A Slowing Economy & Other Economic News

for the Week Ending Oct 29 2021

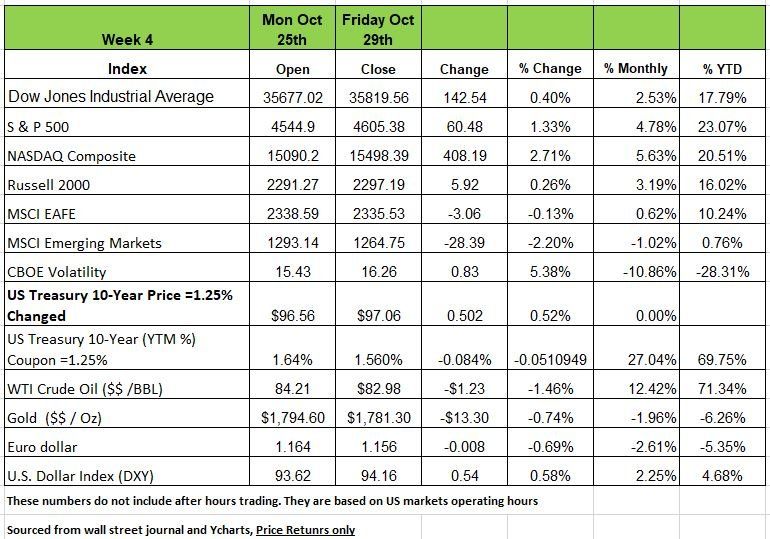

The markets seems to be bullet proof. U.S. equities keeps climbing even in the face of interest rate volatility and economic growth concerns. The S&P500, Nasdaq Composite, and Dow Industrials indexes all reached record highs during the week, with the Nasdaq outperforming despite disappointing earnings from Apple and Amazon. Only 4 of 11 S&P500 sectors were in the red. However, Consumer Discretionary still posted a 3.98% gain.

U.S. GDP grew at a disappointing rate of 2% in Q3, below expectations of 2.8%, putting additional pressure on longer-term rates. We are now coming back to reality as future growth expectations get tempered.

Consumer spending increased by only 1.6% after a 12% rise in Q2. Consumer confidence rebounded to 113.9 in October following three straight declines, boosted by rising wages and a strong labor market with jobless claims falling to another pandemic-era low of 281K. The economy’s sore spot continues to be supply chain shortages, with durable goods orders dropping 0.4% in September after four straight monthly gains.

The U.S. yield curve experienced major flattening, as rate hike expectations are getting pulled forward due to high inflation. U.S. 10-year and 30-year yields plunged 10 and 15 basis points respectively, while the 2-year note jumped 7 bps, and the spread between the 5 and 30-year narrowed to the lowest point since March 2020.

New home sales surged to a 6-month high in September, but higher house prices and mortgage rates may dampen future demand, and pending home sales dropped unexpectedly.

Chicago PMI hit its strongest reading since July at 68.4 for October. Interest rate movements were largely influenced by international developments, as the Bank of Canada struck a hawkish tone mid-week before GDP data showed likely Q3 underperformance. Australia’s core inflation numbers revealed more broad-based price increases, perhaps putting its central bank behind the curve on tightening policy. In Europe, ECB watchers expect a formal tapering announcement in December, as Eurozone inflation hit 4.1% in October on surging energy costs. Finally, German GDP rose 1.8% in Q3, missing expectations of 2.1% growth, and business sentiment worsened again in October on supply bottlenecks.

It seems that changes are coming quicker than expected, in sharp contrast to September’s Bank of England MPC (Monetary Policy Committee) meeting, financial markets now seem convinced that Bank Rates will be hiked at least once, if not twice, before the end of the year. Indeed, the market consensus is a 15 basis point increase to 0.25 percent at this week’s announcement which, if correct, would be the first time that the UK central bank has raised its key interest rate since August 2018. Adding to the chances of a move Thursday will be a new Monetary Policy Report that typically provides the fundamental justification for any change in policy. This change is mostly due to concerns of inflation getting out of hand. Now the questions is will the U.S. Fed follow.

A slowing economy

Everywhere we look, growth is slowing. Now that government support programs are now in the rear-view mirror, we are getting a clearer picture of what the economy will really do. Bell-weather companies, like Apple and Amazon badly missed their top-line (sales) estimates. Economic forecasts have been and continue to be extremely optimistic as many think that spending will continue and people will return to work at the flip of a switch. But the switch was flipped in early September and we are still dragging a bit

There is a new labor issue that could potentially disrupt the labor market and the economy, it’s the vaccine mandates. Many municipalities are requiring that city/State workers be vaccinated. The Federal Government is mandating that any company doing business with the U.S. require all employees be vaccinated. I guess we will see how many people buckle and get the vaccine. As it currently stands, these mandates cover about two-thirds (100 million) of the workforce. If we go off the assumption that 5% end up being non-compliant and are released (fired), that’s five million newly unemployed impacting an already short labor force. We doubt that they will also qualify for benefits and while it is still too early to draw any conclusions, 5 million people coming out of the work force in addition to those that left the work force for early retirement it looks like we will face some challenges

Another emerging issue is the shape of the yield curve. (Yield curves track the relationship between interest rates and the maturity of U.S. Treasury securities at a given time). Over the past few weeks, the yield curve has flattened (the difference between long-term rates and short-term rates has diminished). Such yield curve behavior means:

Markets expect central banks to raise short-term rates (administered rates like the Fed Funds rate).

But flatter or falling long-term rates means that markets also expect a slower economy (or at least a reduction in the inflation premium (it could be both).

Historically, when the yield curve flattens and then inverts, a recession is imminent. We’re not there yet, but it is something to ponder with your investments and business operations.

Trying to understand what the fed will do is always a challenge. The Fed has become a wild card so to speak. We expect them to announce a “taper” of their quantitative easing (money printing) program at the upcoming November meeting, but we are not sure of a rise in the Fed Funds rate anytime soon.

The “taper” is long overdue as banks are swimming in liquidity. This is not good, when banks are holding on the cash that means they are not comfortable lending money. Money needs to be loaned out in order to stimulate real economic growth.

The inflation narrative that exists is stemming from the supply side. When supply is low and demand is high prices increase. Demand increases because the Fed put extra money into people’s pockets and spent it on discretionary items not staples or rent. The Fed’s short-term tools are demand side oriented (i.e., they can immediately impact demand – for example, the cost of a mortgage), so an increase in rates will impact demand (just at a time when the economy is approaching its pre-pandemic state and demand has already started to wane). The Fed knows this, so we expect no firm dates for the first-rate hike.

We don’t see an imminent recession, but we do see a return of the economy to its pre-pandemic 1%-2% growth path.

Housing

Housing and non-residential construction faltered in Q3 with residential falling at a -7.7% annual rate (after -11.2% AR in Q2). Could it be that the near 20% Y/Y rise in home prices had something to do with this? Non-residential fell -7.2% too (-3.0% in Q2). While the media continues to emphasize rising wages as supportive of consumer spending (these are mainly occurring in the lower wage leisure/hospitality and retail sectors), with the elimination of the government support programs and taking price increases into account, real personal disposable income fell in Q3 by -1.4% Q/Q and -1.7% Y/Y. This bodes ill for Q4 growth.

Around the World

Australia opened its airports to travelers from abroad, after more than a year and a half of enforcing one of the world’s strictest border regimes. Initially only Australian nationals and permanent residents are being allowed back in. Those who are vaccinated need not quarantine. The first images of the respite were of emotional family reunions, postponed since the pandemic began.

The Week Ahead

The Fed meets on Tuesday and Wednesday this week and is widely expected to keep rates unchanged, before raising rates in 2022. The Fed is also expected to announce the tapering of its monthly asset purchases, which it signaled in September.

November kicks off with a busy and important week of data. It starts with the U.S. ISM Manufacturing PMI, which will be followed by the services PMI on Wednesday.

NFP lands Friday, preceded by the ADP report two days prior. Crude oil prices have stabilized the past few weeks, but remain near 7-year highs, and OPEC is expected to keep supply tight when it meets Wednesday. Other events of note include employment numbers and PMI from Canada, and Eurozone retail sales and PMIs.

Major economic reports (related consensus forecasts, prior data) for the upcoming week include Monday: October ISM Manufacturing (60.3, 61.1), October Final Markit US Manufacturing PMI (59.2, 59.2), September Construction Spending MoM (0.5%, 0.0%);

Wednesday: November 3 FOMC Rate Decision – Upper Bound (0.25%, 0.25%), October 29 MBA Mortgage Applications (N/A, 0.3%), September Final Durable Goods Orders (N/A, -0.4%), October ADP Employment Change (400k, 568k), September Factor Orders (-0.2%, 1.2%);

Thursday: October 30 Initial Jobless Claims (278k, 281k), September Trade Balance (-$75.0b, -$73.3b); Friday: October Change in Nonfarm Payrolls (400k, 194k), October Unemployment Rate (4.7%, 4.8%).

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/