The Global Economy & Other Financial News

for the Week Ending March 18th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. Just email us at info@optfinancialstrategies.com

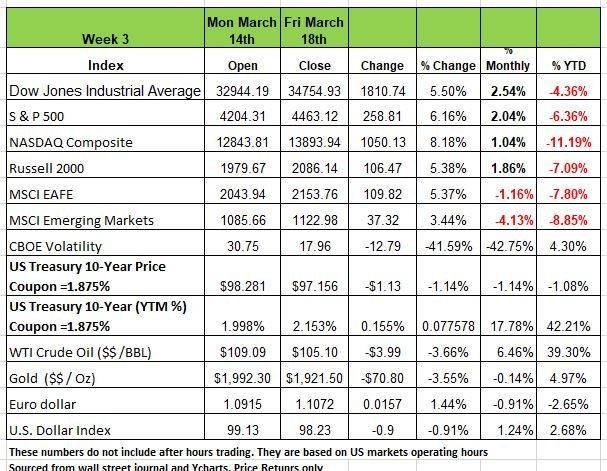

All of the major indices skyrocketed last week with the NASDAQ leading the pack at 8.18% increase followed by the S&P 500 at 6.16% the DJIA at 5.5% and the Russel 2000 at 5.38%. Crude and Gold prices dropped and the 10-yield jumped to 2.153%. All this upward movement despite ongoing concerns of inflation and the Ukraine/Russia conflict. The Fed’s FMOC released its position on increasing interest rates moving the overnight rate to .25bps this was expected so not much of a surprise to the street and the ”Dot-Plot” forecasting (which we will discuss in more detail)

Many in the economic community believe that the U.S. economy has a strong enough foundation of fundamentals to withstand rising rates without spiraling into a recession, we think otherwise and will dig deeper into our position.

As of the writing of this article U.S. stocks are trading lower today as a new week follows last week’s parabolic rise. The markets continue to grapple with uncertainty regarding the implications of the persisting war in eastern Europe and last week's start of the Fed's monetary policy tightening mission.

Again, the big news last week was the Fed raising interest rates by a quarter-percentage-point, as expected, this being the first time since 2018. It also signaled more hikes for all six of its remaining meetings this year.

Treasury yields, particularly those with shorter maturities, moved higher with the Fed being seen as more hawkish than expected. Inflation data released before the meeting showed the Producer Price Index increased 10% YOY through February. Most of the increase came from an increase in energy prices. January’s increase was also revised up to 10%, which is the highest increase on record back to 2010.

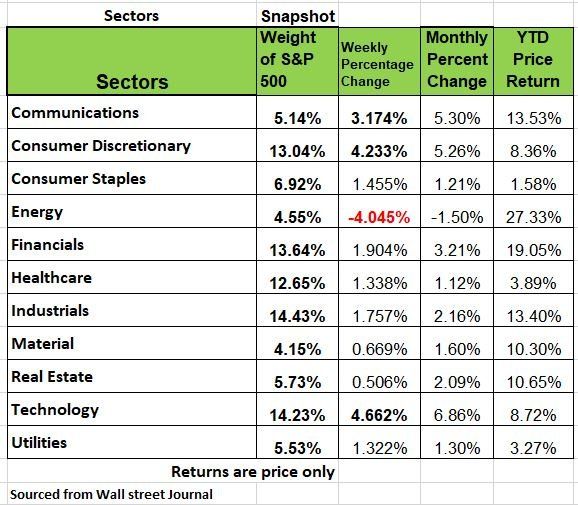

10 of the 11 sectors were in the Black last week with only Energy down-3.57%. The big movers were in Consumer Discretionary +9.26% Financials +7.13% & Healthcare +5.31% . But be cautious if you think its time to jump back in or to double down. We are still in a volatile market state meaning extreme market swings and it may not stabilize anytime soon

As we discussed last week Black Swan events come as a surprise and often have a significant negative impact to an economy. The Russian invasion of Ukraine overturned a lot of assumptions about the direction of the global economy, following the pandemic. These events are so rare that any predication on the outcome/resolution would be nothing more than a wild guess as the situation changes daily.

For global stocks, the key question is whether the conflict will result in a European recession. Then how will it impact the U.S.? Historically, global stocks have recovered and posted gains after periods of armed conflict—except when a recession followed.

So, Investors are keeping a close eye on soaring energy prices and rising inflation, which typically hurts household spending. The U.S. household savings rate is already at its lowest point since 2013, providing little cushion for consumers. The Federal Reserve is caught in the middle with the outbreak of the Russian Ukraine conflict, it needs to make smarter decisions. The Fed has been signaling tighter monetary policy for months, and if it fails to follow through, it could lose its inflation-fighting credibility. On the other hand, if it tightens policy too much or too fast, it could cause the economy to stall.

The conflict was a catalyst in ending the perennial standoff in Washington over the federal budget. More than $13 billion in aid for Ukraine was added to the massive government funding bill, and a bipartisan desire to get aid to Ukraine quickly led to the massive spending agreement.

Global Economic Challenge

The Russian /Ukraine conflict continues to intensify daily, with attacks on cities and infrastructure. Putin seems determined to continue the assault, and NATO’s military action remains unlikely in fear of Putin use of chemical or nuclear weapons. Further sanctions look increasingly inevitable. Europe is the main focus of investor concern due to its proximity to the conflict and its dependence on Russian energy. The escalation raises the potential for further energy price inflation and an economic recession in Europe.

Europe’s economy is currently being challenged by higher energy prices and tighter lending conditions in the wake of the Ukraine invasion. Energy prices have the potential to rise, with or without sanctions, if global deliveries of Russian energy products are refused in a boycott. This will result in higher costs for companies in many sectors.

The European economy did strengthened in February (prior to the invasion) as the economy rebounded from an omicron-driven slowdown. Measured just before the invasion, the composite purchasing managers index (PMI) for February rose to 55.5, a level historically consistent with an above-average 2.6% pace of gross domestic product (GDP) growth. We will see how the post invasion number look before jumping to conclusions

There is a tremendous amount of uncertainty in Europe which makes a rate hike by the European Central Bank less likely, so current monetary policy should stay in place. While financial conditions have tightened rapidly, they remain within the range of non-recessionary periods of the past 10 years.

European governments are further boosting fiscal spending, as seen by Germany’s €100 billion increase in defense spending.

Unlike their U.S counterparts’ European consumers have excess savings, well above average resulting from the COVID-19 restrictions, this we believe will help cushion the impact of higher consumer prices as a result of energy rate increases.

The conflict raises the potential for higher inflation and an economic recession in Europe. Any de-escalation could lead to a relief rally and the release of pent-up consumer demand. Having a high degree of consumer confidence, the near term, is going to be challenging.

The conflict has resulted in two seemingly contradictory market reactions: rising inflation and lower bond yields. Commodity prices have soared as sanctions on Russia reduced the flow of products, oil, metals and grains to the global markets, this sent inflation sharply higher how long this will continue is the big question. However, the supply-side shock produced by the crisis is simultaneously reducing growth expectations and boosting demand for safe-haven assets like U.S. Treasuries. This leaves the Federal Reserve and other major central banks in a bind.

Late last year, the Fed seemed surprised by the strong growth coming out of the pandemic and rapidly rising inflation, mostly due to limited supplies of goods. We do not know why with all the money and policies they put in place what did they think the consumer would do. It is now clear that the policy was too easy given the situation.

Keep in mind we’re in a different world with a global economic outlook looking much weaker. A Global economy affects the global. High energy costs will likely act as a tax on consumers and reduce business investment longer term. Financial conditions are tightening on the back of a stronger dollar and widening credit spreads as investors become more risk-averse. Tighter financial conditions often precede slower growth. Source https://www.schwab.com/resource-center/insights/content/market-perspective

A Strong U.S. Economy? Really

Politicians rarely admit to mistakes and now that our Federal Reserve (institution) has become so political and that several members are awaiting reappointment we know that they are not going to admit to mistakes. All of us make mistake but the issue is how we handle them. It appears that the Fed is trying to bury its mistakes and manipulating numbers. For example, the Fed lowered its GDP numbers for 2022 from 4.0% to 2.8% but the Q4 unemployment rate remained at 3.5%. Think about that? The Fed Atlanta office had forecast its Q1 GDP at 1.2% and it may be lower. So in order for the economy to achieve a 2.8% GDP for 2022 the next 3 quarters would have to grow at a rate of 3.3%. That is a fairly aggressive number considering we have rising inflation, rising interest rates, a smaller labor force and more QT (Quantitative Tightening) a reduction in the size of the Fed’s balance sheet will put more upward pressure on interest rates and likely downward pressure on stock prices.

One point that came out of the FMOC last week was the “Dot-Plots” a tool that each Fed Open Market Committee member used for forecasting. Remember this does not signify policy but forecasting of each member and the result was that we can expect 6 more rate hikes in 2022 raising rates to a target between 1.75%-2.0%. In addition, they are expecting several more rate hikes in 2023 bringing the goal in at 2.75%-3.0%.

Now according to Rosenberg research, the Dot-Plots tool established in 2012 had a 37% track record of accurately predicting rates.

Prior to the pandemic, GDP growth averaged 2.3% from 2012 to 2019. Now in the face of fiscal policy headwinds, rising food and energy prices (which is a regressive tax on low- and middle-income people), sluggish real retail sales growth, and negative real wage growth, such a growth forecast appears unrealistic. Economist David Rosenberg thinks the likelihood of hitting the GDP forecast is 17%, not great odds.

As we have mentioned in the past the pandemic did not contribute anything to support post pandemic economic growth. Remembers all of the growth we have seen had been based on low numbers from 2020, not 2019. The base was lowered.

If you look at the S&P index for Retailers, Homebuilders and Consumer services all of them are in negative territory and approaching the bear market number of -20%

Below are a few economic points to consider

Real Retail Sales (inflation adjusted) have only grown at a +1% annual rate for the five months ended in February (i.e., October through February). Prior to the Russian invasion, food and energy were 50% of February’s CPI growth. The Post-invasion numbers for food/energy have not been calculated yet but that will be higher.

Surging energy prices are almost always associated with recessions. Note that prior to the invasion, energy prices were already rising (from $66/bbl. at the end of November to $92/bbl. the day before Russia’s attack).

The growth we saw in 2021 was all artificial since it was mostly supported by the Fiscal stimulus which is now in the rear-view mirror, reality is here and will act as a real drag on 2022’s GDP.

Existing Home Sales fell -7.2% in February and -2.4% Y/Y. These are closings, so the sales occurred in the December/January period when mortgage interest rates were hovering around 3.5%. Today, they are 4.5%. This will make first time home buying a challenge and for many that want to upgrade their home(buy something bigger) it will mean cutting back on other spending. So that will impact GDP.

Falling home sales appear to be a surprise to the markets, but it shouldn’t be the University of Michigan’s Consumer Sentiment Survey has telegraphed a soft housing market for a while, as intentions to purchase have fallen to some of the lowest levels, not seen since the early 80s. Keep in mind that 25% of all home sales are to institutions that have purchased to rent in need for yield. So this in one major reason prices are so high, they are all cash deals with quick closings.

In addition, the latest NAHB (National Association of Home Builders) Index which points to a -10% decline in new home sales over the next six months. Mortgage rates are substantially higher now, supply is limited (1.7 months of inventory at current sales levels, -15.5% lower than a year ago) higher prices (+15% Y/Y) all will put real downward pressure on home sales moving forward. We think that the economy has too many obstacles to overcome to meet this rosy forecast. The risk of stalling the economy are much greater than its meeting those GDP numbers

There is some good news, Industrial Production rose +0.5% in February and is now above its pre-pandemic high. Despite a fall in auto production, manufacturing rose 1.2% on the back of soaring defense spending (+2.7%) and oil and gas drilling (+3.4% and up +47% Y/Y). So, yes, spiking gasoline prices have induced a supply response, proving once again that the cure for high prices? Are Higher Prices! Source Bob Barone

The Week Ahead

With the FOMC in the rearview mirror and a much lighter economic calendar, the potential for stocks to build on gains will depend on several factors. There was a faint glimmer of hope that a ceasefire might emerge in eastern Europe, which faded by last week’s end. Oil prices and more Covid outbreaks will be closely monitored.

The S&P500 regained some important ground but more work is needed. These volatile markets tend to have wider movements between highs and lows. Flash PMIs from across the globe are the main event on the schedule, and the numbers from Europe may offer clues to economic downturn risks given the inflationary effects of the region’s dependency on Russian oil and gas.

In the UK, Wednesday’s CPI release is expected to show a YoY increase nearing 6%, and the BOE anticipates inflation peaking at 7.25% by April. But that’s not even considering the additional recent swell in commodity prices as a result of the conflict, which could push the number towards 10% by summer. U.S. durable goods orders will drop with PMIs on Thursday, and new and pending home sales round out a limited domestic agenda.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/