The Problem with Economic Theories & Other Financial News for the Week Ending Oct 22 2021

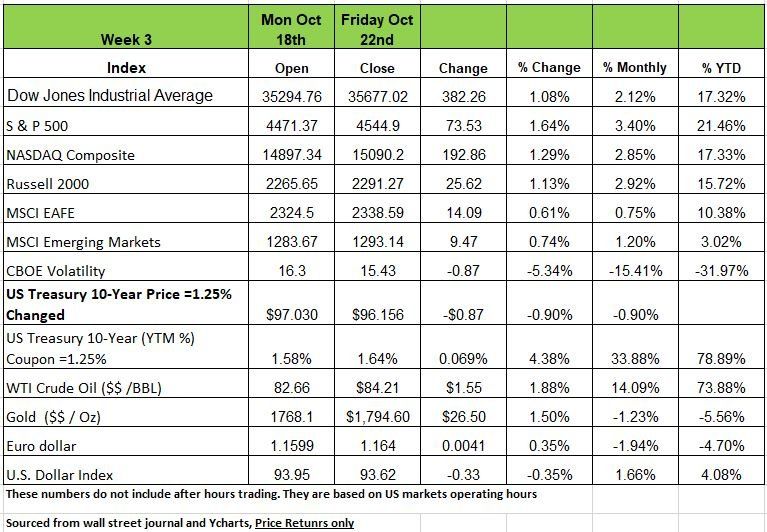

Last week U.S. equities had moderate gains despite disappointing earnings from some technology companies and other general economic data. The S&P500 Index reached a new all-time high, advancing 1.6%+ for the week, the Nasdaq Composite’s returns were similar. YTD these indices are up +21% +17% The Russell 2000 end, with a 1.13%+ price return as growth outperformed value & is up +15% YTD.

10 of the 11 S&P500 sectors finished positive, led by 2- 3%+ gains in real estate, healthcare, financials, and utilities. Communications was they only sector to post negative return for the week with a -.61%.

U.S. economic data was mixed, with factory production falling 0.7% owing to a sharp pullback in auto manufacturing. The Fed’s Beige Book revealed economic activity continued to grow recently at a modest to moderate rate, with the pace of growth slowing. The Philly Fed Index fell to 23.8 in October, reflecting an expected pullback from the prior month’s spike. October PMIs were driven by services, which rebounded to 58.2 from 54.9, while manufacturing fell to a 7-month low of 59.2 on raw material shortages.

Homebuilder confidence rose on high buyer demand, as existing home sales surged 7% in September to an 8-month high, while housing starts fell on input and labor scarcities. Weekly jobless claims hit another pandemic-era low of 290K with continuing claims dropping to 2.48m.

Interest rates continued to climb, with the 10-year Treasury yield touching 1.69% before easing and ending the week at 1.64%. Much of this was based on fears of inflation and the looming Federal Reserve’s tapering date

In the United Kingdom, CPI dipped slightly to 3.1% in September as retail sales fell unexpectedly, ahead of the Bank of England’s decision on interest rates which due in several weeks. Canada’s inflation rate reached an 18-year high of 4.4% as their central bank prepares to meet this week to discuss actions. In the Eurozone, Germany’s composite PMI slid to 52.0 In October from 55.5 as the manufacturing index fell to a 16-month low of 51.1. Finally, China’s Q3 GDP came in at a disappointing 4.9% versus forecasts of 5.2%, and September’s industrial production lifted by just 3.1%, below the 4.5% expected.

The fixed income market's confidence in transitory inflation is weakening after investors digested an equity earnings week filled with supply chain issues and higher input costs. The 5-Year breakeven rate – a gauge of implied 5-year inflation expectations – surged to its highest level since being introduced in 2002. The index touched 3% on Friday before retreating to 2.90% at week end.

On Friday, Fed Chairman Jerome Powell spoke at the Bank for International Settlements conference for the final time before the highly anticipated Fed policy meeting on November 2 & 3 and reaffirmed the Fed's plan to begin asset purchase tapering this year. He also signaled that supply chain issues and high inflation will likely persist into 2022 after proving stickier than Fed policymakers originally expected.

The Problem with Economic Theories

By definition a “Theory” is an idea or principle related to a specific subject that is suggested or presented as possible truth but that is not known or proven to be true

John Maynard Keynes was a British economist during the 1930s. He attempted to understand the Great Depression. He authored many books and one whose economic theories are embraced by many politicians.

So what is he theory?

Keynesian economics is considered a "demand-side" theory that focuses on changes in the economy over the short run. Keynes’s theory was the first to sharply separate the study of economic behavior and markets based on individual incentives.

Keynes advocated for increased government expenditures and lower taxes to stimulate demand and pull the global economy out of the depression. Subsequently, Keynesian economics was used to refer to the concept that optimal economic performance could be achieved (and economic slumps prevented) by influencing aggregate demand through activist stabilization and economic intervention policies by the government.

When the US fell into the COVID crisis, the federal government went on a massive spending binge. Pre-COVID, in the twelve months through March 2020, federal outlays were $4.6 trillion, or 21.4% of GDP. In the next twelve months outlays soared to $7.6 trillion, or 36.2% of GDP. In no other time has the government has ramped up spending that much or that fast. (excluding War) As a result, as well as very easy money, the economy partially bounced back faster than it would have in the absence of the extra spending.

But the extra spending was like a drug, temporarily masking the economic pain caused by government-imposed shutdowns. But we know all too much that there is no free lunch when it comes to spending, and the economic bill is already starting to come due. Someone has to pay

The consensus among economists was that real GDP would grow at about a 7% annual rate in the third quarter, even faster than it grew in the first half of the year when the government was passing out checks like candy at Halloween. Now, we're estimating that the economy grew at only about a 2% rate. And that is a huge short fall considering the tax revenue expected from the estimate. Regardless of one’s politics at the end of the day government spending needs to be properly financed and paid back. Taxing just the rich will only hurt the middle class as those tax dollars will not be spent on innovation and real economic expansion. Which will ultimately hurt the U.S.

Financial Planning

Working with a professional financial planner can help (with caveats) you get on track financially, address poor financial decisions and create a healthy stable financial wellbeing. Research has shown that households that work with a professional financial planner were more likely to make better financial decisions than those without a planner, taking into account portfolio risk levels, savings habits, life insurance coverage, revolving credit card balances, and emergency savings.

In a study published in the Journal of Financial Planning, found that Households working with a financial planner were found to be making the best overall financial decisions. Keep in mind that they study defined this as financial planners that are fee based, not transactional such as those that work in banks or with brokers.

The study also pointed out that the type—and objective—of the financial planner matters. There are many types of planners and different types of planning engagements. The study didn’t use a certification or a designation to determine if an advisor was a financial planner, though those designations certainly can help. The survey asked respondents what type of service they received: Were the advisors providing more holistic planning services? Or less holistic and more transactional in nature?

The advisors who provided more holistic services were called financial planners and, on average, led to a clearer planning process—and better outcomes. Bottom line A financial plan may sound like a chore.

But for successful investors, it’s the foundation on which to build, understand and achieve your goals. Having a written plan can increase confidence and result in more constructive financial behavior. However, the potential value of financial advice may vary based on the nature of the planning. People working with a financial planner who is taking a holistic look at their needs, beyond just products and portfolio, are likely better off than those working with a planner who takes a transactional approach and selling products for compensation.

Electric Avenue

If you live in a city like Chicago or New York you are probably aware of the difficulty of finding street parking, especially in neighborhoods that have mostly apartments and limited garage parking available to tenants. Well, if you are considering purchasing an electric vehicle and live in one of these areas you may find that owing such a car may present many inconveniences. Currently most owners of EV have access to electric charging ports either in their own home, apartment complex with private indoor parking or at a work facility that provides recharging. But if you live in an area with street parking you may find your self in a bind.

Municipalities will soon be faced with the task of building charging stations for residents in such areas to have access to charging their vehicles. New York state set a goal for all new passenger cars and light-duty trucks to be zero-emission by 2035. That’s 14 years to move everyone to EV’s. An April study commissioned by New York State estimated electrifying its transportation would cost the state some $500 billion to set up these Charging stations and it won’t happened over night. Shouldn’t they have done the study before voting on such a law? New York City currently has just 1,580 charging plugs for around one million cars that rely on street parking. Owning an EV in a large city like New York is a really painful experience and inconvenient in a city that is always in a rush and on the move.

We expect that large cities like Chicago and NYC will see a lag in sales until this problem is resolved. Its not all that easy. Grids need to be redesigned, cost will be high at first and then we will have the issue of destruction and theft of these charging stations, not to mentioned the amount of time a individual will have to sit outside with their vehicle while its charging. One issue that I am not sure has been addressed with EV’s is cold. Those living in Chicago know what cold is and how that can impact your ordinary car battery. I am not sure of the battery life if the car is sitting in the cold for a few days unused but have to think it will impact the battery in severe cold conditions. Setting ambitious goals need to be thought through and realistic. Source : https://www.nasdaq.com/articles/insight-rocking-down-to-electric-avenue-good-luck-charging-your-car-2021-10-13-0

Housing Market

Existing home sales increased 7.0% in September to a 6.290 million annual rate, easily beating the consensus expected 6.100 million. Sales are down 2.3% versus a year ago.

Sales in September rose in all major regions. The increase was due to both single-family homes and condos/co-ops.

The median price of an existing home fell to $352,800 in September (not seasonally adjusted) but is up 13.3% versus a year ago. Average prices are up 8.6% versus last year.

Implications: Existing home sales surprised to the upside in September, posting the largest monthly gain in a year and rising to the fastest pace since January. Since the pandemic hit US shores in early 2020, sales of existing homes have been through a wild ride. Now it looks like the upward trend in sales may be returning despite buyers’ ongoing struggle with higher prices and lack of supply. The number of listed, but unsold, existing homes was 1.27 million in September, the lowest number for any September on record (dating back to 1999). Our thoughts are that listings will soon move upward again, at least on a seasonally adjusted basis, as virus fears fade. Meanwhile, the months’ supply of existing homes for sale (how long it would take to sell today’s inventory at the current sales pace) fell to 2.4 months in September, remaining near record lows. Despite the ongoing shortage of listings, there is still significant pent-up demand from the pandemic, with buyer urgency so strong in September that 86% of existing homes sold on the market for less than a month.

The combination of strong demand and sparse supply has pushed median prices up 13.3% in the past year, but the good news is that price gains have been decelerating rapidly since hitting a year-to-year gain of 23.6% in May. Sales in 2021 are on track to be the highest for any calendar year since 2006 and we expect another solid year in 2022 as more inventory becomes available and price gains continue to moderate.

With millennials now being the largest living generation in the US and have begun to enter the housing market in force, making up over 50% of new mortgage issuance for the first time in 2019. This could represent a demographic tailwind for sales for the foreseeable future.

Materials Sector

The Materials sector includes companies that make or process chemicals, construction materials (bricks, cement), containers and packaging (metal, glass, plastic, cardboard), forest products (lumber, paper), and metals and mining (aluminum, steel, copper, gold, silver).

The Materials sector is sensitive to fluctuations in the global economy, the U.S. dollar, and inflationary pressures. Accommodative monetary and fiscal policies are underpinning global economic growth and pricing power. However, the U.S. dollar has trended higher recently, which historically is a headwind for the sector.

The cyclical-value characteristics, which tend to do well amid improving global growth and strong demand for industrial metals, have been a tailwind, though demand appears to be curbing a little lately. Any traction on the Biden administration’s clean energy and infrastructure initiatives could sustain the boom for industrial metals and materials (though tougher regulations are a risk. And demand for chemicals (the largest industry in the sector) may continue to increase as oil demand improves) but oil rig counts have been slow to rise.

Supply chain bottlenecks are a big concern, and strong performance has eroded valuations. Finally, the run-up in industrial and agricultural commodity prices may have run its course.

Positives for the sector:

Improving global economic growth is supporting chemical demand and pricing power.

Strong gold demand is supporting precious metals mining.

U.S. clean energy and infrastructure spending could spur demand for industrial materials.

Negatives for the sector:

The slow recovery in the oil rig count is a headwind for oil-fracking chemicals (as though demand for oil is improving and prices rising).

Valuations have been eroded by strong recent performance.

Risks for the sector:

A pickup in global COVID-19 cases; this depends on how many variants develop and if the public will resist vaccinations

Potential stringent environmental regulations

Reversal of the 2017 corporate tax cuts

Strong rally in the U.S. dollar and/or weaker than expected economic growth.

The Week Ahead

The final week of October kicks off with earnings from Facebook, whose stock has been reeling from regulatory pressures and now Snap’s advertising income revelations.

Reports from Boeing, General Motors, Caterpillar, Mastercard, and Exxon Mobil are also on the calendar. Three central bank meetings highlight the economic agenda. The Bank of Canada is expected to further reduce asset purchases on Wednesday, and markets are pricing in 3 rate hikes for next year as the Canadian economy is firing on all cylinders. In Europe, the ECB has stagflation concerns, with slowing growth accompanied by escalating energy prices, and may take a more cautious tone towards rate increases on Thursday. Not much is expected when the Bank of Japan meets, as the economy is still showing little inflationary pressures. In the U.S. investors get the first look at Q3 GDP on Thursday.

Estimates have steadily decreased the past several months, and Fed models sit much lower than the current 2.6% forecasts. This week also offers the durable goods report on Wednesday, and the monthly PCE Price Index on Friday. Elsewhere, Australian inflation numbers drop mid-week, and GDP releases from Germany and Canada close out the week.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/