From Russia without Love, Black Swan events & Other Economic News for the Week Ending March 11th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter.

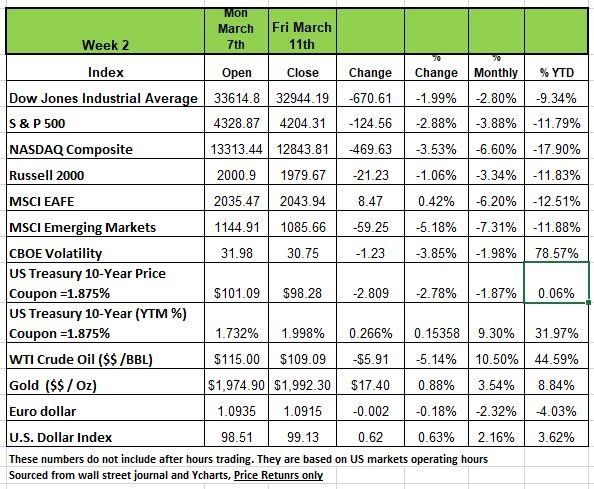

As the Russian /Ukraine conflict continues to grow the markets are reacting to every bit of information. Last week a press release from Putin stating that the negotiations for a resolution were promising until Ukrainian minister was televised stating that there were no negotiations and that Putin’s statement was an outright lie. The markets were like a whipsaw but ended the week down. The largest drop was seen in the NASDAQ with a -3.53% decline followed by the S&P -2.88% the Down -1.99% and the Russell 2000 -1.06%

The U.S. President announced a ban on Russian oil, gas and coal imports, noting the move would likely send US gas prices higher but would also "inflict further pain" on Russian President Vladimir Putin. This has led to our President to negotiate with both Venezuela and Iran to stabilize U.S prices

In the US, data showed the seasonally adjusted consumer price index, a measure of inflation, rose by 0.8% in February following a gain of 0.6% in January. Core CPI, which excludes food and energy prices, rose by 0.5%, following a 0.6% gain in January. The year-over-year rates for overall and core CPI accelerated to 7.9% and 6.4%, respectively, from 7.5% and 6% in the previous month, lifting them to the highest levels since 1982.

Treasury Yields rose across the curve last week with the middle of the curve witnessing the most dramatic jumps. Fears of exacerbated supply chains, energy supply shocks, and the fallout of sanctions mount as the war persists sending U.S. inflation break evens higher with yields.

Commodity prices also rattled markets last week. Oil closed 14% lower from intraweek highs while nickel and uranium prices skyrocketed. The London exchange shut down trading on nickel as a large short position that could not be satisfied sent concerns of a collapse.

Persistent inflation and the rally in commodity prices drove U.S. consumer sentiment down to a 10-year low of 59.7 from 62.8 increasing stagflation concerns.

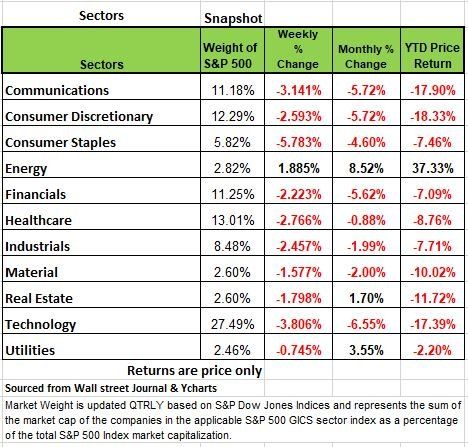

Every sector other than energy fell this week. Consumer staples had the largest percentage drop, down 5.8%, followed by a decline of 3.8% in technology, a loss of 3.1% in communication services and a 2.8% slip in health care. Energy, meanwhile, climbed 1.9%.

The sanctions against Russia hit every sector, with companies from McDonalds to Phillip Morris have seen stocks prices fall based on reduce revenue from the sanctions

This week, all eyes will be on a two-day Federal Open Market Committee meeting scheduled to conclude on Wednesday. Last week, Federal Reserve Chairman Jerome Powell said he would propose a quarter-percentage point increase at the meeting. But the markets are more concerned about the rest of the year. Pundits from every media outlet have voiced opinions that ranged from 3-7 increases. We think the Fed will not commit to anything and take this month by month

From Russia Without Love

Is control of the Ukraine all about power and Putin’s attempt to rebuild the USSR to the empire it was in the mid-20th century? Or could this be an economic play to make Russia a more powerful economic force in the future?

The Ukraine has vast amounts of critical raw material (It’s the second largest natural-gas reserves only Norway has more), It holds the sixth largest iron-ore reserves in the world and the tenth largest reserves of titanium. The region is rich in lithium (yes, that mineral needed in EV batteries) and a number of other critical “rare earth” minerals. If that is not enough, it is also rich in agriculture.

Whether or not control of natural resources is the key motivating factor for Putin, Should Russia succeed it will end up coming out of this invasion that much better position in the commodity arena.

Ukraine’s huge natural gas reserves will give Putin an even bigger stranglehold over the EU in terms of controlling the flow of energy into the continent. This would have long term consequences for Europe.

What can we learn from history?

We can try to go back and learn from similar situations but that is generally left to a handful of academics that are late to the game in counseling world leaders. We recently wrote a piece on the difference between Long Game and Short Game players. Putin is a Long Game player. He has been planning this event and has been patiently waiting to execute at the right moment. Putin has upgraded his military, improved the country’s balance of payments and foreign exchange reserves. He has plenty has gold stockpiled. We do not think Putin goal is just the Ukraine, he wants control over the Baltic region and all the benefits that come with it. Europe may need to brace itself for a huge economic downturn.

Technical overview of the Markets

The beginning of 2022 has been a difficult year for investors who employ the traditional, fixed percentage, asset allocation portfolio management method. You know the pie chart from the 8 -10 question quiz you may have taken when you started with your advisor. For those that have all broad asset investments, Index, ETF and Mutual funds only are experiencing a lot of angst.

Many broad asset classes are in bearish Market States, and both global stocks and bonds are currently highly correlated and highly volatile. Holding a combination of broad equities and fixed income is producing no meaningful benefit of diversification for the average balanced portfolio.

An investor with a “balanced” allocation would hope that a declining equity market would be partially offset by owning bonds. Traditionally that is what has worked. It has always been assumed that diversifying between stocks and bonds would lower risk during difficult markets. That has not been the case for the last several years. In fact, year-to date, both stocks and bonds have experienced a substantial increase in volatility and have had declines that have exceeded the normal 10% “correction” level.

Most stocks and bonds have also suffered several unhealthy “outlier” days (a trading day beyond +/-1.50%) which are typical of bear markets. The 20-year treasury bond has experienced a peak-to-trough decline of more than -20% dating back to its high a year and a half ago.

Bottom line, there have not been many “safe” asset classes in this market. For this reason, you need to be aware of the impact of the underlying securities in your portfolio. There are many opportunities in market conditions like this. But they do not come in the form of ETF’s and Index funds you need to handpick the gems. Source Canterbury Investments

What Is a Black Swan?

For those unfamiliar with the term a black swan, it is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe economic consequences. For those familiar with Statistics a Black Swan event is about 6 standard deviations from the norm. to put this in perspective 1 standard deviation covers about 68% probability, 2 standard deviation is 95%, 3 standard deviations is 99.7%, so 6 Standard deviations is so rare and improbable that we give little attention the possibility of it, until it happens.

The term was coined by finance professor Nassim Taleb from his 2007 book “The Black Swan Event” oddly enough the following year the book was released, a black swan event emerged with the financial crisis of 2008. The crash of the housing market and everything that followed. The Dot com bubble of 2001 is another a Black Swan event.

Black swan events are characterized by their extreme rarity, severe economic impact. In most cases It cannot be predicted beforehand. Some may argue that we do not see them coming because our attention is usually focused elsewhere since the probability is so low. During the 2008 financial crisis a handful of people such as Michael Bury and Ben Hockett saw the problem.

Black Swan events are the result of extremely poor decisions on a large scale. However, the closer we approach these events the more evident they become to those that are paying attention.

While Taleb states that the pandemic was not a Black Swan event because too many people saw it coming i.e. Bill Gates famous Ted talk, but he did not know when. We feel it was a black swan and as we already know the world was unprepared for it, just like the invasion of Ukraine by Russia. Both of these events have placed the world in a vulnerable economic situation and we believe that the stress from these two back-to-back events will have longer term consequences on the world’s economy.

The question of when is always the difficult part, which is why it makes it so difficult to prepare

But the best position to be in when it does hit is to build up a cash reserve.

The Week Ahead

Months of anticipation will culminate in the FOMC’s interest rate decision this week. The Fed finds itself in a quandary. Surging inflation is largely attributable to supply-side challenges, yet the FOMC firmly believes their current policy is too loose. Investors must contemplate to what extent the FOMC is willing to destroy demand to curtail inflation. Most experts agree the Fed’s hiking path is likely to be slower and shallower than previously expected considering the geopolitical environment, with a 25bps rise priced in for Wednesday. The U.S. economy has been resilient, but Goldman Sachs sees risk of a U.S. recession as high as 35% over the next year given the flattening yield curve and other dangers. Chair Powell’s tone and the Fed’s updated economic forecasts will be closely scrutinized. In the UK, the BOE is expected to hike another 25bps on Thursday, but that may do little to stem the pound’s recent slide. Elsewhere in the U.S., February’s PPI will be released on Tuesday, and Wednesday’s retail sales report will reveal recent consumer spending behavior in the face of soaring inflation. Also on the U.S. calendar are regional manufacturing reports from New York and Philadelphia, industrial production numbers and existing home sales. Overseas, China’s retail sales and industrial production figures will drop late today, along with minutes from the most recent RBA meeting. Tuesday brings economic sentiment updates from Germany and the Eurozone. Other highlights include Canada’s CPI and retail sales and the Bank of Japan’s monetary policy meeting.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/