Weekly Market Review for January 20, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Market Review

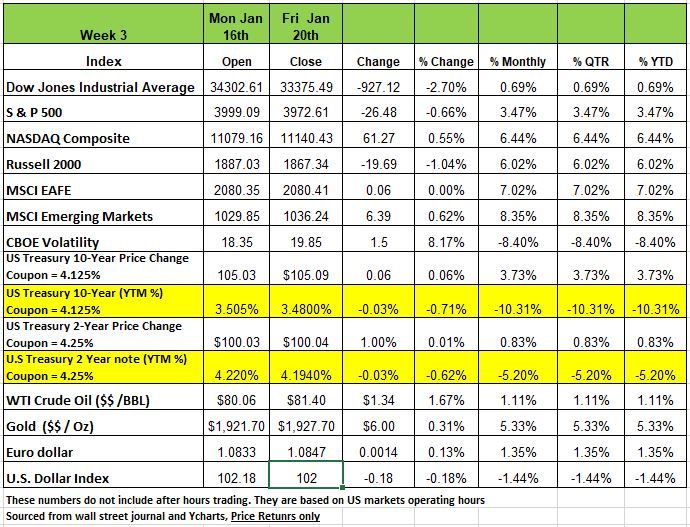

The markets were a bit rocky for the week ending Jan 20th but Fridays rally helped recover some of the losses seen earlier in the week. Much of the volatility came with concerns that the Federal Reserve may go too far with interest rate hikes and push the economy into recession. According to a Reuters poll, economists now expect the Fed to raise rates 25bps at the next two meetings and then pause, which is in line with fed funds futures pricing. However, last week some FOMC members signaled a more hawkish forecast despite the weak economic data. The Nasdaq Composite led the pack with a modest gain of 0.55%. Followed by the S&P 500 down -.66% The Russell 2000-1.04% and the DOW down 2.7% for the week. U.S. retail sales fell more than expected in December, while housing starts, and existing home sales slid further.

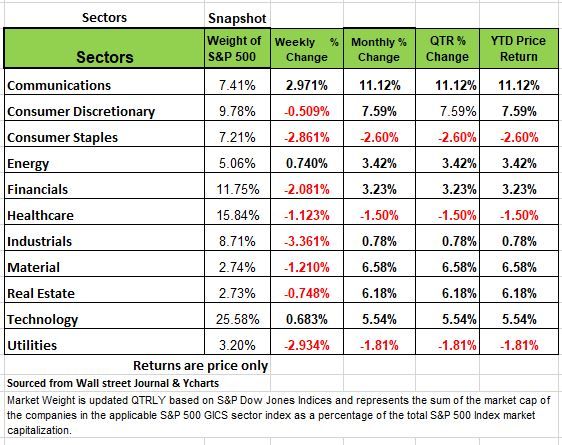

Eight of 11 S&P500 sectors finished lower, with industrials, utilities, and consumer staples all dropping by more than 2%. Crude oil rose 2% as traders remained hopeful that demand from China would accelerate as their bumpy reopening process continues.

U.S. Treasury yields fell (prices increased) as economic data revealed that business conditions weakened considerably in early January and inflation continued to moderate. Yields further inverted, as measured by the 3 Mo. - 10 Yr., which is natural as economic data deteriorates. The curve is intensely watched by the market for its history of anticipating economic contractions. Also weighing on the market is the upcoming spectacle surrounding the debt ceiling. At some point in time the U.S. is going to have to come to the reality of dealing with its debt. We seem to be pushing the envelope on just how far we can go. Politicians are playing a game of chicken with the debt and the consequences may have lasting impact on America and future generations.

The Empire State Manufacturing Index saw its worst monthly output since mid-2020, with prices paid and received extending downward trends. The Philadelphia region report, seen as better barometer for nationwide conditions, improved slightly but remained in contraction. U.S. PPI declined sharply in December, with falling gasoline and food costs contributing to a 0.5% MoM drop.

Large technology companies announced more layoffs, with several large companies announcing job reductions in the tens of thousands. but the labor market remained tight, with weekly jobless claims dropping below 200K If these layoffs are not seen in the jobs coming numbers we know something is just wrong in the data.

Internationally, China’s GDP beat expectations in Q4 but grew just 3% in 2022, far below target and the worst performance in 50 years outside of 2020.

In Japan, the central bank made no additional policy adjustments, disappointing bullish yen traders, but pressure for action mounted with core consumer prices rising 4% YoY in December. Finally, in the UK, a spike in food and beverage prices offset a slight decline in December’s CPI, which remained well above 10% YoY. Officials fear a wage-price spiral as pay growth jumped in the resilient labor market.

Inflation

Inflation has been the focus of the media and the fed for the past two years. Most politicians do not realize that they caused the mass inflation we experienced with the handling of the pandemic. The amount of money sent to people that encouraged them not to work had a cost and that cost came in the way of the highest inflation we have seen in decades. Two weeks ago the inflation number came in at 6.5% lower than the expected 7.1%. As we have penned in the past inflation was always transient it just took 18 months to prove to the media and inept politicians.

The inflation we experienced was the result of supply chain and labor issues and excess money given away to people all coming together at the same time, But now the supply chain issue has been resolved. Most of the money at least by the Fed has ceased being distributed to the population but for some the labor issue seems to still be a problem for many industries. Supply chains are back to normal, and we see evidence of falling prices everywhere we look. The ISM survey of prices paid in the manufacturing sector (39.4 December vs. 43.0 November) is approaching the lows reached during the Covid lockdowns since April 2020, and they are significantly below the pre-Covid years. Clearly deflationary.

There is one area that inflation has not leveled off yet shelter costs. While we know home prices are declining due to the high cost of interest rates /mortgages the BLS focuses mostly on rents for this calculation, which account for approximately 30% of the total CPI number. This area had an increase of +0.8%. Of course, since most landlords are small business owners this came as a result of people not paying their rent when the government sent them all that money. We also know that the BLS uses antiquated methods when measuring rents, (phone calls) and we know that in real time, rents have been falling. BLS’s rent data are about nine months behind reality as seen from the tight fit of the CPI Rent Index to the New Tenant Repeat Rent Index advanced nine months (see chart below).

If this tight relationship continues to hold, then CPI Rent Index is at or near its peak. So we think that future CPI releases won’t be as bloated by the lags in the current methodology.

If we do the math if rents rose +0.8% in this calculation, then, given its 30% weight in the CPI calculation, to get to the -0.1% overall figure, the net of all other prices combined had to decline by nearly -0.5%. That’s real deflation! Source Economist Bob Barone Ph’D

Private Placements

Sometimes, not always having some alternative investments in your portfolio can be a good thing, but like everything in life it should be done with caution. Private placements gained a lot of traction over the last decade with interest rates being so low and investors craving yield. Alternatives can provide a source of income and help better allocate one’s portfolio. But not every private placement make sense and you must be aware of the person you are trusting for advice, especially in this particular space. Like all investment publicly trade or not you need to have a solid understanding of the health of the company you are investing your money, especially if there is a commission associated with the investment. Many advisors that work for Broker Dealers receive an incentive for selling products to their clients. Sometimes these investments are good and sometimes they are purely speculative, regardless of the return they are promoting.

Private placements of debt, equity and other assets don’t move in sync with public markets—and, because they don’t trade, their reported prices fluctuate much less. This can seem appealing to an individual that has difficulty stomaching the volatility associated with the markets.

These investments often offer the hope of higher returns, since these smaller issuers often have to pay more to obtain capital. And every corporate titan started out tiny, and many legitimate companies have offered securities in this private market.

The fatal flaw: You can’t always sell these securities when you want to, and often you can’t sell at all. Financial disclosures range from minimal at best—an offering document, perhaps cursory annual or quarterly reports—to nonexistent. The risk of default or bankruptcy is high. Commissions and other fees can easily exceed 10%. The investors that are buying these private placements are doing so because they trust their advisor and that they wouldn’t steer them into something bad. But most advisors are not analyst they’re salespeople and good ones if they’re still in the business after a few years. If you are considering putting a portion of your assets into private placement offering, make sure you do a few things. 1) only allocate a small percentage of your overall portfolio into these investments and make sure that amount is diversified amongst several different alternative investments. Never put all the eggs in one basket. 2) get a due diligence report on the company, understand what risk is associated with the investment and that the company has some stability. 3) take the time to understand the product or service and how much demand there is for that particular company’s product. Housing and Oil and much safer that medical advancements and drugs that must pass FDA approvals. 4) Be cautious and avoid the motivation of a promised return by a good salesperson, if you’re not comfortable and your advisor is pushing the opportunity, you might consider finding a new advisor. Source https://www.wsj.com/articles/regulation-d-private-offering-debt-equity-11673625595?mod=djintinvestor_t

How The SECURE Act 2.0 Will Impact Your Retirement Plan

On December 29, 2022, the Consolidated Appropriations Act of 2023 was signed into law which included the highly anticipated Securing a Strong Retirement Act (commonly referred to as SECURE 2.0). This new legislation builds upon the enhancements that were implemented under the SECURE Act of 2019, including over 90 provisions taken primarily from three draft House and Senate bills

(1) the Securing a Strong Retirement Act, (2) the Retirement Improvement and Savings Enhancement to Supplement Healthy Investments for the Nest Egg (RISE & SHINE Act) and (3) the Enhancing American Retirement Now (EARN Act).

The provisions included in this legislation will take effect in varying years giving plan sponsors and service providers more time to understand and implement changes to their plans and recordkeeping systems.

The following is a summary of selected provisions that are effective now.

Modification of credit for small employer pension plan startup costs

Favorable changes have been made to increase tax credits for many employers establishing new plans.

The startup credit will be increased from 50% to 100% or employers with up to 50 employees. for employers with up to 50 employees. The existing annual cap of $5,000 per year will be retained.

An additional credit is also available for employer contributions made to newly established defined contribution plans.

For employers with up to 50 employees, the credit is 100% of the employer contributions made to each eligible employee (earning less than $100,000), limited to $1,000 per employee.

For employers with 51-100 employees, the credit is reduced by 2% for each employee more than 50 employees, limited to $1,000 per employee.

The credit amount in all cases is phased out over time as follows:

Years 0-1 – 100% credit

Year 2 – 75% credit

Year 3 – 50% credit

Year 4 – 25% credit

Year 5 or later – 0% credit

The above credits are available to employers that merge into another plan as a part of a Multiple Employer Plan (MEP).

These tax credits are available in lieu of tax deductions, which in some cases may be more valuable.

Raising the age for Required Minimum Distributions (RMDs)

The SECURE Act of 2019 increased the RMD age to 72. SECURE 2.0 will expand on this recent change and once again increase the RMD age to:

Age 73 starting on January 1, 2023

Age 75 starting on January 1, 2033

Reduction in excise tax

The penalty for failure to take RMDs will be reduced from 50% to 25%. Further, if a failure to take an RMD from an IRA is corrected in a timely manner, the excise tax is further reduced from 25% to 10%.

Optional treatment of employer matching or non-elective contributions as Roth Contributions

Under prior law, your plan was not permitted to provide employer contributions to your plan on a Roth basis. SECURE 2.0 allows defined contribution plans to provide participants with the option of receiving matching contributions and non-elective contributions on a Roth basis. We are awaiting further guidance and system updates to implement this new option.

Employer may rely on an employee certifying that deemed hardship distribution conditions are met

Employees are permitted to self-certify that they have had an event that constitutes a hardship for purposes of taking a hardship withdrawal.

Cash balance interest crediting rate

For cash balance plans that credit a variable rate of interest, the plan sponsor can assume an interest credit that is a “reasonable” rate of return, provided it does not exceed 6%. This clarification will allow plan sponsors to provide larger pay credits for older and long-tenured workers.

Eliminating unnecessary plan requirements related to unenrolled participants.

Your plan will no longer be required to provide certain intermittent ERISA or Internal Revenue Code notices to unenrolled participants who have elected not to participate. This can help reduce plan expenses significantly for some employers.

However, to further encourage participation of unenrolled participants, you are required to send (1) an annual reminder notice of the participant’s eligibility to participate in the plan and any applicable election deadlines, and (2) any otherwise required document requested by the participant at any time. This rule applies only with respect to an unenrolled participant who received the summary plan description in connection with initial eligibility under the plan and any other notices related to eligibility under the plan required to be furnished.

Recovery of retirement plan overpayments

You will now have discretion over whether to recoup overpayments that were mistakenly made to retirees. If plan fiduciaries choose to recoup overpayments, certain limitations and protections apply. Rollovers of the overpayments also remain valid.

Overall, the goal of this new legislation is to make saving for retirement easier and more accessible while simultaneously tackling issues that may have prevented employees from actively participating in their workplace retirement plan.

Any plan amendments needed because of this new legislation must be adopted by December 31, 2025 (or December 31, 2027, for certain governmental and collectively bargained plans), unless an extension is provided by the Department of Labor (DOL) or the Internal Revenue Service (IRS).

Optimized Financial Strategies will be providing more information around SECURE 2.0 in the coming weeks. In the meantime, please let us know if you have questions about how these provisions will impact you and your plan(s).

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

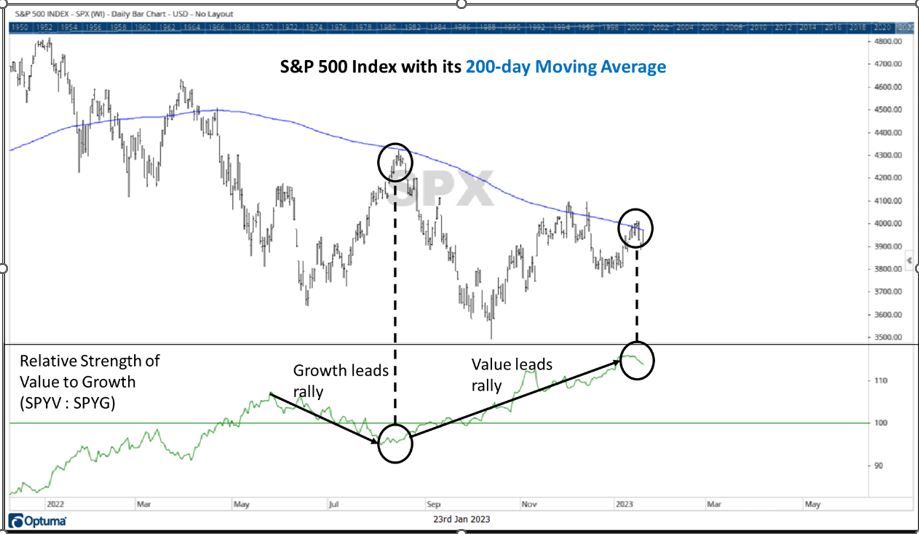

The S&P 500’s 200-day moving average continues to be a resistance point for the index. Volatility has fallen off some in recent weeks but does remain high. The next few weeks will be interesting as companies begin to report Q4 earnings. During a volatile market, and one up against resistance, even the slightest “beat” or “disappointment” in earnings could cause a wave of short-term fluctuations, in either direction, particularly in tech stocks.

Markets ended last week with another outlier day (a trading day beyond +/-1.50%). 2022 displayed 77 outlier days in 2022 (3rd most outliers for a single year since 1950), there have already been three outlier days in 2023 or one per week so far. During a typical year that exhibits normal, rational behavior, the S&P 500 is expected to have around ten to twenty outlier days. But again, the markets did not enter into 2023 during a rational market environment.

Volatility has begun to fall in recent weeks, as the markets moved sideways in late December, and rose slightly up into the new year. Right now, the S&P 500 sits at a point of previous resistance: its 200-day moving average of price.

The 200-day moving average has been a point of contention for the market throughout this bear market period. Each time that the index has hit the moving average, it has bounced off and headed lower. This was the case back at the market’s peak in August when many thought the worse was behind us.

Back in August, the index went up against its 200-day moving average and failed, falling -17% to its low point October. In mid-December, the index yet again hit the moving average, before opening above it, and falling -6% in just four days.

Will this time be any different? One factor that does seem to be different this time around, compared to August, is market leadership. “Growth” sectors such as Information Technology, Consumer Discretionary, and Communications are what led the market’s volatility last year and drove the index lower. At the market’s peak in August, when it was sitting at its 200-day moving average of price, these sectors had led a bear market rally to that point. Now, after the market has sold off to its lows, and rallied back to its 200-day moving average, the rally has been led by “value” oriented sectors, which were less volatile than Growth stocks last year.

The chart below shows the S&P 500 with its 200-day moving average. The lower half of the chart displays the relative strength of Value versus Growth. When the line is rising, Value is outperforming Growth. When the line is falling, Growth is outperforming Value. While economic conditions seem to be weakening it might be prudent to demonstrate some caution with trading. Source Brandon Bischoff

The Week Ahead

It’s a busy week on tap, highlighted by a pair of announcements in the U.S. Thursday we get a preliminary look at Q4 GDP, with growth expected to moderate from the prior quarter as consumer spending has slowed. Friday, if the Core PCE Price Index eased further in December, expect the debate to commence on whether the Fed’s next rate hike could be the last in this cycle.

Also, this week major economic reports (related consensus forecasts, prior data) for the upcoming week include Monday: December Leading Index (-0.7%, -1.0%) Tuesday: January Preliminary S&P Global US Manufacturing PMI (46.5, 46.2); Wednesday: January 20 MBA Mortgage Applications (N/A, 27.9%); Thursday: January 21 Initial Jobless Claims (205k, 190k), December New Home Sales (612k, 640k) and December Preliminary Durable Goods Orders (2.5%, -2.1%); Friday: December Personal Income (0.2%, 0.4%), December Personal Spending (-0.1%, 0.1%) and January Final University of Michigan Sentiment

Earnings season in the U.S. ramps up with reports due from Microsoft, Tesla, Boeing, Intel, Chevron, and others.

Internationally, Wednesday the Bank of Canada is expected to step down to a 25bps rate rise after data showed inflation slowed in December. And finally, the Bank of Japan will release the summary of opinions and minutes from the December meeting, which may provide further color on its shocking decision to adjust the yield curve band late last year.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/