The Great Resignation, Economic implications of

unemployment Benefits ending

& Other Economic News for the Week Ending Sept 10th 2021

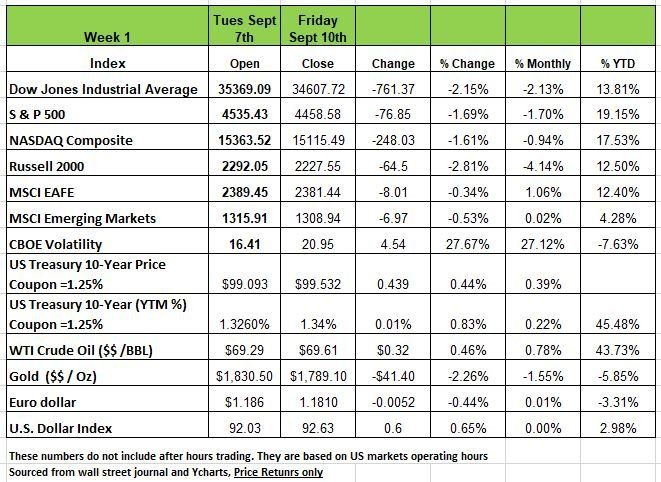

All of the major indices were down last week with the DOW and the Russell 200 having the largest decline of 2.15 and 2.81% respectively. The S&P 500 Index returned -1.69% last week, all of this in a shorten week due to Labor Day.

The August non-farm payroll data that was released on 9/3 showed an increase of 235K jobs which was well under the expectations of 733K. While leisure and hospitality had strong job gains in the previous two months, hiring in the industry appeared to be flat for the month of August with some attributing that to increased concerns over the spread of the Delta variant and others just not interested in working until the governments support is over. End of the month should give us a lot more insight to the country behavior. Anyway, the jobs news brought downward pressure on stocks last week as the underperforming jobs numbers and Delta may have led some investors to take profits over concerns of future growth.

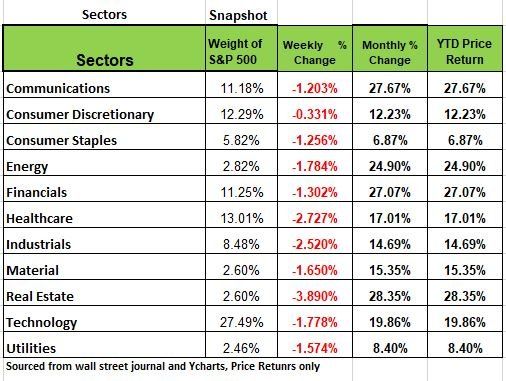

No sector was immune to the negative sentiment, as all economic sectors were down last week with the worst pain felt by real estate, health care, and industrials. Crude oil prices increased 0.46%, the energy sector declined -1.78%.

Treasury yields initially spiked higher (prices dropped) after Australia’s central bank announced plans to proceed with its tapering and the European Union GDP report showed an upward revision. However, rates retreated after strong U.S. 10-year note and 30-year bond auction, and the ECB decision not to risk a hawkish policy error and repeat the mistakes of 2011. The ECB will reduce the pace of net asset purchases, technically not yet a taper

The Job Openings and Labor Turnover Survey released Wednesday by the Labor Department showed U.S. job openings reached a record 10.9 million in July. Initial jobless claims for the week ending on September 4 reached a pandemic low of 310,000.

The four-week moving average of 339,500 was also a pandemic low, indicating there has not been a rise in layoffs due to the Delta variant. The Producer Price Index increased 0.7% from July to August, and 8.3% from last year. Both increases were above forecasts. August’s year-over-year increase in producer prices is the largest on record. Labor and materials shortages and supply chain bottlenecks contributed to the price increases.

Regarding inflation, the CEO of Union Pacific said in an interview last week that “it doesn’t look like it’s temporary,” and that cargo congestion will likely continue well into next year. While he thinks it may continue that in itself does not mean it is systemic inflation. With an end in sight inflation will tapper off and most of the inflation we are seeing is centered around a few industries transportation being one of them. August’s reading of the Consumer Price Index will be released this week.

Major economic reports to keep an eye on for the upcoming week include:

Tuesday: August CPI MoM (0.4%, 0.5%); Wednesday: September 10 MBA Mortgage Applications (N/A, -1.9%), August Industrial Production MoM (0.4%, 0.9%); September Empire Manufacturing (18.0, 18.3); Thursday: September 11 Initial Jobless Claims (320k, 310k), August Retail Sales Advance MoM (-0.8%, -1.1%); Friday: September Preliminary U. of Mich. Sentiment (72.0, 70.3).

The ‘Great Resignation’ is on

In a recent article in the WSJ many younger professionals (millennials) have reached a crucial point in their life. Rather than scale the career ladder in search of higher salaries, these workers want work-life balance, giving priority to family time and personal life. “Quarantine was the nail in the coffin,” By reduce commute time and having flexibility to address personal needs many younger professionals are refusing to go back to the office and making a work from anywhere benefit part of their employment agreement.

Employers are seeing a wave of sabbaticals, leaves of absence and job departures this year in what’s been dubbed “The Great Resignation.”

According to the Bureau of Labor Statistics, 2.7% of U.S. workers left their jobs in July, just under the highest level on record. In addition, another 41% are considering leaving within the next year, this info is based on the 2021 Microsoft Work Trend Index.

While many who quit are jumping right into a job that was just as demanding as before, others are not.

The shift by workers into new jobs and careers is prompting employers to raise wages and offer promotions to keep hold of talent. The appetite for change by employees indicates many professionals are feeling confident about jumping ship for better prospects, despite elevated unemployment rates. This high quit rate is stinging employers with greater turnover costs, and in some cases, business disruptions, labor economists said churn typically signals a healthy labor market as people gravitate to jobs more suited to their skills, interests and personal lives. Source: ttps://www.wsj.com/articles/forget-going-back-to-the-officepeople-are-just-quitting-instead-11623576602?mod=article_relatedinline

The Economic Implications of ending the Government Stimulus

Should a Wall Street investment firm take so long to realize a miscalculation? Goldman Sachs, recently lowered their Q3 GDP growth rate from 6.5% to 2.9% (!!), apparently they are finally realizing that two-thirds of the quarter was gone and that the data for the first 2 months had been weak (i.e. August auto sales), In addition the fiscal stimulus was now in the rear-view mirror so those that spent the extra money that fueled much of the recovery will no longer be available.

Over the last several weeks we have addressed how much slower we thought growth would be than the consensus. This was based on the emerging data which sell side economists and the financial media have ignored because such data didn't fit the “surging” growth or “inflation” narrative.

What we think is even more amazing is that several major investment firms kept its Q4 GDP growth forecast at 6.7% even when knowing that nearly 9 million employable people were going to lose income.

While many sectors are far below the level of revenue that they were seeing pre-pandemic (Hospitality and Travel for example) we feel that the economy has basically “recovered” (at least according to Q2 GDP data) and that, in the absence of a dramatic change caused by another major event, future growth is highly likely to look like it did pre-pandemic. Look for 2-2.5% growth moving forward. Except for some continued supply-chain issues, which are likely to be resolved over the next few quarters, we don’t think there are any underlying reasons for a major shift. The mix may slightly changed, but not the overall growth potential.

Of course, not everything will revert to its pre-pandemic status. Perhaps, due to the reticence of some to return to work, there will be a faster pace of technological change (i.e., rising productivity) as capital is substituted for labor. But those are long-term considerations, not likely to impact growth in the next few quarters. The “recovered” economy is most likely to return to some semblance of its former self, and that includes a slow growth path. Source Bob Barone Ph'D Economist

The Consumer Staples sector

Part 4 in our series of the 11 sectors that make up the economy is on the Consumer Staples/Consumer Defensive sector. This Sector has underperformed and understandably so with so many consumers making more money by not working and having bigger budgets to order out.

This sector includes food, beverage and tobacco products; and food distributors (e.g., supermarkets, hypermarkets); non-durable household goods (e.g., detergent and diapers) and personal products (e.g., shampoo and cosmetics).

The ongoing recovery in the economy and shift toward cyclical sectors has resulted in under performance of the sector, as would be expected for a defensive sector whose constituents are typically less affected by changes in the business cycle. However, with the prospects of reduced social distancing and full reopening of restaurants, food wholesalers that service restaurants have regained some footing, but at the expense of some big-box stores.

In general, retailers within the sector have aggressively cut costs, (have you noticed how many retailers have moved to self-checkout) leaving them in reasonable financial condition. But limited pricing power in a low-interest-rate environment gives them less–than-exciting top-line growth potential—this could change if inflationary pressures prove to be enduring and higher cost can be passed on to consumers but we think this is unlikely to happen.

With the end of fiscal stimulus, increase in vaccinations, and accommodative monetary policies, we think that economic growth is likely to level out, in fact we think that the pace of growth has likely peaked already. At this stage of the business cycle, the consumer staples sector typically underperforms the overall market—but the emergence of various risks could spark volatility that would favor the defensive sector.

Positives for the sector:

It typically has a stable earnings profile.

Companies have engaged in aggressive cost-cutting.

Restaurant openings are supporting wholesale food demand.

Negatives for the sector:

A growing economy and strong stock market historically make this defensive sector relatively less attractive to investors.

Many companies in this sector are facing higher input costs, though they are having success in raising prices.

Risks for the sector:

The sector could perform better than expected if inflationary pressures enable significantly more pricing power.

Risks to the economy, such as the COVID-19 delta variant, could favor this defensive sector more than is currently expected.

Other Economic Data

Mortgage Applications fell again (-1.9%) the week ended September 3, down in three of the last four weeks and in four of the last six. However, lack of supply may be the biggest cause of this number

At least $170 billion of “income” disappeared as the PUA and federal weekly supplement expired the first week of September; that’s equivalent to nearly 1% of GDP, a significant obstacle to overcome for those predicting Q4’s GDP growth near 7%!

The front page of the Wall Street Journal on September 7th read: “Rebound in Business Travel Stalls as Covid-19 Cases Rise.”

The financial media abounds with stories regarding Return to Office Delays. Such delays not only reduce business travel (use of Zoom etc.) but will continue high vacancy rates in major city business districts and cause deflation in commercial rents as leases come up for renewal.

Banks held $2.5trillion of Commercial Real Estate debt on their balance sheets, an even greater amount than they held just prior to the Great Reccession of 2008 ($2.2 trillion). This is, perhaps, an issue will be discussing in future blogs.

Open-Table showed restaurant reservations down -9% the week of September 2 relative to the same week in 2019.

Something to consider from last week’s Payroll Data (not as “hot” as the media would like you to believe):

+235K total new jobs

-30K full-time jobs

+265K part-time jobs

The Week Ahead

With all the global central bank commentary last week, anticipation is building for the Fed’s next meeting on September 21-22. In the meantime, this week presents plenty of additional data for consideration. Things kick off with Australia’s RBA Governor Lowe speaking late Monday, ahead of the country’s employment report later in the week. U.S. CPI drops on Tuesday, and consumer inflation updates from Germany, the UK, and Canada will also filter in throughout the week. U.S. manufacturing numbers are expected to decline, with updates coming in the Empire State and Philly Fed indexes along with the industrial production report. U.S. retail sales have stalled over the past 3 months, and Thursday’s August report is anticipated to show a continued drop. China’s retail sales are likely to weaken considerably YoY. The week finishes up with UK retail sales and U.S. consumer sentiment. Traders will be watching Bitcoin, which fell more than 8% last week after El Salvador’s historic adoption of the cryptocurrency as legal tender.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/