Economic Outlook

Week Ending Dec 18th, 2020

Week In Review

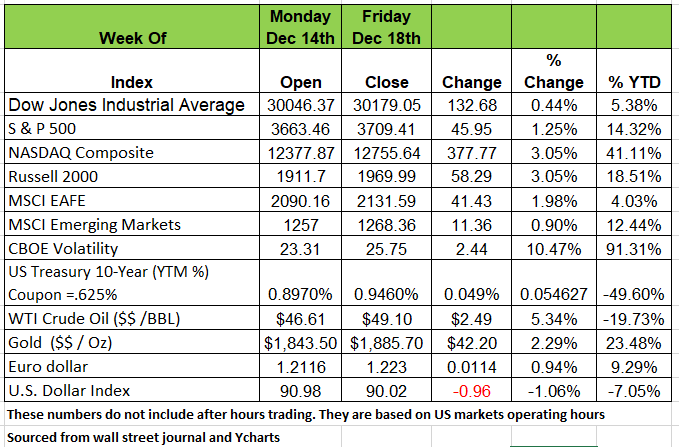

While equities were setting record highs, so was unemployment. There is currently a disconnect between the market and reality. The Dow was up 132 points last week and YTD it has returned 5.38%

The YTD return of the other indices are S&P 500 14.32% NASDAQ a whopping 41.1% and the Russell 2000 at 18.51%. This seems to be difficult to understand with unemployment numbers at all-time highs at least in my lifetime. The DXY (dollar Index) fell below 90 last Friday to 89.4 but rebound slightly by days end to 90.02. This is an important number to keep an eye on as it is a measure of strength of the U.S. dollar. The more it falls the weaker the dollar and the cost of imports.

Treasury yields were seen increasing last week too, as signs of progress for a new Fiscal Relief package were observed by Congress. Indications were for a $900 Billion dollar package and Treasury yields moved around the news. All sectors were in positive territory last week except for Communications (-0.46%) and Energy (-4.25%).

The shortened week will have no shortage of economic data as GDP, home sales, and employment data are all set to be released.

Apple Changes the landscape again

Have you ever clicked on a story on either your iPhone or iPad and seen more advertisements than content of the story that interested you? I have and got into the habit of just not bothering anymore out of frustrating from all the garbage that bombarded me. Well Apple is doing something about that

Apple is making a huge change to settings on users’ iPhones in the name of privacy, and it will fundamentally change mobile advertising on those devices. The change will essentially take a privacy option that was previously buried deep in users’ phones and put it front and center when they open an app. It’s expected to drastically impact the ability of advertisers to target ads the way they have been.

Companies in the space are figuring out how to move forward in a way that doesn’t break the new rules, so they don’t get kicked out of Apple’s App Store. Source https://www.cnbc.com/2020/12/15/apples-seismic-change-to-the-mobile-ad-industry-draws-near.html

Employment and the Economy

The week ending December 12th (which is the week the (Bureau of Labor Static’s employment surveys were taken) saw an uptick of 965K in Initial Unemployment Claims (ICs) in the state programs, the highest level since the end of July. The IC’s in the temporary PUA programs were 455K, the highest level since the end of September. Together, both programs totaled nearly 1.4 million. They were hovering at just over 1.0 million for most of October and November, so, clearly, a marked deterioration in the labor force. continuing unemployment claims remain above 20 million and that does not include those who have exhausted their benefits or those who have simply given up looking for work.

Budget Gap

The U.S. budget deficit widened by 25% in October and November from the same period in 2019 to $429 billion, a record for the first two months of the fiscal year. Higher spending and shrinking revenue tied to the coronavirus pandemic and the resulting economic damage pushed the deficit higher. Federal spending rose 9% to $887 billion during October and November over the same period in 2019, while revenue declined 3% to $457 billion.

The Higher spending to combat the coronavirus was driven largely by increases on our safety-net programs. This includes an increase of 36% by the Agriculture Department, which administers the Supplemental Nutrition Assistance Program, (aka food stamps) Medicaid increased 16%. Labor Department spending on jobless benefits rose to $45.1 billion in October and November. Source https://www.wsj.com/articles/u-s-budget-gap-widened-25-in-first-two-months-of-fiscal-year-11607626849?st=jx3d2prrbgsg0z7&reflink=desktopwebshare_permalink

A light in the tunnel

Remember the old adage “When the going gets tough, the tough get going”? Well, this pandemic has proven this old saying to be true in more ways than one. When looking at those entrepreneurs that will come out of this situation on the other side of failure, we will find a lot of lessons. One might just be attitude. When we look at those that are succeeding, we are finding a common element. Those that attack the challenges of the pandemic are doing so with the same level of enthusiasm that got them into the business in the first place. Let’s take our own local company Lettuce Entertain You Enterprises. The company has re-launched some old familiar concepts as well as a number of new concepts in their existing restaurants. Ben Pao is now serving out of Hub 51, Vong’s TK out of Shaws, Costal Soups out of Summer House and many more.

In Brooklyn NY in the Park Slop fifth Ave business district 37 new ventures opened up. The strip which houses more than 500 restaurants, beauty shops, yoga studios and other small businesses have found opportunity. While 32 privately held business have closed, those that have survived say they will stick it out in the hopes of a post-vaccine rebound in the spring. “The closings have slowed down,” said Mark Caserta, head of the Business Improvement District. Rent deals with landlords and creative ways to bring in revenue have helped, “They’re always finding a way to stay open,” he said. Source: https://www.wsj.com/articles/new-business-owners-look-beyond-covid-19-and-winter-11608120001?st=y1sxdy47gjg8k9g&reflink=desktopwebshare_permalink

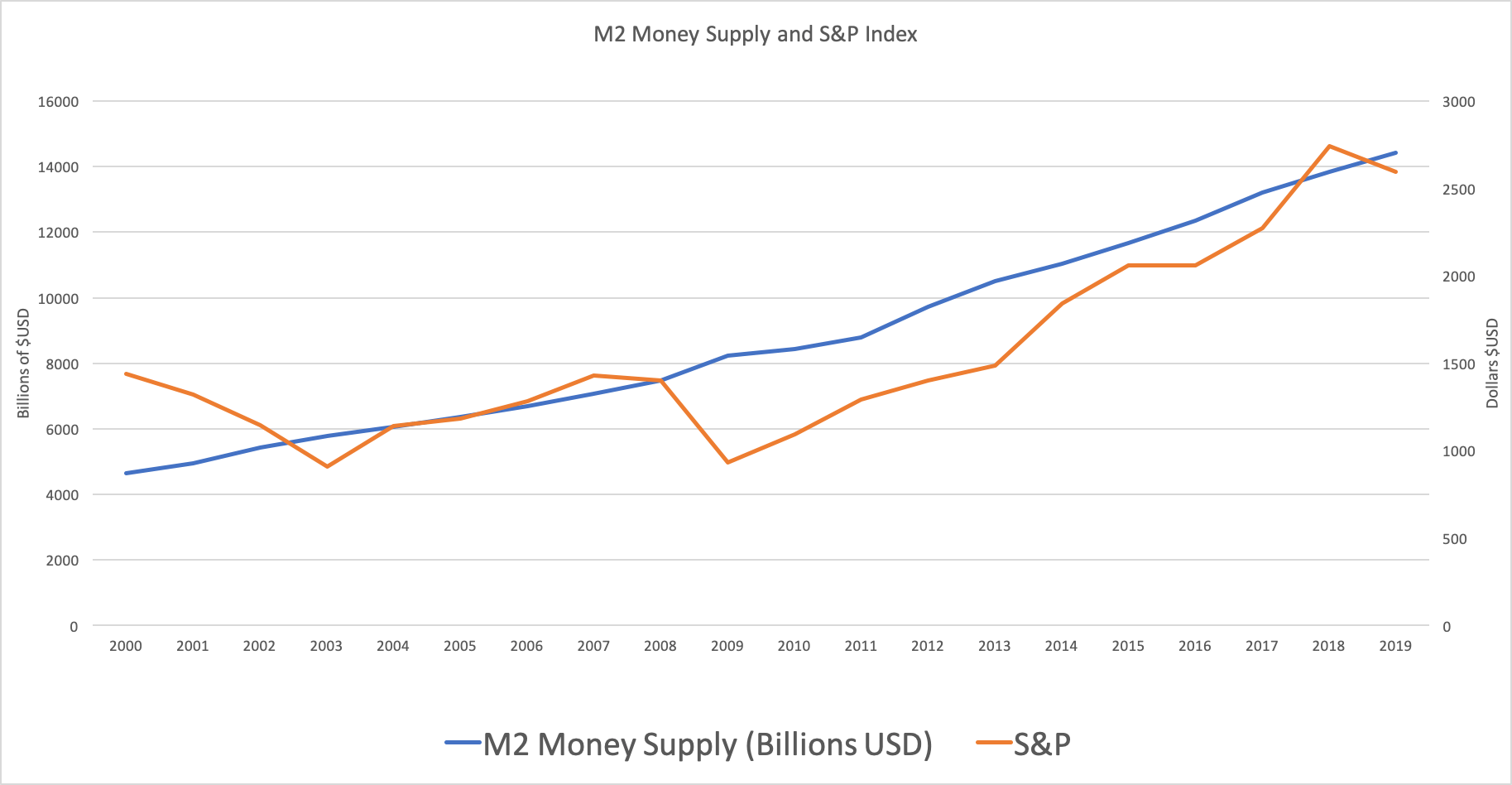

Wealth Gap

Wealth inequality appears to be a by-product of easy money government policy. There is a concept called the “Gini Coefficient” which measures income inequality. The higher the Gini Coefficient, the more skewed the income shares are to the higher earners. The chart below graphs the Gini Coefficient and M2 since 2000. As easy money has come to dominate the scene, as indicated by rapidly rising M2, so has income inequality. The correlation coefficient between M2 and Gini is a whopping .86. This shouldn’t be a surprise, as we have seen that M2 and the S&P 500 are also highly correlated. Easy money and a rising money supply cause asset inflation which benefits the higher income classes.

In addition, there appears to be no end in sight for such easy money, deficit spending (supported by Fed debt monetization), and Fed lending to zombie companies.

Everyone knows that equities are “overvalued” from an historic and economic fundamental perspective. Low interest rates (0% cost of capital) etc. are used to “explain” that markets aren’t really overvalued and that “this time is different.” But we all know better. These “explanations” are market excuses to keep the party going, and the Fed has promised not to remove the spiked punch anytime soon, and not before giving plenty of advance-warning. Markets may very well stay overvalued, especially if the monetary aggregates continue to grow and newly printed money has no place to find a home except in financial assets. Source Bob Barone Phd FourStar Wealth Advisors inhouse Economist

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/