A fed Warning & Other Economic News for the Week Ending

May 7th 2021

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue.

Week in Review

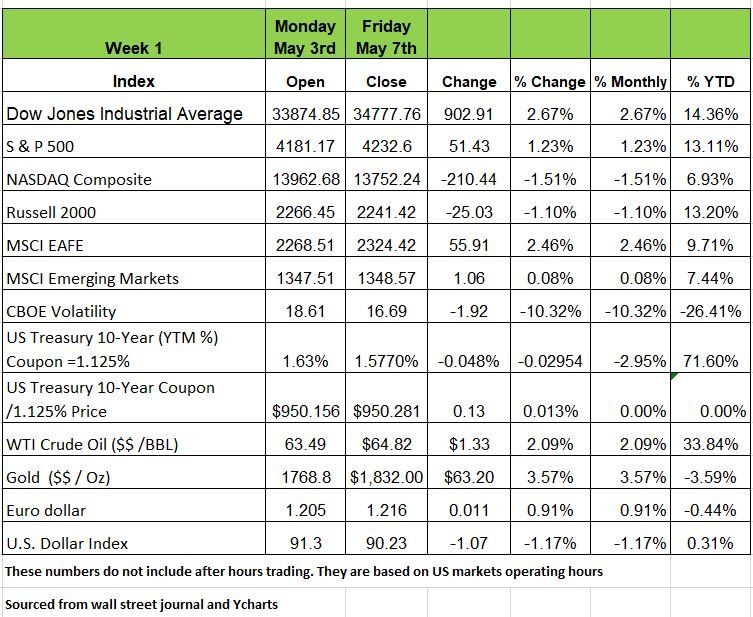

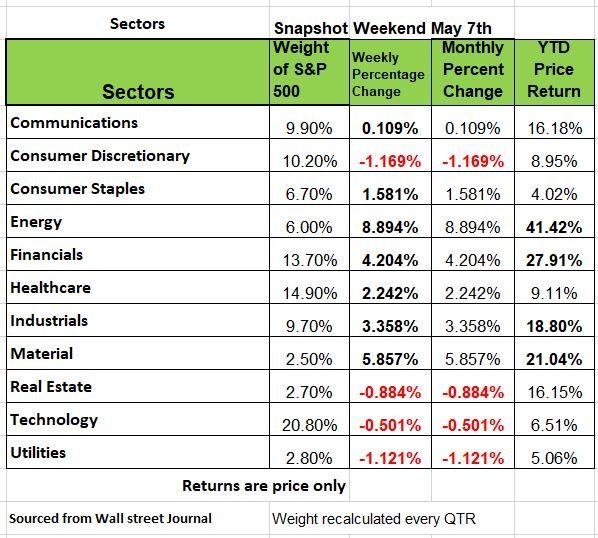

With disappointing economic news, the markets had mixed reactions. The Dow was up 2.67% for the week and the S&P 500 was + 1.23% while the Russell and the NASDQ were down -1.10% and -1.51% respectively. Value stocks again outpaced growth by more than 2%, and earnings from high-growth companies frustrated investors. Seven of 11 S&P500 sectors gained with the inflation theme leading the way. Energy rocketed more than 8.5% higher, and materials jumped nearly 6%, with industrials, financials and healthcare also posting solid gains

The employment news is what put most economist on edge, but the markets’ positive reaction was about more government support. Could we be treading on more dangerous economic territory?

While many are buying into the inflation narrative the Fed is holding its position that the inflation, we are seeing is not systemic and only transitory. However, the Fed is concerned about high asset valuations and prices in the market which is basically Irrational exuberance. At some point in time, probably the near future many who are jumping on this Market band wagon will get a lesson about herding and over paying for a security.

Treasury yields fell, although they recovered from a sharp spike lower after Friday’s jobs data. The ISM Manufacturing and Services PMIs both came in below expectations but remained solidly expansionary. Gold prices rose 4%, breaking out of an 8- month descending channel. In the Eurozone, March retail sales rose 2.7% MoM and 12% YoY, handily beating expectations as the bloc’s recovery gathered steam. The UK Central Bank upgraded its economic outlook to +7.25% from +5% and expects inflation to run above 2%, pushing the British Pound towards 1.40 versus the dollar. The U.S. trade deficit hit a record high of $74.4 billion in March on strong demand for foreign goods, and the shortfall with China increased 22%.

More Fixed Income

U.S. Treasury bond yields were down across the yield curve last week. The risk-off sentiment during the week was largely fueled by mixed economic reports. The ISM Manufacturing and Non-Manufacturing Indexes, which are based on industry survey data, both came in lighter than expected for the month of April.

Though both indexes still signaled economic expansion. Investors digested a softer-than-expected jobs report on Friday. Nonfarm payrolls increased 266,000 in the month of April, which was well short of the consensus expected level of 1,000,000 as increased government unemployment benefits persist.

The largest increase in jobs during last month came from the leisure and hospitality sector. Unemployment ticked up 0.1% in the month of April to 6.1% overall. More encouragingly, average hourly earnings rose by 0.7% and aggregate hours worked increased 0.5% last month. While many people are enjoying the extra pay from Uncle Sam there is a concern amongst economist about how much stimulus is too much and if it will result in runaway inflation. Simply put, employment is the key to recovery, not government spending.

The Unemployment Narrative

The jobs report that came out last Friday was disappointing to say the least. With an addition of 266K jobs added to the economy far short of the 1 MM mark economist had forecasted. The debate started immediately over why the numbers were so low. One narrative is that people have no incentive to get off the couch and look for work with the extra $300/week on top of regular unemployment benefits, the net difference is not enough to push people to take jobs they normally would. The other side is stating that because schools are still not open, one parent is forced to stay at home with children and that because supplies chains are still backed up some effecting certain sectors of the economy like automotive that use semiconductors in all autos. Many may be waiting for their specific jobs to return which may never. While much of the current 18 million currently not working is from the leisure sector, hotels and restaurants, the catch 22 is that spending won’t go up if people can’t get served. Lastly Delta airlines had to cancel over 100 flights because of a lack of workers. If the current administration continues the victim narrative and adds another round of benefits after the Sept expiration. We may find ourselves in deep economic trouble. We all need to get back to work and stop worrying. Source: https://www.wsj.com/articles/april-jobs-report-unemployment-rate-2021-11620332156

Fed warns about potential for ‘significant declines’

in asset prices as valuations climb

What is the security you’re thinking of buying really worth? What about the securities in your portfolio, are they overvalued? Are you continuing to add money to your index & Mutual funds blindly, to ride the wave, without knowing exactly what’s in them?

In its semiannual Financial Stability Report, the central bank said that while our financial system has remained largely stable, even through the Covid-19 pandemic, future dangers are rising, in particular the current aggressive run-on stocks. What happens should they tail off?

The report stated “High asset prices in part reflect the continued low level of Treasury yields. However, valuations for some assets are elevated relative to historical norms even when using measures that account for Treasury yields.” The Central bank said “In this setting, asset prices may be vulnerable to significant declines should risk appetite fall.”

Rising asset prices are posing increasing threats to the financial system, the Federal Reserve warned in a report Thursday.

Fed Governor Lael Brainard said the situation bears watching and points up the importance of making sure the system has proper safeguards.

“Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year,” Brainard said. “The

combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.”

Source:

https://www.cnbc.com/2021/05/06/fed-warns-of-possible-significant-declines-in-stocks-as-valuations-climb.html

Record Indebtedness

We’ve read that too much debt saps the vitality out of an economy – instead of growing, cash is used to pay debt service. Since the autumn of 2019, debt has ballooned. A significant number of Below Investment Grade (known as BIG) companies have issued heaps of new debt. Then there is the Federal debt. The huge Obama stimulus package was less than $1 trillion; today, just about every spending bill is expressed in “Triliions” a bit crazy.

There is so much new U.S. government debt that, despite being rated the highest quality of all sovereign debt, and despite sporting the highest yield of any major sovereign issuer, there is so much of it that the auctions for new paper are considered “sloppy,” meaning that the bid/cover ratio is well below “normal.” The amount of leverage and “margin” in the equity markets and the fact that U.S. households are now holding record amounts of equity securities may be problematic. What happens to household spending if there is an equity market “correction,” especially a significant one?

Home and Equity Observations

Over the past year, we’ve seen record annual home price increases (17+% Y/Y), higher than in the Housing bubble. In that bubble, while home prices were rising double digits, wages were also rising (6%+/year). Wage growth today is well below that despite news stories about companies offering higher starting wages. We’ve already seen slowing in existing home sales and in new mortgage applications due to the rise in interest rates over the past few months and low inventories.

The cost to build homes has risen because commodities have become scarce. Lumber prices have risen because mills closed, because of new tariffs, and because of transportation issues due to pandemic rules. This will correct once the economy completely reopens. Some of the other commodities, like copper, have also risen in price because China was stockpiling. But, now China’s economy isn’t growing as it was pre-pandemic, and, in fact, their stock market peaked last September. So, we may be seeing a topping process in the commodity markets.

As for Equities are the other important asset in today’s world. Here are a few facts:

Today’s earnings forecasts for Q4/2021 S&P 500 earnings is $48.20.

In December, 2019, the earnings forecast for the same quarter (Q4/2021) was $52.20. Thus, today’s earnings forecast is 7.7% lower.

On the last trading day of 2019, the S&P 500 was 3230.78. On Friday, April 30, it was 29.4% higher (4181.17).

So do you think valuations are sky high? No kidding. One popular valuation metric is the Shiller Cyclically Adjusted PE ratio (known as the CAPE ratio). This is the second highest valuation ever for this metric (only higher in dot.com). It is currently 2.5 standard deviations above its mean. For those who believe in mean reversion…

Capital Markets economist John Higgins, in his April 25 note on Asset Allocation, concluded “that the upside for the S&P 500 over the next few years will be limited.” Maybe we should just take our profit and be happy for what we made this past year

Our Week Ahead

Treasury Secretary Janet Yellen made a comment last week suggesting a rate hike which briefly sent tremors through risk markets, while Fed members continued to deflect inflation concerns. There are several speeches by FOMC members scheduled this week, so we’ll see if they maintain a united front. The 10-year treasury yield dipped below 1.5% for the first time in nearly two months, but the technical trend remains largely sideways.

Much of this week’s data will be released on Wednesday, with U.S. CPI, Eurozone economic forecasts, and crude oil inventories all on tap. Oil inventories could be an important figure after last week’s surprise drawdown, as oil prices float near 52-week highs and energy stocks remain well bid.

We will watch to see if the downward trend in unemployment claims continues as companies scramble to hire qualified workers, then rounding out the week, U.S. retail sales are expected to come in strong again following last month’s nearly 10% jump.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/