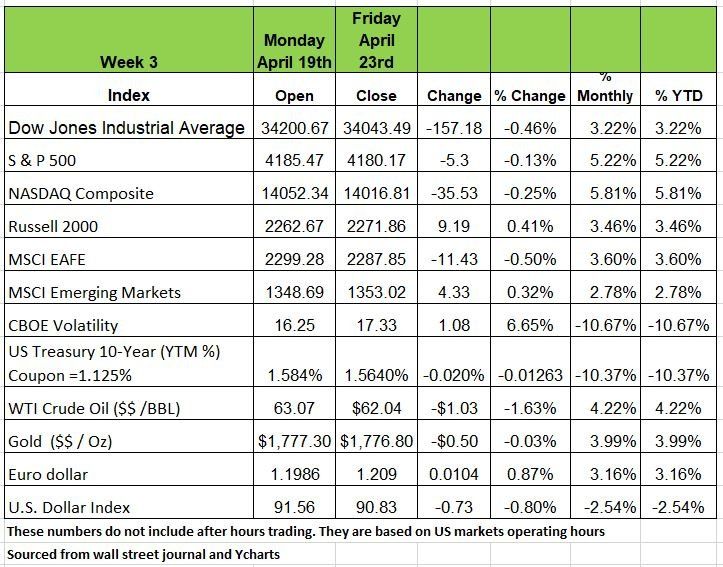

Is the Economy picking up Speed & Other Economic News for

Week Ending 4-23-21

The Fed’s assumption is that inflation is not a significant risk as long as there is excess capacity in the labor market suggesting that wage growth will remain slow. interim inflation is expected to be the result of temporary factors such as shortages of certain goods due to bottlenecks in shipping created by the pandemic.

By most measures, inflation is still relatively low. You can also see that the consumer price index (CPI) has surged, but much of that is due to base effects (last year’s drop in prices). Given the metric is reported in year-over-year terms, the strong gain reflects the depressed prices/demand we saw at this point last year (the depths of the pandemic). Many don’t think, CPI will likely stay elevated at its current level, since much of inflation is driven by wage increases, but with so many companies looking to fill positions and many people having little incentive to go back to work while on the fed’s payroll, so if wages do rise in order to fill positions, many may be eating their words but we don’t think that it would be on a scale of a 1970s-style inflation.

Faster economic growth in Q1 brought a larger trade deficit (at least through February), a by-product of a faster recovery in the US than in Europe. At present, we’re projecting net exports will subtract 1.1 points from real GDP growth in Q1.

Inventories look like they fell in Q1 as businesses that had supply-chain issues had to dip into inventories to meet strong consumer demand. Look for businesses to re-stock shelves and showrooms in the second quarter. We are estimating that inventories subtracted 1.2 points from real GDP growth rate for Q1.

Add it all up, and we get 7.0% annualized real GDP growth for the first quarter. That’s very high by historical standards, but the economy has much further to go to reach a full recovery

U.S. stocks and economy: Picking up steam

The U.S. economy remains on solid ground as we continue to move into a period of exceptional growth. Economists are estimating gross domestic product (GDP) to grow anywhere from 6% to 8% this year—the fastest pace since 1983. But again, keep in mind that the base line is significantly lower since last year when we came to an economic halt. This plus 3 rounds of money infused into the economy from Uncle Sam are reasons for such large results.

A brighter viewpoint can be seen by a reacceleration in the labor market. Growth in nonfarm payrolls in March was quite strong—with 916,000 jobs added and an upward revision of nearly 90,000 in February. The downside is that we still have nearly 8.5 million plus jobs to regain to get back to pre-pandemic levels. Fortunately, nearly every sector added jobs in March and those industries tied closely to the economy’s reopening (such as leisure and hospitality) made substantial gains.

Job openings—as measured by the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics—have sharply recovered, surpassing their pre-pandemic levels. Openings in February reached 7.37 million, just 171,000 below the record high in November 2018. JOLTS is a leading indicator, the resumption in strength confirms the broader improvement in the labor market’s health.

Job openings have rebounded swiftly as payroll gains have accelerated Expectations of rapid growth this year, along with still-accommodative monetary and fiscal policy, have stirred up inflationary concerns, which have already been confirmed by the sharp increases in prices paid by businesses surveyed by the Institute for Supply Management (ISM). You can see in the next chart that these components are well above 50—the point that signals expansion versus contraction—which underscores the pressure companies are facing with rising costs.

Existing home sales slip, while prices surge

Throughout the last 13 months, housing has buoyed much of the economy, there was a migration of city inhabitants, (living in high rises, close to the office, now working from home, needing more elbow room) to move to the burbs, as cities became desolate & services were either not available or vastly reduced.

We’ve seen new starts and permits on the rise. But, the surge in demand has caused prices to skyrocket. The median home price rose +5.9% M/M in March and is now up 17.2% Y/Y. Keep in mind that the peak growth rate of home prices in the housing bubble was in October 2005 at 16.6%!

Existing home sales fell 3.7% in March to a 6.01-million/unit annual rate, a seven-month low, and weaker than the consensus of a 6.03-million-unit rate. Sales fell across the country, driven by a 4.3% decline in single-family homes, (low supply) while condo/co-ops edged up 1.4% (large supply cheap prices). Even so, existing home sales increased 12.3% from a year ago. On average, homes sold in 18 days, a record short time. It shows immense buyer interest, despite the recent increase in mortgage rates. The decline last month was the second in a row, largely attributed to tight housing inventory. Indeed, at 1.07 million units, inventory was 28.2% lower than a year ago. Months’ available supply edged up marginally to 2.1, barely off its record low of 1.9 from a couple of months ago.

Initial jobless claims reach a new pandemic low

As we have stated many times in past newsletters Employment is the key to a recovery from this pandemic induced recession. Right now, many of the economic indicators appear to look favorable but the most important indicator has deep rooted issues. While initial claims for unemployment insurance fell 39,000 last week to 547,000, the lowest level since mid-March 2020, and well below the consensus of 608,000. The four-week average of claims slid to 651,000, also the lowest level in nearly a year, as layoffs continued to trend down.

However, continuing claims; the total number of claims (both state and federal) rose by nearly half a million to 17.4 million. In addition, we have 6.9 million people that dropped out of the work force since the pandemic shut down started and another 5.8 million that are working part time and would prefer full time work This number seems to be extremely high considering the number of “help wanted” signs posted everywhere. I guess we will see what happens in September once the extend government aid is over. Keep this in mind the economy and the market are being propped up by the government, the first time in history this has happened. The number we are sharing and what the media is reporting is based on all-time lows, they are not based on pre pandemic levels, we still have a lot of debt to address, not just Federal, but personal and corporate debt.

Consumer economic expectations rise

Economic can often be an intimidating subject and with all of the numbers and data thrown around difficult for many to absorb, but at the end of the day economics boils down to one thing and one thing only, Consumer Confidence. Nothing more, if you have a dollar in your pocket today and know you will get another dollar tomorrow will you spend it today? Our current economic condition has proven this theory. With the Federal government dropping trillions of dollars” helicopter money” on a financially stress public, that ran to the stores and purchased high ticket items (consumer discretionary sector) they could not afford, while working. Knowing that the government would be there tomorrow.

With that last week the Langer Survey of Economic Expectations for April, the share of optimists about the future direction of the economy rose to 33%, the highest level since February 2020, while the share of pessimists slipped to 31%. As a result, the net share of optimists was positive for the first time also since February 2020.

Separately, the weekly Langer Consumer Comfort Index gained 0.3 points to 54.2, its highest level in over a year. Although still below its pre-pandemic level, the increase in Comfort bodes well for the outlook for consumer spending growth in the near-term. I guess we will see what these numbers look like in September when the Feds allowance stops.

The Week Ahead

An eventful week awaits. It kicks off bright and early today with the U.S. Durable Goods report. Tuesday we’ll see Consumer Confidence numbers before getting to the week’s main events. The Federal Reserve will not likely change monetary policy at Wednesday’s meeting, but with economic data improving and inflation looking like it will hit 4%, market observers will be listening closely for any clues about a shift in strategy.

The U.S. dollar has been under pressure, and that may remain the case with higher yielding currencies available. On Thursday we’ll get our first look at Q1 GDP, with strong growth of 6.6% expected. The main event everyone is waiting for this week are earnings reports, about a third of S&P500 companies, many of the important names in the Nasdaq-100 index, such as Apple, Amazon, Facebook, Microsoft, and Google.

The Nasdaq-100 sits just below all-time highs, and investors will be watching important support levels on any weakness. The week will close out with U.S. pending home sales and several GDP reports from Europe and Canada. Stay Tuned

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/