece of the puzzle the markets are dealing with is the speed of the Feds Quantitative Tightening. This is just as important to fight inflation as interest rates. The fastest pace of QT in the prior cycle was $50 billion per month reduction. We thought the Fed would have reduced its balance sheet a lot more by now but doing both too quickly will increase the risk of stalling the economy.

We have mentioned in previous newsletters that we believe inflation is transitory, and there is much debate between economist on this issue. There are many causes of inflation, for example demand pull inflation, which occurs when the demand exceed the supply/production of goods. Then we have Cost-push inflation which occurs when materials and or labor make it more expensive to produce goods. Then there is inflation caused by central banks by infusing too much money into the economy. This is done by purchasing securities (bonds) like the Fed has been doing.

If we go back and look at what occurred during the pandemic, we can see that demand pull occurred when the Federal government gave people more money to stay at home than to actually show up and work (contribute to the production of goods). This money was spent of items they normally could not afford especially since they were not paying their rent, people had more cash in their pockets.

Cost push inflation was also part of the mix as imports of materials used to produce goods were in short supply increasing the price of materials. Then there is the excess money infused into the economy from the Fed.

Now that all of these issues have been addressed as we have been stating we believe inflation will take a significant noise dive by summer. “Transitory” is not defined by a time line. It is defined by the underlying issues that are contributing to inflation, so if we believe that the above-mentioned causes are accurate, we should see inflation drop

As of the writing of this piece the Federal Reserve called for an emergency meeting of its governors, specifically to address the higher-than-expected inflation data from last week. Not much is being talked about this in the media and we wonder if the Fed may act sooner than March with rate increases. Source https://www.barrons.com/articles/things-to-know-today-51644571694

Bull or Bear Market

Traditionally the financial industry has defined a bear market as a drop of value by more than 20%. Whether it’s the Dow, S&P 500 index or the NASDAQ, the movement of 20% is the metric. Many believe that a 20% drop is also a signal that the economy is in a recession. The industry created these narratives for one reason, to keep your money in the market, to weather it through the rough patches. For most of the last decade we have been in a bull market, even though we had one flat year 2011 0% return and 2 down years 2015 and 2018. Do you remember 2018? That was the year the Fed tried raising interest rates in a strong economy. Even the 20% drop in March of 2020 ended the year on a positive note +16% return, perhaps this was the shortest bear market in history, thanks to the infusion of helicopter money from the Fed.

But here is what you need to be aware of, when you purchase securities a 5 or 10% decline hurts, regardless of what the narrative is. Your entry point needs to be given some thought. If your money is in an index or ETF be careful of what the underlying holding are and more importantly how much weight each holding may influence the movement of the fund. The old rules/laws of investing are gone and you should be aware this. When you make an investment, you should know exactly what your risk is. If your advisor is not taking the time to evaluate your portfolio risk and understand exactly what your needs are instead of just wanting to maximize return without doing any work, you might be in for a bit of a surprise when it comes time reap the benefits of the risk you took. One thing we can share is that historically the more volatility we see the more likely we will be headed into a year with negative returns. Remember the market does not move stock prices, stock prices move the market. Sometimes the best place to be during volatile markets is in cash it allows you to take advantage of opportunities when they occur.

First time homeowner? Perhaps you might want to rethink buying now

Being a young newlywed and looking for a home for the first time is no easy task in this market. Buying a home for the first time is always stressful, trying to find what you like what you can afford and then going through the entire home buying process, financing, appraisals, home inspections etc. But this environment is a bit more challenging. One reason is demand is higher right now and supply lower. Much of the homes that first time home owners are looking at are being swept up by institutions, investment companies willing to purchase properties at above asking, with no need for financing and in many cases no inspections. These firms can afford to put the funds needed into a house to bring its value up and charge premium rent. In a low interest bond environment where else are these institutions going to find a decent yield.

But for the first-time home buyer this makes the decision of buying a home more difficult and perhaps the best deal is found by walking away and waiting. Just because you can afford the mortgage payment does not necessarily mean you can afford the home, especially if you are willing to buy without inspection. Owning a home exposes homeowners to a variety of unknown risk. Home repair expenses for one usually come out of the blue and often hurt when something major breaks, a/c units, water heaters, leaky roofs just to name a few. In addition, since the pandemic many municipalities have found themselves short of funds with many small businesses going out of business, tax revenues are down. What will eventually happen is the tax rate (property tax especially) will increase. Living on a tight budget when buying a home is not wise, and the pain may not be felt right away, especially if you’re not able to save because your budget is stretched too thin. Source https://www.wsj.com/articles/buying-a-first-home-costs-more-than-you-think-especially-now-11643970604

Trade Deficit

The U.S. trade deficit increased 27% last year, this is a significant increase translating to $859.1 billion, underscoring the nation’s hefty dependence on imports from China and other countries. This number also includes additional imports that were pulled forward in Q4 due to the fear of supply challenges which many companies stockpiled

The trade deficit with China grew 14.5% for the full year to $355.3 billion, reversing the decline that followed former-President Trump’s policies aimed at reducing the deficit with tariffs and purchase targets. The agreement between China and the US called for China to increase its purchases but has only bought 57% of what they had promised to between 2020 and 2021. This widening deficit gap increase pressure on the current administration to this failure. Our dependency on foreign products, places America in a vulnerable position as we have witnessed during the pandemic. Source https://www.wsj.com/articles/economic-recovery-pushes-2021-u-s-trade-deficit-to-record-level-11644328979

What are TIPS?

You’ve probably heard a lot about TIPS, recently, but do you know what they are and more importantly how they work

In the simplest terms, TIPS are debt securities issued by the government, designed to increase in value as consumer prices rise. They are issued in 5-year, 10-year and 30-year maturities.

First introduced in 1997, TIPS stayed largely under the radar in the investment universe for years as inflation remained subdued. But last year, inflation shot up from an annual rate of 1.4% in January to 7% in December. The assets of TIPS funds surged and have now nearly doubled since 2018 to about $295 billion.

Last year, TIPS-focused mutual funds and exchange-traded funds outperformed other bond funds for the second consecutive year, with 2021 total returns of 5.5% on average, compared with minus 1.7% for a U.S. bond index fund, according to Morningstar Inc.

How exactly do they work?

Most bonds have a face value (par) and pay investors a set amount of interest semiannually based on the par value of the bond. At maturity the original face value of the bond is paid off with the last interest payment.

TIPS are different in a couple of ways. Their principal, or face value, increases when the consumer-price index for urban consumers rises, and decreases in the historically rare instances when the price index actually declines rather than rising at a slower rate.

But interest payments vary because they are based on the fluctuating face value of the securities.

While the interest rate may be constant the par value changes, so the interest is paid on a changing face value. For example, if the interest rate is 2% and the original face value is $1000. If the inflation rate comes in at 5% the face value is now $1050 and the 2% is paid on the new face amount. The increase occurs ever quarter and interest payments are paid semiannually. At maturity the new par value is paid off to the bond holder. Source:https://www.wsj.com/articles/tips-what-investors-should-know-treasury-inflation-protected-securities-11643849892?mod=djemMoneyBeat_us

The Week Ahead

U.S., economic reports kick off Tuesday with the PPI release and the Empire State Manufacturing Index, which may rebound from the prior month’s surprise tumble into negative territory. Wednesday’s January FOMC minutes will be judged against recent hawkish comments from certain committee members. Domestic retail sales are expected to improve MoM then on Thursday the Philly Fed index drops. The end of the week presents housing data with existing home sales and construction spending. Some home buyers have pulled back as mortgage rates have jumped to near 4%, with applications dropping 10% last week. On the international calendar, inflation updates from China, the UK, and Canada add to a busy Wednesday. Economic sentiment updates from Germany and the Eurozone are also on the docket, and the week wraps up with the G20 meetings in Indonesia.

Throughout January, the Fed met in closed-door meetings as the markets roiled. The emergency meeting scheduled today citing “advance and discount rates” as the matters to be considered, fueling speculation of potential action between scheduled meetings. Whatever the outcome, it seems the only certainty is continued volatility, especially with the Russia-Ukraine situation sparking additional fears late last week.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/