The Fed's Dilemma &

Weekly Market Review for March 17th, 2023

The content of this Newsletter is to provide you with Economic insights to assist you in making better decisions with your investments. Unlike many other financial periodicals we will not mention specific companies, unless it is relevant to an overall economic issue. We welcome your questions on economic concerns and will address in our newsletter. just email us at info@optfinancialstrategies.com #FinancialAdvisor,#investmentmanagement #wealthmanagement #financialplanning #retirementplanning #401kplans

Week In Review

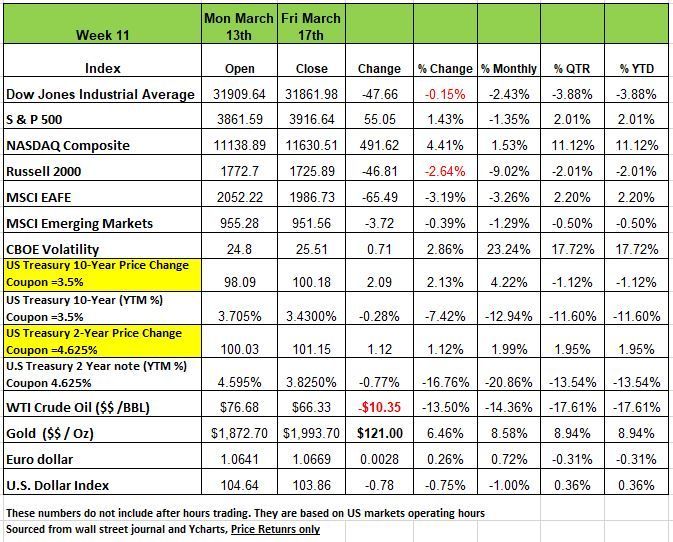

Another volatile week in the markets as investors try to determine the severity of the financial condition of the regional banks and whether there is a systemic problem. The DOW - 0.15% and the Russell 2000 -2.64% were in the red last week while the S&P +1.43% and the NASDAQ +4.41%. YTD the two down indices are also negative for the year while the other two are in the black.

Investors are now questioning what the Feds intervention means for their equity portfolios. Last week, the focus shifted toward quality and safety, leading large cap stocks to outperform small cap, with the S&P 500 and Russell 2000 indexes finishing 1.5% higher and -2.6% lower, respectively.

This can be explained by small cap’s larger exposure to financials at 18.5%, (RUT) compared to large cap at 10.5%. (SPX) Banks account for the majority of small cap’s weighting.

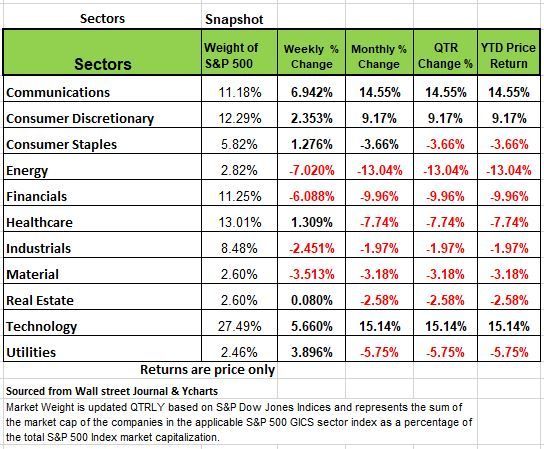

The communication services sector had the largest percentage increase this week, climbing +6.9%, followed by a +5.6% rise in technology and a +3.9% increase in utilities. Other sectors in positive territory for the week included consumer discretionary +2.33%, health care, consumer staples +1.27 and real estate +.08%.

The energy sector led to the downside, falling -7%, followed by a -6.1% drop in the financial sector. The materials sector also was in the red, down -3.5%, followed by a -2.5% decline in industrials.

On the downside, the energy sector's drop came as crude oil futures also fell. In the financial sector, shares of First Republic ended the week down a staggering 72% from last Friday. While investors were relieved to see other banks' efforts to support First Republic, they continued to worry about the bank as it suspended its dividend.

Volatility continued in the Bond Market Treasury yields tumbled significantly over the course of the week as the collapse of multiple banks and the fear of additional bank failures took their toll on the markets. On March 8th the yield on the two-year treasury hit a peak at 5.075% with a coupon on 4.625% this signaled that investors felt interest rates would continue to rise and hence prices dropped. This past week in less than 10 days the yield on the 2 year, sank as investors feared a collapse of the regional banks and rushed to safety rising the price on the 2 year Treasury from $985.83 to $1010.15 dropping the yield to 3.825% more than 100 basis points. This is a significant decline in such a short period.

By Monday of last week, Silicon Valley Bank and Signature Bank had both collapsed, leading investors to believe that the Federal Reserve Bank may pause interest rate hikes at the upcoming March 22nd meeting or, at the very least, drastically reduce interest rate expectations for the year.

At the end of the week ending March 3rd, the market implied Fed Funds Rate for the July 26th meeting was 5.27%. By the end of Monday March 13th that implied rate dropped to 4.11%. On Tuesday, the February Consumer Price Index showed that inflation remained elevated at an annual rate of 6.0%, but this was in line with expectations and a drop from 6.4% the previous month.

This caused Treasury yields to rebound significantly but remained much lower than the prior Friday’s close. Treasury yields then dropped significantly again on Wednesday as investors became concerned that Credit Suisse would become the next financial institution to collapse. Yields rebounded again on Thursday after Credit Suisse received stabilizing funds from Swiss regulators and a rescue package for First Republic Bank in the U.S. was secured.

Last week the European Central Bank also went ahead with a 50-basis-point rate hike on Thursday. Ultimately, Treasury yields finished the week down significantly again on Friday and the market implied Fed Funds Rate after the July 26th meeting finished the week at 4.20%.

Gold finished the week up +6.4% while fears of a recession weighed on investors and confidence in the banking system.

The Fed's Dilemma

A truly free economic system must have both sides of the coin, success and failure. What the Fed did last week to prevent further damage to the banking system in essence wiped out all the work it did last year to reduce its balance sheet with quantitative tightening

The more the government tries to take risk out of the financial system, the more it moves the country in the direction of a national bank, whether intentionally or not. It seems that crisis by crisis, the Federal Reserve, lawmakers, and regulators are focused on designing a financial system that insulates against failure at the expense of the country’s potential financial demise.

We are not stating that they job of the Fed is easy, just that it becomes more difficult by to prevent any pain in the system.

Inflation eased in February but remained stubbornly high, presenting a challenge for the Federal Reserve as it confronts how to slow the economy with higher interest rates at the same time it moves to stem banking problems. The consumer-price index, a closely watched inflation gauge, rose 6% in February from a year earlier, down from a 6.4% gain the prior month, the Labor Department said. It was the smallest increase since September 2021. When excluding volatile food and energy costs, prices advanced a slightly slower 5.5%. Economists view so-called core prices as a better indicator of future inflation.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in February on a seasonally

adjusted basis, after increasing 0.5 percent in January. Over the last 12 months, the YOY index increased 6.0 percent before seasonal adjustment for all items.

As we have discussed in previous blogs the index for shelter was the largest contributor to the monthly increase, accounting for over 70 percent of the increase, with the indexes for food, recreation, and household furnishings and operations accounting for the remainder.

The food index increased 0.4 percent over the month with the food at home index (groceries) rising 0.3 percent. The energy index decreased 0.6 percent over the month as the natural gas and fuel oil indexes both declined.

The index for all items less food and energy rose 0.5 percent in February, after rising 0.4 percent in

January. Categories which increased in February include shelter, recreation, household furnishings and

operations, and airline fares. The index for used cars and trucks and the index for medical care are

among those that decreased over the month. Source https://www.bls.gov/news.release/cpi.nr0.htm

The Feds Dilemma on whether to continue fighting inflations or risk more small banks finding liquidity issues for depositors. But that is just one issue. As we discussed last week the high yield bond market will have another set of challenges. Rolling over debt that was not able to be paid off, by poorly operated companies will be coming due and present another set of financial problems. Our continued history of bad decisions is catching up with the country. The ultra-low interest rates for over a decade and the attitude of not being efficient with operations (because there has been an abundance of cheap money) may be showing its ugly head quicker than we think. Business leaders have been able to cover up mistakes easily since money was cheap. But it is not just with business leaders, the Government has the same attitude, of bailing everyone out. the Trillions of dollars given away during the pandemic and the 2008 financial crisis, but what worse is the lack of responsibility it has created. A morale hazard, an attitude in America, that the Government will bail out everything. Last time I check this was not how a free economy operated. There must be pain associated with bad decisions /behavior otherwise the lesson is not learned. Much like a parent that rewards a child for not doing their homework at some point in time reality hits and hits hard.

Getting back to the current crisis, It is never a good time for a bank run, but it becomes an especially bad time when it happens while the Federal Reserve is fighting inflation by raising rates. We still do not know if Silicon Valley Bank (SVB) was an outlier in terms of the mismatch between its highly run-prone funding base and longer-duration asset composition. Some economist have taken a close look at trends among FDIC-insured banks over the past 15 years, shows that what happened at SVB is indicative of a system-wide issue.

We think that the easing of terms on the Fed’s discount window and the creation of a new Bank Term Funding Program (BTFP) were designed to address possible similar scenarios that may play out across the banking system.

We expect there will be a lot more market volatility in the days approaching the next several FOMC meetings. Will the FOMC dig in and continue to raise rates to fight inflation many experts expect another 25 basis point hike on Wednesday and are also looking further down the road to the debt limit battle that looms this summer. That’s because when it is resolved Treasury will need to issue hundreds of billions of dollars in T-bills to replenish its depleted cash balance. As all of this plays out, investors will be well served by being appropriately vigilant in their investment selections, keeping an eye on duration positioning, and asset allocation decisions. No w is not a time to have your portfolio on autopilot and to be more involved in what is purchased and when.

A Technical Perspective

For those new readers to our newsletter technical analysis is an investment strategy /trading discipline that relies on identifying opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. While no one can identify the bottom and peak price of a security, technical analysis tries to identify opportunities close to it.

Markets can be unpredictable. Just when you think you have the key, the market changes the lock. The financials sector had been highly ranked prior to the SVB collapse and recent banking news. Now, the sector is experiencing a wave of volatility that has bled over into other market segments. This has caused market conditions to shift slightly and allow for other sectors to rotate into leadership positions.

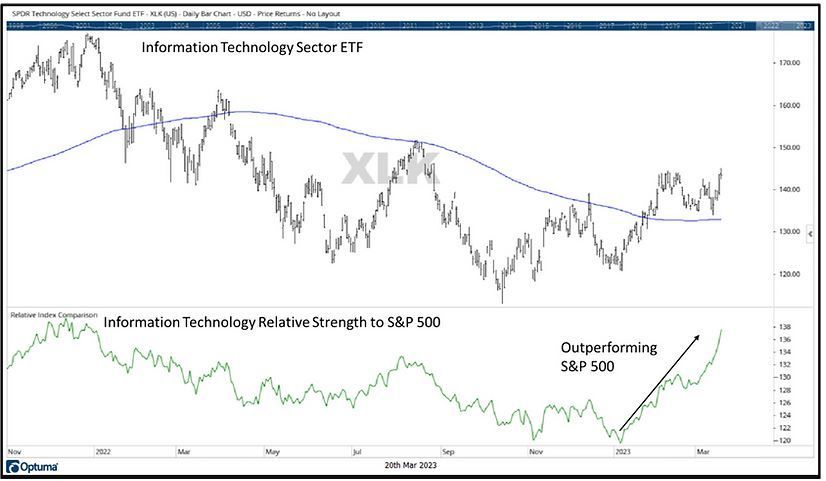

Following the scare in the financials and banking sectors, market strength continued to rotate. While the rise in volatility impacted most of the market, its effect was largely ignored by technology-related stocks. Technology stocks, which had some of the worst performance in 2022, are now leading the markets on a relative, risk-adjusted basis.

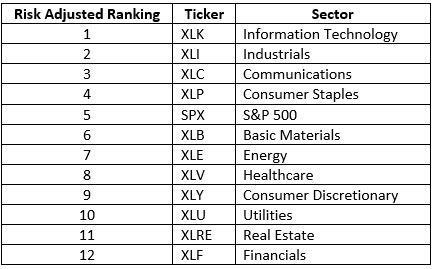

The table below shows the S&P 500’s 11 sectors, ranked according to Volatility-Weighted-Relative-Strength. The ranking is a risk-adjusted rank that accounts for both a sector’s performance as well as its level of volatility (risk / Standard Deviation). Currently, Information Technology is the number 1 rated US sector on a risk-adjusted basis. Another tech-related sector, Communications, is ranked 3rd. But there may be some membership confusion as both google and Meta are part of the communications sector.

The chart below shows XLK, which is the Information Technology Sector Spyder ETF. Information Technology’s two largest stocks are Apple and Microsoft. The lower third of the chart shows XLK’s relative strength (green line) to the S&P 500. When the line has a positive slope, Information Technology is outperforming. When slope is negative, the Information Technology sector is lagging. As you can see, for most all of 2023, and particularly in the last few weeks, Information Technology has been leading the broad market. Another reason for the NASDAQ which is heavily weighted in Technology to be outperforming the other indices.

Market Comment

Since the market’s relative peak in early February, it has been choppy and has declined to its 200-day moving average. From the market’s highs, it is normal to experience a “pullback,” especially following a significant rally.

The S&P 500 is currently hovering right around its 200-day moving average. It broke below the moving average two weeks ago in the wake of the surprising banking news, before rallying back to the 200-day moving average last week. All-in-all, volatility only rose a few points, while volatility of the technology sector, which is the index’s largest component, has been stagnant.

If we look at the other US market sector components, only four of the eleven US sectors are in one of the 5 “Bullish” Market State. A “Bullish” Market State means that a security is exhibiting positive trend characteristics and low or declining volatility (risk). Those four sectors are Information Technology, Industrials, Communications, and Consumer Staples (which were the top 4 ranked sectors shown at the beginning of this update. Source Brandon Bishcoff

The Week Ahead

All eyes and ears will be on the Fed this Wednesday to see how the FOMC reacts to the banking issues. After the recent violent swings in Fed funds futures and the short end of the bond market, there is elevated uncertainty for the FOMC policy decision and Summary of Economic Projections on Wednesday. As of Friday’s close, there was a 63% probability of a 25bps rate hike and a 37% chance of no hike. There are even rumblings of a rate cut, which seems unlikely given the worrisome message it would send, but it’s clear that confidence in the banking sector has not returned just yet.

The possibility of systemic risk spreading makes this one of the more ambiguous central bank meetings in recent memory. The Bank of England convenes Thursday, and the prior day’s CPI report may be the decider between a 25bps hike or a pause. The usually sleepy Swiss National Bank meeting on Wednesday could garner attention given their pledged support for Credit Suisse.

A busy week concludes with global flash PMIs on Friday, expected to reveal slowing in the services sector. Other releases of note in the U.S. include existing and new home sales along with durable goods orders. Overseas, Germany’s PPI and economic sentiment figures, Canada’s CPI and retail sales, and Japan’s core CPI are on the docket.

This article is provided by Gene Witt of FourStar Wealth Advisors, LLC (“FourStar” or the “Firm”) for general informational purposes only. This information is not considered to be an offer to buy or sell any securities or investments. Investing involves the risk of loss and investors should be prepared to bear potential losses. Investments should only be made after thorough review with your investment advisor, considering all factors including personal goals, needs and risk tolerance. FourStar is a SEC registered investment adviser that maintains a principal place of business in the State of Illinois. The Firm may only transact business in those states in which it is notice filed or qualifies for a corresponding exemption from such requirements. For information about FourStar’s registration status and business operations, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website at www.adviserinfo.sec.gov/