Investing or Speculating & Other Economic News

for the Week Ending Sept 17 2021

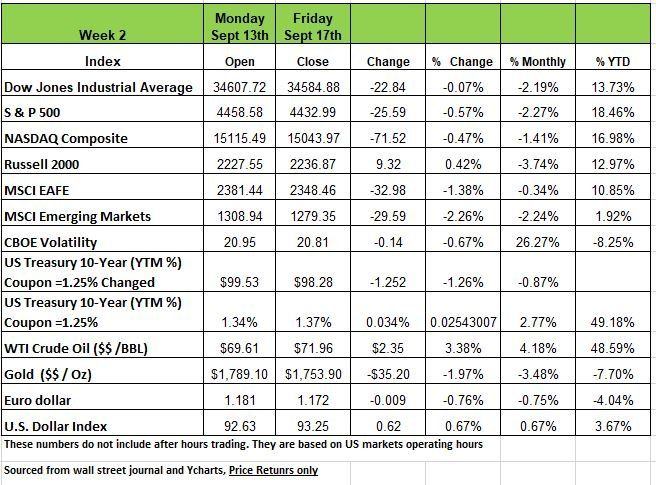

U.S. equities ended the week basically flat but in negative territory as they crawled into the weekend with mixed economic data. inflation expectations weighed on sentiment. 3 of the 4 major indices were negative, with the Russell 2000 Index eking out a small gain, while the Dow, S&P500 and Nasdaq Composite all finishing down a little less than -1%. Volatility rose slightly up with the VIX closing at a 1-month high.

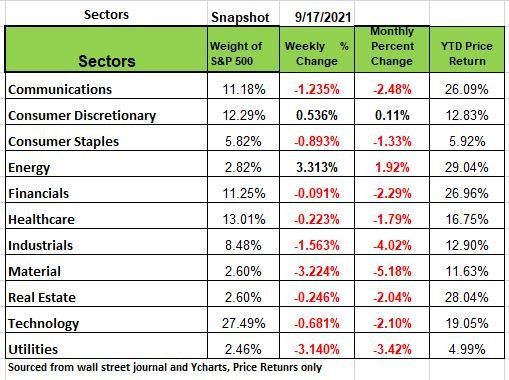

Only two of 11 S&P500 sectors managed gains, led by a 3%+ jump in energy as oil prices rose on supply concerns and consumer discretionary eked out a +.53% increase. The basic materials sector fell -3% as the dollar rallied slightly, impacting gold and most other metals dropping -2-4%.

The rate-sensitive utilities sector also slipped -3.14% as Treasury yields rallied back to the top of their recent range. U.S. manufacturing numbers surged, and optimism for the next 6 months remained high.

The Empire State index leapt 16 points to 34.3 in September, while the Philly Fed index rose 11 points to 30.7, both well above estimates. Industrial production increased 0.4% in August after a revised 0.8% gain the prior month, while capacity utilization climbed to 76.4%, the highest rate since December 2019.

U.S. retail sales surprised with a 0.7% gain in August despite supply chain issues and escalating Covid-19 cases. However, this is a seasonally adjust number so we think it will be lower for Sept.

Internationally, August wholesale prices sustained gains in Germany and Japan on solid global demand, while CPIs in Canada and the UK surged to multi-decade highs. Weak Chinese data also contributed to the market’s choppiness, as retail sales only grew 2.5% in August versus forecasts of 7%, and industrial production came in slightly below predictions at 5.3%. In other news, British retail sales fell for a fourth straight month in August even as payrolls increased by a record 241,000. Australia’s employment dropped more than expected, supporting the Reserve Bank’s decision to delay a review of weekly bond purchases.

Treasury Yields rose last week in anticipation of this week’s Federal Open Market Committee (FOMC) meeting. Tapering is expected to begin November 2021, according to a Bloomberg survey of economists, but Chairman Powell has indicated that the decision to taper asset purchases will be made independent of any decision to raise interest rates.

Unemployment is still above 2019 levels; the Federal Reserve is expected to be patient on increasing rates. As the discussion over inflation, and whether it is transitory. Last Tuesday’s Consumer Price Index (CPI) offered a little bit increasing 0.3% in August, quite a bit short of expectations. The CPI is up 5.3% from a year ago (keep in mind the low base rate) even with Augusts lower than expected reading. Generally, a CPI reading ahead of long-term bond yields is not a sustainable condition as historically investors demand enough yield from bonds to offset inflation. How long the market will wait to decide if the readings are transitory or not may well determine how aggressive the Federal Reserve must be in deciding on its timing for hiking rates. Industrial Production numbers, reported last Wednesday, were up 0.4% in August, but lagged consensus, partially due to worse than expected shutdowns resulting from hurricane Ida.

Major economic reports (related consensus forecasts, prior data) for the upcoming week include Tuesday: August Housing Starts (1.55M, 1.534M); Wednesday: September 17 MBA Mortgage Applications (N/A, 0.3%), August Existing Home Sales (5.87M, 5.99M) and the September 22 FOMC Rate Decision (Lower Bound 0.00%, Upper Bound 0.25%); Thursday: September 18 Initial Jobless Claims (320K, 332K), September preliminary Markit US Manufacturing PMI (60.5, 61.1); Friday: August New Home Sales (710K, 708K

Investing or Speculating

When we look to invest money into a specific company, it should include a process, a function that is based on thorough analysis that maximizes safety of principal and provides an adequate return. Any operation not including these processes is just speculation.

The distinction between investing & speculating in stocks has always been useful & its recent disappearance is cause for concern.

Throughout history, all investors have understood the existence of some speculative factor in the market. But it is the investor's responsibility to keep this component to a minimum & to be prepared financially & psychologically for adverse results that may be of long or short duration.

Benjamin Graham, author of “The Intelligent Investor” wrote, there is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are: (1) speculating when you think you are investing; (2) speculating seriously as a pastime, when you lack proper knowledge & skill for it; (3) risking more money in speculation than you can afford to lose.

Many people in the industry think we should just adapt to the reality that the Federal Reserve will never again “allow” the market to experience a serious decline. The issue with this idea is that it rests on the premise that Federal Reserve policy supports the market in a clear-cut mechanical way when its effectiveness actually relies on the speculative psychology of investors.

Here’s what we know, replacing a mountain of interest-bearing Treasury bonds with a mountain of zero-interest base money will manipulate & disfigure investor psychology.

There are a number of people that have made fortunes by using leverage, in some cases, it may make sense when money is cheap ROI is higher. When interest is zero then the model for discounting future cash flows is higher.

So, investors are inclined to speculate a lot more (they rule out the potential for meaningful capital loss), because the incentive with zero-interest base money encourages each successive holder to chase riskier securities that they believe will provide them with a higher return.

Cheap money, free money often gives the illusion that one can take greater risk. Each time a buyer puts money “into” the stock market, a seller takes it right back “out” – just like a hot potato.

The thing that “pushes the stock market up” is the behavior generated from zero-interest liquidity, mechanically speaking, it causes more volume. It leads to a particularly distortive form of speculative behavior that rules out the possibility of loss, leveraging more, regardless of how extreme valuations have become.

Throughout history, there has never been so much zero-interest base money, but there has always been the speculative behavior of the investor, and it has usually ended in tears for many

The 50 day moving Average

It’s called the 50-day moving average. It’s the average price of a security or index over the last 50 days

Typically, traders pay close attention to this number along with the 200-day moving average.

The signals give traders an idea of the direction they think markets will go assuming no major event occurs.

Many of the so-called pundits of Wall Street have been talking about the market being over sold and the pending crash/correction. Much of this rest on the idea that the Fed will begin tapering asset purchases sooner than expected and that interest rates will increase due to the inflation numbers we have seen.

The predictions of impending doom from Wall Street’s talking heads are also worried about capital gains tax increases, as well as more concerns of the COVID variant as flu season begins.

All the major indices have been pulling back this month not so drastically but enough that the divergence trends can been noticed the S&P 500 dropped 0.6%, to 4432.99, over the week, while the Dow Jones Industrial Average fell 0.7%, to 34,584.88, and the Nasdaq Composite slumped 0.5%, to 15,043.97.

For the S&P 500, it was the first close since June 18 below its 50-day moving average—a technical measure of the previous 50 days’ closes that often ends up acting as support or resistance and that currently sits at 4436.35. For traders, it was very frightening.

For those that are emotional capable of putting fear aside and avoiding the narrative scare of the media the drop may prove to be an opportunity to buy some sold companies and a value. Many corporations are flush with cash and as we mentioned in past newsletter 20% of the S&P 500 are zombie companies. So be careful and try to avoid broad based indexes. Source https://www.barrons.com/articles/stock-market-falls-because-theres-something-scarier-than-taxes-tapers-and-contagion-51631925838?refsec=markets

Let’s spend Billions Spent on Roads that are over forecast in useage

As Congress debates spending billions of dollars on new projects, transportation planners are looking for ways to improve their travel forecasts

The roughly $1 trillion bipartisan infrastructure bill (of which $550 billion would be new spending above existing levels) state and local officials will have to decide which projects to spend money on. But researchers have found that transportation planners frequently overestimate the use of these projects by a long shot.

Optimistic forecasts become part of the justification for spending millions or billions of dollars on such projects. Let’s face it there is self-interest involved for most of them

“The implication however, are rather stark: It’s wasting resources. Remember the bridge to nowhere? We are often focusing resources and investments in areas that are not as productive as other ones. Politicians need to show constituents what value they are bringing to an area and nothing shows value more that a beautiful highway or bridge few are using.

The infrastructure bill includes a provision requiring the U.S. Transportation Department to assess travel forecasts’ accuracy and to help state and local governments come up with better models. But politics may interfere with logic if a promise for spending is done in order to get the votes needed to pass the bill. Source: https://www.wsj.com/articles/transportation-projects-often-rely-on-optimistic-forecasts-11632216602

The Energy sector

This sector includes oil and gas drilling, equipment, exploration, refining, marketing, storage and transportation; in addition to coal mining and production.

At the beginning of the year there were higher hopes that the sector would outperform the overall market however the sector has not performed as anticipated even with higher oil prices, some new risks have emerged

As you may recall oil was in negative territory last May the first time ever, as inventories were at a peak and storage was unavailable. Tankers were lined up in the ocean as storage facilities until usage came back.

The recent breakdown in talks between OPEC+ members and subsequent call for lower oil prices by the Biden administration are causing concerns, both in terms of the cohesion of the OPEC+ cartels and the increased politicization of the energy market.

The rise in oil prices well above the average breakeven level, may threaten energy companies’ resolve to be more disciplined with expenses and investment.

The U.S. dollar rallied (which is generally inconsistent with higher oil prices) as investor sentiment appears to have become too optimistic.

Together, these developments have diminished the risk/return tradeoff, a bit. However, there are still many positive attributes to the sector that could reassert itself if some of the risks are resolved.

Since the low point of the COVID crisis, the sector has lagged with the sharp rise in price of oil which is well below the average historical correlation between the two. The clean energy movement may have loosened the relationship somewhat.

This is still likely an intermediate-term tailwind for the sector, as it could provide a buffer for energy stocks if the price of oil were to weaken.

Additionally, even with the sharp rise in oil, companies have not ramped up capital expenditures as they have done in the past. Therefore, if there is a significant decline in oil, companies will be less exposed to investments that becomes obsolete.

Valuations in the Energy sector are attractive relative to the other sectors, but despite the strong gains in energy stocks this year, companies have not kept up with rapidly rising earnings expectations. This is not surprising, as investors have remained wary of the boom/bust sector. Some equity analysts have found optimism amid the combination of rising oil prices boosting revenues and restrained expense growth, but more for the short term.

Finally, oil inventories have declined. With the reopening of the global economy, the recovery in demand for oil has outstripped supply by cautious producers—OPEC and U.S. producers alike—driving inventories lower. A continued decline in inventories against the backdrop of higher demand is inherently supportive for oil and potentially energy companies.

There are still many positive attributes of the sector that could spur renewed outperformance. But until the risks are alleviated and the positives reassert themselves, we think that market-weight exposure to the energy sector is appropriate at this time.

Positives for the sector:

Oil prices are being supported by improving demand, curtailed supply and a drawdown in inventories.

Large diversified energy companies have strong balance sheets and have become more disciplined with expense and investment management—though the high price of oil could erode this self-control.

The ongoing recovery of the global economy and expansion phase of the U.S. economic cycle bodes well for the continued recovery in oil demand.

Valuations are attractive relative to other sectors.

Negatives for the sector:

Less cohesiveness within OPEC is causing higher volatility in oil prices.

Strong U.S. dollar is inconsistent with recent strength in oil prices.

Increasingly onerous regulatory environment—though implementation is likely to be measured;

U.S. oil and gas majors have been slow to shift toward clean energy—but potential subsidies might encourage greater adoption of renewables.

Shareholder activism has risen.

Risks to the sector:

Easing in Iranian sanctions and increased U.S. production could increase oil supply and weigh on prices.

OPEC discord could lead to a price war.

Numerous risks to global growth stemming from COVID or geopolitical flareups;

A significant rise in market volatility and rise in the U.S. dollar;

Trend toward clean energy to reduce oil demand in the long term.

Weakening Chinese growth could reduce oil demand.

The Week Ahead

All eyes will be on the FOMC as they wrap up their two-day meeting on Wednesday, and pressure is mounting for more specifics on tapering given recent U.S. inflation and employment data. This week will also feature policy statements from the Bank of England and the Bank of Japan, as well as minutes from the last Reserve Bank of Australia meeting. Thursday is flash PMI day, with manufacturing and services updates from the U.S., Australia, and most of the Eurozone. U.S. housing reports will also drop this week, with the NAHB Index on Monday, housing starts on Tuesday, existing home sales on Wednesday, and new home sales on Friday. Voters head to the polls today in Canada hoping to avoid a gridlocked government that could hamper the recovery going forward. The S&P500 is only down about 2% this month, testing the 50-day moving average, but more volatility may be on the horizon if issues like the debt ceiling gain momentum. Treasury Secretary Yellen has urged Congress to increase the debt limit as soon as possible to avoid any economic turmoil, and the debate could influence the Fed’s actions as well. Investors will also be watching to see if Evergrande, the Chinese real estate company with a mountain of debt, poses any systemic risks to global markets.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/