The Earnings Problem & Other Economic news

for the Week Ending 2-25-22

What a crazy week, to say the least. For a shorten week the markets had its share of extreme volatility. The markets opened on Tuesday with concerns of Russia & Ukraine putting the increase of interest rates by the fed in the back seat. Erratic is the best way to describe the behavior in the markets as the NASDAQ had a 7% swing on Thursday from the low of the day to its close. Then moved +1.6% on Friday for a total 8.7%. The DJIA was 5.3% and the S&P was 6.6% from its low point to the close on Friday.

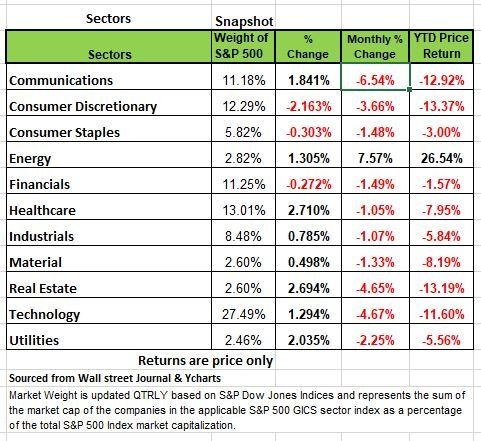

8 of the 11 sectors were in the black for the week with Healthcare, Real Estate and Utilities all returning +2% for the week. Energy is the only sectors with positive price returns with 4.4% for the month and 23.37% for the year. This translates to high gas prices for the consumer.

Treasury yields rose significantly among shorter maturity Treasuries and moderately among longer maturity Treasuries as Russian forces began an assault on Ukraine. Markets are nervous and causing much volatility

Earlier in the week the yield curve flattened to have the lowest 2-year to 10- year spread since April 2020, when the pandemic concerns where highest. Most of this activity came our President announced sanctions on Russian banks and sovereign debt. But President Putin shrugged off these sanctions and ordered military operations, which began the conflict in Ukraine.

President Biden responded with additional sanctions but stopped short of any restrictions on trade with Russia for oil or natural gas, which included allowing energy payments to Russia to continue. Restricting this would have an adverse impact on Europe who is dependent on Russia for fuel and heating. Yields dropped significantly early on Thursday but rebounded to end the day down only a few basis points among all maturity lengths.

MARKETS WILL CONFUSE THE MASSES

What’s happening in the Ukraine right now is a tense situation. It seems that for the first time in a long time, politicians on both sides share the same opinion towards the escalating conflict. Our comments on this situation are only what we think the events will have on market environment and how it will play a role on investor psychology and emotion. We expect the markets to continue to fluctuate, in both directions until there is some resolve.

Volatility continues to increase each week. Last week with only 4 trading days had 3 of the 4 days as “outlier” days (a trading day beyond +/-1.50%).

The most volatile day of all was actually Thursday. The S&P 500 finished up on the day at exactly +1.50%, but its daily range was huge as we mentioned above.

What was the reason behind this rally? The answer isn’t that complicated. The market finished UP because everyone expected it to be down.

The market is counterintuitive, which means that it will often do the opposite of what most investors expect. Similarly, Putin announced military operation in the Ukraine on Thursday. The Market opened down, but finished sharply up, and continued into a strong upward move Friday. Why? Again, most investors expected it to drop.

Markets and Events

Bear markets are volatile because investors are emotional and confused about pricing. Therefore, it is important to disconnect the market’s movements from the emotional events that surround it. The market’s volatility is driven by supply and demand, not the specific economic or geopolitical event itself. Markets are also forward looking, so much of the volatility can be attributed to flows of capital in and out of the market.

The Russia/Ukraine news comes at a time when markets are already volatile. A news event occurring in a volatile market will have a much larger emotional reaction than a news event that occurs in low volatility Bull market environment.

There have been several cases throughout history in which newsworthy events have had very different impacts on the markets, than the public expected, U.S engaging in Kuwait Iraq Conflict, the Boston Marathon bombing, Brexit just to name a few were short lived. It all just depends on what kind of market environment in which the event occurs.

The events happening in the Ukraine are tragic and bring uncertainty. Uncertain events that occur when markets are already volatile, tend to have a larger impact on the market’s movement, because the first reaction is “the worst-case scenario “. We do have some economic challenges which we have discussed in previous news letters and the events on Russia /Ukraine may cause the Fed to be more dovish with interest rates. In any case we have a few weeks before that information is release. Source Canterbury Management

The Earnings Problem

There is a fundamental disconnect between stocks and the economy lately. If you’re an investor, it’s important to understand the impact of stagnation in the economy and how it will impact the prices of stocks. When stocks deviate from the underlying economy too much as they have recently, they eventual correct and the result is lower stock prices. While the media and politicians are telling you how great the economy is, you might want to take a minute and look around and ask the small business owner how they are doing. We also need to remember that the movement of the market during the pandemic was artificially driven, the government infused so much money into the pockets of people that it over inflated the economy. Companies produced abnormal returns but their forecast are not looking the same. Have you noticed the drop in some stocks prices that produced more earnings and sale than expectations?

The problem is that the markets are continuing with the same growth expectations and corporate America is pulling back on those numbers. So when missed expectations lead to disappointment, the result is lower priced stocks. At least this is what has happened historically.

We know from history that over time, we see the close relationship between the economy, earnings, and asset prices.

That close relationship in growth rates is logical given the significant role that consumer spending has in the GDP equation. While stock prices can deviate from immediate activity, reversions to actual economic growth eventually occur. We know this because corporate earnings are a function of consumptive spending, corporate investments, imports, and exports.

We use a number of economic indicators to closely tracks economic activity and the direction of that activity. Not surprisingly, the surge in the data from the 2020 lows has started to reverse along with earnings growth rates. There should be no surprise between the correlation between the economy and earnings.

What is clear to us is that the stimulus-fueled surge is now turning towards economic stagnation. That warrants some curbing of enthusiasm given the stock market’s history of sniffing out economic inflection points.

The truth here is that the mechanisms that drove the economic recovery will not support an ongoing economic expansion. One is self-sustaining organic growth from productive activity, and the other is not.

That market will figure that out.

Watch The Yield Curve

If you want an answer for when economic deceleration becomes a problem, watch the yield curve.

The markets are full of economic indicators and one such indicator is in the bond market

The yield curve is one of the most important indicators for determining when a recession, and a subsequent bear market, is upon us. If /when the Fed begins to hike rates, with the yield curve already declining, an inversion becomes an even higher probability.

Remember people are basically irrational with money, Bull markets lure us into believing this time is different, especially with longer running streaks of higher returns. But when the topping process begins, volatility increases, logical thinking goes out the window and is met with irrational reasons why the bull market will continue. We hold on to assets much longer than we should in hope to catch the rebound. The problem comes when it eventually doesn’t. Bear markets are swift and brutal attacks on investor capital, which is why most will buy high and sell low.

What If

Russia’s Ruble, Financial Markets Are Hammered by Sanctions.

Central bank doubles interest rates to protect the banking system as the ruble plunges

This was the headline in Mondays WSJ. The sanctions by the EU and the U.S has rocked Russia financial system and caused Russia to take some actions, just not the ones we expected. While the Russian ruble fell as low as 111 to the U.S. dollar from 83 on Friday, a drop of more than 20% before recovering slightly, on track for its biggest single-day fall on record. The Bank of Russia took measures early Monday to protect Russia’s banking system. It raised benchmark rates to 20% from 9.5% in an attempt stop a run-on the banks for cash and to attract savings into banks.

But what if none of this works? What are some of the possible outcomes? Russia has become a much stronger economic country since the breakup of the Soviet Union. In addition, the fact that China and Russia are closer allies gives us concern as to what they might collude together. When we were children, we played a game call “King of the Hill” as I am sure many of you may remember the basic concept was to knock the King off the hill. America has been the King of the hill since WWII. But more importantly we have shifted our country from one that produces to one that basically consumes and we consume the products from other nations. If at some point China and Russia collude to create a new world currency one that eliminates America’s economic power, we may have more of a challenge on our hands. In last weeks newsletter we discussed the difference between playing the long game to the short game. Both of these adversaries are long game players and have made their agenda to expand their territories. (China with Taiwan, Russia, well you already know Ukraine)

America may just be creating a Long Game problem and if we do not pay attention, we may not enjoy the privileges we have for the last 85 years. Source https://www.wsj.com/articles/russias-ruble-financial-markets-are-hammered-by-sanctions-11646038133

The Week Ahead

Last week’s events jolted investors, and the fallout will continue to be assessed on both a human and economic level, along with what actions world leaders take beyond the already imposed sanctions against Russia. But will anything affect Putin’s actions?

This week’s economic calendar is busy, highlighted by the U.S. employment report on Friday. Over 1.6M jobs have been created the past 3 months despite the impact of Covid variants, and another strong report may put further pressure on the Fed’s tightening schedule. Fed chair Powell is scheduled to testify before House and Senate committees beginning on Wednesday.

This week also brings ISM PMIs along with the regional account from Chicago. Overseas, OPEC meets Wednesday, and despite facing additional threats to already tight oil supplies the group seems unlikely to raise production beyond its planned increase. The Bank of Canada is widely expected to raise rates this week, earlier than previously thought, while Australia’s central bank likely waits for signs of wage inflation before hiking. In Europe, February’s CPI figures could intensify calls for the ECB to end asset purchases and begin elevating rates.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/