Market and Economic Climate

July 17th, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

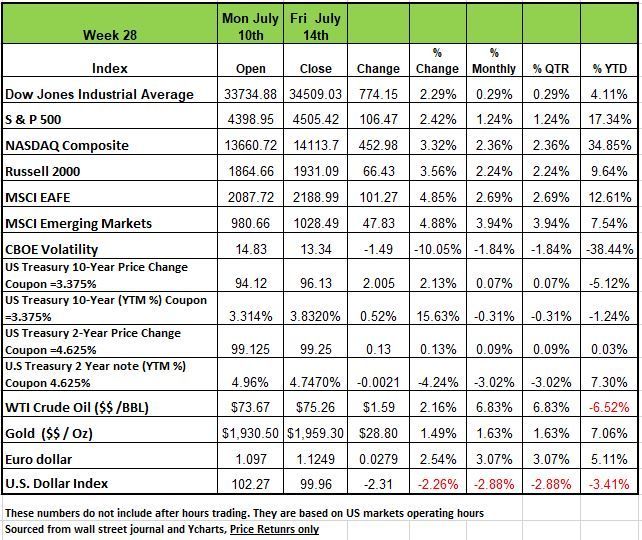

All of the major indices and 11 sectors were up significantly for the week after inflation news came out on Tuesday showing that inflation is cooling. This is the 12th consecutive month of declining inflation after the U.S. government flooded the economy with trillions of dollars during the pandemic. The Russell 2000 led the pack with a whopping +3.56% price return followed by the NASDAQ +3.32% the S&P 500 +2.42% and the DOW pulling up the rear with a +2.29%. As good as that was, international stocks tracked by the MSCI EAFE Index outperformed, gaining nearly 5%.

The market is pricing in an interest rate hike at the upcoming FOMC meeting later this month but that rates will stabilize thereafter. With earning season upon us both JP Morgan and Well Fargo topped Wall Street’s expectations. Still, markets are widely expecting the Federal Open Market Committee to increase its benchmark lending rate by 25 basis points on July 26.

Minutes from the June meeting released earlier this month showed that almost all participants "judged that additional increases in the target federal funds rate during 2023 would be appropriate. Markets are still pricing in that this next rate hike will be the last.

Treasury yields dropped significantly over the course of the week, especially among longer duration maturities. The yield curve started out the week inverting further as shorter-duration yields rose moderately and longer duration yields dropped moderately. On Wednesday, Treasury yields dropped significantly among all maturity levels as the reading for the Consumer Price Index increased 3.0% YOY, down significantly from a reading of 4.0% last month and below expectations of 3.1%.

Investors continued this risk-on approach on Thursday as Treasury yields dropped significantly again with the reading for the Producer Price Index also below expectations. However, Treasury yields rebounded moderately on Friday after a strong report on consumer sentiment from the University of Michigan led investors to believe that the economy may heat up again.

U.S consumer credit expansion surprised to the downside at $7.2 billion versus $20.3 billion in April. Both consumer and producer price growth came in lower, confirming inflation deceleration and adding hope for an end to the Fed’s tightening cycle.

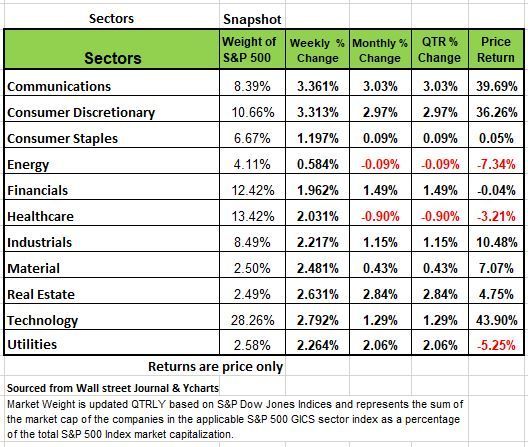

All sectors notched gains for the week, led by communication services' 3.4% increase and consumer discretionary’ s 3.3% rise. Technology, real estate, materials, utilities, industrials and health care rose more than 2% each. Financials saw a roughly 2% increase, while consumer staples and energy advanced 1.2% and 0.6%, respectively.

Within financials, Wells Fargo posted a quarterly beat amid continued benefits from higher interest rates and loan balances, while JPMorgan's results got a boost from its acquisition of the failed First Republic Bank in May. Citigroup's (C) Q2 revenue dropped year-over-year but topped the Street views.

Franklin Resources (BEN) jumped 8.8% for the week after reporting higher preliminary month-end assets under management for June, while Progressive (PGR) plummeted 11%, after Q2 results fell short of the Street's estimates.

Activision Blizzard (ATVI) helped lead the surge in communication services, with the company's stock up 9.3% for the week. Microsoft's (MSFT) proposed acquisition of the video-game developer in a $68.7 billion deal moved a step closer to completion after a federal court judge denied the US Federal Trade Commission's temporary injunction request seeking to stop the takeover. The FTC said it plans to appeal the ruling.

Technology got a boost from a 9.4% gain in Salesforce (CRM), which announced plans to increase its list prices, and a 7% surge in Nvidia (NVDA), which invested $50 million in Recursion Pharmaceuticals (RXRX) via a private investment in public equity deal.

Consumer discretionary’ s rally was led by a 13% jump in Domino's Pizza (DPZ), which announced an agreement with Uber (UBER) allowing US customers to place orders using the Uber Eats and Postmates apps.

Within consumer staples, PepsiCo (PEP) shares rose 2.8% as it increased its outlook after logging higher fiscal Q2 results that topped market expectations.

In energy news, the International Energy Agency lowered its 2023 global oil demand growth forecast, citing "persistent" macro challenges, while the Organization of the Petroleum Exporting Countries raised its outlook amid higher use in China.

Materials advanced for the week despite an 8.7% decline in FMC (FMC), which lowered its revenue guidance.

Economy and the Markets

There is no shortage of opinions out there on the direction of the economy and the markets. For the last year it seems like half of the pundits were calling for a recession and the other half was stating the U.S. economy would have a soft landing. Historically specific events have signaled the prequel to the direction of the economy such as the inversion of yield between the 2- and 10-year treasury. When the 2-year yield exceeds the 10-year yield, historically we have had a recession occur within an 18-month period. Rising unemployment is another indicator, as is inflation and declines in personal consumption and manufacturing output. However, since the pandemic and all the money that was thrown to both consumers and businesses, the economic theories we have relied on in the past seem to be challenged. Is it possible we are living in a new economic paradigm? Perhaps we are just impatient and just want immediate evidence of all these expert predictions. We are also living in an era of misinformation, and this makes it difficult to untangle the data because of justification for adjustments. For example, In the past we have address the birth death rate in which the BLS adds an arbitrary number to the employment data to account for small business which are often not part of the information. Seasonal adjustments are applied each month, applying these adjustments each month means they are not seasonal.

The issue with predicting an economic outcome is dependent on one thing, consumer behavior. The consumer dictates everything. If consumers continue to spend even with rising prices manufactures will continue to sell products and keep people employed. If people are employed, then they will have money to spend on goods and services. But behavior is difficult to predict and while we have history to use as a reference to similar situations society is different today than it was 50 years ago and how we treat money.

Last week’s inflation data came in below expectations for June. Consumer prices rose a moderate 0.2% for the month, while producer prices increased only 0.1%. Not bad. That was good news for both stocks and bonds as you can see from the chart above and the performance. Because the markets felt the new CPI data made it less likely the Federal Reserve would raise rates multiple more times this year, in turn reducing market perceptions about the risk of an eventual recession. This may be a bit of a gamble to try to predict, regardless of how logical it may seem.

Predicting the behavior of the Fed is not a good way to run a portfolio, if Chair Powell comes out at the end of the month with a more hawkish tone markets will respond negatively. If July inflation Data does not move lower markets will react to that.

What may also be more interesting is that the news also boosted the markets’ odds that the Fed would be in a more aggressive rate cutting mode in 2024, not necessarily because the economy would be weak but because inflation would be low. Some people are hoping that the fed will eventually reduce rates back to zero and the likelihood of that happening without a catastrophic economic event is zero.

We think the optimism is overdone. The M2 measure of the money supply has dropped in the past year, and we think that drop is starting to gain traction, including in the form of lower headline inflation.

The CPI is now 3.0% from a year ago, a remarkable improvement from the peak 9.1% gain in the year ending in June 2022. But don’t expect another tame headline inflation number for July. Oil prices have been higher so far this month and housing is still an issue.

Core inflation hasn’t improved nearly as much as headline inflation. Core prices, which exclude food and energy, are up 4.8% from a year ago versus a 5.9% gain in the year ending in June 2022. So, we are not sure that the Fed finds this acceptable to stop rate increases.

If the M2 measure of money declines further, then, yes, perhaps better inflation news lies ahead, including a continued decline in core inflation, as well. But it’s hard to see a drop in core inflation down to the range of 2.5% or below without some significant economic pain that causes consumers to change their spending behavior.

Historically, a drop in core inflation of 1.5 percentage points or more over the course of two years has always been associated with a recession. Now the Fed is projecting that size drop in core inflation in about one year, not two, this is aggressive. If core inflation drops substantially, that also means many businesses will find their pricing power is less than they expected. That should undercut corporate profits and restrain business investment.

While there has been an increase in the construction of manufacturing facilities in the past year or so, largely due to government policies focused on building out tech-related manufacturing capacity domestically to move away from dependence on China. Those resources are being pulled from other sectors and eventually the artificial government-induced spike in that sector will fade.

So, if the Fed keeps the money supply trending down it will succeed in bringing inflation down. But we remain skeptical it can pull that off while leaving the economic expansion intact. Source Economist Brian Westbury

The Week Ahead

This week’s focus turns from inflation to earnings as the second quarter season gets underway. Several banks will report this week, hoping to show improvement after the regional bank failures back in March. Most banks passed the Fed’s stress tests, but these earnings should reveal how healthy they really are. Tesla and Netflix earnings arrive on Wednesday, with their stocks having risen 50% and 30%respectivelysince their last reports. Retail sales figures will come in from several areas of the world with China on Monday, the U.S. on Tuesday, and the UK and Canada both on Friday. Expectations are for a slight rise in the U.S., but the others are expecting lower numbers. U.S. housing starts and existing home sales Wednesday and Thursday and both are expected to drop slightly after recent advances. There are still some inflation figures coming from outside the U.S., with German PPI Thursday, and CPI from Canada and the UK earlier in the week. Finally, look for industrial production numbers from both China and the U.S., as well as the domestic Empire State and Philly Fed manufacturing indexes.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/