Economic week in review & Other News for the Week Ending

March 25th 2022

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com

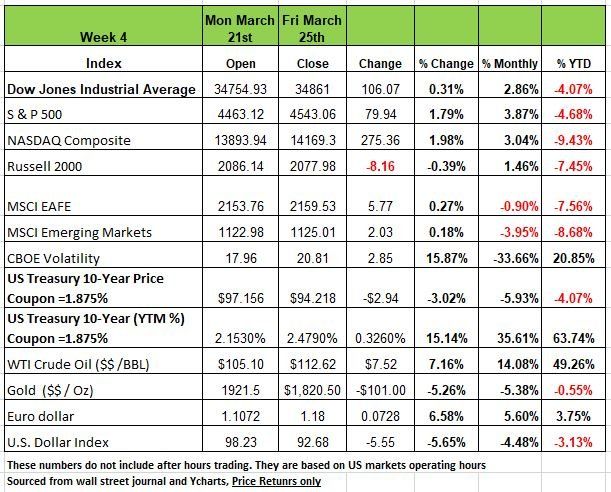

U.S. equities rose modestly last week, 3 of the 4 major indices posted positive returns only the Russel 2000 had a decline of -.39%. Last week lifted all of the indices into the black for the month but YTD all of the major indices are still in the red with the NASDAQ in correction territory.

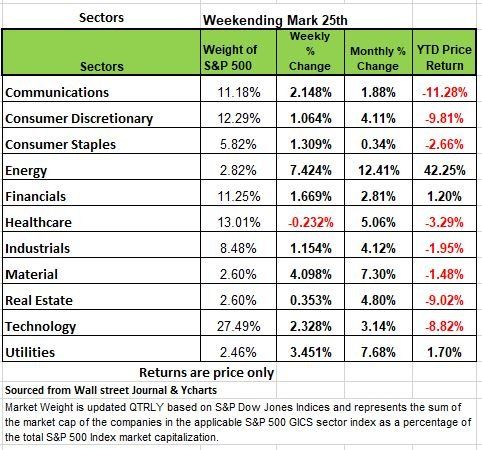

10 of the 11 sectors all posted gains last week with healthcare being the one outliner with a decline of -.23%. Crude oil faded after the EU showed reluctance in banning Russian oil imports, but still added 9%+ for the week to close just over above $112 per barrel.

Many think that the labor market remains strong, with initial jobless claims falling to the lowest level since September 1969. But the issue we have with some of this is that the numbers do not take into account the participation rate. We still have a large number of people that have not reentered the labor force and because they have not and that finding help is difficult there is less turnover, we are concerned what happens when and if they reenter the labor force.

Durable goods orders dropped 2.2% in February, but the decline was largely attributed to the volatile planes and autos categories. In housing news, the average 30-year fixed mortgage rate reached a 3-year high of 4.5%, boxing out some buyers as new and pending home sales fell in February. Inventory remained extremely limited, keeping prices high.

Overseas, the war’s effects started to become evident in the economic figures coming from the UK and Eurozone. UK CPI registered an annual 6.2% rate in February and jumped 0.8% MoM on spiking energy costs, while in Germany producer prices skyrocketed nearly 26% YoY. Business sentiment declined sharply in March as the Bundesbank warned of higher prices and weaker growth. Flash PMIs reflected a softening expansion on the manufacturing side. Finally, UK retail sales missed expectations in February, sliding 0.3% as consumer confidence levels tumbled due to accelerating inflation.

As the equity markets were been rising, the bond markets were going the opposite direction as an increasingly hawkish Fed drove prices down causing yields to rise. (This can be seen more so on the short-end of the yield curve) The yield on the 10-Yr. T-Note, which mortgage rates are based, rose from 2.15% on March 18 to 2.49% at the close of business on Friday 3/25, this translates to a 34-basis point (bps) rise (0.34 percentage points). If we look at the beginning of the year, that yield was 1.50%, so nearly a 100 bps /1% rise. As this continues it will

The 2-Yr. T-Note yield closed at 2.28% on Friday, up from 1.94% a week earlier and 0.73% on the last trading day last year, up a whopping 155 bps.

The spread on the 10yr.-2yr. (Difference between the two) is now only 20 bps. Historically when this inversion occurs (the 2-Yr. yield becomes higher than the 10-Yr.), a recession has soon followed.

In addition, the 5-Yr. T-Note also rose dramatically last week (2.39% to 2.58%) and it is inverted to the 10-Yr. T-Note, which, as noted above, closed at 2.49% on March 25. If we look at the shape of the yield curve, it is flat, another indicator of an oncoming economic concerns.

Beware of the Stock Rally

Most humans are irrational beings when it comes to money, we tend to do the opposite of what is logical. We buy high and sell low when emotions take over. We become overconfident going in and fearful on the way out. Few nonprofessional investors take them time to understand the risk of the investments they choose, often following what others do, (we refer to this as herding), they just do what everyone else is doing and over react to the movement of markets.

There are many ways to lose money in the market and buying stocks during rebounds can be one of the most common. In the last 2 weeks all the indices have bounced back from their lows earlier in this month. It’s easy to get distracted and think that the worst is over. But unless you are willing to take a short-term gain and be grateful for the return you made, you may find yourself depressed down the road. At least this is what history seems to indicate. As we have penned in the past Short-term rebounds are common at the start of a Bear market. In the first couple years of the dot-com bust, there were at least eight significant bear market rallies. The great recession of 2008 also had a half dozen market rallies before the bottom fell out with the Leman Bankruptcy.

What we want to achieve here is not predict what we think will happened but rather to inform you of the possibility of a negative outcome due to certain economic conditions. So, let’s just walk through the last two years and consider the condition of our economy.

The pandemic shut the country down for more than two weeks depending on the sector. Many people did not go back to work for the duration of the pandemic. The government subsidized the public with more income than they would have normally earned had they continued working. So, the outcome was an increase in the demand of goods that many would not normally buy. This was an artificial boost to the economy; it was not organic; it was a shuffling of future taxpayer dollars.

We know that many people left the workforce (one parent to care for children while at home from school, or early retirement) and have yet returned. So many households now that the stimulus is 6 months behind us have reduced the amount of income that is contributed to GDP. This fact makes the employment data distorted, because people not looking for work are removed from the calculation of the employment rate. At some point in the near future this numbers will start to rise and they reenter the work force. Many people that took early retirement may find themselves entering the workforce especially if portfolio values begin to drop again.

The conflict in Eastern Europe has put pressure on fuel prices and at some point, will force the consumer to pull back on spending is certain areas, such as dinning out. Restaurant have yet to return to pre pandemic numbers and the hospitality industry accounts for a large part of the labor force.

The larger concern we have here is interest rates, since the beginning of the year the mortgage rate has increased 1%. That is significant and may continue up, making it impossible for first time home buyers to purchase a home and often that correlates with starting a family. Think of all the dollars spent of children’s needs.

In addition, many companies are over leveraged and if they need to refinance debt that is now more expense it may force layoffs in order to maintain operations. We are not stating that a recession is inevitable but more that you should be cautious. Don’t be naïve and think “this time is different” like most people.

A technical perspective

In the full spirt of the season, March “Market” Madness continued into last week. After declining nearly -13% from January 1, the S&P 500 has since experienced a kickback rally, rebounding a little over half of the overall decline in just under two weeks. This is no surprise and discussed above. Volatility by definition needs to go in both directions. Historically some of the largest short-term market rallies occur in the most volatile of markets states.

There is some positive news for the market. In the last 2 weeks, the Nasdaq 100 has picked up in relative strength. (A technical analysis strategy used in momentum investing) The Nasdaq 100 is an index representing primarily technology-based stocks. Studies show that S&P 500 index tends to be more favorable when the Nasdaq 100 is leading. This makes sense because the S&P 500 is more than 40% allocated towards some of those same technology-related stocks that we see in the Nasdaq 100. When the heaviest sector leads, it makes sense that the S&P 500 would perform well.

There is a caveat. So, keep this in mind Markets are volatile, and technology-related stocks have performed relatively weaker so far this year, excluding the last two weeks. In volatile markets, particularly a bearish Market State, kickback rallies are often led by the weakest sectors. It is good for the markets to see tech-related stocks pick up in relative strength, but there is no indication that the outperformance will last for an extended period of time now.

Relative strength rankings show that the value-oriented sectors and styles still lead growth on a risk-adjusted basis, according to a Volatility-Weighted-Relative-Strength (VWRS) rankings. This is a tool used by Canterbury investments

The number one sector is still Energy, just look at the price of gas, followed by Utilities, Basic Materials, Health Care and Consumer Staples. Growth oriented sectors like Information Technology, Communications, and Discretionary are at the bottom of the sector ranks. These sectors performed extremely well during the pandemic with helicopter money provided by the government and business relying on technology for at home workers. Source Canterbury Investments

The Week Ahead

As the war in Ukraine enters its second month, and with negotiations seemingly at a stalemate, investors’ attention will be focused this week on inflation and jobs data. The Fed is betting on a soft landing for the economy, but the outcome is far from certain. The labor market is tight, and this week brings a slew of related releases culminating in NFP on Friday. The JOLTS report will drop on Tuesday along with consumer confidence, followed by ADP on Wednesday. The Fed’s preferred inflation measurement, the Core PCE Price Index, is the main event on Thursday, while ISM Manufacturing PMI joins a busy end of the week. Other U.S. news of note includes wholesale inventories, trade balance figures, the third and final reading of Q4 GDP, Chicago PMI, and personal income and spending numbers. The international calendar lacks first-tier data, but China’s PMIs will be closely watched as prior readings teetered close to the dividing line between expansion and contraction. Just how much are lockdowns impacting the Chinese economy? In Europe, Germany will publish preliminary CPI for March along with monthly retail sales and consumer confidence, which has turned pessimistic given the RussiaUkraine conflict. Canada’s monthly GDP update and Australian retail sales round out the agenda

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/