The Next phone call you get & Other Economic News

Week Ending April 30th 2021

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. If there is an issue you would like us to address please email us at gene@optfinancialstrategies.com

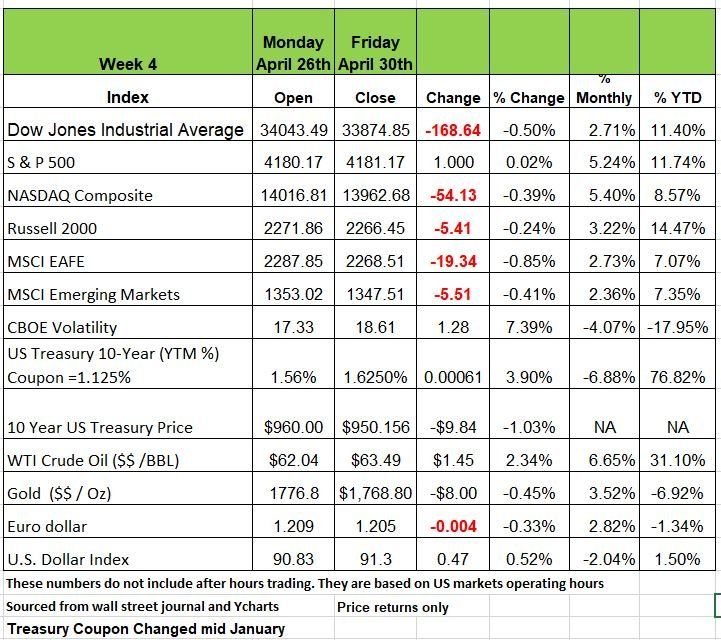

The Weekly Recap

A busy, roller-coaster week finished on a down note, but overall, all of the major indices had little change. Unfortunately, blowout earnings reports from the major technology names failed to propel the Nasdaq higher.

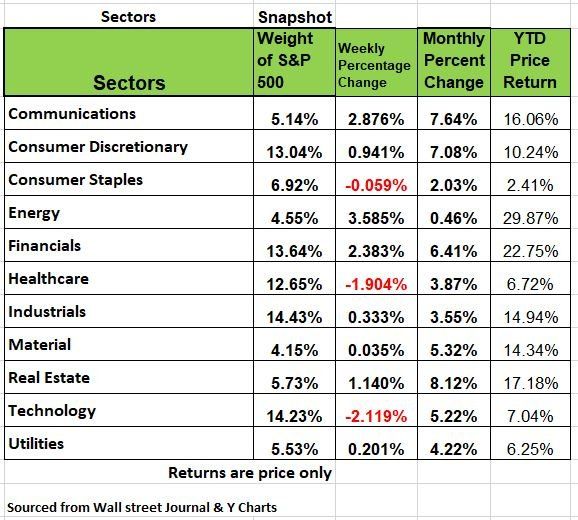

Value stocks outperformed growth by about 100 bps (1%). Nine of 11 S&P500 sectors gained ground, led by a 3.5% jump in energy stocks on a modest crude oil advance. Communications and financials were each up more than 2%, while technology and healthcare dipped.

Treasury yields ticked higher after the Federal Reserve made no changes to interest rate policy but conveyed a mildly hawkish tone, citing economic improvements. Durable goods rose 0.5% in March versus estimates of 2.2% as aircraft shipments dropped sharply. A lack of supplies and labor was noted in the report, and companies like Caterpillar also warned of supply chain issues. Consumer confidence hit a 14-month high, and jobless claims steadied at 553,000. Chicago PMI soared to its highest level since 1983 with new orders rising to a fresh 7-year high. The first look at Q1 GDP showed growth of 6.4%, just missing estimates. Even though consumers accelerated spending by 10.7%, the personal savings rate soared to 21%, from 13% in Q4, As we have stated in the past the money isn’t going into the economy

The Next phone call you get

Every few years when the Administrations and tax policies change Americans get phone calls from a number of "advisors" suggesting that they take their current tax deferred assets, withdraw all of it, pay the taxes now and pursue a Roth conversion. This strategy allows account owners to transfer some or all of the money from a tax-deferred IRA or 401(k) to a Roth account, in which you contribute after-tax dollars and get tax-free withdrawals. For workers with the option, it can also make sense to funnel future retirement account contributions into a Roth 401(k). With tax policies acting like a yo-yo its difficult for many with high savings to make such decisions that impact their net retirement dollars. Do I pay the lower tax rate now or t=ake a chance on a highewr tax rate late? We have never really been a fan of this practice, however, if there ever was a year to do something like this, 2021 might just be that year. Washington has a bit of a distorted view on tax and that unlknown can leave many of you nervous with the net effect on your retirement savings. I am not sure how we got to a point where good and responsible behavior is justification for taxing someone more. The government has overspent and created unprecedented debt and someone needs to pay for it, so if you’re one of these targeted citizens you may give it some consideration, Just be careful about being sold an annuity or life insurance policy as the vehicle to house the conversion. Annuities can have layers of fees that you may not be aware of, if you decide that one may be good for you read the contract fully. Life Insurance agents have already started making calls to convince people to put their money in a permanent life policy so that can take withdrawls tax free. Keep this in mind tax is a one time event on money, cost of insurance is annual. Source: https://www.wsj.com/articles/biden-tax-plans-potential-impact-on-your-ira-11619795375

Unemployment Fraud

As if the pandemic hasn’t impacted your life enough, there is another serious infection circulating our society. Its known as “identity theft”. With continuing security breaches happening all too often, “you can bet that the personal information of every adult in the U.S. has been exposed. Our data is out there, and depending on who gets their hands on it can cause extreme problems for Americans.

During the pandemic, identity theft has soared. Complaints to the Federal Trade Commission more than doubled to 1.38 million from 2019 to 2020, a tally that includes unemployment-benefits fraud. With the Government writing checks to about 10% of the working population. It is estimated that 10% of the $896 billion that was allocated to state unemployment programs have been paid improperly. Some speculate that much of this fraud has been perpetrated by people living in both the U.S and abroad. Many also feel that once the investigation is completed the price tag could exceed $200 billion. Source https://www.wsj.com/articles/unemployment-benefits-fraud-has-soared-in-the-pandemic-heres-what-to-do-11619688601

Are we back in the days of the Wild West

Economics is a study of cause and effect; we just don’t often know what the effect will be since it is often based on human behavior. With all of the riots that occurred over the past year, the push/narrative to defund the police and many police officers doing the minimum in fear of some retaliation due to cell phone videos, crime has risen and citizens have taken to protecting themselves.

In 2020 a record 39.7m federal background checks were conducted for firearm sales, and the first three months of this year set another record. This if anything is a statement of how concerned citizens are for defending themselves.

Many states are now pushing more permissive gun laws. The trend of “permitless carry” of firearms has taken off like a shot. 20 years ago, Vermont was the only state to allow people to carry handguns without a permit. Since February five states have passed new or expanded laws. It is expected to reach 20 states by the end of the year. Violent crimes are rising and with it gun sales.

A further example of how states are loosening gun laws is the growing number that are becoming “Second Amendment sanctuaries”, as Oklahoma and Arizona have already done this year, resolving not to comply with new federal gun laws which requires more background checks

In addition, this autumn the Supreme Court will hear its first gun-rights case in years. Justices will rule on whether a New York law, which makes it difficult to receive a permit to carry a gun in public for self-defence, is legal. Some argue that this would make it easier for criminals to buy guns, but criminals have no problem getting their hands on weapons, including automatic ones. Over time we will find out the impact of these laws, right or wrong, good or bad only time will tell and what the consequences will be

Source: https://www.economist.com/united-states/2021/05/01/looking-down-the-barrel-of-a-troubling-trend

Where did all of American Workers go?

With so many Americans out of work why is Corporate America having such a difficult time finding new employees?

The pandemic has led to all sorts of weird economic outcomes. So many that if feels like all the economic theories have been thrown out the window. The latest oddity is the growing number of complaints in America about a shortage of labor, that right with over 20 million people not working Corporate America cannot find help. In early April Bloomberg reported that Delta Air Lines had cancelled 100 flights for lack of staff. Employees are so hard to find that one café in Florida has turned to robots to greet customers and deliver food. A branch of McDonald’s is paying potential burger-flippers $50 just to turn up for a job interview. Does this seem crazy? Well yes, it is and the main reason for this challenge is that many of the unemployed find it easier to just sit at home and collect money from the government to watch TV. Granted the labor market has changed a number of Americans are “afraid” to go back to work, (Thanks to the Media) and number have given up looking for work, but the rest of America does not have the motivation to get out of bed. As long as the government continues to give money away, we really won’t see a change, come September when the benefits are scheduled to end, we may find politicians playing the same tune over again too many Americans need help. It seems like we’re just creating a bigger problem. Source https://www.economist.com/finance-and-economics/2021/04/29/why-are-american-workers-becoming-harder-to-find

Is Taiwan the most dangerous place on earth

Cognitive Dissonance is holding two opposing ideas, beliefs, or values in your mind at the same time.

It’s a feeling of mental discomfort and often happens when people try to justify behavior, or as F Scott Fitzgerald put it it’s the test of first-rate intelligence and still retaining the ability to function. For decades the U.S and China have exercised such high caliber ambiguity over Taiwan. Taiwan is a small Island some 100 miles off the coast of China. The leaders of China state that there is only one China and that they run it and that Taiwan is a rebellious part of it. America has agreed in part to this idea but for the last 70 years ensuring there is another, leaving the country on its own. However, this ambiguous strategy is no longer working and the U.S. fears that it is only a matter of time before China takes Taiwan by force. In fact, some are predicting that this takeover may happen within the next 5 years.

Why is Taiwan so important now? It is the leading chip maker in the world, accounting for 84% of the most advanced chips needed for just about everything from Cars to phones.

But there is a bigger reason Taiwan is an arena for the rivalry between China and America. Although the United States is not treaty-bound to defend Taiwan, a Chinese assault would be a test of America’s military might and its diplomatic and political resolve. If the U.S would allow China to take over Taiwan, Pax Americana would collapse and China would undoubtably be the dominant economic power in the world. Source: https://www.economist.com/leaders/2021/05/01/the-most-dangerous-place-on-earth

The Week Ahead

U.S. government bond prices are showing some weakness on the heels of the latest Fed meeting. While the Fed is encouraged by the economic recovery, it seems that short-term interest rates are unlikely to budge until the unemployment rate returns to near pre-pandemic levels.

Later this week we’ll get an update on that number along with the ADP jobs report. As we look towards later this year it will be interesting to see if the Fed starts to talk of tapering bond purchases as a first step to tighter policy.

Earnings season is winding down, but despite the market’s muted reaction to last week’s impressive results, the good news is that the outlook for earnings estimates has increased to 28% growth for 2021, up from 21% at the beginning of the year. Given the amount of economic stimulus completed and proposed, the equity market can ill-afford any bottom-line reductions. A few more important economic data points for this week include today’s U.S. ISM Manufacturing PMI, Tuesday’s U.S. Trade Balance, and Wednesday’s U.S. ISM Services PMI. The week finishes up with Eurozone Retail Sales and U.S. Consumer Credit update

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/