Markets and Economic Climate

July 24th, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

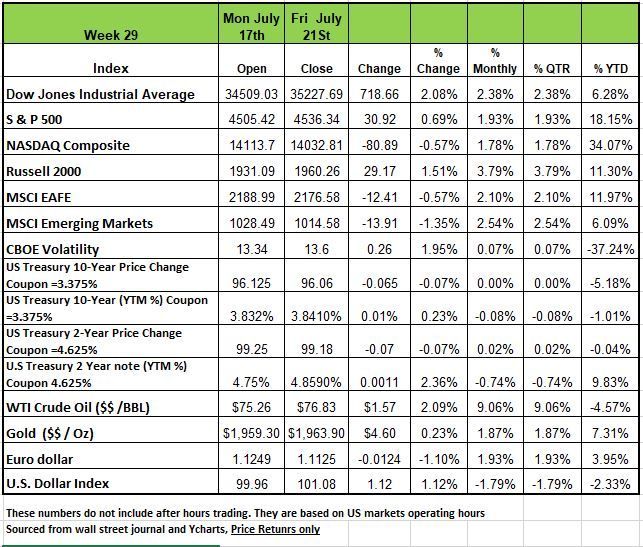

Three of the 4 major indices posted positive returns for the week, with the NASDAQ being one to post a negative return of -.57%. the other 3 were led by the energy, health care and financial sectors as most Q2 earnings reports came in above analysts' estimates.

The market benchmark S&P 500 index ended the week at 4,536.34, up from last Friday's closing price of 4,505.42. The index is now up 1.9% for the month to date and up +18% for the year to date.

The weekly rise came as several companies posted Q2 financial results that surpassed Wall Street consensus views. Investors had feared this quarter's results would suffer under the pressures of inflation and interest rate increases, but many of the reports released so far have shown that companies are doing better than expected while coping with those challenges. We’ll address some of this in our views below.

Treasury yields were mostly higher throughout the week, with only longer duration yields (10 Yr. and 30 Yr.) finishing the week lower. Yields fell early in the week after softer-than-expected China growth data and U.K. CPI data that came in at its lowest level in more than a year. On Thursday, Treasury yields rebounded after initial jobless benefit claims fell to a two-month low, reaffirming the strength of the U.S. labor market. Fed funds futures traders are pricing in an almost 100% chance that the Federal Reserve will raise rates by another quarter point at Wednesday’s meeting, which would bring the target to 5.25% - 5.50%. Industrial production declined 0.5% in June, falling for the second month in a row with every major category contributing to the drop. Retail sales rose 0.2% in June, though they lagged consensus expectations of a 0.5% gain. Housing starts in June also lagged expectations, declining 8.0% as all four major regions contributed to the decline.

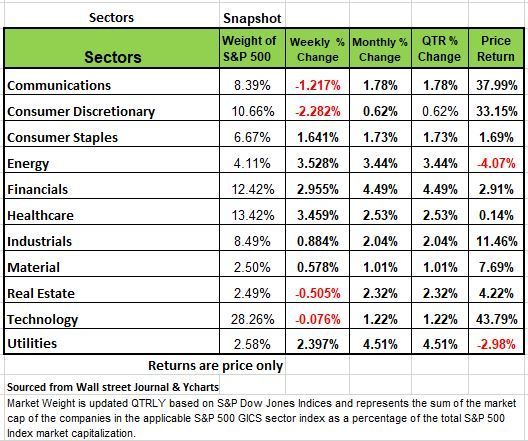

Seven of the 11 S&P sectors posted positive returns on the week led by the energy and healthcare sectors, climbing +3.5% each, followed by a +3.0% rise in financials. Other gainers included utilities+2.39%, consumer staples +1.64%, industrials, and materials both posted below 1%.

The four sectors that were in the red were communication services, down -3.0%, and consumer discretionary, down -2.3%. Real estate and technology also edged lower by less than 1%.

The climb in energy came as natural gas futures rose week over week. Gainers included shares of EQT Corp. (EQT), which climbed 4.4% as the natural gas production company named a new chief financial officer,

In health care, shares of Elevance Health (ELV) jumped +8.5%. The health benefits company reported bigger-than-expected increases in Q2 results as membership and premiums advanced year over year, leading the company to lift its full-year guidance for adjusted earnings per share. Shares of Johnson & Johnson (JNJ) rose +6.5% as the health products company reported Q2 results above analysts' expectations and boosted its full-year guidance.

The financial sector's advance was led by Zions Bancorp (ZION), whose shares jumped +18% this week as the regional bank reported Q2 earnings per share and revenue above analysts' mean estimates. Shares of Bank of America (BAC) rose +9.9% as its Q2 results also topped Wall Street's expectations, boosted by a combination of higher interest rates and continued organic client growth and activity across the bank's businesses.

On the downside, the decliners in communication services included Omnicom Group (OMC), whose shares fell -13% as the marketing communications company's Q2 revenue fell short of Wall Street's estimates. The company warned that it expects to continue to face "economic uncertainty" for the remainder of the year.

In consumer discretionary, shares of Tesla (TSLA) weighed with a -7.6% drop for the week. The electric vehicle manufacturer's Q2 revenue and adjusted earnings per share came in above Street views, but Chief Executive Elon Musk also warned that the company expects Q3 production "will be a little bit down" and said the company might need to cut prices further.

This week all eye will be on the two-day Federal Open Market Committee meeting will also be in focus, along with an initial estimate of Q2 gross domestic product on Thursday and key inflation data on Friday.

For the last 12 months many economists have had a negative view of the direction of the U.S. Economy, we will honestly say we are in that camp. Many economists spend their life studying past economic situations trying to look for similarities that will lead to a similar future outcome.

When we exam the evolution of the US economy and specifically the impact of monetary policy, (expansive or contractionary) one important challenge this year is not what has happened but rather what has not happened, when comparing outcomes to the past. This is a very strange situation. It goes against all of the theories and rules of economics. With rising interest rates, one would think that corporate interest payments would increase but payments in many cases actually fell.

So how did this seem to happen? It appears that many US businesses successfully navigated an extreme cycle of monetary tightening without sparking a recession (layoffs) or at least not just yet.

Since the Federal Reserve began aggressively hiking interest rates last year, more and more economists warned that a US recession was imminent. But that recession has not yet arrived, or it has been delayed significantly even after reliable indicators like the inverted yield curve flashed red flags.

As we have mentioned in past blogs, economics has become the study of behavior with respect to commerce. Historically when the Fed has raised interest rates, companies have laid off workers to keep their company’s financial health intact. The past 12 months have gone against this past trend.

It is a phenomenon that has meant that interest-rate risk has not translated into any material credit risk across the broad spectrum of the economy. There are issues in the commercial real estate sector.

Here are a few things to keep in mind.

Despite 10 consecutive interest-rate increases, which constitute the most concentrated Federal Reserve rate cycle in decades, the labor market has not experienced any significant weakening. Monthly job creation, unemployment rates, and wage growth have remained impressively robust. However, those that left the labor force during the pandemic and took early retirement may find themselves back looking for work when their savings run out. Higher prices have eroded those savings a lot quicker.

The March bank disruptions produced the two largest failures in recent US history, the impact has not spread throughout the financial system, whether to other regional banks or highly leveraged non-bank financial institutions (NBFIs).

Additionally, last week’s inflation readings, both at the producer and consumer levels, were better than expected, further supporting the notion of a soft landing for the economy. This completes the prediction that started late last year when the soft-landing narrative gave way to expectations of a hard landing, no landing, crash landing, hard landing again, and now back to a soft landing.

So, What happened?

In looking back to at least 1975, corporate net interest payments would rise as the Fed raised interest rates. But for the first time in a long time, that isn't happening. Instead, as the Fed raised rates aggressively over the past 15 months, corporate net interest payments actually fell.

Normally when interest rates rise, so do net debt payments, squeezing profit margins, increasing layoffs, and slowing the economy. But not this time.

So, what exactly is happening? Well, there are several factors.

It turns out that during the long period of near-zero interest rates, (another unusual economic factor) especially leading up to the pandemic and during the pandemic, many corporations with good management took advantage and refinanced a ton of their liabilities into long-term, low-rate, fixed debt.

So, this means that many companies bought themselves some time to navigate higher rate environment. In looking at the debt composition of S&P 500 companies includes just 6% in short-term floating rate debt, just 8% in long-term floating rate debt, 10% in short-term fixed debt, and a whopping 76% in long-term fixed debt. Smart managers took advantage of the low interest rates, they have effectively played the yield curve in reverse and have become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual. This according to Societe Generale's Albert Edwards. The flip side of this situation is that banks that provided those loans are not receiving the revenue that they would typically get in a rising interest rate environment, so someone has to pay, and the banks seem to be the one footing the bill. Many smaller banks have stopped taking in new deposits and making loans since they have requirements of loans to deposit ratios.

The lack of a profit decline means companies didn't have to resort to a big wave of layoffs that would have dented the economy and thrown it into a recession. Companies have reduced work hours in order to hold onto employees in fear of labor shortage issues. But few significant layoffs other than the tech sector which those employees seem to have found work quickly.

For the short term it seems that interest rates are not impacting the economy as they once did. For those believers that we will experience a soft landing their concept seems to be based on 3 hypotheses

- Inflation will continue to decline in a consistent linear fashion;

- The Fed will cease raising rates after this month and then cut them, ensuring the economy avoids an overtightening, that could trigger a recession;

- The economy possesses enough resilience to absorb the delayed effects of the rate hikes; and both banks and NBFIs have strong-enough balance sheets and retain affordable refinancing channels.

This theory is highly accommodating for markets, supporting both risky and risk-free assets. Consequently, both stocks and government bonds have already experienced encouraging price increases. If the soft-landing narrative becomes more entrenched in the market psyche, rallies will broaden and deepen. The expansion of margins that has bolstered stocks so far will be accompanied by the lifting of concerns regarding earnings growth. Government bonds (higher coupon) will benefit if a more dovish forward policy guidance comes from the Fed. However, just because market participants expect rates cuts does not mean it will happen.

The probability of a soft landing will depend on several factors:

Inflation: During what is likely to be a three-month period of relatively favorable data, it is essential to monitor that services inflation stops before a likely reversal in the disinflation trend of the goods sector.

The Fed: Policymakers need to feel confident that they will not be tricked by another economic head fake such as the one in mid-2021.

The Economy: Households and corporations need to demonstrate underlying resilience to allow for the absorption of the lagged effects of rate hikes. It seems like many people that took early retirement and spent down savings faster than anticipated are starting to show up in the labor force, we’ll need a little more time to see if this is happening to a broader segment of the older population.

Financial Stability: Regional banks need to maintain sufficient cost-effective funding and leveraged NBFIs need to refinance or absorb in an orderly fashion loss on commitments made during times of low-interest rates and abundant liquidity or both.

For now, markets have largely brushed aside these four concerns because of strong technical influences. However, it is important to remember that technical analysis can drive the market only so far. Fundamental factors are likely to regain prominence in the coming months, although the precise configuration of these factors remains intriguingly uncertain, especially since earnings are looking good for Q2. Reference source Mohammed El-Erian

Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

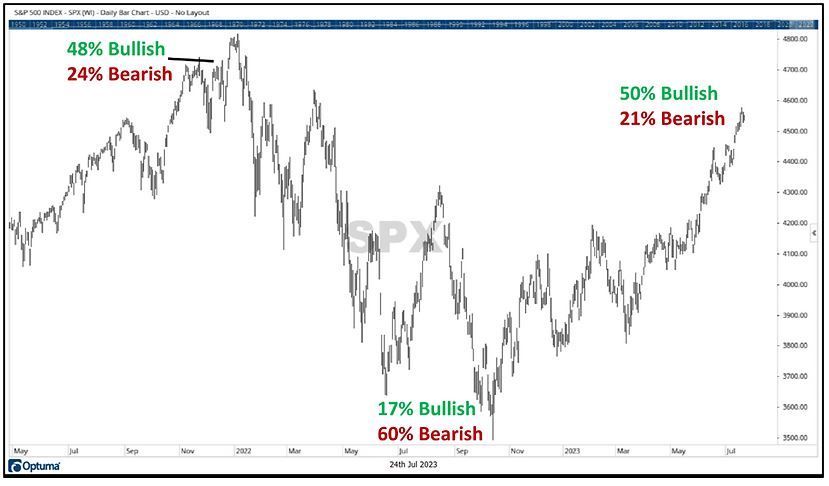

The Investor Sentiment Survey, which is produced by the American Association of Individual Investors (AAII), is a weekly survey that asks individuals whether they have a bullish, neutral, or bearish perspective on the markets right now. The survey results illustrate investor optimism (or pessimism) regarding where they think the markets will be in six months.

Latest Survey Results

For the first time since April 2021, sentiment survey results showed that more than 50% of investors surveyed were bullish on the markets. Additionally, only 21.5% held a bearish point of view, the lowest since June 2021. Given these results, it appears investors have worked off the extreme recession fears that we heard about last year. There is nothing that will raise market optimism quite like higher prices.

What do the latest Sentiment Survey results tell us?

The sentiment survey is often viewed as a contrarian indicator. As stated directly on the AAII’s website, “If you're looking at the AAII Investor Sentiment Survey for guidance on the possible future direction of the market, it's important to understand that it is deemed a contrarian indicator… A contrarian indicator tells investors that it may be a good time to go in the opposite direction of the herd.”

As an example of the contrarian nature of this indicator, just prior to the S&P 500’s peak in November 2021, bullish sentiment hit a high at 48%, while bearish sentiment registered at 24%. Then, nearly a year later, as the market neared its low in September 2022, bullish sentiment was also at its low of 17%, while bearish sentiment was above 60%. Now as the market has rebounded, bullish sentiment is yet again at a high, while bearish sentiment is now at a low.

Markets tend to be counterintuitive. In many cases, they will do the opposite of what the masses expect them to do. Investor pessimism reached a high back in October as the S&P 500 reached a low point, before heading up. Now, as markets have improved, investors have become increasingly optimistic.

High levels of optimism can remain for extended periods of time, but at some point, will revert to the average. As evidence shows, this would mean that the market would decline to lower investor optimism.

Market Trends

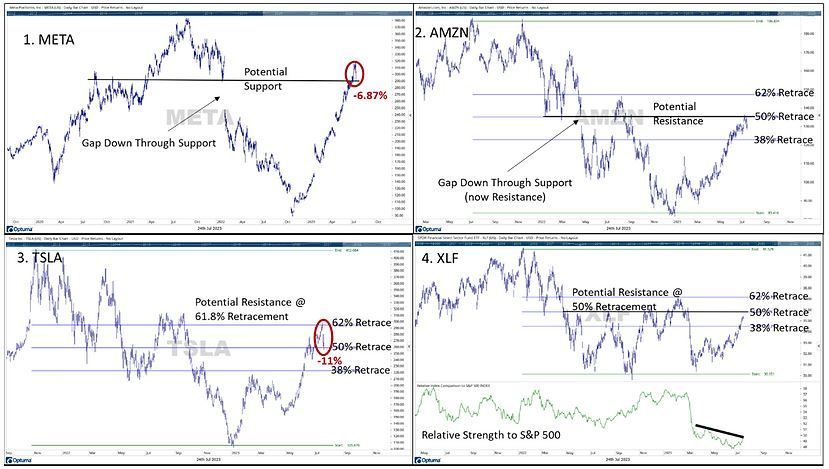

We have discussed how the market has been fueled by a sharp rise in a few larger technology-related stocks. Now, over the last month or two, other market sectors have started to play a little catch-up. Overall, that is a positive for the markets. It should be noted, however, that many technology stocks do appear to be over extended. Last week, a few of the market’s larger components, the same stocks that have seen significant rises this year, looked a little shaky. If “shakiness” in technology stocks becomes a trend, it could have a negative impact on the markets due to the lopsided weightings in the markets.

Here are a Few Things to Watch For

As mentioned above, some stocks looked a bit shaky last week. Here are some securities to keep an eye on that could impact the market’s fluctuations. These are just a few minor technical observations. Note that some observations reference “Fibonacci” retracements. Fibonacci retracement levels stem from Fibonacci sequences and are horizontal lines that indicate where support/resistance are likely to occur.

(1) META- Meta stock (Facebook) is the 7th largest stock in the S&P 500. It has been one of the year’s best performers and has more than tripled in price since its November low (it should also be noted that it is still more than 25% off its 2021 high point, even after the significant rise). Over Thursday and Friday, META declined by -6.87% and had a negative impact on the market. The stock has declined to an area of potential support and will be interesting to see if it can “hold the line.”

(2) AMZN- Amazon, the third largest S&P 500 stock appears to be hovering around technical area of resistance in the $130-135 price range. This area of resistance comes at a 50% retracement level of the stock’s overall decline and could potentially prove difficult to break through.

(3) TSLA- Tesla is usually a very volatile stock. After a parabolic rally, the stock managed to retrace 61.8% (a Fibonacci retracement) of its overall decline, before falling by -11% to end last week. Tesla is the 6th largest S&P 500 stock.

(4) Financials- After a disastrous decline in March, the financial sector (3rd largest market sector) has done some recovery work in the last few weeks, but is quickly approaching an area of resistance, that also intersects a 50% retracement of its total decline.

While those optimistic characteristics may stay in place for some time, sentiment is a contrarian indicator, and high bullish sentiment would increase the likelihood of a pullback or decline.

As an observation, much of the increase in bullish sentiment appears to coincide with the brighter outlook (or less negative outlook) on the economy that is being reported. Regardless of the survey, I think there are still a fair number of investors out there who are hesitant to believe that the markets and economy could get much better from here. Remember that it is impossible to predict the markets. Just a few short months ago, many economists thought the markets would head lower because the economy was doomed for a recession to happen this year. Now those fears have been reduced significantly.

Reading the tea leaves on the markets can be difficult, particularly in an environment like right now. A few larger technology stocks have seen parabolic increases in a very short amount of time. That has caused the markets to rise higher. Now, we are beginning to see some other sectors attempt to play catch up, while those technology stocks enter into areas of potential concern.

Lastly, the S&P 500 has not seen an “outlier” day (trading day beyond +/-1.50%) in the last 52 trading days. On average, the market will experience an outlier day every 20 trading days during a normal, efficient market environment. This is the largest number of consecutive days without an outlier seen since just before the start of the 2020 pandemic. So, in short, the markets may be “due” for an outlier day, in either direction. This outlier could likely be fueled by the upcoming earnings season, particularly for technology stocks. Source Brandon Bischoff

The Week Ahead

This week, the calendar is filled with central bank decisions, economic data, and key earnings announcements. Global flash PMIs get the action started Monday Morning. In the U.S., the Federal Reverse is expected to raise interest rates on Wednesday for possibly the last time in this cycle but will be keen to manage expectations going forward.

The U.S. economy and labor market have been resilient, and inflation has been cooling, a goldilocks scenario for the Fed thus far. On Thursday the first look at Q2GDP arrives, with forecasts calling for around 1.7% growth. Then on Friday, the core PCE and employment cost indexes are both expected to drop on a monthly and annual basis. On the earnings front, updates from Meta, Microsoft, Alphabet, and Intel will keep the technology sector in the spotlight.

Other U.S. releases include consumer confidence, new and pending home sales, durable goods orders, and personal income and spending.

Overseas, the European Central Bank is likely to raise rates 25bps on Thursday, but hawkish sentiment is fading as the euro rise eases inflationary pressures. The yen has also risen steadily this year, but with core CPI above 4% a policy tweak from the Bank of Japan may come before year end, if not at this week’s meeting.

This week's earnings schedule features a number of heavyweight companies including Microsoft (MSFT), Alphabet (GOOGL), Visa (V), Meta Platforms (META), Coca-Cola (KO), Boeing (BA), Amazon.com (AMZN), Mastercard (MA), AbbVie (ABBV), McDonald's (MCD), Intel (INTC), Exxon Mobil (XOM), Procter & Gamble (PG) and Chevron (CVX).

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/